Records Fall as Fed Cut Bets Trump Shutdown | Weekly Recap: 29 Sept – 3 Oct 2025

Economic Overview

Markets began Q4 steady despite the US government shutdown on 1 October, which halted key data releases including the September jobs report. Investors largely viewed it as temporary and focused on the Fed’s next steps.

The Fed’s first rate cut in nearly a year remained the main theme. Softer payroll data and cautious remarks from officials kept expectations alive for another move before year-end. With limited data, investors concluded the easing cycle is still in play.

The BoE kept Bank Rate at 4%, with inflation at 3.8%, the highest in the G7. The UK Services PMI fell to 50.8, showing softer demand. Deputy Governor Ben Broadbent said policy would stay restrictive until prices normalise. Sterling gained on dollar weakness.

In the eurozone, inflation rose to 2.2% and the composite PMI improved to 51.3, driven by stronger German and French activity. President Christine Lagarde said the ECB would stay patient as inflation nears target and growth stabilises.

China reopened after Golden Week with manufacturing PMI at 49.8 and services at 50.0. The PBoC pledged to use “multiple tools” to support growth but avoided rate cuts to protect the yuan. Trading was light due to the holiday-shortened week.

Equities, Bonds & Commodities

Wall Street extended gains despite limited data. The S&P 500 hit a record near 6,750, the Dow rose 1.5% to 47,000, and the Nasdaq gained 1.7% on strength in semiconductors and AI names.

Europe outperformed: the STOXX 600 rose 2.8%, and the FTSE 100 gained nearly 2% on stronger financials and energy stocks. Asia followed, with the MSCI Asia ex-Japan up 2.7% and Japan’s Nikkei up 1.5% on yen weakness.

Bond yields eased: US 10-year at 4.10%, 2-year at 3.53%, Bunds near 2.4%, and UK gilts around 4.3%. Japanese yields edged higher on fiscal speculation.

Oil dropped over 8% to $64.50 as OPEC+ signalled higher production and US inventories rose. Gold climbed 2.5% to $3,845, extending a seven-week rally as yields and the dollar fell.

