Economic Indicators & News Trading

Have you ever wondered why the markets suddenly spike or crash after a specific news release? That’s the power of trading news! The news can have a significant and instant impact on the market, so staying updated with current affairs and leading economic indicators is crucial to your trading success!

In this article, we are going to answer the question, 'what are economic indicators?', and break down news trading in a simple and interactive way, so you can start reacting to market moving events with more confidence, not confusion.

So let’s jump straight in!

What are Economic Indicators?

Let’s start with the big and most important question: what are economic indicators?

Economic indicators are the official statistics released by governments, central banks, and financial institutions that can give you insights into the health of an economy. They can show whether an economy is growing, shrinking, or stagnating, and based on this information, you can make strategic trading decisions and start making profits. Let’s break it down.

When someone asks you what economic indicators are, you can think of them as the “vital signs” of a country’s economy.

Here are some key examples:

- GDP (Gross Domestic Product)

- CPI (Consumer Price Index)

- Unemployment Rate

- Interest Rate Decisions

- Retail Sales

- Manufacturing PMI

Now, here's the catch: these reports are absolutely crucial, but they can move the markets fast, which makes them extremely important for trading news effectively.

What are Economic Indicators used for?

If you’re still wondering why economic indicators matter, here’s the reason! They can offer traders an early look into what might come next in the markets, these releases generally cause volatility in the markets, especially in currency pairs, stock indices and commodities, so predicting market movement can not only help you make gains, but it can also protect you from significant losses.

So if you're into trading news, knowing what are economic indicators isn't optional, it's absolutely essential.

Here’s another example:

- A stronger than expected jobs report would mean bullish for a country’s currency.

- A weak manufacturing data report could trigger a sell-off in stocks.

Knowing this information allows you to position yourself ahead of time, before the crowd. Or even more importantly, you can avoid getting caught on the wrong side of a major move, a mistake that many new traders make.

What are leading Economic Indicators and Why are they so important?

Okay, let’s go a little deeper: what are leading economic indicators? Not all indicators are created equally, some predict future movements (leading), and others confirm trends (lagging).

Leading economic indicators are the early signals, and they change before the economy starts to follow a trend, which makes them incredibly valuable for traders.

Here are some examples of leading economic indicators:

- Manufacturing PMI

- Building Permits

- New Orders for Durable Goods

- Stock Market Indices

- Consumer Confidence Index

When you understand what are leading economic indicators, you're no longer just reacting, instead, you’re anticipating, and that’s the holy grail of trading news: reacting before the crowd.

Let’s see if you really understand with a quick test.

Imagine this scenario:

- Manufacturing PMI just dropped for the third month in a row.

- Consumer confidence hits a 2-year low.

- The stock market begins to trend downward.

Question: What are these leading economic indicators telling you?

If your answer is yes, well, you're right! These are early clues of an economic slowdown, and for someone serious about trading news, this insight could guide them to short stock indices or reduce the exposure to risky, unpredictable assets.

What are Economic Indicators used for when Trading the News?

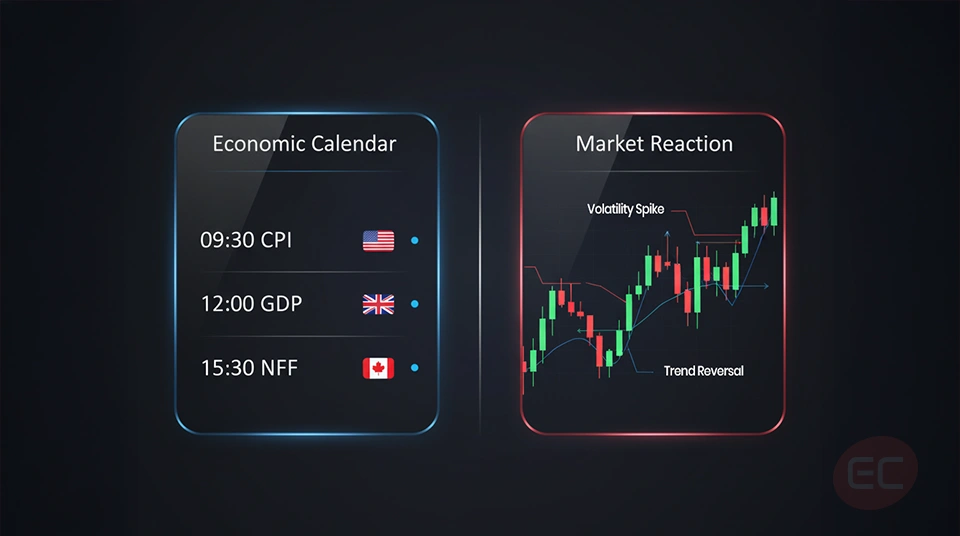

By now, you should understand what are economic indicators and leading economic indicators, but how do you actually trade them? Let’s break it down step by step.

