Trend Analysis & Trendlines: How to read Market Momentum

Have you ever felt like the market is moving in waves, but you're not quite sure how to catch them? Well, you’re not alone! At some point in their journey, many new traders ask the same question: What is Trend Analysis? That's where trend analysis and trendlines come into play. These tools help traders spot momentum, ride the wave and exit before the market shifts. They are crucial in the success of your trading journey! But what exactly is trend analysis and how is trend trading any different from just buying low and selling high? In this article, we are going to break it all down, one step at a time, so you understand what is trend trading and start using market trend analysis in your own trading strategy right away.

What is Trend Analysis?

So, what exactly is trend analysis?

In simple terms, trend analysis is the process of analysing price movements over a period of time to identify the market’s direction. Does it go up, down, or sideways? The market direction says everything you need to know. Traders generally use it to answer one of the most important questions in trading: where is the market going? What should my next move be? When should I get in and when should I get out?

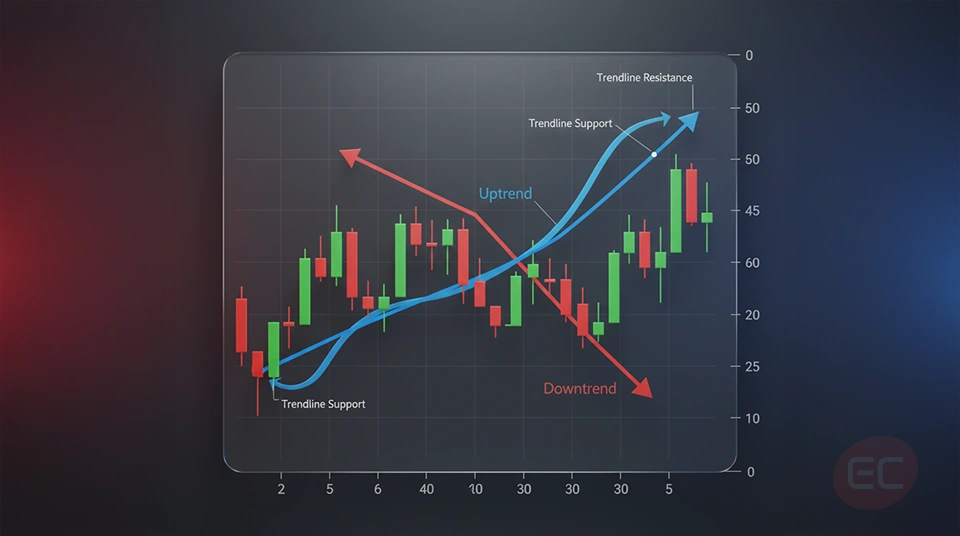

The market can trend in three directions:

- Uptrend: Higher highs and higher lows

- Downtrend: Lower highs and lower lows

- Sideways: No clear direction

When you’re studying past movements, trend analysis can help traders predict future price action. And once you really understand what is trend trading, you’ll realise just how powerful it is for making consistent trades over a long period of time.

Why is Market Trend Analysis crucial for traders?

You might be asking yourself, why are trends so important when it comes to trading. Well, because trading against the trend is like swimming upstream, it’s exhausting, risky, and most often unsuccessful, so why would you do it? Trend analysis works in the exact same way. Use it efficiently and it can help you make long term consistent profits. Now let’s look at how market trend analysis can help.

Here’s what market trend analysis helps you do:

- Identify when to enter a trade

- Know when to stay out of the market

- Follow the momentum instead of fighting it

- Maximize profits by riding strong trends

When you understand what is trend analysis, you’ll quickly realize that it's about so much more than lines on a chart, instead, it's about interpreting price behavior and market psychology, two concepts that are crucial for traders to know. If you want to know more about trading psychology make sure to read our course on ‘Managing Emotions & Psychology of Trading’ here at the EC Markets Academy.

What is Trend Trading and why do traders absolutely swear by it?

So far in this course, we’ve talked about identifying the trend. But what exactly is trend trading?

