Chart Patterns: Triangles, Head & Shoulders, Flags

Understanding forex and stock chart patterns is like trying to learn to speak the market’s native language. Once you really understand what these patterns are trying to tell you, spotting high-probability trade setups suddenly becomes a whole lot easier. In this guide, we are going to explore a wide range of topics around chart patterns, answering the following:

- What is a Head and Shoulders chart pattern and how does it signal reversals?

- What are the different types of the forex pattern Triangle?

- How to spot Flag pattern trading opportunities?

- The difference between a Bull Flag pattern and a Bear Flag pattern.

- How these stock chart patterns apply to all markets, from crypto to forex to stocks.

- What are Chart Patterns?

- What is a Head and Shoulders Chart Pattern?

- Stock Chart Patterns vs. Forex Chart Patterns: What’s the difference?

- Forex Pattern Triangle: How does it work?

- What is Flag Pattern Trading?

- Bull Flag Pattern vs Bear Flag Pattern, let’s compare them

- How to use a Triangle, Flag or Head and Shoulders Chart Pattern when trading

- Conclusion: Triangles, Flags and Head and Shoulders Chart Pattern

What are Chart Patterns?

Before we go into details, let's first cover the basics: what are chart patterns?

Well, in the simplest terms, chart patterns are visual formations created by the movement of a price on a chart, they’re repeated setups that are based on the psychology of traders, that includes fear, greed, hesitation, and momentum, which are all playing out in real time.

You can think of them as the market leaving clues. And the best part? These stock chart patterns are universal, so whether you’re analysing EUR/USD, Bitcoin, or Apple stock, these formations show up everywhere and learning how to read them can give you a significant edge.

So let’s dive in a little deeper starting with answering: 'What is a Head and Shoulders Chart Pattern?'.

What is a Head and Shoulders Chart Pattern?

Let’s get started with one of the most famous chart patterns: What is a head and shoulders chart pattern?

It might sound unusual, but actually, it's incredibly useful for traders! Why? Because it’s a reversal pattern that signals that a trend might be coming to an end, here's how it looks:

- A left shoulder forms as price rises, then pulls back.

- A head forms when price makes a higher high.

- A right shoulder forms when price rises again but fails to break the head.

Connect the lows (in other words, the "neckline") and when the price breaks below it, that’s your signal! So what is a head and shoulders chart pattern's reason for being such a powerful pattern? Because it shows fading bullish strength, where buyers are running out of steam.

Let’s explore a real life example so you really understand the concept: assuming a tech stock like Apple forms a head and shoulders chart pattern near all-time highs, it might signal the beginning of a bearish reversal. Sounds pretty straightforward, well, it is, but it’s important to remember: patterns don't guarantee outcomes, they simply suggest probabilities, so going deeper in your analysis and trading strategy is crucial.

Stock Chart Patterns vs. Forex Chart Patterns: What’s the difference?

You might be wondering: are stock chart patterns the same as those in forex? The answer is simple. Yes. Chart patterns reflect trader psychology, and people tend to behave similarly whether they’re trading Tesla or EUR/USD. So, whether you're looking at stock chart patterns or forex pattern triangle formations, you're using the same technical foundation.

Although the foundation is the same, some markets move differently, and it's important to note them down:

- Forex: more consistent trends, ideal for triangle patterns.

- Stocks: more prone to gaps, earnings shocks, and head and shoulders chart patterns.

- Crypto: the most volatile, great for flag pattern trading (high opportunity = high rewards, but also higher risks).

The bottom line? Learn the patterns, understand them, put them into practice, then apply them to any market.

Forex Pattern Triangle: How does it work?

