Forex Trading Terms: Pips, Lots, Spreads and Leverage

If you are new to forex trading and feeling a little overwhelmed by all that trading terminology, you’re not alone! You may have been looking into how forex leverage works or the meaning of a 'pip' and a 'lot'. If so, this article is for you. We are going to break down the most essential forex trading terms that every beginner trader must know. We'll answer the most common questions that everyone has at the beginning of their trading journey, such as 'what is a pip?' and 'what is spread in trading forex?' We'll also answer 'what is a lot in forex?' and the importance of forex trading lot size. Getting comfortable with basic trading terminology is one of the fastest ways to build confidence as a new forex trader. Let's get started!

Understanding Forex Trading Terms

What is the point of learning all of these forex trading terms? Understanding forex trading terminology is the first step to laying the foundation of your trading knowledge. Understanding trading terms is crucial because it has a direct impact on your risk management and strategy development, thereby affecting your trading performance. For example, knowing what is spread in trading helps you estimate transaction costs, while forex trading lot size determines how much each pip movement actually matters in dollars.

What is a Pip in Forex?

A 'pip' is short for 'percentage in point', also known as 'price interest point'. It represents the smallest price movement of a currency pair in the forex market. Major currency pairs are generally priced to four decimal places, so one pip is typically equal to 0.0001. However, JPY pairs are an exception and are quoted in the 2nd decimal point, so one pip is typically 0.01.

For example, if the EUR/USD moves from 1.1050 to 1.1051, the price has increased by one pip. The pip is an important piece of forex trading terminology because knowing what it means will enable you to measure how much a currency pair's price has risen or fallen during a specific period. This becomes even more meaningful once you pair pips with forex trading lot size to calculate 'Pip Value' (i.e. the amount of USD each pip is worth), because by doing so, you can translate a price move into money gained or lost. This is important to understand before we dive into how to calculate pip value and profit or loss.

What is a Lot in Forex?

Now that we know what a pip is, let’s answer another common question: 'what is a lot in forex?' Put simply, the term 'Lot' refers to the volume or quantity of a trade. To give you a better idea, here are four typical types of forex trading lot sizes:

- Standard lot = 100,000 units of currencies

- Mini lot = 10,000 units of currencies

- Micro lot = 1,000 units of currencies

- Nano lot = 100 units of currencies

The size of the lot will have a direct impact on how much each pip is worth. This is what we call 'Pip Value' and the larger the pip value, the higher the potential profit or loss will be. Knowing how to answer 'what is a lot in forex' is important to understanding how many units you buy or sell in an order because it affects how big or small you can expect gains or losses to be per trade.

Let’s now examine the effect of lot size in two separate scenarios to further answer 'what is a lot in forex and how does it affect profitability?' Each scenario will use a different forex trading lot size under the same exchange rate movement.

Let’s say you've opened a long position of EUR/USD at 1.2000 and close it at 1.2050. In this trade, you have gained 50 pips. Your trade size (which is determined by your lot size and number of lots traded) will affect the amount of profit made from this trade.

(Remember, profit and loss is always denominated in the quote currency i.e. the second currency in the forex pair. So in this EUR/USD example, the value of the trade is to be expressed in USD.)

Scenario 1

If your trade size is 1 standard lot (100,000 units), the pip value will be:

0.0001 x 100,000 = 10 USD per pip

Therefore, a 50-pip profit in dollars is:

50 pips x 10 USD = 500 USD in profit

Scenario 2

If your trade size is 10 standard lots (1,000,000 units), the pip value will be:

0.0001 x 1,000,000 = 100 USD per pip

Therefore, a 50-pip profit in dollars is:

50 pips x 100 USD = 5,000 USD in profit

As you can see, with a 50-pip increase in the EUR/USD, the pip value in Scenario 2 is ten times greater than Scenario 1. As a result, the profit is also ten times higher.

Forex trading lot size clearly plays a crucial role in determining the potential profit of your trade and it is even more important when it comes to losses. If instead of going long, you opened a short position of EUR/USD at 1.2000 and covered it at 1.2050, you would have made a loss of 50 pips. In dollars:

- 1 Standard Lot = 500 USD loss.

- 10 Standard Lots = 5,000 USD loss.

To put this into perspective, if your trading capital was 10,000 USD, these losses would be 5% and 50% of your trading capital respectively. That's a significant difference! This is why in forex trading lot size is a critical component of risk management in forex trading. Once you can confidently answer 'what is a lot in forex?', it becomes easier to decide how large your position should be, based on your account size and risk tolerance.

What is Spread in Trading Forex?

If you've been wondering 'what is spread in trading forex?', it is simply the difference between the bid price and the ask price. The bid price is what buyers are willing to pay, and the ask price is what sellers want to receive.

For example, if the EUR/USD is quoted at 1.2000 / 1.2002, then 1.2000 is the bid price and 1.2002 is the ask price. The difference between the two prices, 1.2002 − 1.2000 = 0.0002, is the spread. Since one pip in EUR/USD is quoted at the fourth decimal place, this spread equals 2 pips.

