What Happens When the Fed Cuts But Inflation Stays Sticky?

Rate cuts usually get investors excited. Lower interest rates, easier credit, and more breathing room for consumers and businesses alike. But what if inflation’s still hanging around, not falling, not rising dramatically either, just… maybe stubborn?

That’s the strange bind central banks may find themselves in. And the Fed? It’s inching toward a decision that could be as risky as it is necessary.

Why Would the Fed Cut Now?

You’d think it wouldn’t. Inflation’s still above 3%, and the Fed’s target is 2%. That’s been their red line. But the economy isn’t moving in a straight line, yet! Growth is softening in some corners, credit conditions are tightening, and the labour market isn’t as strong anymore (July 2025 employment reports suggest this).

So, here’s the dilemma: do they wait until inflation gets to 2%, which might never happen neatly, or cut sooner to prevent a deeper slowdown? The Atlanta Fed’s “sticky CPI” still shows elevated prices in many services, especially those tied to wages. So, inflation’s not exactly cooling off on its own.

That’s why officials keep using words like “adjustment” and “fine-tuning” instead of “stimulus.” It’s not about juicing the economy. It’s about not overshooting.

Market Reality Check

Early in 2025, markets got a bit carried away. Central banks cut rates, stocks rallied, and yields dropped fast, too fast. The narrative was one of “immaculate disinflation.” Everything would work out. Until it didn’t.

Inflation shot up again. Core PCE didn’t move much. And suddenly, traders started walking back their bets. Six rate cuts became maybe two. Maybe one.

Breakeven inflation rates (those bond-market measures of expected inflation) stayed stubbornly high. That’s not what the Fed wants to see. And when GDP growth cooled at the same time? That’s when people started whispering the word “stagflation.”

Core PCE vs. Fed Funds Rate (2020-2025)

Sources: Board of Governors of the Federal Reserve System (US); US Bureau of Economic Analysis via FRED®

The Fed has tightened policy aggressively since 2022, but Core PCE inflation remains above the 2% target. With inflation proving sticky, any rate cuts in 2025 may be modest, and closely watched.

The Bigger Picture Isn’t Better

The US isn’t alone in this mess. BoE’s got inflation around 6 to 7%, and the UK economy isn’t exactly roaring. We discussed this in the Weekly Market Recaps that the UK has remained fairly flat for the last two to three weeks. Europe’s somewhere in between. And the ECB? Still cautious.

Some emerging markets like Brazil started cutting rates last year, but only after they’d hiked early and hard. They had real disinflation. Not the kind the US is hoping for.

Global institutions like the BIS and IMF have been blunt: don’t cut unless you’re really sure inflation is coming down. Because if you ease too early, you might have to slam the brakes later, and that usually ends badly.

So What Happens to Assets?

