Technical Analysis vs. Fundamental Analysis: Which is the Best to use in your Trading Strategy?

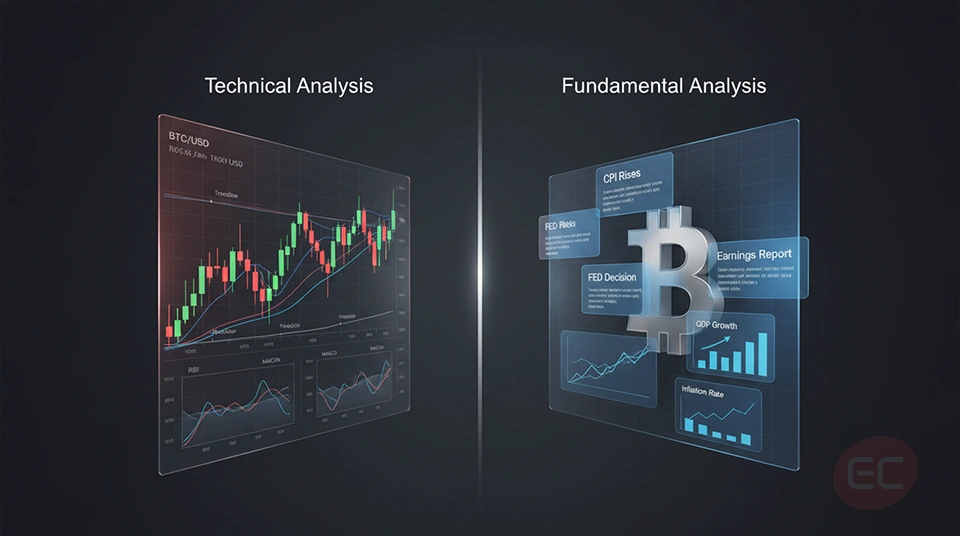

When you first start trading, one of the biggest questions you’ll probably ask yourself is: What is Technical Analysis of the financial markets? What is Fundamental Analysis? Which one is better and which one should I use in my trading strategy? Well, both are extremely powerful tools used by traders globally, but they serve very different purposes and work in different ways. This article will dive into Technical vs Fundamental Analysis as well as explore BTC Technical Analysis in crypto. By applying trading technical analysis and fundamental analysis, traders can transform complex price charts into actionable trading signals.

But what do they really mean? In this article, we are going to break them down step by step so you can decide which analysis fits your trading style the best.

What is Technical Analysis of the Financial Markets?

So, let’s start from the beginning, what is technical analysis exactly? If you're the type of person who prefers to look and analyse charts, if you’re the type to spot trends and if you’re the type to analyse past price movements, then technical analysis might just be perfect for you.

In other words, technical analysis of the financial markets is the study of price action and it mainly involves:

- Chart patterns

- Candlestick formations

- Support and resistance levels

- Volume analysis

- Technical indicators like RSI, MACD and moving averages

So when traders are using trading technical analysis, they actually believe that all current market information is already reflected in the price and that price often tends to repeat itself in patterns. Let’s now put this into practice!

How to put trading Technical Analysis into practice

When you’re using trading technical analysis, you’re not just randomly drawing lines on a chart, instead, you’re actually using a proven system of analysis that has been refined over decades and even centuries.

Let’s look at an example:

- Assuming a trader might notice that BTC technical analysis shows a pattern called a “bullish flag”

- This pattern has a history of leading towards upward breakouts.

- Based on this, the trader might decide to enter a long position, with a stop-loss below the flag and a target above it.

By doing this, BTC technical analysis isn’t about guessing, or making empty decisions, it’s an informed decision based on probabilities and historical data.

Still confused about what is technical analysis and how it can make you a better trader? Keep reading, we’ll explore some more real life examples.

Let’s look more into Bitcoin. If you’ve already seen terms like “RSI is overbought” or “MACD just crossed bullish,” then chances are you’ve already come across BTC technical analysis.

When you’re doing BTC Technical Analysis, you’re actually looking at:

- Chart patterns (triangles, flags, wedges)

- Candlestick signals (doji, engulfing patterns)

- Volume spikes and breakdowns

- Moving average crossovers

And although technical analysis of the financial markets isn’t so black and white, many traders trust BTC technical analysis. But why? Because the crypto markets are dramatically driven by speculation and by momentum, the two things that technical analysis of the financial markets is designed to capture. But is technical analysis enough to succeed in the market? Let’s look at the other side of the coin: Fundamental analysis.

What is Fundamental Analysis?

So, we’ve looked into what is technical analysis of the financial markets, now let’s look into what is fundamental analysis. At its core, what is fundamental analysis about? It’s about evaluating the underlying health and potential of an asset rather than its short-term fluctuations. Unlike technical traders who focus mainly on reading charts, fundamental analysts generally look at the bigger picture. What does that mean? News. Fundamental analysts read economic reports, company earnings, blockchain updates and so much more. They use that information to make decisions on the market.

So when you ask, what is fundamental analysis, think of it as why something is moving, as opposed to just seeing that something is moving. Fundamental analysts ask why, based on an overall picture, whereas technical analysts examine based on the data put in front of them. Understanding what is fundamental analysis means being able to interpret macroeconomic indicators and industry trends in real time.

Here’s what Fundamental Analysts generally examine the most:

- Economic data (GDP, interest rates, inflation)

- Industry trends and global news

- Company earnings, balance sheets and cash flows

- Real world cases in crypto projects

What is Technical Analysis and Fundamental Analysis? They actually work together in a way and answer two very different, but important questions:

- Technical analysis: When should I buy/sell?