- Check the economic calendar (you can stay updated on the EC Markets economic calendar by clicking here.

- Understand the forecast: markets will usually price in expectations ahead of time.

- Watch the actual result: a surprise number (better or worse than expected) usually causes the biggest moves.

- React with caution: enter trades with tight risk management. Think and analyse before you act.

The most powerful Economic Reports to watch

Do you want to focus on the reports that move the markets most? Great start! Here’s a quick list of high-impact releases that are all tied to trading news:

- Non-Farm Payrolls (NFP) – U.S. jobs report that always sparks volatility.

- FOMC Interest Rate Decisions – Affects all USD-based assets.

- Inflation Data (CPI, PPI) – Ties into future rate hikes/cuts.

- GDP Reports – Big-picture economic health.

- Retail Sales – Consumer demand trends.

- Unemployment Claims – Weekly check on job market.

Each of these are crucial to keep an eye on as they tie directly into understanding what are economic indicators, and most are considered leading economic indicators.

Trading News Strategies: Conservative vs. Aggressive

There are two main ways to approach trading news using economic indicators, conservative vs aggressive, let’s break them down:

1. Conservative Strategy (in other words, post news reaction), this includes:

- Waiting for the news to be released.

- Allowing volatility to spike and settle.

- Place trades based on the market’s direction afterwards.

The conservative strategy is best for new traders still learning what are economic indicators and how the market reacts.

2. Aggressive Strategy (in other words, pre news anticipation), this includes:

- Analyzing expected outcomes.

- Placing trades ahead of time based on forecast.

- Higher risk but higher reward.

The aggressive strategy is best for more experienced traders with a deep understanding of leading economic indicators.

You can decide which strategy is the best for you based on your risk tolerance, experience and trading goals.

Even the best, most experienced traders can make mistakes, it’s crucial to write down these mistakes and memorize them so you don’t make them yourself. Here are some of the most common mistakes traders make when trading news.

The most Common Mistakes to avoid when trading news

Even though trading news is exciting, and it can lead to serious opportunities in the market, it’s also risky, so here are some key pitfalls to avoid:

- Don’t ignore the forecast, you should always compare actual vs. expected numbers

- Don’t over leverage, volatility can cause major slippage

- Don’t trade every single news release as some are not worth trading

- Don’t confuse lagging with leading, focus on leading economic indicators for a predictive edge

If you’re asking yourself what are economic indicators and are they worth your time, start by focusing on those that cause the biggest market reactions, then work your way down.

What are Economic Indicators? Test your knowledge

Let’s see what you’ve learned so far with this quick quiz:

- What are economic indicators?

A) Random market tools

B) Government stats showing economic health

C) Stock tips from Twitter

Answer: B - What are leading economic indicators?

A) Stats that follow the economy

B) Indicators that predict future trends

Answer: B - Is NFP an example of trading news?

Absolutely!

Why every trader should master Economic Indicators

If you’re really serious about trading, then you can’t ignore what are economic indicators or dismiss the impact of trading news. News releases can cause significant movement in the market, and catching this movement early can make the difference between a significant gain and a loss.

Let’s recap why it’s so important:

- Economic data shapes price movement, especially in forex and stocks.

- Leading economic indicators help you anticipate future trends.

- Proper news trading strategies can give you a major edge.

So, next time someone asks you what are economic indicators, you won’t just know the definition, but instead, you’ll actually know how to profit from them.

So what’s next? We’ve covered a lot in this course, now it's time to implement it! Here are a few steps to help you get started:

- Pick a few leading economic indicators and track them over a month or so.

- Mark key events on your calendar (like NFP, CPI, Fed meetings).

- Watch how the markets react to surprises.

- Practice small trades on demo accounts using real-time news.

If you put this into practice, then soon enough, trading news won’t feel risky, but instead, it will feel like strategy.

We hope you enjoyed this course on economic indicators and news trading! If you’re new to trading and looking to unlock more trading tips and tricks, then keep on reading the EC Markets Academy as we unlock all new trading topics that will get you feeling like a confident trader in no time!