What is Spread in Forex? Understanding the Bid Ask Price Spread

If you’re new to trading, one of the first questions to answer is: "What is spread in forex?”. The forex spread is a built-in cost when trading currency pairs – it is the price of participation. However, it's not as simple as a flat fee. Spreads change according to the behaviour of the market, which means the amount you pay in spreads can change each time you place a trade. Markets fluctuate, trading activity varies throughout the day, news headlines can appear out of nowhere to shake things up and before you know it, spreads are eating away at your profits. The good news is that this can be managed. No trader can escape spreads but minimising them as a trading cost can significantly improve your performance. This article will answer 'what is spread in forex?' by breaking down the bid ask price spread, the factors that affect it, how to manage it and how to use it to your advantage. Let’s dive in!

What is Spread in Forex?

Simply, the spread is the ask price minus the bid price.

Let's break down the bid ask price spread. In forex trading, there are always two prices:

- Bid: This is the price you sell at when closing a long position or opening a short position.

- Ask (aka ‘offer’): This is the price you buy at when opening a long position or closing a short position.

The ask price is always higher than the bid price. This difference between the bid and ask is the spread, and it is the cost you 'pay' the moment you enter a trade. The bid ask price spread is the reason why a new trade starts slightly negative by the size of the spread, so in order to break even, the price must move in your favour enough to cover that gap.

Most of the time, forex spreads are not fixed. When market activity is high and liquidity is deep, spreads are often tighter. However, a quote that is normally only a few pips wide can suddenly expand. When liquidity thins out, especially during times of sudden volatility or major news releases, spreads usually widen and it can happen very fast. A wider spread can increase slippage risk, entry and exit costs, and can leave less room for stop-losses.

That's a simple answer to the question "what is spread in forex?". Now, let's walk through a quick example to show how the bid ask price spread works.

Example of a Bid Ask Price Spread

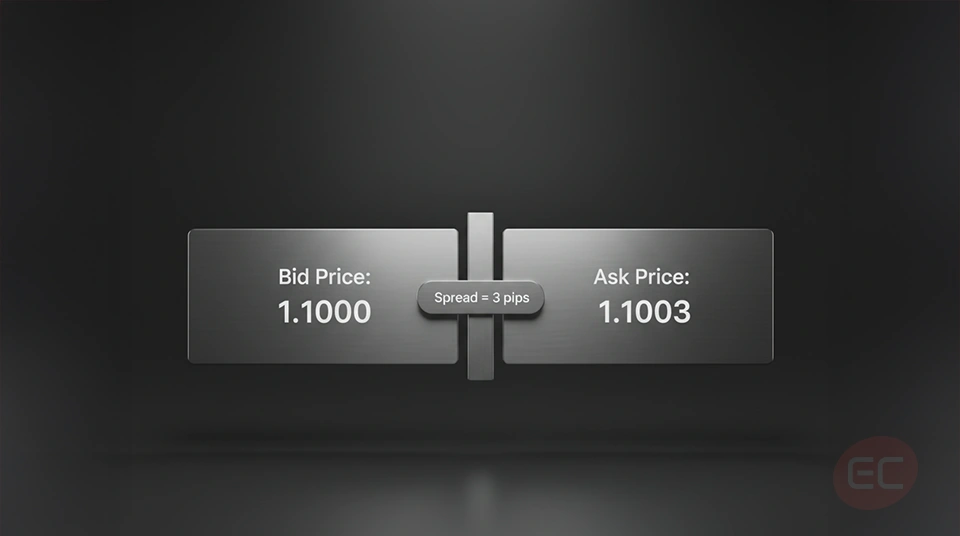

Here’s what the bid ask price spread looks like using real numbers:

Suppose EUR/USD is 1.1000 / 1.1003, which means the bid is 1.1000 and the ask is 1.1003.

Let's say you decide to buy, so you enter a trade at the ask price of 1.1003. If you turn around and close the trade immediately, you will sell at the bid price of 1.1000. That 0.0003 difference is the bid ask price spread, meaning you would be down by 3 pips, and it is the built-in transaction cost of entering the trade.

As mentioned, spreads are always subject to change. EUR/USD spread often stays tight, so ‘entry costs’ are small. However, a high-impact event, such as an FOMC statement, can cause the currency pair’s liquidity to suddenly thin out, widening forex spreads sharply and making execution less predictable.

