Markets Balance on Rate Hopes and Growth Jitters | Weekly Recap: 1-5 December 2025

Economic Overview

With long-delayed data finally released post-shutdown, investors welcomed signs of easing inflation, core PCE rose just +0.3% in September. Early-December sentiment surveys ticked up, but labor market softness lingered. Markets expect the Fed to cut rates by 25bps at the December 9-10 meeting. Optimism remains fragile, but most traders now anticipate a third consecutive cut as the Fed aims to cushion a slowing economy.

Eurozone inflation inched up to 2.2%, with core holding near 2.4%, reinforcing ECB caution. Markets expect no rate change at the December 18 meeting. Slower wage growth and softer energy prices suggest continued disinflation, giving policymakers breathing room. In the UK, the BoE held rates at 4.00% after a narrow 5-4 vote. October CPI came in at 3.8%, and Chancellor Reeves’ new budget includes tax hikes to tame debt, possibly opening space for rate cuts in early 2026. Growth remains weak, with unemployment near 5%.

China’s economy showed fresh signs of strain, with manufacturing activity slipping and firms cutting jobs and stockpiles. Exports improved slightly on better US-China trade tone, but domestic demand stayed weak. Markets now look to the upcoming economic conference for stimulus signals. The central bank is holding rates steady but adding liquidity. Meanwhile, Japan’s central bank surprised with a hawkish shift, hinting at a potential rate hike, underscoring the contrast between China’s easing and Japan’s tightening.

Ukraine ceasefire talks gained traction, with potential implications for energy markets. Taiwan Strait tensions remained calm, and OPEC+ opted to maintain current output levels, helping stabilize oil prices. Overall, macro conditions are improving modestly, though growth worries persist.

Equities, Bonds & Commodities

Global equities fell last week as investors trimmed exposure to stretched valuations, Equities rose modestly. The S&P 500 added +0.3%, marking a second weekly gain, and the Nasdaq outperformed with a +0.8% lift, thanks to tech strength and returning risk appetite. The STOXX Europe 600 was flat (+0.4%), with Germany’s DAX gaining +0.8% on solid factory data. The FTSE 100 dipped ~–0.5%, weighed by sterling strength and post-budget caution. Japan’s Nikkei 225 ended marginally up (+0.5%), despite a late pullback from BoJ shocks. Chinese stocks recovered after mid-week losses, helped by tech optimism and stimulus hopes.

Bond markets were split. US 10Y yields hovered near 4.13%, while 2Y yields stayed flat (~3.56%), with a Fed cut largely priced in. German Bunds and UK Gilts were steady as ECB and BoE remained cautious. The spotlight was on Japan: JGB yields surged to multi-year highs after the BoJ signalled a potential hike. Yield spikes spurred carry trade unwinds and yen volatility, prompting safe-haven buying elsewhere.

Commodities diverged. Brent crude bounced to ~$64 after touching $62 early in the week, with OPEC+ maintaining supply cuts. WTI held above $60. Gold hovered around $4,200/oz, flat on the week, while silver jumped +2% to $58.4/oz.

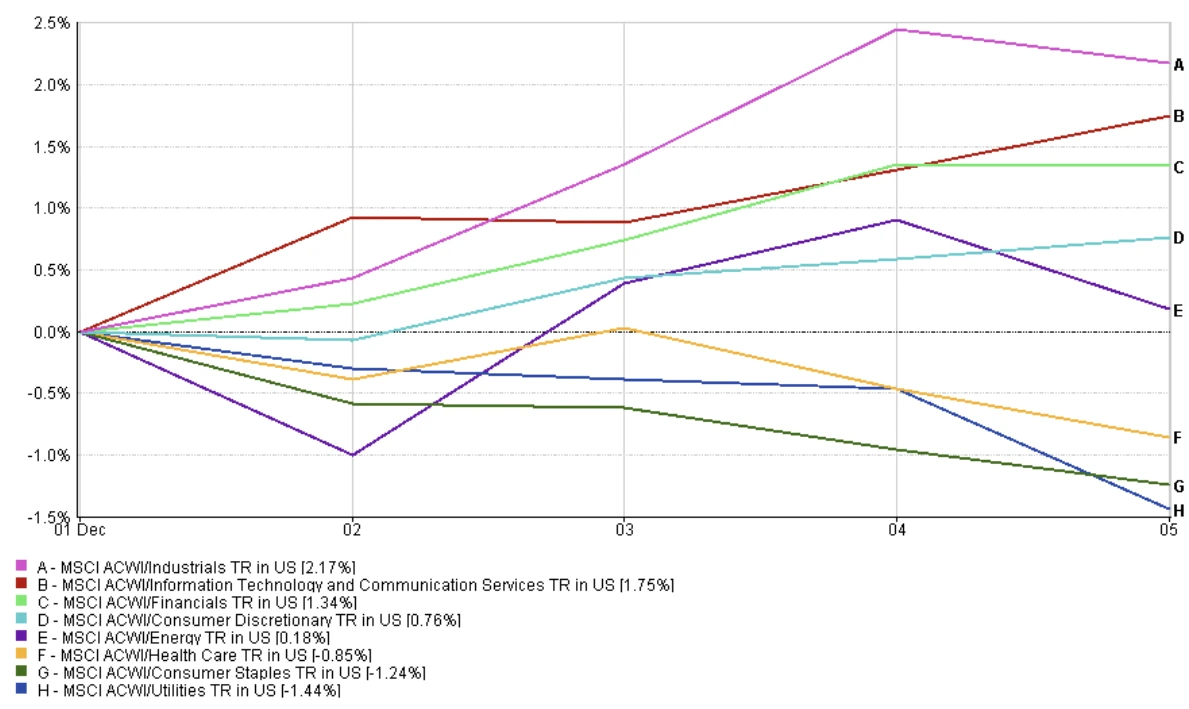

Sector Performance

Sector leadership rotated back toward growth and cyclicals. Information Technology (+1.75%), Industrials (+2.17%), and Financials (+1.34%) led gains, supported by easing rate expectations and strength in chipmakers and software. Consumer Discretionary rose +0.76%, rebounding modestly. Energy ticked up only +0.18% despite oil’s late-week recovery.

