How to find Support and Resistance Levels

Whether you're new to trading, just starting out, or looking to sharpen your existing trading strategy, there’s one skill that stands above the rest and that is how to find Support and Resistance levels. These two terms form the foundation of almost every single price chart, but what is support and resistance in trading and why is it so important to your trading success? Let’s find out! Join us as we take a dive in to the world of support and resistance trading!

You’ve probably already seen prices "bounce" or "reverse" at specific zones, that’s no accident! Those are the support & resistance levels and understanding these levels is crucial to reading any chart like a professional trader. But how should you be using them? And more importantly, how do you spot them? In this article, we are going to break it all down in a way that’s easy, interactive, and useful, so let’s get started!

- What is Support and Resistance in trading?

- Why Support and Resistance trading works and why it’s important

- How to find Support and Resistance Levels

- Tools to help you understand how to find Support and Resistance levels

- The Trading Psychology behind how to find Support and Resistance Levels

- Trading Strategies for Beginners on how to find Support and Resistance Levels

- How to find Support and Resistance Levels when trading: A summary of everything we’ve covered so far

What is Support and Resistance in trading?

Let’s start from the very top, in other words, the basics: what is support and resistance in trading?

- Support is the price level where demand is strong enough to stop a price from falling further, you can think of it as the “floor.”

- Resistance is the price level where selling pressure tends to stop a price from rising, you can think of this one as the “ceiling.”

When you really understand what is support and resistance in trading, you’ll begin to see how the market moves in waves, hitting these floors and ceilings repeatedly. Let’s explore why they matter though.

Support and resistance matters because the price action respects these levels over and over again. As a matter of fact, most successful strategies are based around the concept of support and resistance trading.

Why Support and Resistance trading works and why it’s important

You might be wondering, “why does support and resistance trading work so well and why is it so important?” Well, it all comes down to one thing: market psychology. When a price hits a certain level where it’s reversed before, traders usually remember it. If a price bounces off $50 multiple times, then $50 becomes support, and if a price gets rejected at $70 often, then $70 becomes resistance. The best traders remember and note down these levels, using them as trading strategies to make a profit.

You can use this strategy across all markets, including:

- Stocks

- Crypto (yes, even Bitcoin)

- Forex

- Commodities

In other words, once you really understand what is support and resistance in trading, you can apply that knowledge in any market, diversifying your portfolio and increasing your trading opportunities.

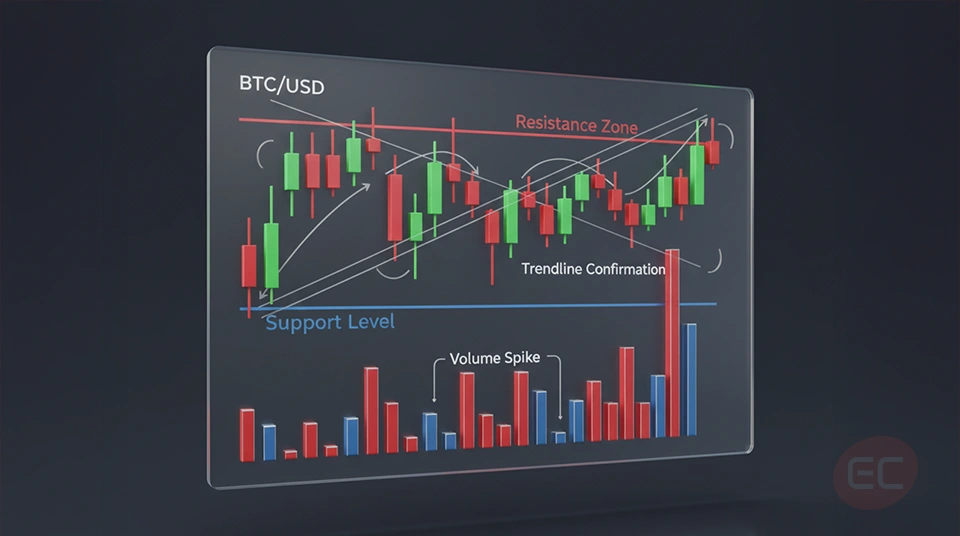

How to find Support and Resistance Levels

Now for the big question: how do you spot support and resistance levels? It is all well and good understanding the concept, but spotting these levels is what will make the real difference, and it’s easier than you think, but just like anything, it takes practice. Here’s how you should start spotting support and resistance levels:

1. Use historical price data to your advantage.

Look left on the chart, wherever the price reversed in the past, chances are you’re seeing support and resistance trading levels.

2. Look out for multiple touch points.

If a certain level has already been tested multiple times without breaking, it’s an indication that it’s a strong support or resistance zone.

3. Use candlestick clues.

Wicks often show failed breakouts, those areas are particularly great signals when trying to spot support and resistance levels.

4. Switch your timeframes.

What looks busy and overwhelming on a 5-minute chart might become clear on the 4-hour or daily chart, the best support and resistance trading strategies use multiple timeframes, for a better overview.

