Forex Currency Pairs and Forex Quotes

The best currency pairs to trade largely depend on how well the currency pair aligns with your strategy, risk tolerance and style of trading. It is crucial, when choosing forex currency pairs, to know how the different types of pairs behave and how to interpret their prices. In this guide, we will walk through how to properly read forex quotes and distinguish between major, minor and exotic pairs in detail. Without this foundation, it will be very difficult to judge your trading costs, size your positions and manage risk properly. For instance, major currency pairs often behave differently from minor currency pairs in terms of price action and liquidity, which can affect your costs per transaction through spreads and potential slippage. That's why the best currency pairs to trade for a swing trader may not be the same for a scalper. Forex trading is about following a plan, not playing guessing-game. Let’s dive in!

What Are Forex Currency Pairs?

In forex, we always deal with two currencies at a time, such as EUR/USD or GBP/JPY - that's why they are called 'currency pairs' (or 'forex pairs'). The forex quotes of currency pairs represent the exchange rate between the two currencies. In other words, how much of the quote currency is needed to buy one unit of the base currency. For example, if the price of the currency pair, EUR/USD, is 1.0850, that means 1 EUR is worth 1.0850 USD (EUR is the base currency and USD is the quote currency).

The EUR/USD exchange rate will rise if the euro strengthens against the US dollar, or if the US dollar weakens against the euro. Conversely, the exchange rate will fall if the dollar strengthens against the euro, or if the euro weakens against the dollar.

The exchange rates (or forex quotes) of forex currency pairs change when there is an appreciation or depreciation of one currency relative to the other. Understanding this makes price action seem much less random.

How do Forex Quotes Work?

When trading, forex quotes will always include two prices for a currency pair: bid price and ask price. If you are selling, you will sell at the bid price. If you are buying, you will buy at the ask price. Also when reading forex quotes, it is important to know that the gap between the ask and the bid is called the 'spread'. Forex quotes can differ from broker to broker as prices can depend on their liquidity and execution conditions.

Bid Price (the price you sell at): This is the price that the market is willing to pay. If you want to sell (go short) GBP/USD right now, your order is filled at the bid price.

Ask Price (the price you buy at): This is the price that the market is offering. If you want to buy (go long) GBP/USD, you pay the ask price.

Here is how forex quotes work using a simple example: GBP/USD = 1.3050 / 1.3052

- If you sell, your order will be filled at 1.3050 (bid).

- If you buy, your order will be filled at 1.3052 (ask).

That 2-pip (0.0002) difference is the spread. Think of the spread as a transaction cost. When you open a trade, you’ll notice a small unrealised loss equal to the spread. The price of the currency pair must move in your favour by at least that amount in order for you to break even.

Forex quotes are not just numbers on a screen. They indicate the cost of every trade and it is a cost that needs to be accounted for in your risk management plan.