Fixed vs Variable Spread

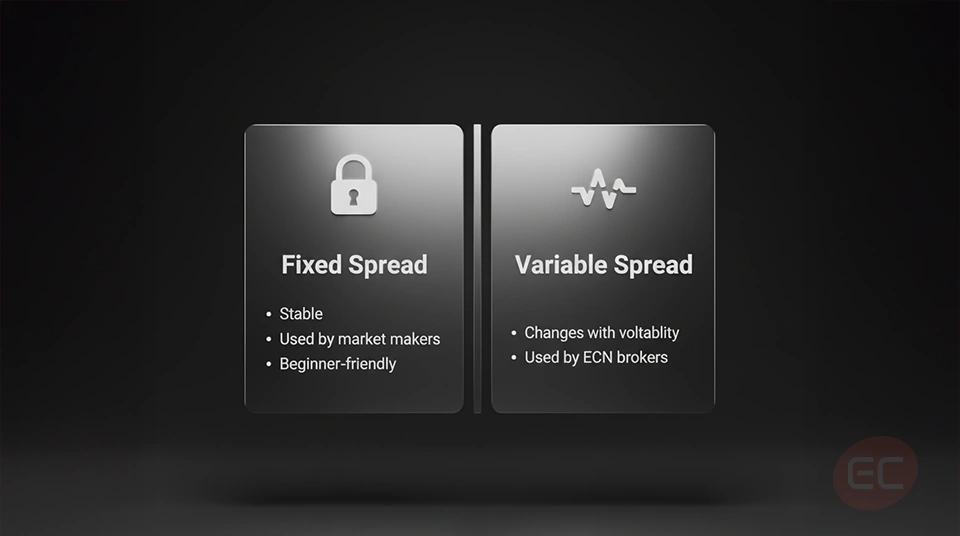

A big part of understanding 'what is spread in forex?' is knowing whether your account uses fixed or variable pricing. Let's take a look at these two pricing models:

- Fixed spreads stay the same under normal market conditions. They are often associated with market maker pricing, which is where the broker quotes the bid-ask and may fill orders internally. This can be simpler, especially for beginners, because entry costs and break-even distances are easier to estimate. The trade-off is that they are typically wider as they are usually priced with a buffer. However, fixed spreads are not immune to changes. In very fast markets, there can be execution issues, such as re-quotes, which is when prices are moving too quickly to fill at the displayed level.

- Variable (floating) spreads change depending on market conditions, i.e. liquidity and volatility. These are common on STP/ECN-style accounts and the quotes you see typically reflect real-time market liquidity. Forex spreads tend to tighten when trading activity is high, especially when the main sessions overlap. On the other hand, the spread widens when activity is low or when there are major headlines, raising entry costs and increasing execution friction.

Neither model is considered as being better than the other. Fixed spread prioritises consistency in quoting. Variable spread reflects real-time market conditions, which means watching the economic calendar and being aware of high-impact events is vital.

What Causes the Bid Ask Price Spread to Change?

The spread doesn't move at random. Forex spreads are a live reads on market liquidity and risk, so it helps to understand what makes them tighten and widen.

- Liquidity is the biggest driver. During highly active trading hours, such as the London–New York overlap, there are plenty of buyers and sellers on both sides. More participants mean more orders in the market, so pricing is competitive and forex spreads often stay tight. Conversely, when liquidity thins out, the bid-ask gap can widen quickly.

- News is a common trigger for sudden widening. Around high-impact releases such as non-farm payrolls or major rate decisions, prices can move sharply within seconds. As a result, liquidity can thin out and quotes update quickly, causing forex spreads to widen.

- Time of day matters more than most beginners expect. The forex market may be open 24/5, but liquidity never remains constant because market participation varies throughout the day. For example, during the daily rollover (usually at the end of the New York trading session), forex spreads often widen because there are typically fewer large players active in the market. The same can happen during bank holidays or very quiet hours, when the market is less competitive.

- Currency pair selection matters too. Major pairs tend to have the tightest spreads because they have the most participation and the deepest liquidity. Less-traded pairs, like minors and exotics, have wider spreads because liquidity is thinner and execution is more expensive.

Managing Forex Spread

Spreads matter because they are a direct cost of trading, and it is important to manage it properly. It is sometimes misunderstood that, when answering “what is spread in forex?”, the spread is a one-off fee; however, it’s actually a cost built into every trade you place. Every time you open a position, your trade effectively starts behind by the spread and you can only break even if the market moves in your favour. Not paying attention to spreads and market conditions will eat into your profits, especially if you trade frequently. Because spreads tend to be tighter during peak trading hours, when liquidity is deep, traders typically aim to trade during these periods to prevent costs from compounding over time.

How much this matters can depend on your strategy. A scalper targeting 5-10 pips is highly sensitive to every pip of friction, so a wider spread can quickly make a trade unattractive. A swing trader targeting 200 pips can usually tolerate more spread, because it’s a smaller proportion of the intended move. The smaller your target, the more that the spread will eat into your edge, so manage the friction before worrying about the outcome.

Important Tip for Beginners

Many retail platforms plot the bid price on charts by default, leading many beginner traders to ignore the ask, even though both prices matter. If you’re in a long (buy) position, your stop-loss is triggered by the bid, since you exit by selling at the bid. If you’re in a short (sell) position, your stop-loss is triggered by the ask, since you exit by buying back at the ask.

