Margin & Leverage: What is Margin in Trading?

Have you ever watched the markets move and wonder how traders control such large positions with only a small amount of money? Well, you’re not alone! Welcome to what is margin in trading! Trading on margin is one of the most powerful tools a trader can use, but it can also be the most misunderstood. In this guide on what is margin in trading, we are going to break down everything you need to know about margin, trading on margin, crypto margin trading, forex and leverage, what is leverage in forex, what is margin in forex and how to use it the right way! Let’s dive straight in!

- What is Margin in Trading: The Basics

- What is Margin in Trading: How does it work?

- What is Margin in Trading: Why do traders use margin?

- What is Margin in Trading: The Role of Leverage

- What is Margin in Trading: Understanding Margin Calls

- What is Margin in Trading: Crypto margin trading explained

- Here are some common crypto leverage rates:

- What is Margin in Trading: What is Margin in Forex?

- What is Margin in Trading: Final thoughts

- Conclusion: What is Margin in Trading?

What is Margin in Trading: The Basics

Let’s start from the very top, what is margin in trading? In the world of forex and leverage, margin is the total amount of money a trader needs to deposit to their broker to open a leveraged position. Unlike a fee or a cost, it’s actually a part of your own funds that acts as a type of security deposit. Here’s a real life example: assuming you want to buy $10,000 worth of a stock, but you only have $1000, by trading on margin, your broker can actually lend you $9000. Sounds great doesn’t it? Well, as great as it is, it also comes with risk: leverage. This risk becomes even more important once you fully understand what is leverage in forex and how small market movements can amplify results.

What is Margin in Trading: How does it work?

So, what is margin in trading in terms of the actual mechanics of forex and leverage? When you’re trading on margin, you’re actually borrowing funds to increase your position size, this way, you can control more assets than you would do with your own capital. But how does it work in real terms? Let’s look into another example:

Let’s say your broker offers you 10:1 leverage, meaning that for every $1 of your own money, you can trade up to $10 worth of an asset, so $1 is your margin and the remaining $9 is provided by your broker as leverage. Let’s break it down:

Your capital: $1,000

- Leverage: 10:1

- Trading power: $10,000

- Margin required: $1,000

In other words, only need $1,000 to control a $10,000 position!

What is Margin in Trading: Why do traders use margin?

You might be wondering, why not just trade with your own money? Well, by using margin and leverage, traders can actually access larger positions, potentially increase their profits, and diversify with limited capital. However, although trading with margin can lead to significant profits, it can also lead to losses. If the market decides to move against your position, you would actually lose more than your initial margin deposit, so understanding what is margin in trading is crucial to the safety of your funds.

What is Margin in Trading: The Role of Leverage

We’ve explored what is margin in forex, now let’s dive into the other side of the coin: Leverage. If you’ve ever wondered what is leverage in forex, here’s a clear explanation of it. Leverage is the ability to control a larger position with a relatively small amount of money. That’s what makes trading on margin so attractive! With forex and leverage trading, brokers can often offer leverage up to 50:1 or even higher! That means you can control $50,000 with just $1,000 of margin. But, what would happen if the market drops by 2%? That would be a $1000 loss on a $50,000 position, which is your entire margin! This example highlights exactly what is leverage in forex and why traders must calculate their risk carefully before opening a position. So things can turn quickly, but how quickly?

What is Margin in Trading: Understanding Margin Calls

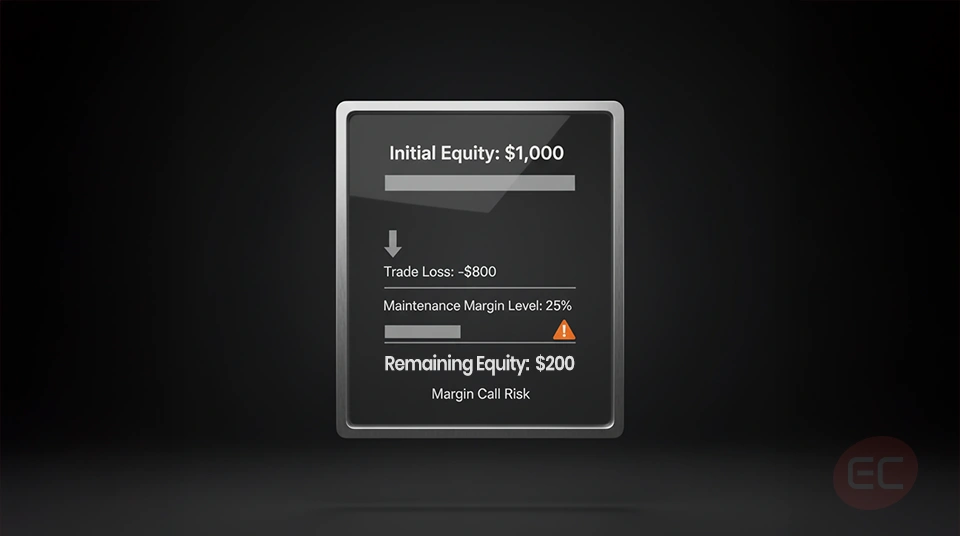

Let’s assume you’re trading on margin, and all of a sudden, you receive a margin call. But what does that mean exactly? A margin call happens once your account value falls below the broker's required margin level. Usually, this happens when your trade moves significantly against you.

Let’s break it down:

- Let’s assume your initial margin requirement is $1000

- Market loss is -$800

- Remaining equity is $200

- Broker’s margin maintenance level is 25%

You would need at least $2500 in total value to be able to maintain the $625 margin (25% of $2,500). If your equity would fall below this point, you’d either have to deposit more funds or your position is at risk of being liquidated. Therefore, understanding what is leverage in forex is crucial so that traders don't take on far more risk than they realise.