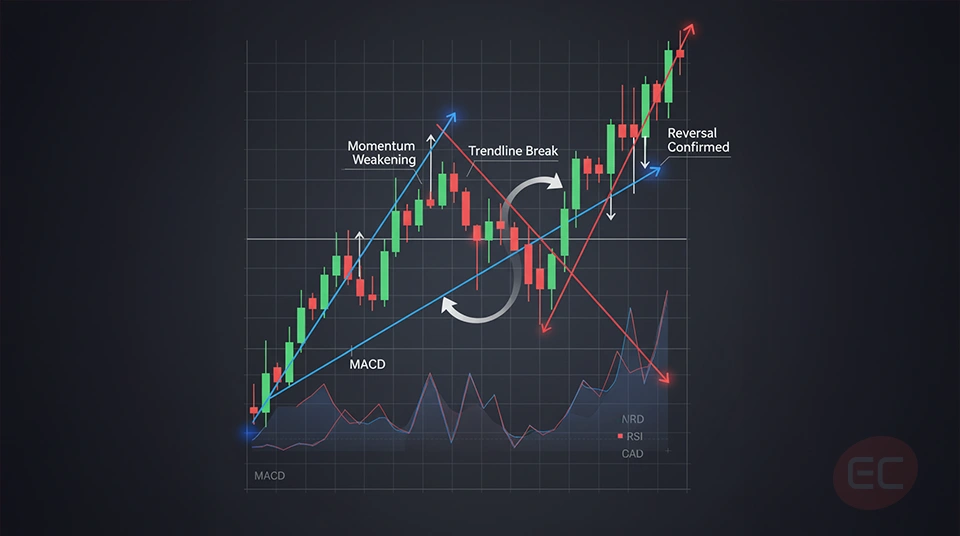

Trend trading is essentially a trading strategy that involves entering a position in the direction of the existing trend, and making sure to stay in that position until the trend shows signs of reversal. Does it make sense? If not, let’s look at an example.

Here is a real-world example. Assuming BTC is in a steady uptrend, a trend trading strategy in this case would involve:

- Buying during pullbacks

- Holding as long as the trend continues

- Selling only when a clear reversal is forming

This point is exactly where market trend analysis becomes critical, you would use it to assess the trend’s strength, direction, and potential continuation. Essentially, this is the backbone of trend trading.

What is Trend Trading? How to draw Trendlines?

So, by now you should know what is trend analysis and what trendlines are, but how do you actually draw them? Let’s find out!

Here’s a mapped out guide on how to use trendlines in your trend analysis:

- Zoom out: What does that mean? Start with higher timeframes, like 1-day or 4-hour to identify the most dominant trend

- Connect at least two points: For uptrends, connect swing lows and for downtrends, connect swing highs

- Adjust to fit the price action: A perfect trendline rarely exists, try not to force it too much

- Avoid choppy zones: Try to stick to clean, consistent moves when you apply market trend analysis

Remember these points because once you master them, trend trading becomes a whole lot more strategic and a lot less emotional, which we all know is crucial when making informed and clear trading decisions.

What is Trend Trading vs. Swing or Scalping?

What’s the difference between them? Let’s compare.

- Trend trading: it focuses more on capturing long-term price movements

- Swing trading: it focuses more on short-term moves within a trend

- Scalping: This is quick in and out and its generally not trend-dependent

All three strategies are proven work, granted, but trend trading is especially powerful when used side by side with solid trend analysis. By doing this, you’re essentially allowing the market to do the heavy lifting, while you manage the risk and profits.

Now that we’ve looked into trend trading, swing trading and scalping, let’s explore trend analysis on different timeframes.

What is Trend Analysis on different timeframes?

Let’s jump straight in! A trend on a 5 minute chart may look completely different on a daily chart, but how does that affect your trend analysis? It all comes down to one thing: fractal behavior. The market trends in all timeframes, that’s why multi timeframe analysis is crucial when applying market trend analysis.

Here’s how you should be aligning timeframes for more effective trend trading:

- Daily chart: Good to identify the major trend

- 4-hour chart: Good to confirm trend strength

- 1-hour chart: Good to time your entry point

What is Trend Trading? Can you spot the trend?

Now that you’ve made it this far into the course, let’s put your skills to the test.

Open a live chart on any asset and ask yourself:

- Are you seeing higher highs and higher lows?

- Where could you draw a trendline to connect the swing points?

- Does this align with the trend of the bigger time frame?

By doing this regularly and by constantly asking yourself these questions, you’ll eventually train your brain to see market trend analysis opportunities instinctively, in other words, it will become second nature to you.

Conclusion: What is Trend Analysis and why Trendlines & Trend Analysis are essential

We’ve covered a lot in this course, so let’s wrap it up with a quick summary:

- What is trend analysis? It’s the process of identifying the direction of the market using historical price data

- Trendlines help visualize this direction clearly

- Market trend analysis gives traders an edge by aligning trades with momentum.

- Trend trading is a strategy that is based on holding positions in the trend’s direction to gain maximum profits

Once you start practicing and you really start to understand what is trend trading, you’ll soon begin to see that trading doesn’t have to be chaotic. With the right trend analysis, the right knowledge and a little patience, trading can actually feel calculated and calm, in fact, that’s how the best traders feel. If it’s thought out and calculated, it will feel right.

So what’s next? Well, like I said, stay educated and keep on practicing until it feels right. Start with a demo account. Open a chart and draw your first trendline, identify an uptrend or downtrend and practice entering trades in the direction of the trend. The more you practice, the more natural trend analysis will become.

We hope you enjoyed this course here at the EC Markets Academy! Keep on reading as we continue to unlock more trading knowledge throughout this course.