Stop-Loss vs. Trailing Stop: Which One Saves You More Money?

Every trader believes they can control risk, until the market reminds them otherwise. This sobering thought underlies the illusion of control in trading. We set entry points, study charts, and place stop orders as if we command the outcome. In reality, technical tools can only control our decisions, not the market itself! Stop-loss and trailing stop orders are designed to impose boundaries on our trades – automatic exit points meant to protect us. But while these tools offer technical control, the deeper challenge is emotional control, which is our discipline and mindset. Are you setting your stops to genuinely manage risk, or simply to avoid the pain of admitting you were wrong..?

What Is a Stop-Loss Really Protecting You From?

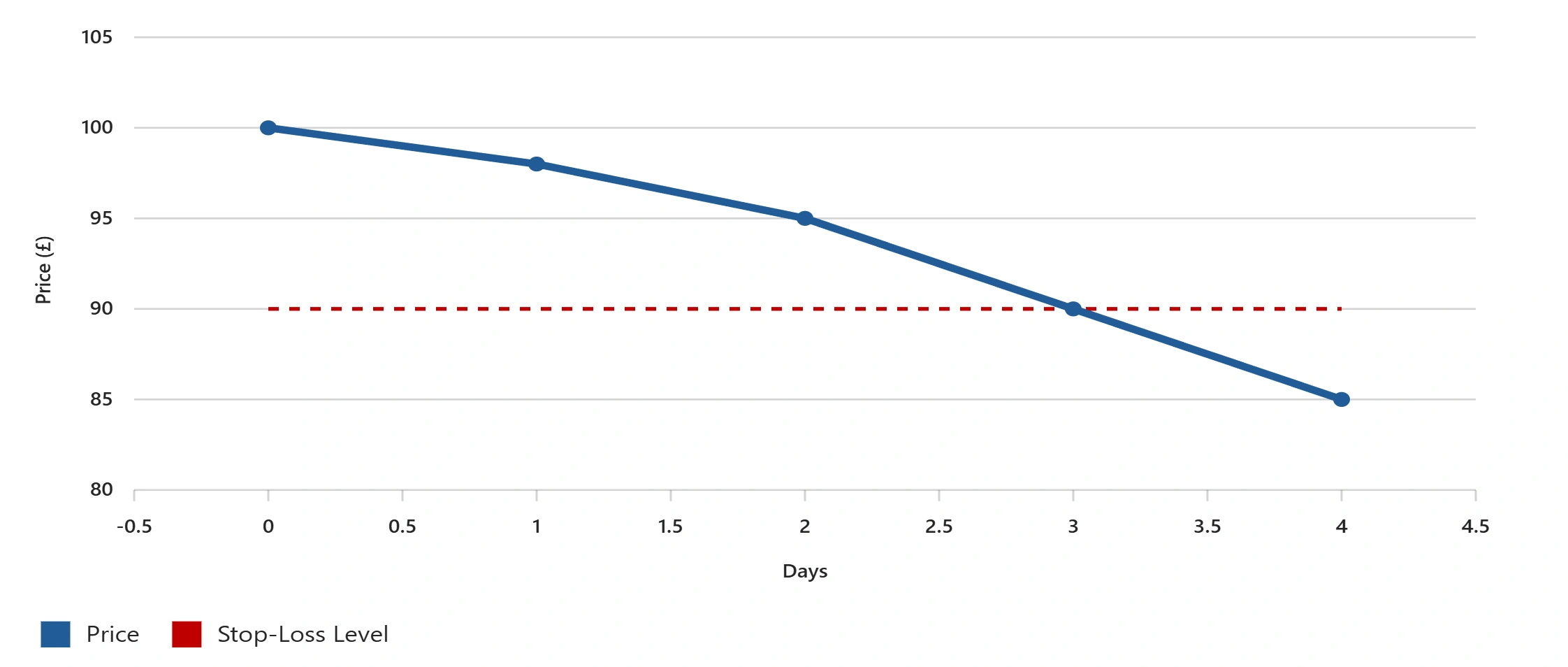

Technically, a stop-loss order is a simple concept: it’s a preset instruction to automatically sell (or buy, if shorting) an asset once it reaches a specific price against you. In practice it acts as a safety net, catching a falling position before losses increase beyond a chosen point. For example, if you bought a stock at £100, a 10% stop-loss would trigger a sale at around £90. By setting the exit in advance, you decide your maximum pain threshold when you’re calm, rather than in a panicked state during a selloff.

Stop-Loss Order Example

Illustration of a fixed stop-loss level protecting against downside risk. For illustrative purposes only.

A stop-loss saves you from the temptation to “wait and hope” as red candles pile up. Many traders have watched a small 5% loss swell to 50% simply because they couldn’t pull the trigger. A stop-loss enforces the one thing many of us struggle with: cutting losses early. Imagine a trader who refuses to set a stop and keeps holding a sinking trade; the stop-loss he didn’t place was really there to protect him from himself. Yes, taking a loss hurts – but it hurts a lot less than facing a total wipeout! In short, a stop-loss shields you from financial ruin and the emotional spiral of failure to admit defeat.