5. Mark down psychological numbers.

Many round numbers like $100, $10,000, or even $1 generally tend to act as support and resistance levels. These are areas where a trader's emotions might kick in. This is crucial to support and resistance in trading.

Tools to help you understand how to find Support and Resistance levels

In addition to your eyes and your chart-reading skills, there are many great tools to help you learn how to find support and resistance levels, let’s look at some of the most popular ones:

- Horizontal Lines: Draw across swing highs and lows.

- Trendlines: Diagonal lines that show the dynamic support/resistance.

- Moving Averages: They act as floating support/resistance.

- Fibonacci Retracements: They show potential turning points.

- Volume profile: They highlight price areas with heavy volume.

Have you made it this far but you’re still wondering exactly how to find support and resistance levels that actually work? The best practice is to draw them yourself. Although the tools help, your intuition will build up through observation.

The Trading Psychology behind how to find Support and Resistance Levels

Here’s where it gets really interesting, support and resistance in trading psychology. Probably one of the most important topics to cover in this course! Once you really understand what is support and resistance trading, you’ll soon begin to realise it’s not just about the price, but instead, it’s about trader behaviour.

Let’s look at this in real time:

- Assuming the price drops to Support → The buyers step in → The price reverses.

- Now assuming the price rises to Resistance → The sellers enter → The price drops.

Why does this happen? Simple really, because strong traders remember past reversals and act accordingly. That’s why learning how to find support and resistance levels is crucial, because it means understanding people’s behavior.

Trading Strategies for Beginners on how to find Support and Resistance Levels

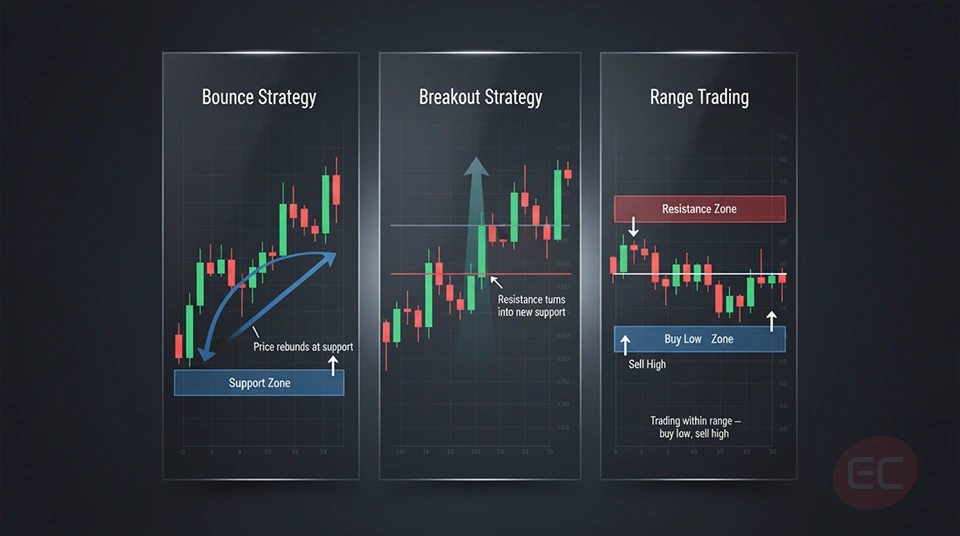

Let’s turn this theory into practice! If you’re just getting started with support and resistance trading, here are a few simple but powerful strategies that can really help you:

1) The Bounce strategy

How it works:

- Identify strong support and resistance levels.

- Wait for the price to touch the specific level.

- Enter a trade in the opposite direction.

- Confirm with volume or with candlestick patterns.

2) The Breakout strategy

How it works:

- The price breaks above resistance or below support.

- Wait for a retest of the broken level.

- Enter with momentum in the direction of the breakout.

3) The Range strategy

How it works:

- The price moves between two levels, the support and resistance.

- Buy at support, sell at resistance.

These are a few simple but effective methods, but they all rely on knowing how to find support and resistance levels accurately, so understanding how to spot them is absolutely crucial to the success of your trading journey.

How to find Support and Resistance Levels when trading: A summary of everything we’ve covered so far

Congratulations on making it this far into the course! Let’s now recap what we’ve covered so far about what is support and resistance in trading:

- Support is where the price usually tends to stop falling.

- Resistance is where the price usually tends to stop rising.

- These levels are formed based on specific trader psychology and repeated behaviour, in other words, patterns.

- Understanding and mastering how to find support and resistance levels is key to identifying trade entries and exits points.

So, if you're still unsure about what is support and resistance in trading, just remember this crucial point: it's where buying and selling pressure meets, and it's where many traders make or lose money, so practicing how to spot these levels is the best knowledge you can gain as a beginner trader.

If you’re new to trading and still need to unlock crucial trading terminology and real life practices, then keep on reading the EC Markets as we explore more trading topics that will get you from a beginner trader to a knowledgeable trader in no time!