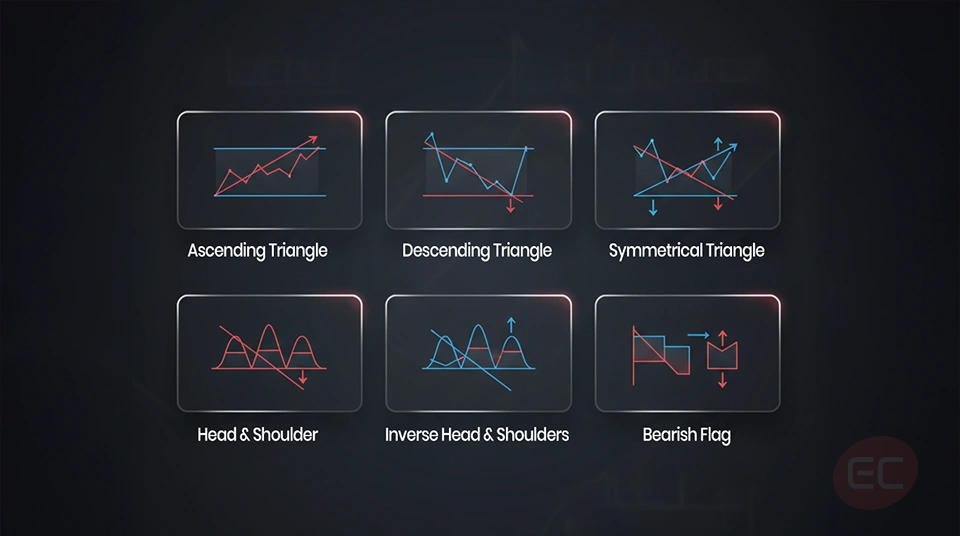

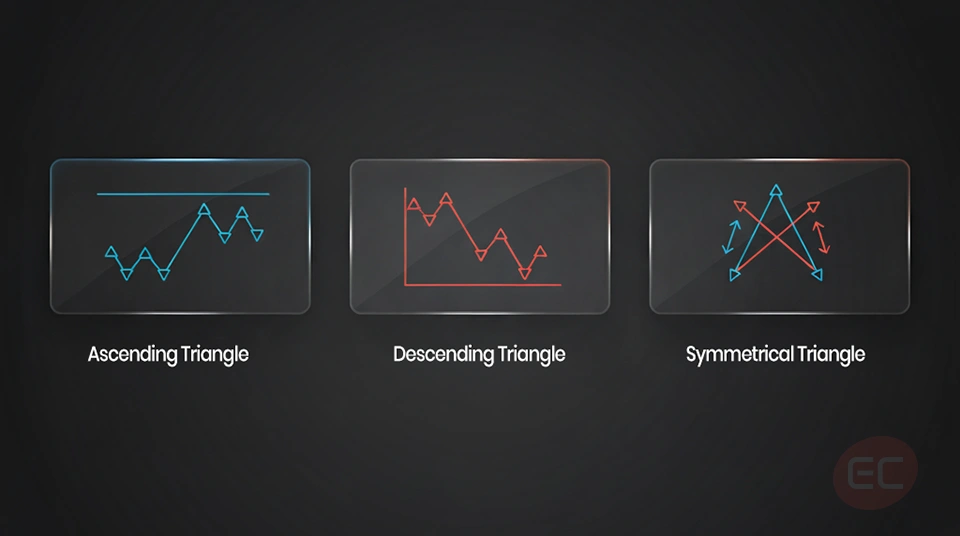

Triangles are some of the most common chart patterns, especially when trading forex. But let’s focus on the forex pattern triangle. The forex pattern triangle comes in three main forms:

1) Ascending triangle: flat resistance, rising support.

2) Descending triangle: flat support, falling resistance.

3) Symmetrical triangle : both support and resistance converge.

Clear diagram showing the three types of forex pattern triangle chart patterns.

These patterns usually tend to form during consolidation, just before a breakout.

Why is a Forex Pattern Triangle so important?

You might be wondering why forex pattern triangle is so important. Well, the answer is simple: because when the price is coiling tighter and tighter, it’s essentially building energy, and when it breaks, boom! That’s when you would often get a strong directional move.

So next time you see a forex pattern triangle, make sure to pay close attention to which side it breaks out of, as that’s often your next big trade.

What is Flag Pattern Trading?

Now, let’s talk about flags. Flag patterns are continuation setups that form after a strong price movement, then followed by a small pullback before the price continues in the same direction.

There are two main types of flag patterns to look out for when flag pattern trading, let’s break them down:

- You have Bull Flag pattern: where the price surges upward, then pulls back in a downward-sloping channel.

- And you have Bear Flag pattern: where the price drops sharply, then retraces upward in a small consolidation.

For a bull flag pattern, traders usually wait until the price breaks above the top of the flag with stronger trading volume. This shows that buyers are stepping back in and the uptrend is likely to continue. For a bear flag pattern, traders look for the opposite which is a drop below the lower edge of the flag. This suggests sellers are taking control again.

Why does Flag Pattern Trading work so well?

Because it's a reflection of a healthy trend, in other words: brief rest, then continuation. Traders use it to enter after the move has started, reducing the risk of false signals.

Bull Flag Pattern vs Bear Flag Pattern, let’s compare them

| Pattern | Trend Direction | Pullback | Breakout |

| Bull Flag Pattern | Uptrend | Slight dip | To the upside |

| Bear Flag Pattern | Downtrend | Slight rise | To the downside |

How to use a Triangle, Flag or Head and Shoulders Chart Pattern when trading

Alright, so now that we’ve covered the theory of what is a head and shoulders chart pattern, triangle pattern and flag pattern trading, let’s talk about how you actually trade these chart patterns.

Here’s a simple guide you can follow to help you get started:

- Identify the pattern: is it a forex pattern triangle? A head and shoulders chart pattern? A bull flag pattern?

- Wait for the confirmation: don’t just jump the gun, instead, let the price break key levels, like the neckline, triangle boundary, or flag pole breakout.

- Set entries and stop loss: for flag pattern trading, enter on breakout and set stop below the flag. For head and shoulders chart pattern, set your stop above the right shoulder.

- Use realistic targets: most patterns provide clues about how far the move might go, generally by measuring the height of the pattern and projecting it forward.

Conclusion: Triangles, Flags and Head and Shoulders Chart Pattern

Learning to read chart patterns is an absolute game-changer, when done right! So whether you’re watching for a bear flag pattern continuation, a bull flag breakout, waiting for a forex pattern triangle to tighten or even spotting a classic head and shoulders chart pattern near resistance, you’re essentially tapping into the psychology behind the price. And that’s really the core concept of trading.

So now that you know the answer to 'what is a head and shoulders chart pattern?' and can recognise the difference between a bear flag pattern and a bull flag pattern, you’re already miles ahead of the average beginner! Mastering forex and stock chart patterns takes time, patience and practice. The more historical charts and live markets you analyse, you’ll start noticing how often these patterns repeat themselves. Over time, interpreting chart patterns will feel intuitive and you will be able to trade with greater confidence and precision. Put what you’ve learnt into practice using a demo account and it will become second nature in no time!

Congratulations on making it this far into the EC Markets Academy! We hope you’ve enjoyed it so far! If you’re looking to explore more trading topics to get you towards becoming a confident trader, then keep reading as we unlock an array of new trading topics that every trader needs to know.