Understanding Price Action: Learn to Read the Markets

Have you ever looked at a price chart and thought, “what is this trying to tell me?” Well, you’re already asking the right question! Because what is price action can be defined in one term: the language of the market. In this article, we are going to break down what is price action trading, Tesla action price, how it works, and why it’s such a powerful tool for traders, without needing to rely on indicators or algorithms. So whether you're watching Bitcoin, gold, or even Tesla action price, learning to read price action trading will change the way you see the markets.

So let’s get started, from the very beginning!

What is Price Action?

At the core, price action is simply the movement of a market’s price over a specific period of time. It’s what you see when you look at a candlestick chart, without any indicators, and without any overlays, just the price movement.

So when traders ask, “what is price action?”, they’re really asking how to read price charts in a way that’s meaningful. In simple terms, 'what is price action trading?' can be answered as using only raw price data like candlesticks, patterns, and market structure to identify trade opportunities. It’s about interpreting buying and selling behaviour, straight from the candles.

But why is it so important and how is it so powerful?

Because it’s immediate, it works in real-time, it shows you what traders are doing right now, not based on past averages or lagging indicators.

What is Price Action Trading?

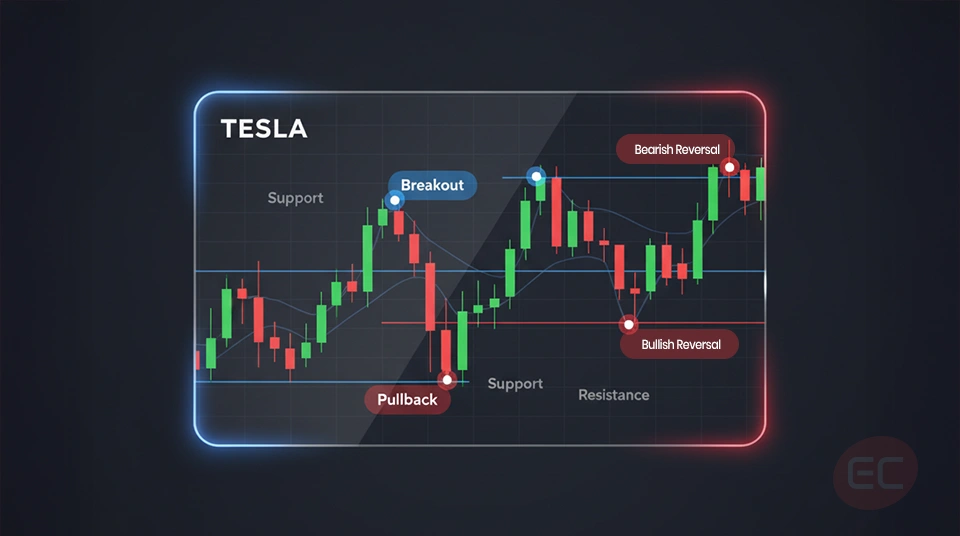

Now that we’ve covered what is price action, let’s talk about what is price action trading. Price action trading is the strategy of making trading decisions based entirely on price movements. This would usually take place by watching candlesticks, chart patterns, and key levels like support, resistance, and trend lines.

So when someone refers to price action trading, they usually mean:

- That they enter trades after breakout or rejection candles.

- They watch for patterns like pin bars, engulfing candles, or inside bars.

- They read the “story” of the market based on recent highs, lows, and structure.

It’s one of the cleanest, most minimalist approaches to trading, and although it can be effective across all markets, from Forex to stocks like Tesla action price, it can also come with risks.

Let’s look at a real world example to understand this a bit further.

Tesla Action Price and Price Action Trading

Let’s take Tesla action price as a real-world example.

If you look at Tesla’s daily chart, you’ll probably notice how certain price zones get tested over and over again, maybe around $250, the price bounces multiple times. Then you see a strong bearish engulfing candle at a recent high, well, that’s price action trading at work.

By recognizing how prices react at these levels, without using any indicators, you’re essentially making decisions based purely on what the price is telling you.

So next time you’re analyzing Tesla action price, try asking yourself the following questions:

- What’s the overall structure?