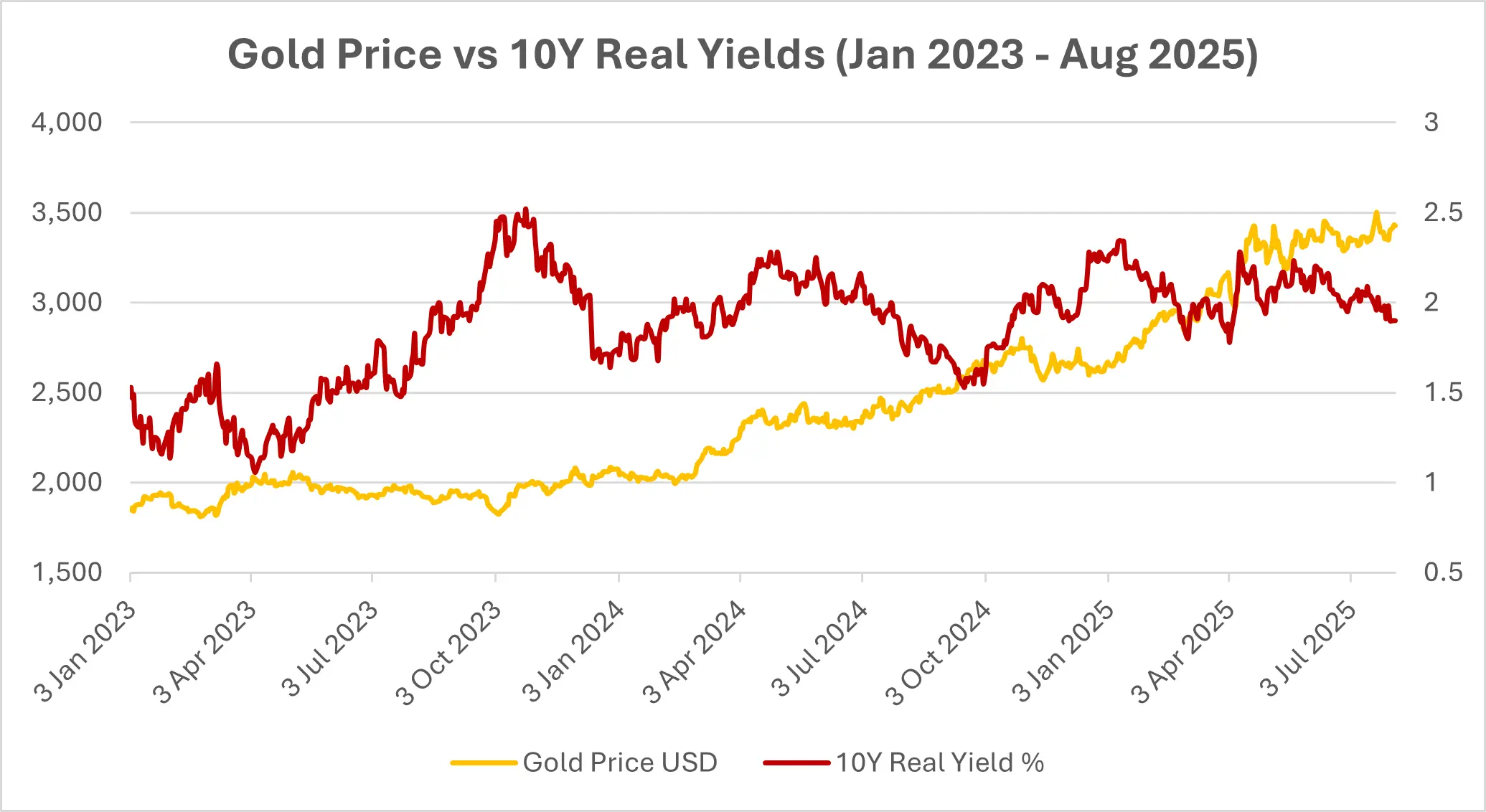

Let’s start with gold. If real yields fall, which they often do when the Fed cuts amid sticky inflation, gold tends to benefit. And this is exactly what happened last week; Gold rose 2%.

Sources: Investing.com (Gold); Board of Governors of the Federal Reserve System (US) via FRED® (10Y Real Yield). Data as of 1 August 2025.

Bonds are trickier. Yes, yields might drop. But if inflation eats into returns, those gains don’t mean much. And longer-dated bonds? They could actually under perform if investors demand a premium for inflation risk.

