Oil, Inflation, and the Dollar: Can Energy Stay a Hedge in 2025?

The oil price surge during early 2025 has made energy costs a primary factor behind inflation growth. The ongoing high US household inflation expectations have led investors to use oil as their inflation protection strategy. The oil market now leads the way in determining inflation rates and dollar value and market sentiment.

The market seeks to understand if energy investments will continue to shield portfolios during a period of reduced economic growth and decreasing interest rates.

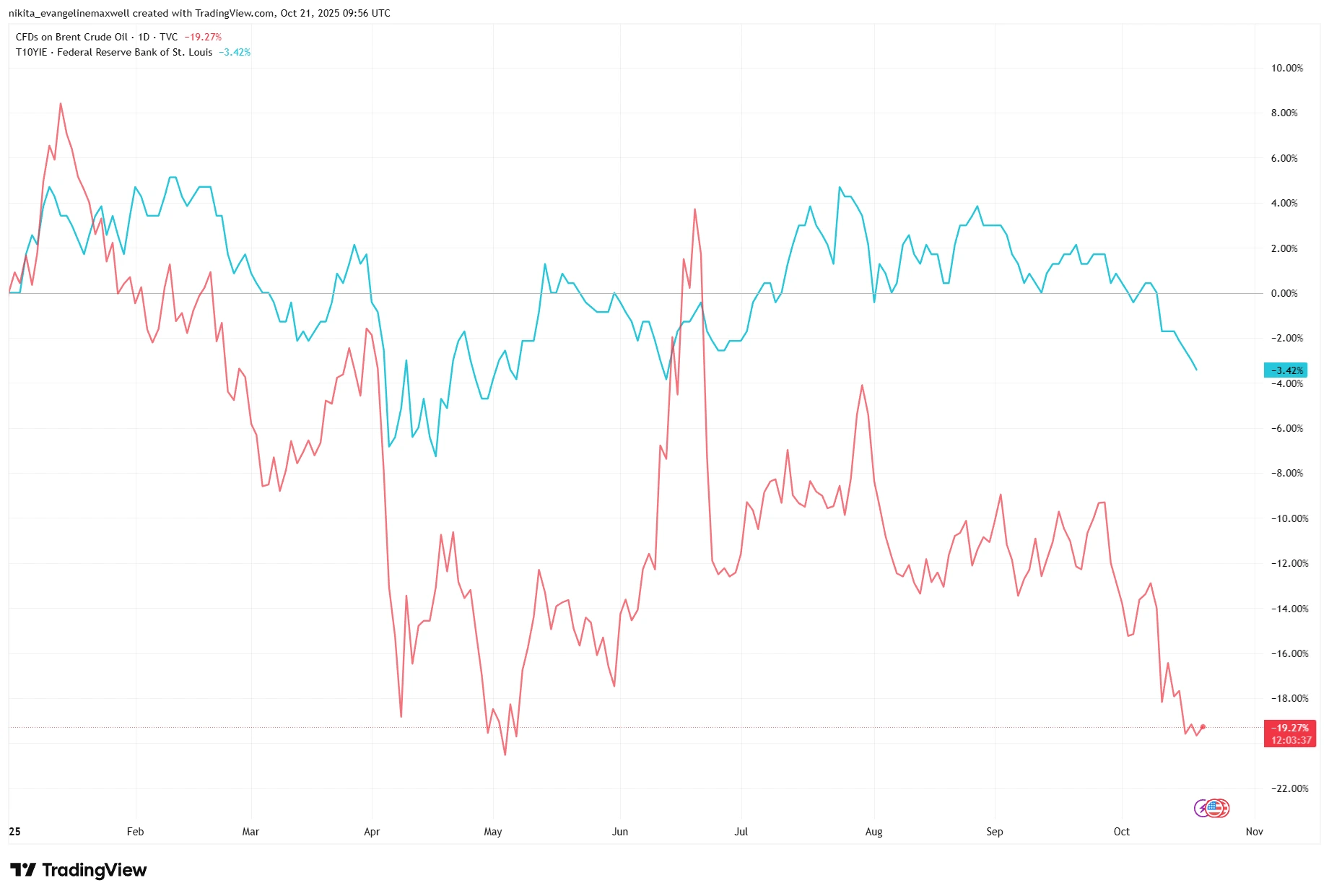

Brent Crude and Inflation Expectations Have Diverged Sharply Since Q2

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 21 October 2025.