Defensives underperformed. Utilities (-1.44%) and Consumer Staples (-1.24%) were the worst performers as investors rotated out of yield-sensitive sectors. Health Care declined -0.85%, less than the 2-3% previously suggested.

Overall, investor appetite favoured higher-beta names as yields steadied and risk sentiment improved.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 5 December 2025.

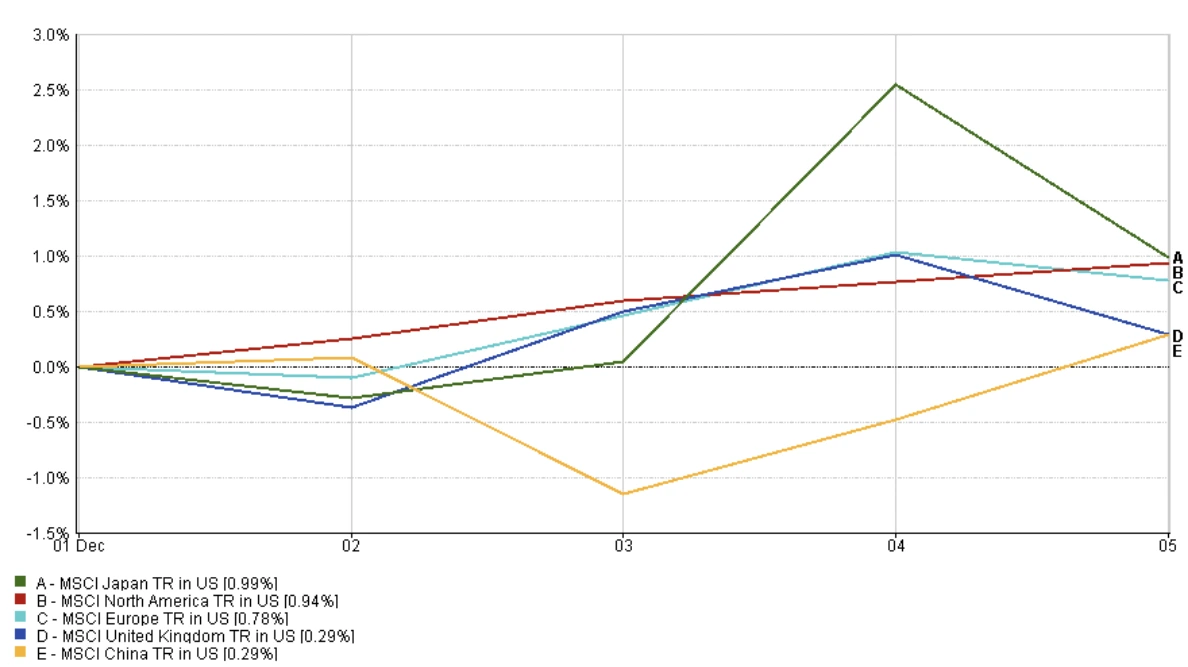

Regional Markets

Regional equities posted broad but modest gains. Japan led (+0.99%) amid yen weakness and a dovish BoJ. North America followed closely (+0.94%) with strong tech momentum. Europe rose +0.78%, while the UK advanced +0.29%, contradicting earlier suggestions of underperformance. China also gained +0.29%, reflecting a late recovery from midweek losses.

Overall, global equity momentum improved, led by Japan and the US, while the UK and China posted smaller, but positive, returns.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 5 December 2025.

Currency Markets

The dollar weakened further, with the DXY falling to 99.0 (its lowest since early 2024) as traders priced in a December Fed cut. The euro rose to $1.16, helped by narrowing rate differentials and a surplus-supported backdrop. The pound rallied to the mid-$1.24s, boosted by fiscal tightening and speculation of a BoE rate cut. The yen strengthened, reversing months of weakness amid BoJ hawkish signals, sparking yen carry trade unwinds.

Outlook & The Week Ahead

Markets now turn to the Fed’s December 9-10 meeting, where a 25bps cut is widely expected. Chair Powell’s guidance will be crucial. Will he hint at further easing in 2026 or strike a more cautious tone? Upcoming data, long delayed due to the shutdown, could influence sentiment. November’s jobs report and October/November retail sales will offer fresh insights into the labour market and consumer strength. November CPI will be especially important; a soft reading could cement dovish expectations.

Globally, eyes also turn to the BoE and ECB meetings on December 18. The BoE faces a probability of a cut, depending on upcoming UK growth and inflation data. ECB is expected to stay put but may acknowledge inflation nearing target, hinting at 2026 cuts.

Other factors in focus: lingering earnings, oil price reaction to OPEC+ output policy, Ukraine ceasefire talks, and US-China trade follow-through. Sterling and gilts could react to any UK budget pushback. Speculation about a new Fed Chair – Kevin Hassett is rumoured – has started to steepen US curves. With equities near highs and yields low, investors are bracing for a key week that could validate or challenge the “soft landing” thesis.