Limit Order vs Stop Order: Key Differences and How to Use Them

Trading the financial markets can often feel like learning a whole new language. Understanding specific terms can be confusing to new traders at first such as a Limit Order vs Stop Order or a Trailing Stop Loss. But don’t worry, in this course on limit order vs stop order, we are going to break it all down, using real world examples and useful tips to help you make more informed, smarter and confident trading decisions. We'll take it step by step and first answer the simple question of 'what is a Market Order?' before we ask 'what is Stop and Limit Order?'. By the end of this course, you should have a good understanding of the difference between a limit order vs stop order and you should also be able to know how and when to use each to your advantage. So let’s get started!

What is a Market Order?

A market order is the most direct and fastest way to enter or exit a position. It instructs the broker to execute an order immediately or as soon as possible at the best available price. However, the trade-off for the speed of a market order is the lack of protection against poor pricing.

In stable market conditions, when liquidity is high, fills are often close to the quoted bid/ask prices. But during high volatility or low liquidity, that ‘immediate’ fill could happen several pips away from your intended entry – this is called ‘slippage’.

With a market order, execution is prioritised over price precision. So, if you’re a trader who values more control over your entry conditions, it’s time to consider using Limit and Stop Orders. Let's find out what these are and explore the differences between them.

The Main Differences: Limit Order vs Stop Order

Limit order vs stop order, what is it that really sets them apart?

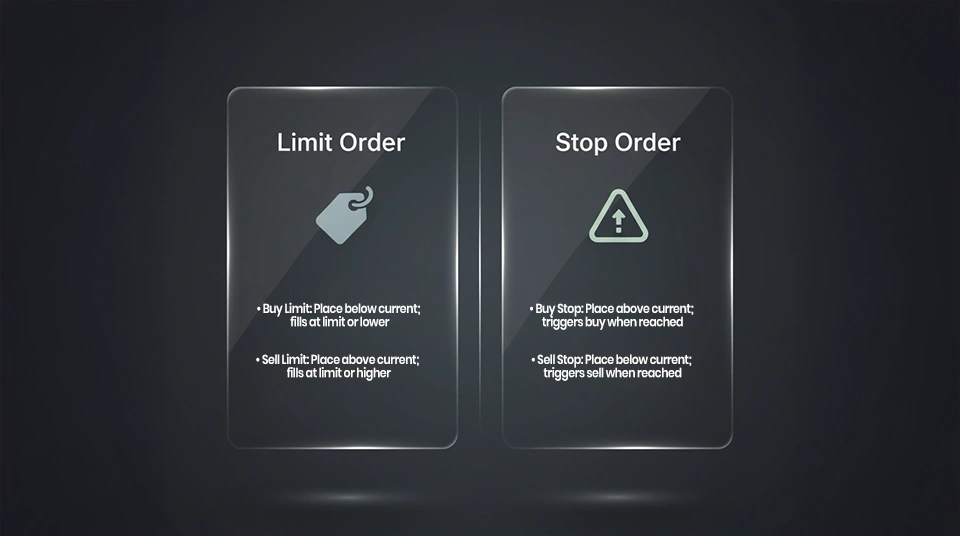

Limit Order:

A limit order allows you to set a specific price where you would like to buy or sell an asset. The order will only go through if the market hits that particular price, or even a better price. There are two type of limit orders:

1) A buy limit order: set below the current price of the market

2) A sell limit order: set above the current price of the market

Here’s a real life example: let’s say at this exact moment, EUR/USD is trading at 1.1000, and you only want to buy if it drops to 1.0950, you would want to place a buy limit order at 1.0950. Does it make sense? So let’s look into the other side of limit order vs stop order.

Stop Order:

A stop order is slightly different to a limit order. It actually becomes a market order once a certain trigger price (called the stop) is reached. Just like the limit order, there are two types of stop orders:

1) A buy stop order: set above the current price of the market.

2) A sell stop order: set below the current price of the market

Here’s another real life example to show what is a market order: assuming you believe that EUR/USD will continue rising after breaking 1.1050, you would most likely want to set buy stop order at 1.1050. As soon as the level is reached, your trade becomes a market order and will execute at the next available price. To sum up the limit order vs stop order topic, here are the key main differences you need to know about:

- A limit order essentially aims to get you the best possible price

- A stop order helps to protect you against potential losses and also helps you catch momentum

Limit Order vs Stop Order: What is Stop and Limit Order in a Trading Strategy?

When someone asks: what is stop and limit order, they’re usually trying to figure out how these orders fit into their trading strategy. And although they are both very powerful tools, they serve a different purpose with regards to your trading strategy. Here are a few key points to know, to help you decide when to use a limit order and when to use a stop order.

Use limit orders when you want to enter or exit the market at a specific price. Use limit orders when you’re trading during lower volatility market movements. Use limit orders if you’re not in a specific rush and you want to avoid slippage.

On the other hand, you should use stop orders when you want to catch a breakout, when you’re protecting an open position, or when you need to ensure a quick exit in case the market starts moving against you. The best way to understand limit order vs stop order is by fully comprehending how they fit your trading style and objectives.