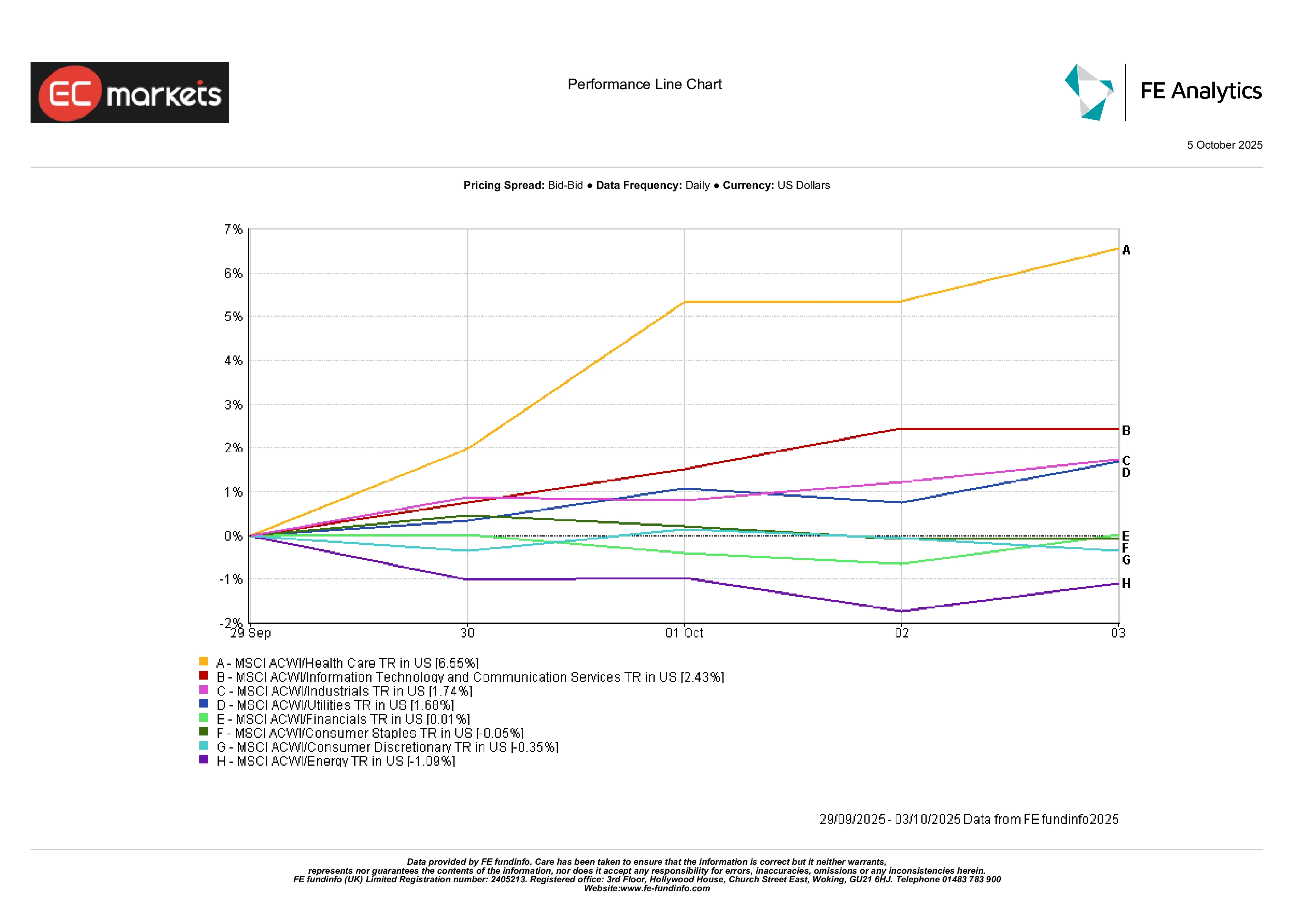

Sector Performance

The global rotation back into growth sectors stood out. Healthcare led with a 6.6% jump, helped by easing regulatory pressure and renewed interest in defensives after a volatile summer. Technology added 2.4% as chipmakers and AI plays rode the rate-cut narrative. Industrials rose 1.7%, mirroring stronger PMIs and infrastructure optimism.

Energy was the notable laggard (-1.1%) amid oil’s slide. Consumer Discretionary slipped 0.3% on retail profit-taking; Staples were flat. Financials and Utilities hovered near breakeven as lower yields offset weaker earnings momentum. In short, investors leaned back into cyclicals, betting that easier policy can stretch the expansion a little longer.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 3 October 2025.