Early in 2025, Brent and inflation expectations tracked closely. Since mid-year, falling oil prices have diverged from still-sticky inflation readings (a signal that energy’s hedge status may be shifting).

Key Drivers

The oil market has shown significant volatility because it responds to changes in inflation rates and currency market predictions. The Brent price increased during the first part of the year because a declining dollar value made foreign currencies more expensive which boosted market demand. The market experienced higher prices because of two factors: seasonal demand increases and forecasts indicating cold weather conditions. The market supports crude prices because China implements stimulus programs and people continue to travel extensively while OPEC predicts worldwide fuel consumption will expand during 2025.

The supply of oil remains restricted because OPEC+ members follow their agreed production limits. The group produces less than its official targets while upcoming production boosts will be balanced by scheduled output reductions. The US maintains elevated oil production levels which approach historical highs but these numbers have not created a market surplus.

Investors are also experiencing higher risk premiums because of ongoing Middle Eastern conflicts and Russian oil supply interruptions.

Fundamentals

Major oil firms entered 2025 in strong shape. Companies like ExxonMobil and Shell are generating high free cash flow, carrying low debt, and returning billions to shareholders via buybacks. Exxon avoided adding net debt and bought back $4.8 billion in Q1 alone. Shell continued repurchasing stock despite softer commodity prices. Lower-cost producers also remain stable, while more leveraged firms like BP have trimmed dividends and slowed buybacks.

Sector-wide, balance sheets are healthy, and free-cash-flow yields are among the highest in the market. Valuations remain low relative to broader indices, partly due to the sector’s cyclical label. Dividend yields around 4-5% remain attractive.

Not all companies have the same exposure. Refiners tend to benefit when crude prices fall or stabilise due to wider margins. Integrated majors, with diversified operations, are better insulated from oil price swings. Oilfield service companies, however, are directly exposed to cuts in upstream spending and tend to feel pain quickly if prices drop.

Macro Tailwinds & Headwinds

The market continues to support oil prices through several major factors. The market will experience increased demand because of relaxed monetary policies and reduced interest rates. The combination of fiscal spending for infrastructure development and stimulus programs will lead to higher fuel consumption. The early 2025 dollar weakness created conditions which boosted worldwide fuel consumption.

But risks loom. The upcoming period will bring down worldwide economic expansion rates with China and Europe leading the decline. The market will lose interest in oil if demand remains below expectations. The market will lose interest in oil as a hedge investment when inflation stabilizes because rising energy costs will negatively impact consumer spending.

The relationship between economic growth and policy decisions will determine if oil maintains its position as a hedge investment. The market will return to its cyclical nature when growth remains weak but demand strengthens.

Energy Sector Has Lagged the Broader Market Despite Strong Fundamentals

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 21 October 2025.

XLE has barely broken even year-to-date while the S&P 500 surged. This suggests markets are treating energy stocks as a cyclical trade, not a structural hedge.

Risks

Several key risks could flip the script:

- Oversupply – A rapid ramp-up from OPEC+ or US shale could flood the market.

- OPEC+ Discord – Disagreements or broken commitments could rattle supply expectations.

- Demand Shock – A major slowdown, crisis, or policy misstep could hit consumption hard.

- Dollar Rally – A stronger dollar would make oil pricier globally, hurting demand.

- Regulation – Climate policies or taxes could chip away at future demand.

- Refining Margins – Softer product demand may squeeze downstream profits even if crude stays high.

Final Takeaway

Oil can still act as a hedge in the right conditions; especially when inflation surprises to the upside. But in a rate-cutting, slow-growth environment, its role is more complicated. For 2025, energy may be more of a cyclical play than a structural hedge.

Oil may still protect portfolios when prices rise, but in 2025, it’s just as much about timing as it is about trend.