What is Margin in Trading: Crypto margin trading explained

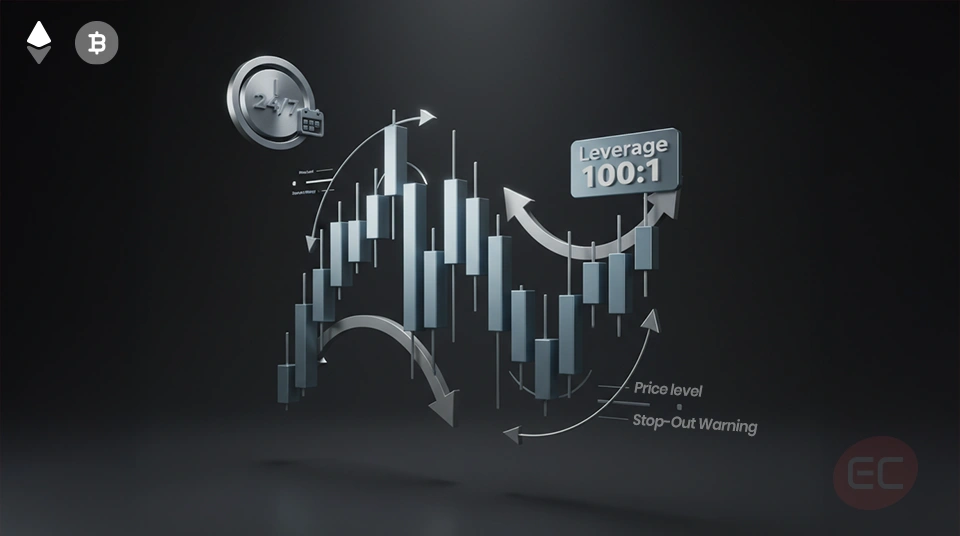

If you’ve made it this far into the course, you should by now have a good understanding of what is margin in trading, let’s now explore the world of crypto margin trading! In crypto margin trading, traders essentially borrow funds to increase their crypto positions. Sounds pretty good doesn’t it? Well, considering the high volatility of cryptocurrencies, margin trading can be incredibly profitable, but can also be risky, and understanding crypto margin trading is crucial to your long term success!

Here are some common crypto leverage rates:

- 5:1 to 100:1 on platforms like Binance, Bybit

- Bitcoin and Ethereum are commonly used in crypto margin trading

- Positions can be either long (which means you’re betting on a rise) or short (you’re betting on a drop)

As we all know, the crypto market operates 24/7, so margin calls can happen at any time and any day of the week, even while you’re sleeping!

What is Margin in Trading: What is Margin in Forex?

Now let’s explore the largest and most liquid market in the world: forex. What is margin in forex? Let’s break it down:

Let’s assume you open a 100,000 EUR/USD trade, and a broker offers you 50:1 leverage. Your margin required is $2000. The rest ($98,000) is borrowed from your broker. This is essentially what is margin in forex.

Sounds pretty straightforward so far? Just in case, let’s summarize the pros and cons from using margin in trading:

Pros:

- Benefit from greater exposure with less initial capital

- Enhanced potential to make profits

- Short selling opportunities

- Diversify your portfolio

Cons:

- Margin calls and liquidations

- Potential risk of amplified losses

- Emotional trading under nerves of pressure

To make sure that you succeed at trading on margin, you’ll need more than the basic knowledge, you’ll need strategy and most importantly, discipline. A few tips to help you get started:

- Always use stop loss orders

- Start with low leverage until you get comfortable with it

- Do not invest more than what you can afford to loose

- Make sure to always monitor your trades closely

- Understand your broker’s margin policies

In both crypto margin trading and forex and leverage, discipline and understanding is crucial to your trading success!

What is Margin in Trading: Final thoughts

Congratulations on making it this far into the EC Markets Academy course on what is margin in trading! By now you should have a good understanding of the power of margin. Let’s recap some of the most important points:

- What is margin in trading? Margin allows you to borrow funds to essentially increase your trade size.

- Leverage can both amplify your gains but also amplify your losses, so using leverage with caution is a must.

- Trading on margin requires clear strategy and risk management.

- Crypto margin trading and forex leverage can offer high rewards, but also high risk!

- Understanding what is leverage in forex and what is margin in forex is crucial to your trading success and can help you avoid any unexpected surprises.

Conclusion: What is Margin in Trading?

As we wrap up this course on what is margin in trading, you should have a good understanding of margin, forex and leverage including its potential power on your trading account. It’s not just a trading tool, it’s a strategy that can open a whole new level of opportunities when used the right way. So whether you’re new to trading or you’re a seasoned trader, understanding what is margin in trading is crucial to a successful investment. We’ve looked into trading on margin and how it can offer the power to control a larger position with a smaller initial investment, but we’ve also explored how this can lead to more risks, so understanding concepts like what is leverage in forex, what is margin in forex, how forex and leverage work together and using margin correctly is crucial to safeguarding your funds. We also explored the fast moving world of forex. What is margin in forex is so much more than just a technical definition, it’s a crucial factor in your trading survival! Now add on top of that the rising popularity of crypto margin trading and you quickly realise why knowing what is leverage in forex and managing your trading risks correctly is an absolute must!

We hope you enjoyed this course on what is margin in trading! If you’re new to trading and still want to learn more about topics like forex and leverage in the world of trading, then keep on reading the EC Markets Academy as we look into more topics that will get you from a beginner to an expert trader in no time!