Having the knowledge to answer 'what is spread in trading?' is helpful, especially when choosing a broker and identifying the best times to trade. Tighter spreads often mean lower trading costs. This means the wider the spread, the more the trade needs to move in your favour to become profitable. High spreads can eat into your profits, particularly if you’re trading frequently or using forex leverage to open larger positions. This is a basic explanation to 'what is spread in trading forex?' To learn about spread in more detail, check out this EC Academy article.

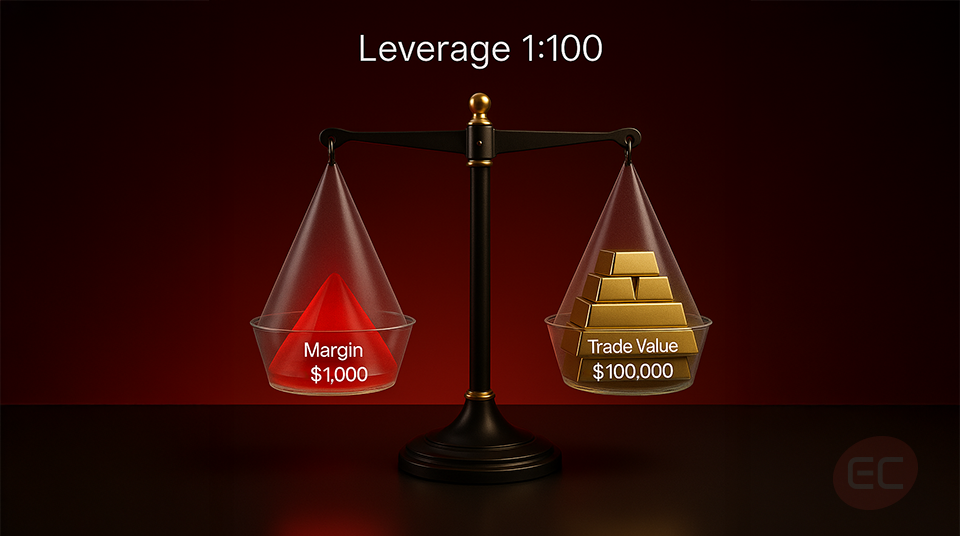

Forex Leverage

Leverage a must-know piece of trading terminology because it is one of the most powerful tools in forex trading. Forex leverage allows you to control larger trading sizes with a relatively small amount of real money (margin). For example, with 1:100 leverage, you can trade $100,000 with just $1,000 in your account. If market movements are in your favour, you can make much larger profits. However, if the market moves against you, your losses will be magnified. Because of this, forex leverage is often described as a 'double-edged sword' and it is important for beginners to use it carefully. As much as it can boost your gains, it can also wipe out your account.

How to put Forex Trading Terms into Practice

- Start with a demo account: Practice first on a demo account to apply your understanding of trading terminology without risking your actual capital.

- Review your trades thoroughly. After you close your trades, look back at how spread, position size and leverage affected your overall performance.

- Choose your broker carefully. Different brokers may offer different leverage and spreads for the same forex pair. Forex leverage and spread can impact your profitability, so it's usually best to choose a broker with lower pricing and a leverage ratio that suits your risk tolerance. You can check out what EC Markets offers here.

- Keep an eye on the latest major economic announcements. Spreads can widen during high-impact news events such as Federal Reserve interest rate decisions and Non-Farm Payroll releases.

Common Mistakes with Forex Trading Terms

Even experienced traders aren't immune to making mistakes and misunderstanding forex trading terminology. Here are a few common mistakes you should avoid:

- Not fully understanding spread, especially during times of high market volatility.

- Overusing or misusing forex leverage, which can lead to high risk and rapid losses.

- Confusing position size with lot size. Position size refers your total current exposure, while lot size is the the unit you trade.

- Not knowing how many pips a trade must move in order to become profitable after spread.

FAQs | Forex Trading Terms

What is a pip in forex?

A pip is the smallest unit of price movement - usually 0.0001 in forex.

What is a lot in forex?

A lot refers to the size of a trade. The different forex trading lot sizes forex are Standard, Mini, Micro or Nano.

What is spread in trading forex?

The spread is the difference between the bid and ask prices.

What is leverage?

Leverage is the ability to trade more than you own by borrowing temporarily from your broker.

Conclusion | Forex Trading Terms

If you’ve made it this far in forex trading terms course, you should by now know how to answer the basic questions: 'what is a pip', 'what is a lot in forex?' and 'what is spread in trading forex?' Additionally, you should also have an understanding on how forex trading lot size and forex leverage can greatly enhance profits or losses.

If you’re serious about trading forex, it is an absolute necessity that using trading terminology becomes second nature to you. Understanding what is spread in trading, what is a lot in forex and how forex leverage works can significantly improve your trading experience. These core concepts influence how traders manage risk, size positions and identify opportunities in the forex market. When starting out it may feel overwhelming learning a lot of trading terminology, but just remember to take it step by step - every successful trader started as a beginner. The difference between a successful trader and a beginner is the time spent learning, practicing and staying informed.

If you’re ready to deepen your knowledge, then keep reading the EC Academy as we unfold more crucial trading education that will guide you towards becoming a skilled trader.