- Fundamental analysis: What should I buy/sell?

Understanding what is fundamental analysis also gives you context for market movements, something that charts alone might not reveal. Although a lot of traders tend to fall into one of these two boxes, the best practice is to implement both in some way within your trading strategy.

Technical vs Fundamental Analysis: Which one should you choose?

So here’s the big question: Technical vs fundamental analysis, which is better and which one should you choose for your trading strategy? Well, honestly, it really depends on your trading goals, style and timeframe.

Let’s compare them so you can have a better overview:

| Feature | Technical Analysis | Fundamental Analysis |

| Timeframe Focus | Short to medium term | Medium to long term |

| Tools Used | Charts, indicators, patterns | News, reports, financial statements |

| Type of Trader | Day traders, swing traders | Investors and long-term holders |

| Market Reaction | Anticipates price moves | Reacts to market changes |

| Example (BTC) | RSI overbought on BTC | Bitcoin halving could affect scarcity and price |

While fundamental data explains why prices move, trading technical analysis reveals when those moves are most likely to happen. Different traders have different trading styles and as you can see, the technical vs fundamental analysis debate isn’t about which is best, it’s more about which is right for you.

Why you should be using Technical and Fundamental Analysis together

Why choose one when you can use both? The smartest traders will usually combine a mix of technical vs fundamental analysis together for the best of both worlds. And although it may seem like more ‘work’, by using both fundamental analysis and technical analysis of the financial markets, you’re covering your basis against any unexpected movements.

Here’s how it would look when put into action:

- You should be using fundamental analysis to pick strong assets (like a solid crypto project or an undervalued stock)

- You should use trading technical analysis to find the best time to enter or exit the trade

- You should use BTC technical analysis to track Bitcoin trends, but also following news about regulation, ETFs, or institutional adoption.

By using technical and fundamental analysis together, this approach allows you to make more informed trading decisions, increase your confidence and manage risks more effectively for an overall better trading experience.

BTC Technical Analysis vs. Bitcoin Fundamentals

When comparing Bitcoin’s chart patterns to news-driven catalysts, trading technical analysis offers a data-backed perspective on market psychology and momentum. In volatile assets like Bitcoin, trading technical analysis gives structure to decision-making when prices move unpredictably.

Let’s look at another real world example: Assuming you’re looking at BTC technical analysis and you see a descending triangle forming, in other words, a bearish signal.

But, at the same time, the news has just informed people that a major asset management firm has launched a Bitcoin ETF.

Here’s how you would apply technical vs fundamental analysis together:

- The technical analysis says: Watch out for a breakdown.

- The fundamental analysis says: There’s an increase in demand coming soon.

- Your decision: Maybe wait for final confirmation or simply adjust your risk levels before making a dramatic move.

Understanding what is technical analysis and what is fundamental analysis is what helps you balance both perspectives in your trades, something that is crucial if you want to make informed, well thought out decisions.

A few of the most Common Mistakes when using Technical vs Fundamental Analysis

No matter which method you choose, people make mistakes, even some of the top traders make mistakes. So understanding these ‘traps’ is important so you can consciously try and avoid them. Here are some of the most common mistakes traders make when learning about technical vs fundamental analysis:

- Blindly trusting indicators without really understanding what is technical analysis.

- Many beginners misuse trading technical analysis by focusing solely on indicators without interpreting the broader trend or context.

- Ignoring macro events that impact fundamentals.

- Using outdated or irrelevant data.

- Not matching the method to the timeframe (e.g., short-term technical analysis for long-term investments).

- Overcomplicating your trading strategies rather than focusing on clear signals.

Remember: Both fundamental analysis and. technical analysis of the financial markets require practice, discipline and time to get to the point that it really becomes second nature. Always start with a demo account before putting your real money at risk.

Quiz time: What is Technical Analysis and Fundamental Analysis?

Now that you’ve made it this far into the course, let’s test your understanding. Think about these questions and check how comfortable you are answering them:

- What is technical analysis and what tools should you be using?

- When might BTC technical analysis show a false signal?

- Why is fundamental analysis so important for long-term investors?

- How can combining technical vs fundamental analysis improve your decision making process?

- What’s one mistake that many beginners make when they first start learning technical analysis of the financial markets?

Make sure to write your answers down or talk them through, reflection is key to learning!

Conclusion: Now can you answer what is Technical Analysis vs Fundamental Analysis?

Congratulations on finishing this course! You’ve just taken a deep dive into the two most important methods of evaluating the markets: technical analysis vs fundamental analysis. But whether you are analysing price charts or whether you’re studying economic data, both methods provide crucial insight into what moves the markets and why.

Here’s what we’ve covered in this course so far:

- What is Technical Analysis and how it's used in charts.

- How trading Technical Analysis applies to real assets like BTC.

- The value of BTC Technical Analysis in fast-moving crypto markets.

- What is Fundamental Analysis and how it helps long-term investors.

- The power of combining Technical vs Fundamental analysis and why it should be used for best practice.

So, you might be wondering, what should my next step be? Will you explore the depths of technical analysis, or will you start reading reports and news for fundamental analysis? Just remember, whichever one you choose, understanding the basics of both concepts will already give you an edge in the market!

We hope you enjoyed our course on technical analysis vs fundamental analysis. If you’re looking to unlock more trading knowledge, then keep on reading as we still have many more trading topics to cover at the EC Markets Academy.