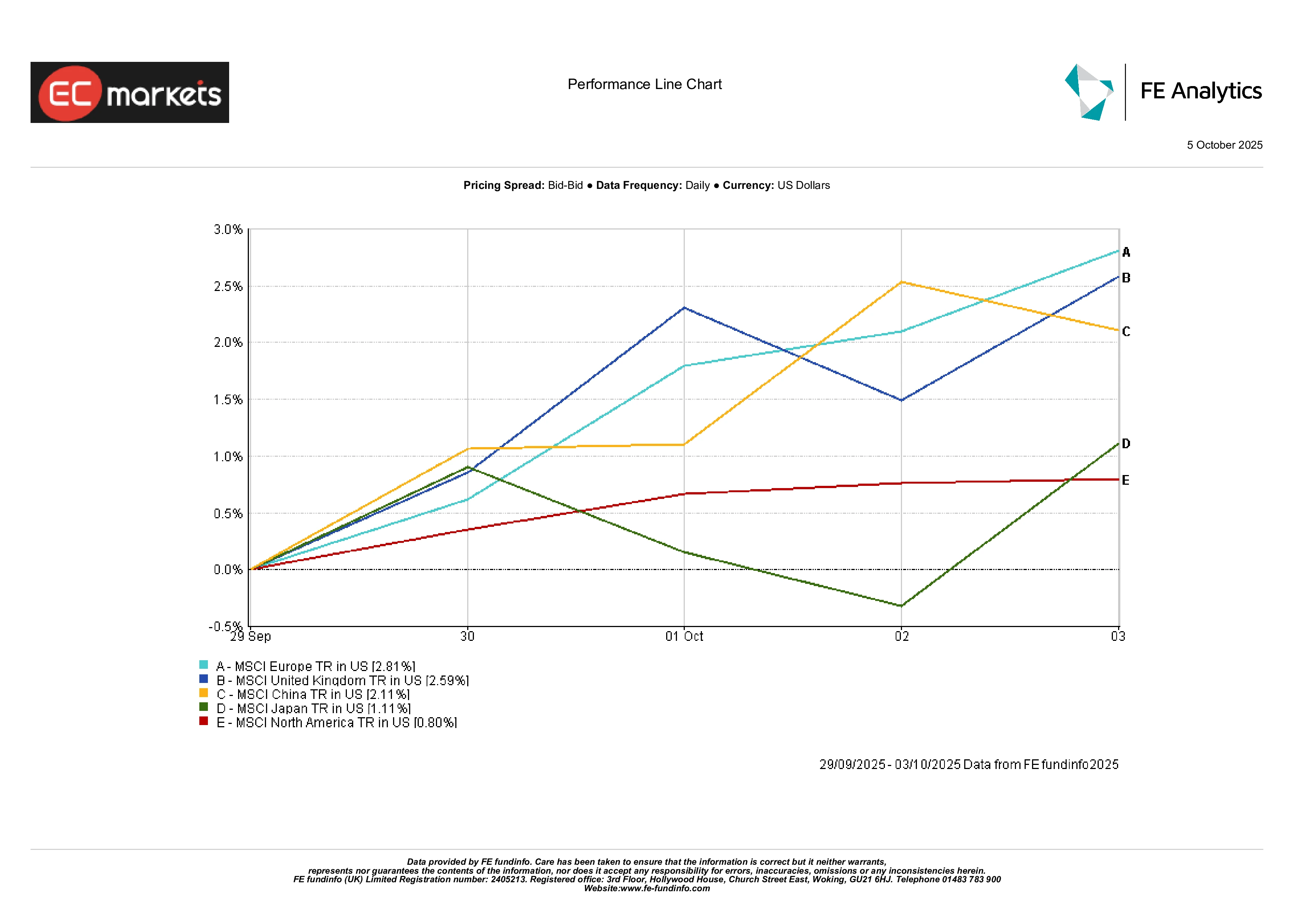

Regional Markets

Europe topped the global leaderboard with the MSCI Europe up 2.8%, followed by the UK (+2.6%), and Japan (+1.1%). North America trailed slightly (+0.8%) as stretched valuations and energy weakness limited upside. China gained just over 2% in light holiday trade – not euphoric, but definitely more constructive than a month ago.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 3 October 2025.

Currency Markets

The dollar weakened broadly as traders priced in further Fed cuts and fretted over the prolonged government shutdown. The DXY index lost around 0.4%, its worst weekly showing since July. Sterling was the standout – GBP/USD climbed roughly 1% to 1.3479, its strongest level since April, helped by high UK yields and the softer greenback. The euro advanced to about 1.1743 (+0.8%), supported by firm inflation data and steady ECB rhetoric.

The yen underperformed, reversing early gains as risk appetite improved. USD/JPY ended around 147.4, up 1.4% on the week, while GBP/JPY broke above 204, its highest since 2018. The move reflected a clear “carry trade” revival, with investors borrowing in yen to buy higher-yielding assets. Overall, sterling led the G10 pack, the dollar softened, and the yen lagged – a classic pattern in risk-on weeks.

Outlook & The Week Ahead

The near term hinges on Washington resolving its shutdown so the data calendar can restart. If that happens, the spotlight shifts to September CPI and retail sales, both key for confirming the Fed’s path. Overseas, China’s trade and credit figures will gauge whether stimulus is biting, while Europe and the UK report fresh industrial and GDP numbers.

Oil headlines and geopolitics may colour sentiment, especially with OPEC+’s output decision and IMF/World Bank meetings in view. With equities at record highs and volatility low, the market mood is quietly optimistic – though everyone knows one hot inflation print could change that in a heartbeat.