Has Big Oil Found Its Floor? Efficiency Over Expansion

Energy stocks have been on a remarkable run over the past few years, especially after Covid-19. The S&P 500 Energy sector surged nearly 50% in 2021 and 55% in 2022, vastly outperforming the broader market. This rally was underpinned by surging profits and gushing free cash flows, which oil & gas firms funnelled into record shareholder payouts. Even as oil prices have come off their 2022 highs, energy companies in 2025 are still raking in near-record earnings. Now that’s a testament to newfound capital discipline. Big Oil is making almost as much money with $80 crude as it did with $100+ crude, reflecting a dramatic improvement in efficiency and cost control.

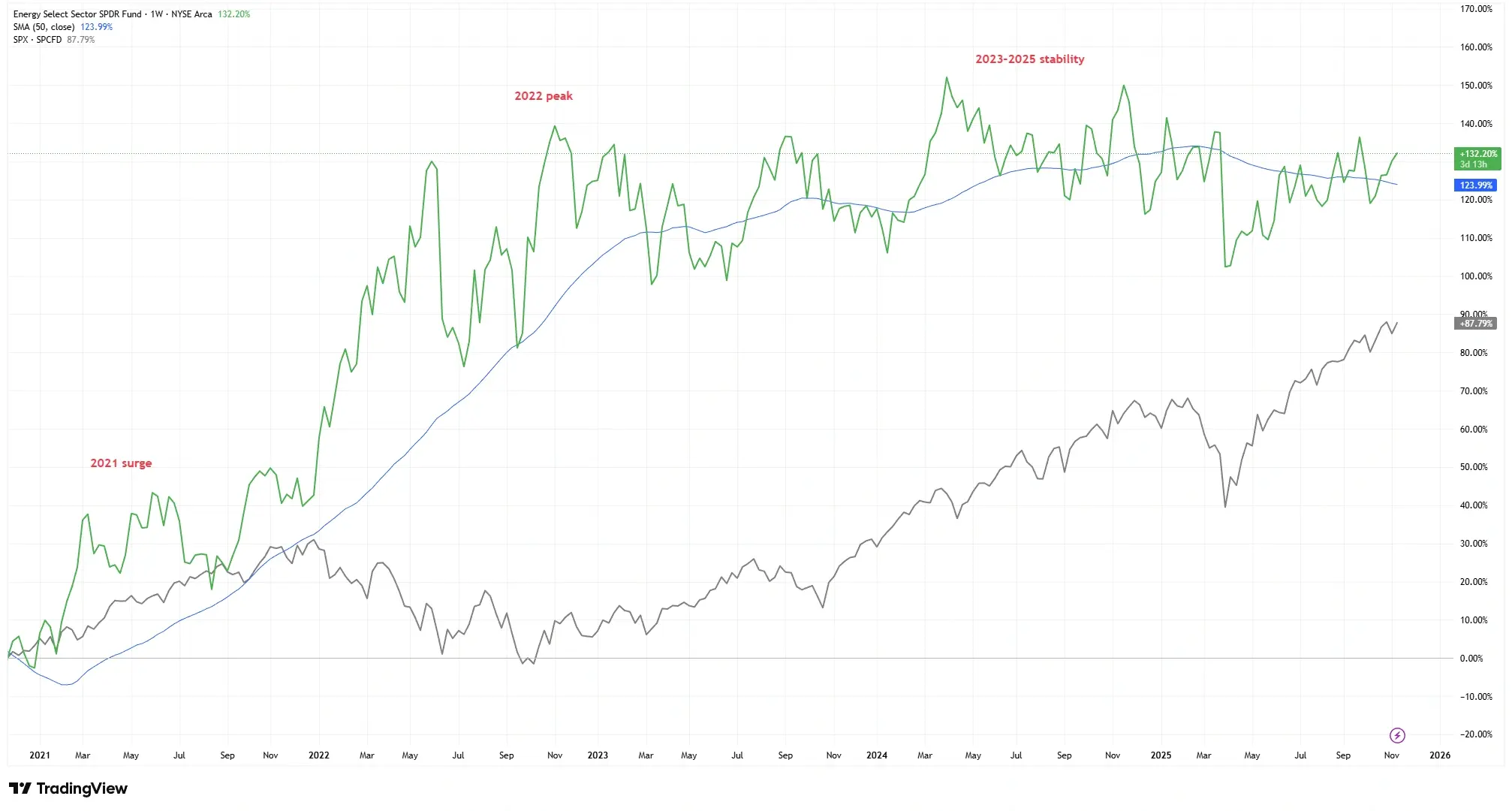

Energy Sector’s Historic Rally vs. Market Performance

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 11 November 2025.

The Energy Select Sector SPDR Fund (XLE) surged over 120% from early 2021 to late 2022, vastly outperforming the S&P 500, before stabilizing through 2025.

Yet with oil markets relatively stable, investors are beginning to wonder: Are we at the peak of this earnings cycle, or are energy companies simply getting smarter at making money..??

The Efficiency Story: Discipline Over Expansion

A decade ago, oil traders chased growth at almost any cost. The 2010s shale boom saw aggressive drilling and heavy capital expenditure, often with barely any returns. Those boom-and-bust days have given way to a new ethos: discipline over expansion. Today’s majors are restraining capital spending and prioritizing shareholder returns. Many public oil companies now reinvest only about 50% of their cash flow into new projects. That’s a historically low rate; and then return the rest to shareholders. The result is lower production growth but much higher free cash flow per barrel.

