Yen at a Crossroads: BoJ Normalisation and Carry Trade Risks

The Japanese yen is at a crossroads. After years of playing dual roles – safe-haven asset and funding currency for carry trades – it faces a turning point. BoJ is hinting at ending its era of ultra-low rates, so will the yen regain its safe-haven shine or remain the world’s favourite funding currency?

Diverging Central Bank Paths

One big driver of the yen’s recent moves is the divergence in interest rates. In the last few years, the US Fed and other central banks hiked rates sharply from near zero, while the BoJ stayed ultra-dovish. This yawning rate gap made borrowing in yen extremely cheap and the dollar more rewarding to hold, fuelling “carry trades.” Investors took out low-cost yen loans to buy higher-yielding dollars. The result? The yen weakened – by late 2023 it was around ¥150 per dollar.

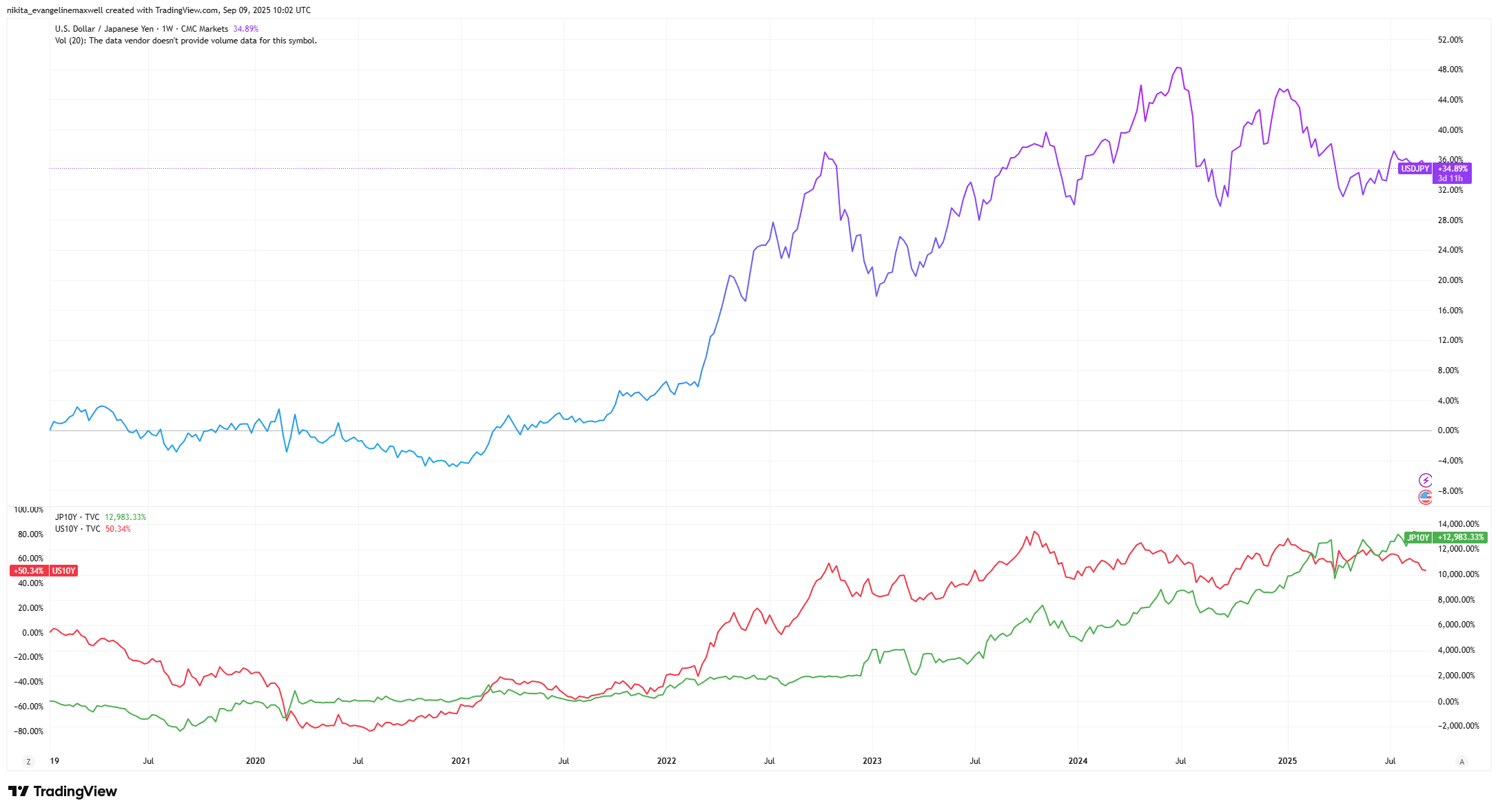

USD/JPY Tracks the US-Japan Yield Gap (2019-2025)

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 9 September 2025.

As the chart shows, USD/JPY climbed when the US-Japan yield gap widened in 2022, but started to reverse as BoJ hinted at tightening and US yields peaked in 2023-25.

Now Japan finally has some inflation, and the BoJ is dropping hints of policy change. Even a whiff of tightening has jolted the yen – in late 2023, mere talk of ending negative rates sparked a 2% jump against the dollar. The tide is turning as the Fed pauses and Japan inches toward normalisation.

Safe Haven Status: Lost and Found

The yen has long been seen as a safe haven – a currency investors trust during global storms. Japan’s overseas investments can be repatriated in a crisis. And years of near-zero yields led many to short the yen; when those trades unwind, the rush to buy yen tends to drive it higher.

However, the yen’s haven halo has slipped. During the 2022 Ukraine war, the yen fell instead of strengthening. Surging oil prices (Japan imports most of its oil) blew out the trade deficit and hurt the yen. Meanwhile, high US interest rates made the dollar more appealing than the yen, even during the crisis.

As the US-Japan rate gap begins to close, the yen could gradually regain its safe-haven role. Traders are already positioning for a stronger yen – speculative bets increasingly favour yen gains. If the BoJ makes even modest rate hikes, it would further restore the yen’s safe-haven appeal.

Carry Trade Risks and Ripple Effects

If the BoJ stalls on tightening, the yen may stay weak and carry trades could run longer. A BoJ surprise hike or a global shock, by contrast, could send the yen soaring as carry trades abruptly unwind. It’s like a coiled spring – years of one-way bets could snap back suddenly, catching many off guard.

A surging yen would pressure Japan’s exporters and could spark broader volatility as investors flee risk assets. Other safe havens like gold and US Treasury bonds have recently outshone the yen, but that could flip if Japanese rates rise. And if yen-funded investments in emerging markets unravel, those markets would feel the strain too. The yen’s trajectory has global consequences.

Final Takeaway: Why Yen Matters Now

The yen is entering a new era. It’s no longer a one-way bet for carry trade profits, and its safe-haven status may strengthen as Japan normalises. For investors, a suddenly stronger yen can upend global portfolios – unhedged overseas positions might face currency losses, but holding some yen or yen-denominated assets could provide a buffer. The yen’s story is evolving, and staying alert to BoJ policy shifts and yen moves is key to navigating global markets ahead.