Types of Forex Currency Pairs

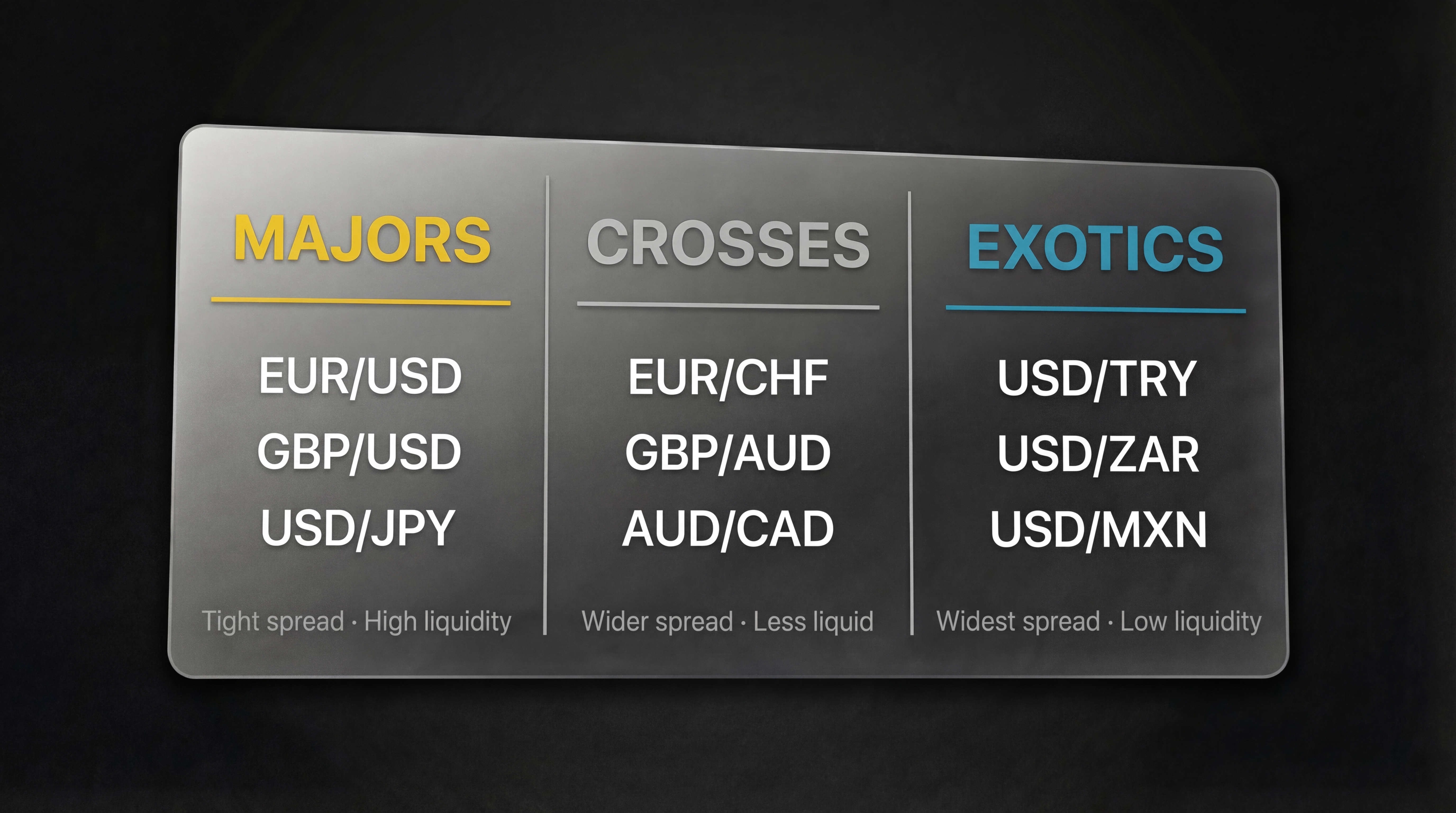

The forex market is often described in three broad groups.

Major Currency Pairs

Major currency pairs are the most frequently traded and are the pairs you will see the most often. A currency pair is considered a ‘major’ when one of the pairs is US dollar (USD) and the other is another heavily traded currency, typically EUR, JPY, GBP, CHF, CAD, AUD, or NZD. Common examples are EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD and NZD/USD.

Because they are traded in large volumes across all the main market sessions, major currency pairs usually have more liquidity than other less-traded forex pairs. This means tighter spreads and smoother execution, especially during the most active trading hours. For beginner traders starting out, major currency pairs are usually the best currency pairs to trade, as transactions costs are often lower and prices jump around less compared to thinner markets. That doesn't make major currency pairs predictable, it just means that they trade more efficiently than many exotic and minor currency pairs, making them a good starting point.

Minor Currency Pairs:

Minor currency pairs (also called crosses or cross-currency pairs) are pairs that do not include the US dollar. These pairs are generally less liquid than major pairs, which can mean they have wider spreads and more ‘jumpy’ price action, especially during less active periods of trading or around major news releases. Some examples of minor currency pairs are EUR/GBP, EUR/JPY, GBP/JPY, EUR/CHF, GBP/CHF, AUD/JPY and NZD/JPY.