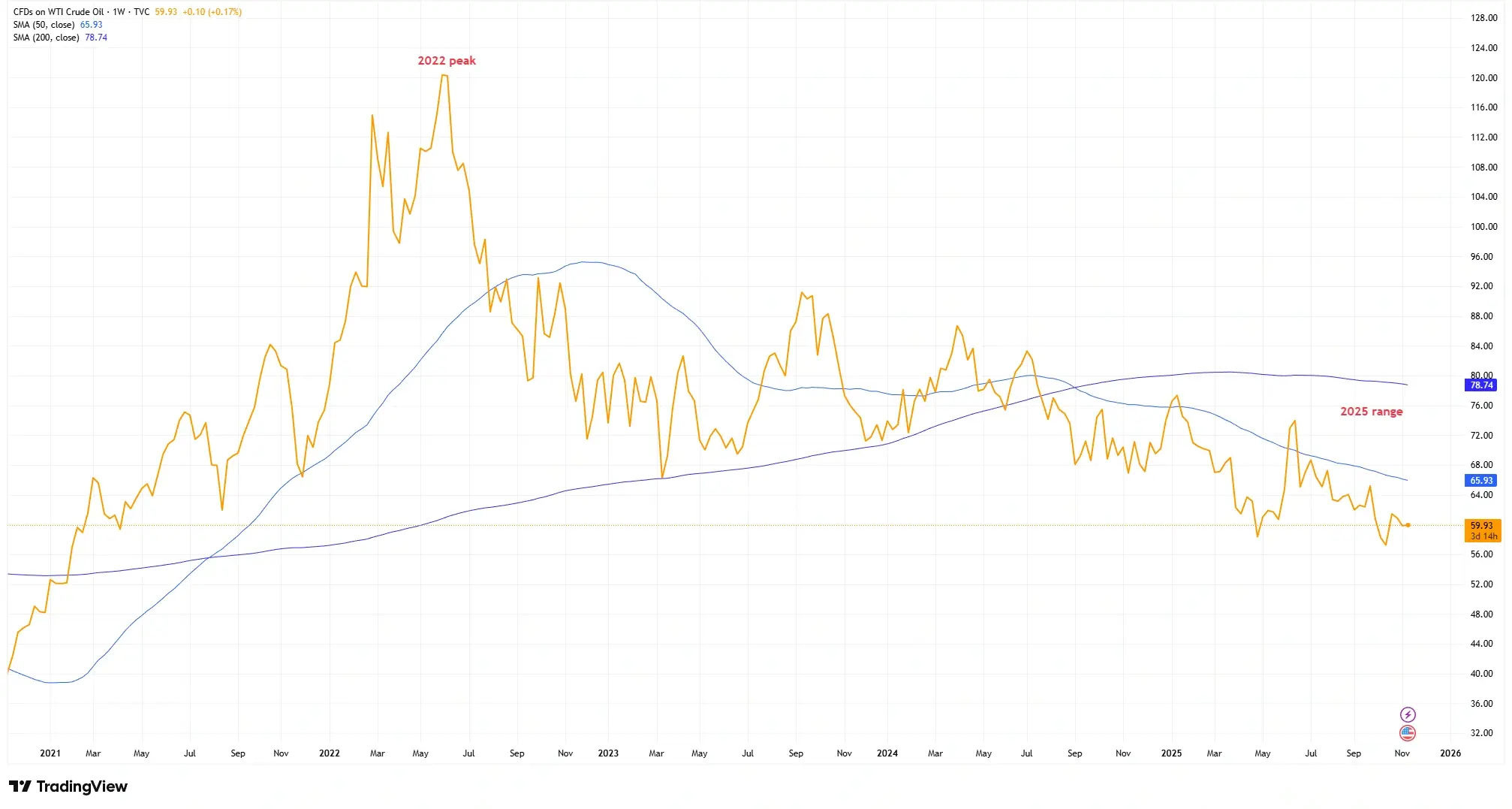

Crude Oil Prices: From 2022 Highs to a New Normal

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 11 November 2025.

Oil prices peaked near $120 in 2022 before retreating to the $70-$80 range, yet energy majors remain highly profitable thanks to efficiency gains.

Break-evens have plunged: oil majors are now targeting projects profitable at $30 per barrel, roughly half the breakeven price from a decade ago. Technology improvements and cost cuts mean that at $70-$80 oil, many producers generate solid profits where they once struggled.

Are investors underestimating how much profitability now hinges on execution and efficiency, not just the headline oil price? Let’s see.

Earnings Resilience and Cash Flow Trends

Despite a modest dip in oil and gas prices from their 2022 peaks, the earnings of global energy majors have proven surprisingly resilient! BP, Chevron, ExxonMobil, Shell, and TotalEnergies still amassed $123 billion in net income in 2023v. Crucially, free cash flows remain robust. These firms collectively returned a record $111 billion to shareholders in 2023, even though commodity prices were lower compared to previous years and other asset classes.

Profit margins are holding up even as prices soften (a sign of structural improvement). Refining and trading divisions have stepped up. TotalEnergies saw its downstream profit jump 76% YoY. Integrated giants are leveraging diverse businesses to stay profitable. Many have also paid down debt, lowering interest costs and boosting flexibility.

