Are We Entering a Multi-Year Soft Landing Cycle?

Investors have spent the past two years in a will-it-or-won’t-it debate, wondering if economic growth could really hold up while inflation cooled off. Central banks have been trying to control inflation without triggering a recession, and as price pressures ease, markets keep asking: is this time different?

Real GDP Growth (World)

Source: IMF, World Economic Outlook (October 2025), via IMF DataMapper.

Corporate Earnings: Resilience and Breadth

One pillar of the soft-landing case has been the surprising resilience of corporate earnings. Companies are not just getting through; many are thriving, thanks to stable profit margins and efficiency gains. S&P 500 firms have maintained net profit margins above 12% for five consecutive quarters. After facing inflation’s squeeze in 2022, companies moved quickly to streamline operations to protect profitability. Productivity picked up and expenses stayed narrow, allowing companies to preserve their pricing power. By 2025, about 88% of enterprises are using AI in some capacity, delivering productivity gains.

Revenue has held up better than expected. A wide set of companies beat expectations – about 81% of S&P 500 firms beat earnings and revenue estimates in Q2 2025. Europe and other regions are seeing a more mixed picture, but corporate profits have been relatively resilient. Companies have adapted quickly – cutting costs when needed, investing when it pays off, and embracing innovation.

The Consumer: Strong, But Uneven

Consumers have held up better than many expected. Unemployment is still near historic lows in a lot of countries, and labour markets remain tight. Wages aren’t rising as fast as they were, but in many places, pay is now outpacing inflation. In the US, for example, real earnings are growing again. Many households also came into this period in relatively good shape, having refinanced at low rates during the pandemic.

Still, it hasn’t been smooth for everyone. Lower-income households have felt more pressure. Credit card balances have gone up. So even though overall spending looks okay, the gains haven’t been evenly shared. There are signs of strain; rising defaults, shrinking savings, but the big-picture data still shows resilience. Confidence has dipped, but it hasn’t fallen off a cliff. A soft landing doesn’t mean everyone’s landing softly, but it’s still a much better outcome than a full-blown recession.

The Central Bank Pivot

Perhaps the most intriguing part of this cycle is what central banks are poised to do next. Typically, rate cuts come as an economy weakens. This time could be different: we might see cuts into strength. The mid-1990s offer a useful reference point: in 1995, the Federal Reserve shifted course with a series of “mid-cycle” rate cuts that ultimately helped extend the expansion. We could see something similar today. If inflation continues to ease while growth simply moderates, central banks may choose to reduce rates back toward neutral levels. Some have already begun that transition. With price pressures cooling, the case for normalising policy is gaining traction.

Lower interest rates would gradually ease borrowing costs, offering relief to both households and businesses. For firms facing significant debt maturities in 2025-2026, refinancing could become less burdensome. Still, any rate-cutting cycle is likely to be slow and data-driven. If inflation continues to decline and output remains steady, this kind of measured easing could support a longer economic expansion.