Some minor currency pairs, like EUR/GBP, may move more steadily. Others, like GBP/JPY, can go through large price swings and cover a large number of pips within a session.

The main appeal of trading minor currency pairs is the different market drivers, with some pairs showing greater fluctuations and more opportunities. The trade-off is that market conditions can have a bigger effect on execution reliability. Spreads may be higher and slippage can occur due to thin or fast markets. Minor currency pairs are not all alike, so it is best to treat each pair individually and size your trades based on the pair’s typical volatility.

Exotic Currency Pairs

Exotic currency pairs typically include a major currency, often the US dollar (USD), paired with an emerging-market currency such as the Turkish lira (TRY) or the South African rand (ZAR). These pairs can be attractive because their prices can move substantially in a single day. However, the trade-off is usually higher trading friction compared to what you’d get with majors and some minors. In other words, traders should not be surprised by wider spreads and higher chances of slippage.

Paying attention to costs matters more when trading exotic currency pairs. A wider spread means you open trades at a larger disadvantage and if you hold positions overnight, swap/financing fees can build up faster and become more significant than expected.

For these reasons, exotic pairs aren’t typically ideal for learning. Major currency pairs tend to be more liquid and predictable. Exotics are better left for when you feel more comfortable managing slippage, wider spreads and overnight holding costs. Although much riskier, more experienced traders may consider exotics to be the best currency pairs to trade for its bigger price swings and potential for bigger opportunities compared to major and minor currency pairs.

How to Choose the Best Currency Pairs to Trade

There isn't exactly a shortlist of the world's best currency pairs trade because it depends on which forex currency pairs align with you best in terms of strategy, risk and trading hours. Major currency pairs are usually the simplest pair to get started with. Orders are generally filled more smoothly and the costs of execution (such as spread and slippage) tend to be smaller because of the fact that major currency pairs are traded so heavily. They still move enough to create opportunities, but you are less likely to feel as though you are competing against slippage and high spreads on every entry. Many traders start their journey with major currency pairs to get a better understanding of spreads, volatility and execution, before expanding into minor currency pairs.

Selecting the best currency pairs to trade is also about picking a market that you can manage it well, which is why a major factor to take into account is trading hours. This matters because it needs to fit your lifestyle. Despite the forex market being open 24/5, many forex currency pairs have certain hours of the day in which trading activity is higher. For example, GBP/USD tends to be most active during the London-New York session overlap. On the other hand, if you mainly trade during the Asian session, forex currency pairs that include the AUD or JPY, such as AUD/JPY, are typically the most actively traded. More trading activity of a pair means tighter spreads and more consistent price action. Therefore, the best currency pairs to trade are the ones that match the hours you trade to ensure you don’t face low liquidity.

Volatility, spreads and trading hours are three main factors that shape your overall trading environment. Rather than trying to find a ‘lucky ticker’, choosing the best currency pairs to trade should be based on these factors as it should align well with your risk tolerance, sensitivity to costs and daily routine.

News sensitivity is another big factor that needs to be considered. For example, EUR/USD, one of the most traded major currency pairs, is known for its deep liquidity and relatively tight spreads, which is why many traders consider it a benchmark pair. However, even EUR/USD can react strongly to major news releases, such as US Non-Farm Payrolls (NFP), which can cause spreads to widen and prices to move sharply in seconds. Minor currency pairs may not always be the best currency pairs to trade during high-impact news events, especially if you value smooth execution.