That’s why beginners can get confused when they’re stopped out on a short even though the chart never appears to touch the stop level. However, they don't realise that the ask may have hit it even if the bid chart didn’t.

Key takeaway: Know whether your chart is bid-only. If it is, consider showing the ask line and always allow for the spread when placing entries, targets and stops.

Tools for Managing Spread in Forex

Monitoring the spread in forex is an important part of managing your trading costs. Here are two tools to help that help traders track spreads in real time:

- Spread Indicator

On many retail trading platforms, the spread is not displayed explicitly on charts by default, so a spread indicator can be used to display the live bid-ask gap in pips. - Ask Line

Because many charts plot only the bid prices by default. Enabling the Ask Line makes it easier to understand why orders may trigger even when the candles don’t appear to touch your level — especially for short positions, where stops are typically triggered by the ask.

Also, always remember to keep an eye on the economic calendar. Avoid using it to predict direction. Instead, use it as an early warning system to anticipate periods of thin liquidity, wide spreads and increases likelihood of slippage.

Using the Spread to your Advantage

Experienced traders use the spread as an indicator of market conditions, not just a fee. A wider bid ask price spread is often a sign that the market is stressed, which can be caused by sudden risk events, major news or thin trading periods. When this happens, sometimes the best thing to do is to wait until pricing normalises.

That’s why the bid ask price spread should never be an afterthought. It should be used as a filter when selecting currency pairs to trade:

- Set a maximum acceptable spread for each pair.

- If the market is stressed and the spread widens beyond your limit, do not open a position.

For example, if you’re looking at USD/CAD and the spread is 3 pips, you effectively start the trade 3 pips behind. If your take-profit target is 30 pips, that means about 10% of the move you’re aiming for is spent just to break even (before considering any commission or overnight financing). This may not matter as much for long-term trades, but for short-term strategies, like scalping, a few pips can determine whether a setup is viable.

Tight spreads may not always guarantee a good trade, but setting an 'acceptable spread' helps keep the numbers in your strategy realistic.

Conclusion | What is Forex? The Bid Ask Price Spread Explained

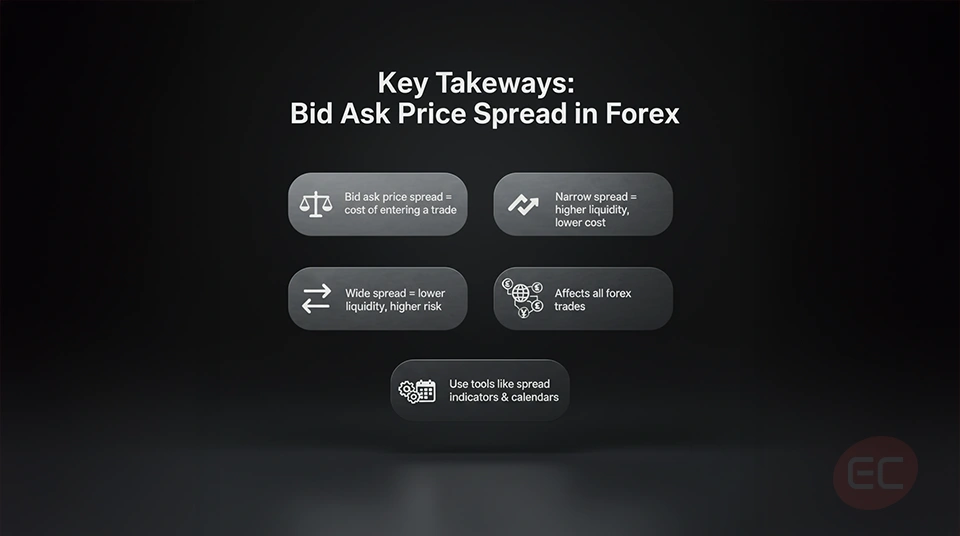

Understanding the bid ask price spread is more than just defining 'what is spread in forex?'. It is about preventing avoidable losses. Poor fills, unnecessary slippage, surprise stop-outs and trades that fail usually happen because costs were ignored.

To really answer 'what is spread in forex?' is to realise that spreads change as result of market conditions. They are usually tighter during times of strong liquidity and high competition in the market, and they are wider when conditions are less stable. So treat the spread as a check for what market conditions are like before you enter; look at the current spread, check the economic calendar, and ask yourself, ‘is this a normal trading moment or would I be paying a premium just to participate?’ If the spread is unusually wide, waiting is often the most disciplined decision.

By now, the forex spread should feel more practical than theoretical. So, what is spread in forex? In short, it is the cost you 'pay to play’. Sometimes that cost is small and sometimes it isn’t - being able to recognise the difference matters as it can change the outcome of a trade.