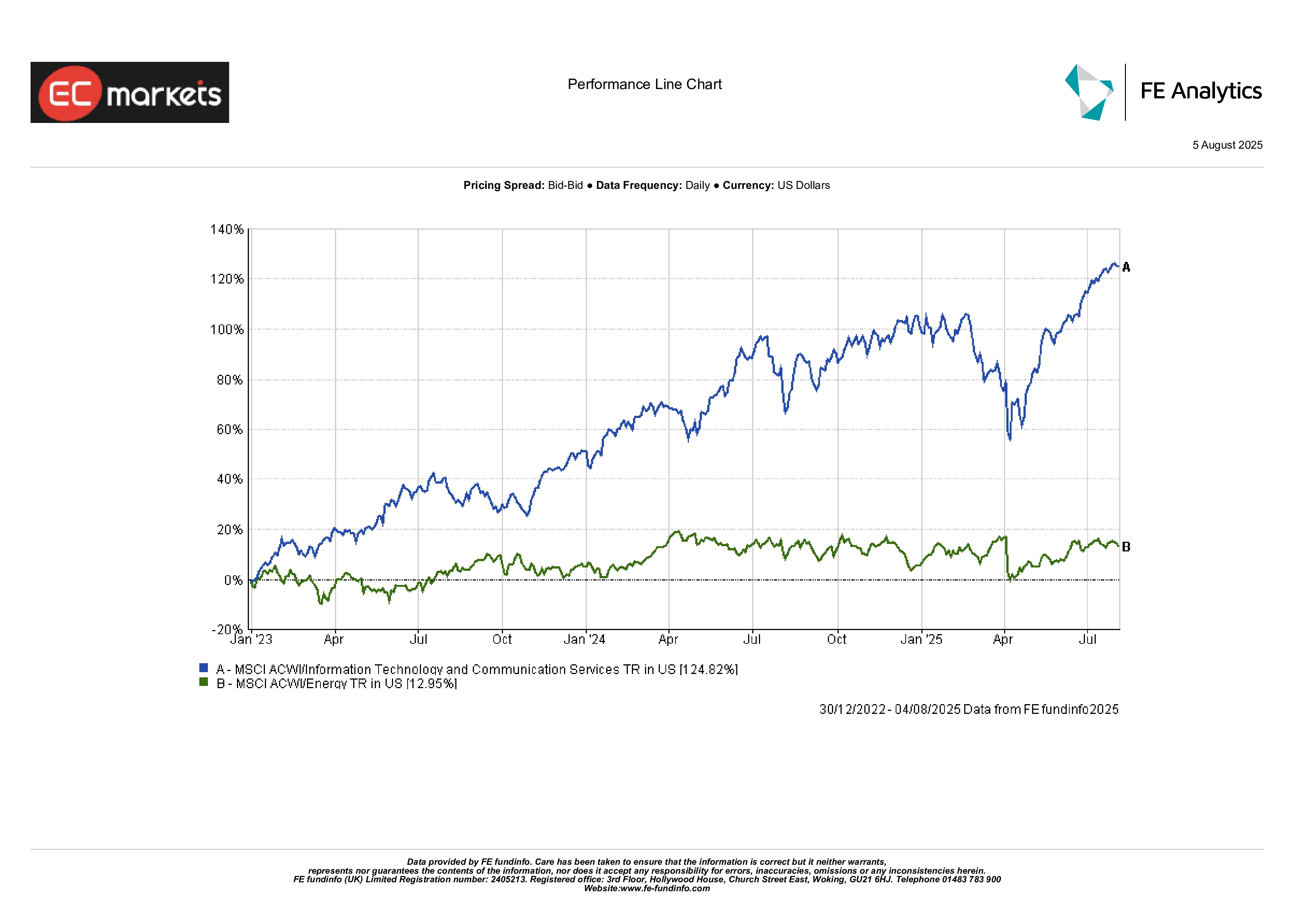

Growth stocks might get a short-lived boost from easier policy, but they’ll also face margin pressure if inflation stays hot and consumers get squeezed. Energy and commodity-linked stocks might look better in that case. They tend to do well when inflation’s persistent.

Energy vs Tech Performance (Jan 2023 – Aug 2025)

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 4 August 2025.

REITs? Maybe. If rents can adjust and inflation isn’t too aggressive, they’re a decent hedge. But consumer-facing sectors could be in for a rough ride.

Where This Could Go Wrong

The scariest outcome isn’t just inflation. It’s a loss of credibility. If the Fed cuts while inflation is still elevated, people might stop believing they’ll ever get it back to 2%. And once expectations drift, behaviour changes, and investors panic.

You start seeing more wage-price spirals. More inflation hedging. More volatility.

And what if other central banks hold firm while the Fed eases? The dollar could weaken, which imports more inflation back into the US It’s a feedback loop, one that’s hard to manage once it starts.

Final Thought

This isn’t a typical easing cycle. And it’s definitely not a free lunch.

If the Fed cuts while inflation’s still sticky, markets might cheer at first, but that enthusiasm could fade fast if it starts to feel like policy is drifting. For investors, it’s a time for realism. That might mean rotating into real assets, inflation-protected bonds, and companies with genuine pricing power.

Because let’s face it, if inflation isn’t going anywhere for a while, you’ll want to own things that can keep up.