- Is this a higher low or a break of structure?

- Did we just print a bullish engulfing candle at support?

How to start reading Price Action

Are you ready to dive into price action trading for yourself? Here’s a beginner friendly step by step approach to help you get started.

1. Strip your Chart: Remove any indicators, clean it up until you’re just left with price and candles, this will help train your eye to focus on what matters.

2. Understand Candlestick Behavior

Look at common candlestick patterns, including:

- Pin bars (showing rejection)

- Engulfing candles (showing strength)

- Inside bars (indecision or continuation)

These candles are the building blocks of what is price action trading, so it’s important to learn them and to put them into practice.

3. Identify Key Zones: Mark out any support and resistance levels where the price tends to usually react. When the price returns to these zones, you’ll often see a pattern emerge, these patterns give you an idea for potential entries.

4. Read the Structure: Ask yourself this question: is the price forming higher highs and higher lows? Or lower highs and lower lows?

Why Traders tend to prefer Price Action over Indicators

Traders often start with lots of indicators, but many eventually shift to price action trading. Why does this happen? Well, because the price is immediate and honest. So when you really understand what is price action, you won’t need to wait for an indicator to catch up, you can actually see the trend shift, the momentum change, and breakout setups as they happen, on the spot.

And as we know, when it comes to volatile stocks like Tesla action price, timing is absolutely everything.

The Psychology of Price Action

One of the most important and best parts of understanding what is price action is realizing that it's a reflection of human behavior. In what way you might be wondering? Every candle essentially tells a story, here’s how:

- A long wick shows rejection and hesitation.

- A strong bullish close near the high shows confidence.

- A failed breakout suggests market traps or false moves.

This is why so many traders are loyal to price action trading, because it feels intuitive and they trust their gut. Although it might be risky, once you get it, you really get it.

Common Price Action Patterns you should know

Here are some key patterns used in price action trading that you should absolutely know:

- Pin bars: long wick, small body, they suggest rejection and potential reversal.

- Engulfing candles: a big candle that fully covers the one before, it shows strength.

- Inside bars: a smaller candle within the range of the previous one, it shows consolidation before a breakout.

Learning how to spot these on charts like the Tesla action price can give you an edge in timing your trades better, which can essentially lead to better opportunities and therefore more profits.

Why is Price Action Trading so unique?

Are you still wondering what is price action trading and why people love it?

Here’s why it stands out so much:

- No lag: unlike indicators, price action is real-time.

- It works everywhere: including Forex, crypto, commodities, and yes, even Tesla action price.

- Simple tools: a simple chart, a few lines, and your eyes.

- It’s adaptable: it works for scalping, swing trading, or long-term investing.

So if you're asking “what is price action?” It’s the most pure way to read and react to the market movement.

Is Price Action Trading right for you?

Although price action trading is generally loved amongst traders, it’s not for everyone. So when deciding if price action trading is right for you, ask yourself these questions:

- Do you prefer clean charts?

- Are you willing to learn how to read structure and candles?

- Do you want to understand the market without relying on indicators?

If so, then price action trading might be your perfect approach! But remember, traders watching Tesla action price, Forex pairs, or Bitcoin all rely on one thing: the price. Everything else is secondary.

Conclusion: What is Price Action?

If you’ve made it this far into the course, you should no longer be asking what is price action or what is price action trading, because now you know.

We’ve covered how the price can reveal market structure, trader sentiment, and potential setups, no matter whether you're looking at crypto, currencies, or Tesla action price.

In the end, all indicators derive from one specific source: the price.

So why not learn to read it directly? Keep your charts clean and watch the candles, because once you really master price action trading, the market starts to make more sense, and trading becomes a whole lot more enjoyable!

Remember, always practice trading on a demo account before you switch to a live account with real money! Put what you’ve learnt into practice, and practice over and over again until it feels right.

We hope you enjoyed this course on price action. If you’re keen to learn more about the global financial markets and how to become a confident trader, then keep reading the EC Markets Academy as we unlock more trading topics that will get you from a beginner to a confident trader.