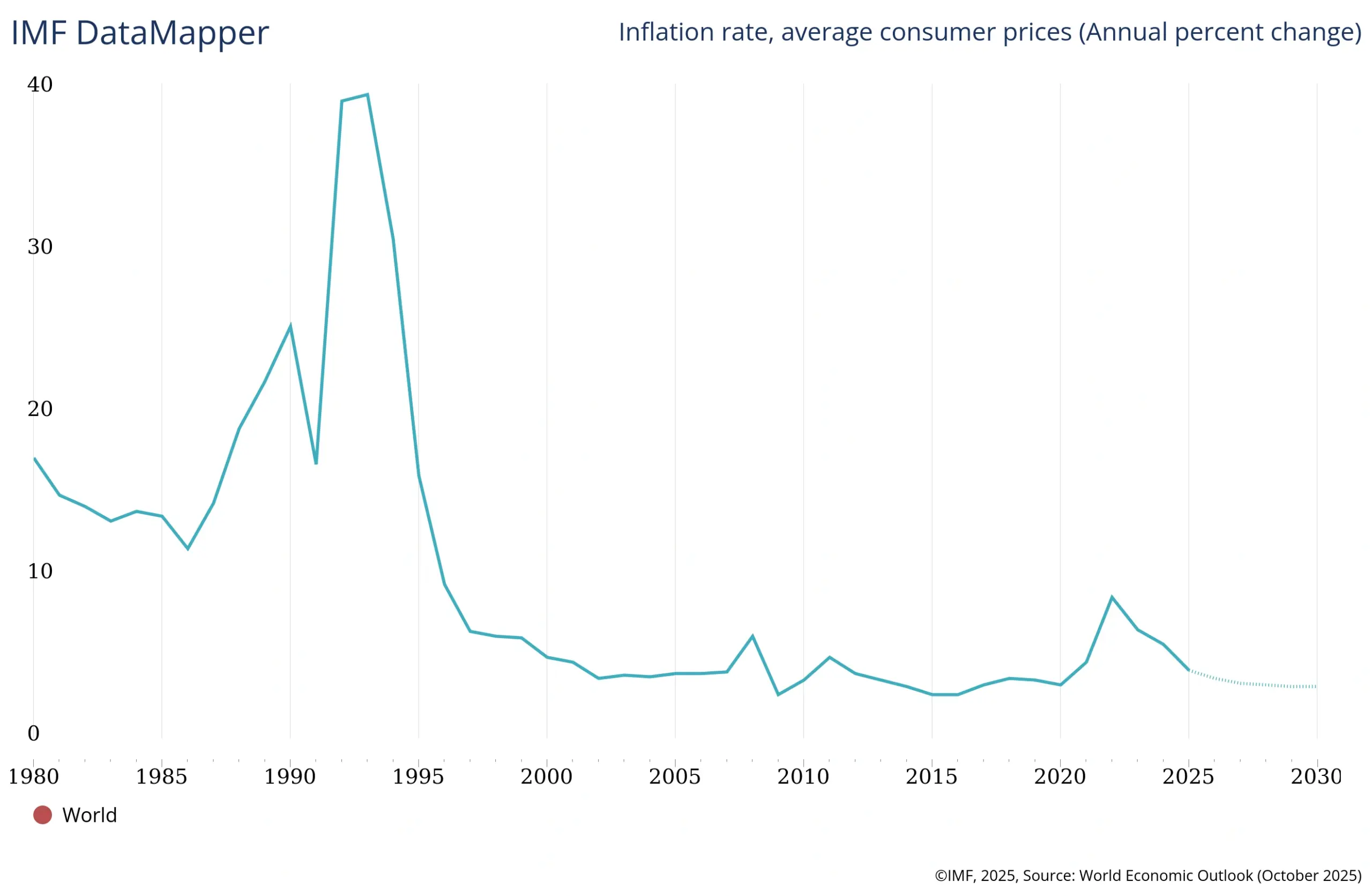

Global Inflation (Average Consumer Prices)

Source: IMF, World Economic Outlook (October 2025), via IMF DataMapper.

How Markets Are Reacting

A soft landing is often the market’s ideal scenario. When inflation eases without tipping into recession, equities typically respond well. We’ve already seen stock markets climb as inflation has cooled. Investors are less concerned about aggressive rate hikes, and earnings haven’t shown signs of sharp deterioration.

Bond markets, meanwhile, are entering a new phase. Yields generally decline when rate hikes end and cuts begin, boosting bond prices. If central banks pivot toward neutral policy, fixed income could benefit, especially in longer-duration segments. If easing is driven by stable growth rather than crisis, the bond rally may be modest but steady.

Currency markets are adjusting too. Exchange rates tend to reflect changes in rate differentials and global risk appetite. As the Fed approaches the end of its hiking cycle, the dollar has started to lose ground. If US rate cuts arrive ahead of those in Europe or the UK, that trend could deepen. Traders will be watching rate signals closely, especially where monetary policy paths begin to diverge. Some of the outsized currency moves of the past two years could start to unwind.

Risks That Still Linger

A soft landing isn’t a sure thing. Inflation could stick around longer than expected, especially in services, which might make central banks hold off on cutting rates. Geopolitical tensions could flare up and shake markets. And with borrowing costs higher, some companies or governments could struggle to refinance their debt.

A New Phase?

Strong company earnings, steady consumer spending, and the possibility of gradual rate cuts all point toward a soft landing that could last. It’s not guaranteed, but the conditions are starting to line up. If it plays out, it’ll be a reminder that economic expansions don’t just end because they’ve been going for a while.