If energy profits hold up even in a softer price environment, what does that say about the new “floor” for this sector’s earnings?

Valuation, Payouts, and Market Perception

Even as cash flows gush, energy stocks remain priced as if trouble is around the corner. The sector trades at forward P/E multiples around 8-10×, roughly half the broader market’s 20-22×. Dividend yields of around 4% for many majors far exceed the S&P 500’s ~1.5%. Many oil & gas stocks now sport free cash flow yields in the high-single-digits, supporting strong payouts and buybacks.

Why the discount? Memories of the 2010s, ESG concerns, and the sector’s index weight drop from ~14% to ~4% all play a role. Low multiples may signal scepticism: “We don’t believe these earnings are sustainable.” Or are investors missing a structural shift?

Is the market pricing the energy sector for decline even as its fundamentals suggest resilience?

Conclusion

Energy’s evolution appears to be more than another upcycle. By emphasizing capital discipline and cost efficiency, oil and gas companies have fundamentally improved their financial resilience. Over the past decade, many upstream firms have managed to strengthen profitability even as oil prices fluctuated. It’s an achievement that underscores structural gains rather than short-term trends.

Even at $70-$80 oil, many producers are thriving. If demand plateaus and prices ease, the best operators could still remain highly cash-generative. Maybe the story isn’t about earnings peaking, maybe it’s about reinvention.

Has Big Oil finally learned how to make hay even when the sun isn’t shining so bright?