Value vs. Growth Investing: Which Fundamentals Make Sense in Today’s Market?

The distinction between value and growth investing has become a major focus in 2025 because of sustained inflationary pressures and rising interest rates and market volatility. The S&P 500 has regained its earlier losses to reach a 1.4% YTD level, but the market recovery remains limited to specific sectors. The market recovery has been led by a few leading growth stocks from technology and AI sectors, yet most other market sectors have not participated in the gain.

For investors, this isn’t just market noise – it’s a signal worth paying attention to. Choosing between value and growth stocks carries real consequences for portfolio performance, particularly as central banks continue to influence the pricing of risk across global markets.

What Separates Value from Growth?

At their core, value and growth investing represent two distinct philosophies.

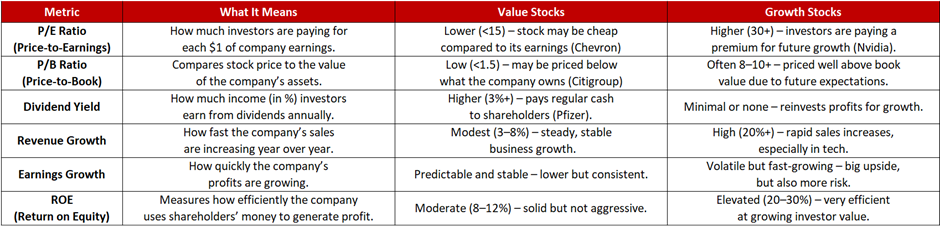

Value stocks are shares of companies that trade at prices below their true market, often measured using financial ratios like price-to-earnings (P/E) and price-to-book (P/B). These companies typically operate in long-established sectors – such as banks, utilities, or industrial firms – and may not be fast-growing, but they tend to generate steady profits. These companies usually distribute dividends to their shareholders through regular cash payments. For example, JPMorgan Chase (P/E ~13) and Chevron (P/E ~16) are considered classic value stocks. They have strong balance sheets, reliable cash flows, and are currently trading at relatively low valuations.

Growth stocks, on the other hand, are shares of companies that could expand rapidly in the future. These companies usually do not distribute dividends, because they use their profits to develop new products and technologies and expand into new markets. Well-known examples include Nvidia (trading at a forward P/E above 40), whose valuation has soared due to its leadership in artificial intelligence, and Tesla, which continues to trade at high prices despite facing production challenges. Investors are drawn to growth stocks for their potential to deliver big returns – even if the risks are higher.

Comparing the Fundamentals

Why Value Has the Edge – For Now

With the US 10-year Treasury yield hovering near 4.3%, the way investors value future earnings has shifted. When interest rates are high, the expected future profits of companies – especially fast-growing ones – are worth less in today’s terms. This has put pressure on high-priced growth stocks, leading many investors to shift their focus toward more stable, income-generating sectors.

Lately, investor focus has shifted to areas like energy, banking, and healthcare. Rising interest rates are boosting profits for banks, with Bank of America trading below their historical market level – suggesting potential undervaluation. In the energy sector, firms like ExxonMobil (largest publicly traded oil and gas company in the US) maintains solid dividend payments (near 3.7%), benefits from steady demand even as the world transitions to cleaner alternatives, while producing strong cash flow ($13 billion operational, $8.8 billion free cash flow in Q1). Meanwhile, healthcare companies such as Pfizer and Merck are seen as relatively safe bets, supported by consistent revenue from strong product pipelines and regular dividend payments.

According to J.P. Morgan Asset Management, value stocks tend to outperform during periods of high inflation and restrictive monetary policy – just like the one we’re navigating now.

Don’t Count Out Growth – If It’s Quality

Despite the macro shift, high-quality growth companies remain relevant. Those with durable revenue, improving margins, and strong free cash flow are holding their ground—even in a higher-rate environment. Firms like Nvidia and Microsoft are prime examples. Nvidia, with its booming data centre business, Microsoft, expanding its leadership in AI, and Meta, which has improved its profit margins after restructuring, show that strong fundamentals still matter. These are examples of high-quality growth companies that continue to perform well – especially when their share prices are backed by real earnings, not just market excitement.

A more balanced approach known as GARP (Growth at a Reasonable Price) c is gaining traction in 2025. This strategy focuses on companies that offer steady growth but are not excessively overvalued. Firms like Adobe, Visa, and L’Oréal fall into this category. According to Invesco, these types of stocks tend to perform well during periods when the market isn’t clearly favouring either high-growth or deeply undervalued companies.

The Bottom Line

In today’s market environment, investment style alone isn’t sufficient. What matters is fundamentals! With the Fed now maintaining a tight policy stance and sustained market volatility, the companies that consistently generate real profits – and can sustain them – could set the pace.

Whether it’s through undervalued sectors with steady cash flow or forward-looking firms built on real earnings, investors need to base their decisions on substance. Not sentiment. Not hype. Not trend. Not any gut-feeling. But just solid, proven fundamentals.

We, at EC Markets, can help you achieve your long-term returns.