Oil and Inflation: Can Energy Prices Derail the Rate-Cut Story?

Central banks finally look ready to ease up. After two years of aggressive hikes, rates are edging lower. The BoE has trimmed Bank Rate to 4% from 5.25%, the ECB has cut back to 2% from its peak of 4%, and the Fed followed with a reduction last week. Inflation is cooling too: US CPI eased to 2.9% in August, while the eurozone dipped below 2% in May. On paper, rate cuts look set. But oil remains the joker – slipping into the mid-$60s before rebounding near $75, a reminder how quickly energy can flip the inflation story.

Brent Crude Oil Price

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 23 September 2025.

Brent crude has swung between the mid-$60s and upper-$70s over the past year, showing how quickly geopolitics and supply shifts can rattle markets.

Key Drivers

Supply is the first piece of the puzzle. OPEC+ has started easing its output cuts, with Saudi Arabia pumping harder. Global supply hit about 105 million barrels a day in mid-2025, roughly 3 million more than a year earlier. That sounds comfortable, but if demand picks up faster than expected, the cushion could disappear quickly.

Then there’s geopolitics. Oil moves on headlines. Last June, fighting in the Middle East sent prices spiking. Weeks later, ceasefire news knocked them down again. Gas is no less twitchy. Europe still frets over LNG flows, cold winters, and those fragile pipelines.

Demand growth, meanwhile, is anaemic. Less than a million barrels a day this year, the weakest in over a decade if you ignore 2020. China’s slowdown is a big part of it – consumer prices there actually fell 0.4% in August. If growth in the US, Europe, and China all weakens at once, oil demand could stall. But stimulus, or a sudden rebound in factories, could flip that story overnight.

Finally, the energy transition. Renewables and electric cars keep eating into oil use, though not enough to kill demand outright. Years of under-investment in new fields could mean shortages later. And variable factors like politics, subsidies, even the weather, still hang over the market.

Fundamentals: Supply, Earnings, and Balance Sheets

For now, supply is ahead of demand. Inventories are high. That should keep a lid on runaway spikes. Oil companies, meanwhile, aren’t exactly struggling. ExxonMobil made more than $7 billion profit in Q2. Shell, TotalEnergies have the same story, strong earnings and generous buybacks. They’ve got the balance sheets to handle turbulence.

Consumers don’t feel it that way. $65-70 oil still hurts compared with the $50-60 range of just a few years ago. Households pay more at the pump, factories absorb higher energy bills, and margins tighten. In the eurozone, inflation is near target mainly because energy inflation has been negative. Flip that back to positive, and CPI moves higher again.

Macro Tailwinds and Headwinds

Outside energy, inflation looks calmer. Core prices (excluding food and fuel) are near 2% in Europe and only slightly higher in the US. Jobs are steady, wages are rising at a manageable pace, and the IMF expects inflation to drift lower. Central banks are cautious but leaning toward cuts. Still, cracks remain. Europe is barely growing, the UK saw inflation jump to 3.8% in August, and Japan has raised rates for the first time in years. China faces the opposite problem: falling prices and weak demand. Each region is on a different path, but energy could disrupt all.

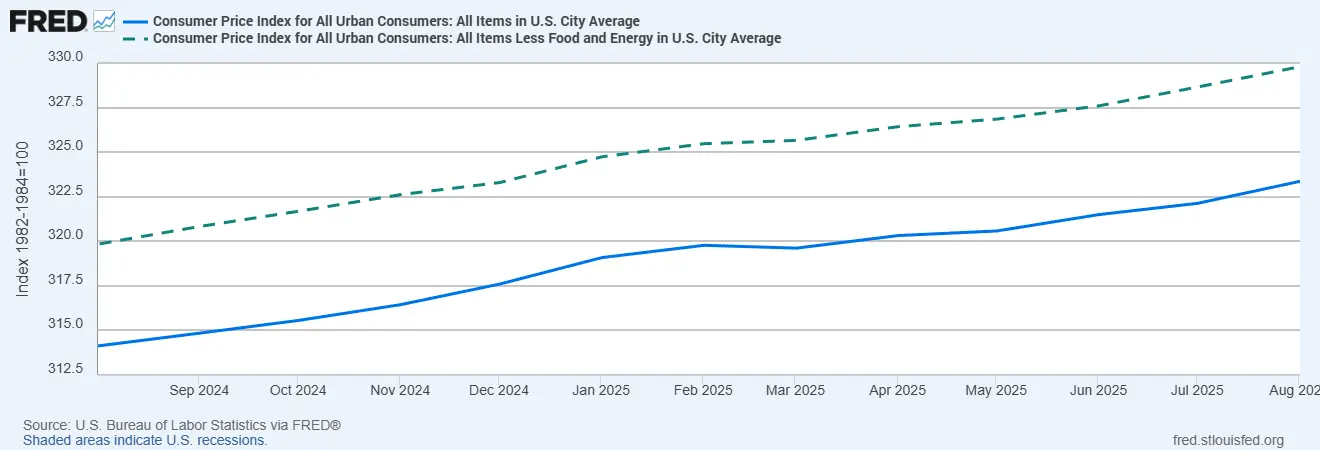

US CPI vs Core CPI

Sources: U.S. Bureau of Labor Statistics via FRED®

US inflation trends: headline CPI has cooled but still shows more volatility than core prices, underlining energy’s outsized role in the disinflation story.

Risks

The obvious one: another energy shock. Middle East tensions, a flare-up in Ukraine, or OPEC+ deciding to cut deeper – all could send oil and gas higher. That would push headline CPI back up and derail rate-cut plans.

Then there are second-round effects. Keep energy prices high for long enough and wages, rents, and transport costs start to embed those increases. Sticky inflation follows. Policy surprises matter too. Europe has already toyed with windfall taxes. The US is layering on tougher bank capital rules. And don’t ignore the “black swans”: cyberattacks on pipelines, hurricanes, droughts, anything that chokes supply.

It’s the same story as post covid…

Final Takeaway

Right now, the base case is still lower rates. Inflation is easing, growth is sluggish, and policymakers want a little bit of a breathing space. But energy is the joker card! It can flip the narrative in a heartbeat!

If prices stay calm, expect gradual easing. If they spike, cuts get delayed or cancelled. Simple as that.

For investors, the message is clear: don’t assume easy money. Watch oil futures, OPEC statements, and inventory data.