The FX Carry Trap: USD/JPY and BoJ Normalisation

Why Traders Borrow Yen in the First Place

For decades, Japan has been the land of cheap money. Interest rates sat near zero, sometimes even below, while other countries offered much higher returns. That gap created what traders call the “carry trade.” The logic is simple: borrow yen at almost no cost, swap it into dollars, and invest in US bonds paying 4-5%. The difference becomes your profit.

It sounds easy, but there’s a catch. Carry trades are often described as “picking up pennies in front of a steamroller.” The pennies can add up, yes – but if the market shifts suddenly, the steamroller wins. And right now, the landscape is changing. BoJ has started nudging rates higher, while the US Fed is preparing to cut. That combination chips away at the very foundation of the trade.

Drivers & Trends

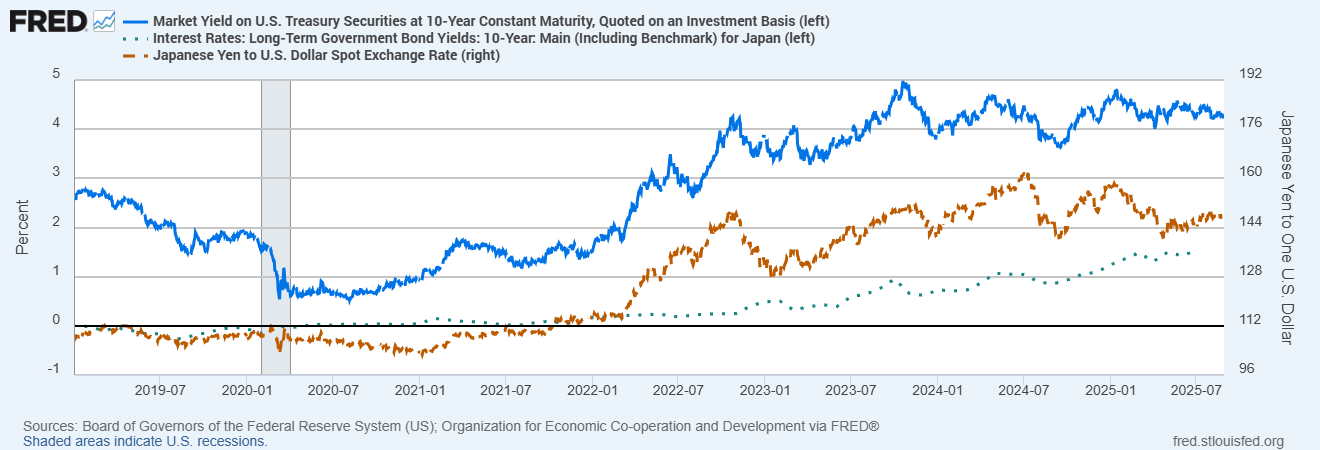

The fuel for this trade has always been the interest-rate gap. At its widest, the difference between US and Japanese rates was more than 4.5 percentage points. Imagine borrowing at 0.5% in Tokyo and earning 5% in Washington – the math practically begged investors to take advantage!

That flow pushed USD/JPY higher, meaning the dollar climbed against the yen. Confidence spread, equities gained momentum, and for a while it seemed like free money. But momentum doesn’t last forever, right?. Inflation in Japan has been hovering near 3%, and wages are finally rising. In 2025 the BoJ raised rates to 0.5% – their first move in two decades. Governor Ueda still calls policy “very low,” but the signal is clear: the era of free yen may be ending. At the same time, markets expect the Fed to cut toward 4.25% by year-end. Narrower gaps mean thinner rewards.

Supporting Data: The Rollover Angle

For retail traders using CFDs, the interest gap shows up as the daily “rollover” or “swap.” When US rates are far above Japan’s, holding a long USD/JPY position overnight often means you get paid a small amount each day. But when that gap closes, and if the Fed cuts or the BoJ hikes, the tables turn. Instead of collecting a little extra, you start paying instead.

We’ve seen how fragile the setup is. In mid-2024, rumours of a BoJ shift sent the yen surging. USD/JPY fell more than 10% in weeks. Japanese equities tumbled, and global banks estimated that most carry trades were unwound almost overnight. What looked like a safe drip of income turned into sharp losses…

US-Japan Yield Gap vs USD/JPY (2019-2025)

Sources: Board of Governors of the Federal Reserve System (US); US Bureau of Economic Analysis via FRED®

USD/JPY has closely tracked the US–Japan yield gap in recent years. As the spread narrows in 2024-25, the currency pair faces pressure, underlining the fragility of carry trades.

Central Banks Out of Sync

Japan is in a delicate spot. Inflation forecasts hover around 2.7-3%, but policymakers insist any further rate rises will be cautious and data-driven. Markets see only a 50-70% chance of another hike this year.

The US, on the other hand, is shifting toward easing. The Fed has held rates near 5%, but with growth slowing, cuts seem increasingly likely. In Europe, the ECB has already reduced rates to 2%, down from 4%. Central banks are no longer moving in opposite extremes, and that shrinking gap is the heart of the carry trap.

Why It Matters Beyond FX

The yen carry trade doesn’t exist in isolation. When it unravels, ripples spread.

- Gold often rises when US real (inflation-adjusted) yields fall, just like the yen. In mid-2025, both gained as Fed cuts came into view.

- Tech stocks mirror the carry trade in some ways: they thrive on cheap money and risk appetite, and shake when conditions tighten.

- Emerging markets are another echo. High yields lure investors in good times, but when sentiment turns, they sell off fast — often alongside yen carry unwinds.

In short, when USD/JPY falls sharply, it’s rarely just about currencies. It’s often a sign of a broader “risk-off” mood across global markets.

Final Takeaway: Keep Your Eyes Open

The yen carry isn’t dead, but it’s no longer easy money. The forces that made it work, including wide gaps, a strong dollar, a weak yen, are shrinking. For investors, that means stay safe! Watch the spreads, track BoJ signals, and don’t ignore rollover costs.

The safest approach is balance. Diversify into assets like Treasuries, investment-grade bonds, or gold, so you’re not overly reliant on a fragile trade. Carry can work for years, but when the tide turns, it usually does so fast.

History’s lesson is clear: carry trades look steady, until suddenly they don’t.