The Pros and Cons: Limit Order vs Stop Order:

Let’s narrow down the pros and cons of limit order vs stop order. This should be able to help clarify your decision making process:

Limit Order Pros:

- Better price control.

- Avoids slippage.

- Ideal for range trading.

Limit Order Cons:

- If the market doesn’t reach desired price, the order may not be executed

Stop Order Pros:

- Ideal for managing risks.

- Can help you catch momentum.

- Crucial to trend trading.

Stop Order Cons:

- Becomes a market order, slippage may occur.

- Can execute at a worse price, especially during moments of high market volatility.

Understanding what is stop and limit order can help you make the right decisions by choosing the right tools at the best possible time.

If you’ve made it this far into the course, you probably have a good understanding of limit order vs stop order, but just in case things are still unclear, let's have a look at some real life examples:

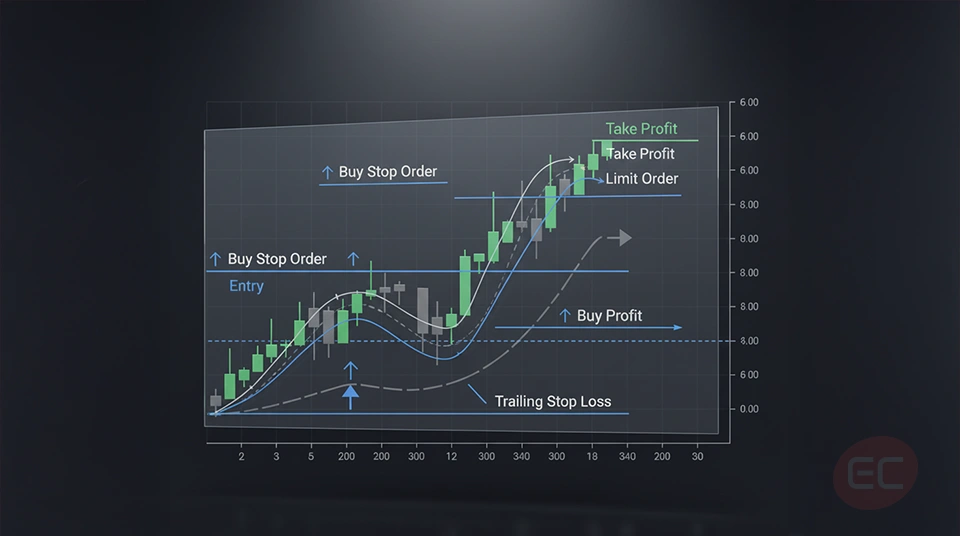

Let's dive into another scenario to know what is stop and limit order where we assume you're trading Tesla and it's currently trading at $800. Do you think it will dip before going back up? Then you would want to place a buy limit order at $780. On the other hand, if you think it's going to surge past $820? Use a buy stop order at $820 to ensure you catch the breakout. Maybe you don’t want to lose more than $20 per share? Then add a trailing stop loss to your trade.

A trailing stop loss is a stop order that automatically adjusts as the market moves in your favour. It maintains a fixed distance called the 'trail', for example, a number of pips or a percentage, and the order follows the market until a reversal of that size occurs, which helps you to capture large moves while maintaining defined exit rules.

Using these orders correctly and efficiently is the best way to create a well rounded trading plan that will bring you long term success.

Final Thoughts: How to master Limit Order vs Stop Order for a better trading experience:

By now, you should have a good understanding of what is a market order, what is stop and limit order and understand the clear differences between limit order vs stop order. It is important for any trader to know just how powerful these tools can be when used in the right way. But to really become a confident trader and make correct, informed decisions, you not only need to understand the terminology of these tools, but you also need to understand the context in which these order types work the best and how they can support your trading journey in the long run. So let’s tie everything together with a few final insights that will strengthen your understanding of what is a market order, what is a stop and limit order, what is the difference between limit order vs stop order and the critical role of the trailing stop loss in your trading experiences.

One of the biggest advantages of limit order vs stop order is that these tools have the power to remove any emotional based trading decisions, which we all know can be detrimental to your trading account. When you’re trading with real money, it's easy for emotions to get in the way and to get caught up in the moment. Beginner traders who are unfamiliar with what is stop and limit order are more likely to panic sell during a dip in the market or buy impulsively due to a specific trend. By using a limit order or stop order, you allow yourself to make rational and calculated decisions in advance. You’re not guessing, you’re planning ahead! Let’s cover a few of the key takeaways you should always remember:

- A limit order can help you control the price, by choosing your entry and exit points.

- A stop order can help you control the risks, by allowing you to get in and out when certain levels hit.

- A market order offers speed but less precision.

- A trailing stop loss can allow you to lock in profits as the market moves in your favor.

- All these tools combined allow you to give a strategic edge in the market.

So, next time someone asks you ‘what is a market order’ or ‘what is stop and limit order’, you’ll not only have the answer but you’ll also have the experience to back it up!

We hope you enjoyed this course on limit order vs stop order! But stick around as we still have a lot of trading courses to cover in the EC Markets Academy.