The Trailing Stop – A Tool for Trust

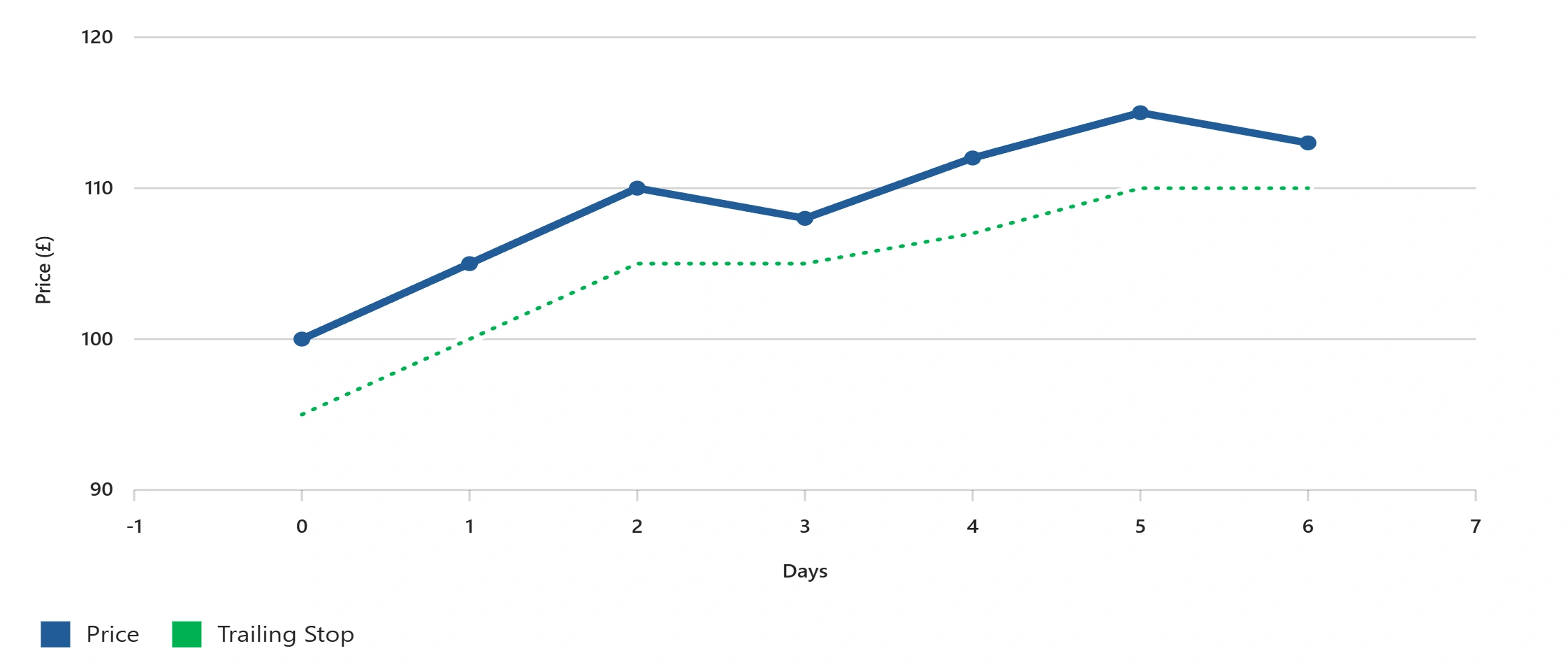

A trailing stop is like a stop-loss with a built-in adaptive quality. Instead of sitting at a fixed price, it “trails” the market by a set amount or percentage. If the price then reverses by 5% off its peak, the trailing stop triggers a sale. This means the stop level automatically moves up in your favour during an uptrend. Traders often use trailing stops to protect unrealised profits (to “let your winners run”). By using a trailing stop, you’re telling the market: “I’ll be patient and let this trade play out, as long as it continues working.”

Trailing Stop Order Example

Trailing stop dynamically adjusts with price movement to lock in gains. For illustrative purposes only.

Emotionally, the trailing stop can be seen as a bridge between greed and prudence. It allows you to stay in a winning trade longer because you know some profit is protected. In volatile markets, this can be a relief. The trailing stop steps in to secure gains if a sharp reversal hits. However, this tool isn’t without its frustrations. A trailing stop can stop you out with a normal market wobble. You’ve been exited early and left watching as the trade continues higher. It’s a tool that requires confidence in your strategy, and acceptance that catching every part of a move is less important than protecting what you’ve gained.

Which Protects You Better – Or Hurts Less?

When comparing a stop-loss and a trailing stop, it’s tempting to ask which one is “better.” The truth is they protect you in different ways. A stop-loss helps you prevent significant loss. A trailing stop helps you protect gains. One isn’t inherently superior; each addresses a different kind of risk. A stop-loss shields you from large setbacks, whereas a trailing stop shields you from giving back profits. So you need to decide what is your priority!

It also depends on market conditions. In a choppy market, a tight trailing stop might stop you out repeatedly, and a looser fixed stop might “hurt less.” Conversely, in a strong trending market, a trailing stop can work well. Some traders use both: setting a stop-loss to cap risk, then switching to a trailing stop once the trade is in profit.

Stop-Loss vs Trailing Stop: Pros and Cons

Bottom Line – The Real Stop Is You

Whether you use a stop-loss, a trailing stop, or both, the real responsibility lies with you. The market will constantly test your limits. Stop orders help you act when those limits are reached. They only work if you use them consistently. Discipline, not cleverness, is what protects your capital over time.

Used properly, both stop types support structure and reduce emotional pressure. The key is making sure any mistake is manageable and doesn’t spiral. Your job is to respect the limits you set. These tools will help, if you let them.

Happy trading!