If you’re still deciding what the best currency pairs to trade are, here’s how the ‘Big Three’ generally compare across all four criteria (volatility, spreads, trading hours and news sensitivity):

- EUR/USD (The Benchmark)

EUR/USD is often the first pair traders use to learn how news affects prices. It reacts quickly to ECB and Fed headlines, but liquidity is usually deep enough for execution to be smoother than thinner forex currency pairs. This pair still sees meaningful movement, just with fewer surprises when it comes to spreads and order fills under normal conditions. - GBP/USD (The Aggressor)

GBP/USD tends to be busier when both the London and New York sessions are open. During this time, the market will usually see the best flow and the most consistent participation. However, traders should be aware of UK data releases as they can move the price sharply and, at times, whip it back just as quickly. That’s why it is important for risk settings (stop placement and position size) to be planned in advance. - USD/JPY (The Risk Barometer)

USD/JPY is one of the major currency pairs that tends to be very sensitive to interest rate expectations and moves in bond yields. When central banks shift their tone or when bond yields reprice, this pair often reacts immediately. This currency pair is great for learning how interest-rate expectations show up in FX, but traders must be weary that it can also change direction just as sharply.

All forex currency pairs are affected by the news. The key is to be aware of the schedule; check the economic calendar, know when the big releases are due and decide in advance whether you want to trade through the event or wait for conditions to return to normal.

Common Mistakes Beginners Make

Even if you've already figured out what the best currency pairs to trade are, you have only covered 'step one'. Staying consistent long enough to learn is what many beginners struggle with. Here are three of the most costly mistakes that beginners commonly make:

- Confusing “more trades” with diversification.

Holding multiple forex currency pairs does not always mean your portfolio is diversified. If you’re long EUR/USD, GBP/USD, and AUD/USD at the same time, you’ve heavily concentrated your exposure to the US dollar across all three positions. This is risky because a single move driven by the Fed can hit everything at once, so your ‘portfolio’ is actually just one oversized bet. For traders looking to diversify, minor currency pairs can be used to reduce USD exposure.

- Underestimating spreads during major news events.

Many beginners focus only on the prices they see on charts without realising execution costs can matter just as much, especially during major news releases when liquidity can thin out quickly. This can cause spreads that were normally tight can widen sharply and slippage can increase, and as a result, unexpectedly trigger stop-loss orders early or cause orders to be filled at worse prices. This is why keeping on top of the economic calendar shouldn’t be optional; you need to know when high-impact releases are scheduled and decide in advance whether you’ll trade through them or wait it out. - Expecting demo trading to match live conditions.

A demo account is useful for learning the basics: how to read quotes, how pip value works and how to place a stop-loss correctly. But live trading adds real execution conditions (including slippage), not to mention your emotions, now that real money is at stake. When switching to a live account, it is important to start small and focus on developing a repeatable process. There will always be an element of uncertainty when trading forex currency pairs - what helps you stay in the game is disciplined risk management.

Conclusion | Forex Currency Pairs and Forex Quotes

Forex currency pairs behave differently from one another because their liquidity, volatility and news sensitivity are not the same. Those differences are reflected in forex quotes and how wide the spread is. It is also why the best currency pairs to trade for you may not be the best for someone else. Understanding currency pairs and forex quotes is an important step to developing strong risk management. Effective risk management is what helps traders preserve their capital.

Choosing the best currency pairs to trade is less about hunting for a winner. Instead, choose the forex currency pairs whose liquidity and volatility profile match your risk tolerance, your execution requirements and the hours you can trade. For the majority of beginners, major currency pairs are the ideal place to start.

Your immediate action plan:

- Practise on a demo account and keep records.

Don’t just ‘taste-test’ different forex currency pairs. Track them and keep a simple log. Note how GBP/USD behaves around the London open and into the New York session, and record how to spreads and slippage changes during different levels of activity.

- Narrow your focus.

Trying to watch too many charts at once can make things too messy and is a common way for beginners to lose control of risk. Start with one or two major pairs and get familiar with their typical rhythm, what headlines move them (e.g. rate expectations or employment data) and how they behave around key technical levels.

- Improve skill, not confidence.

Confidence is not a performance metric. Measure what you can control: Are you following your entry rules? Are you placing stop-losses consistently? Are you reducing exposure during high-impact releases? Track execution quality and risk discipline, not emotions. - Scale gradually.

You should only consider increasing your exposure after you’ve proven that you can consistently control risk on a demo or micro account. Earn the right to scaling by developing a repeatable process. Process first, size later.