Jobs Cool, China Drags, and Gold Shines | Weekly Recap: 1– 5 Sep 2025

Economic Overview

September began with investors weighing softer data, cautious central banks, and persistent geopolitical risks.

In the US, the August jobs report set the tone. Payrolls rose by 165,000, below expectations, while unemployment edged up to 4.3%, the highest since 2023. Wages slowed to 3.9% YoY, pointing to easing inflation pressures but also weaker labour demand. Manufacturing remained in contraction at 47.8 on the ISM index, though services held at 52.7. Combined with Powell’s dovish Jackson Hole remarks, the data strengthened bets on a September Fed cut.

The UK faces its own turning point. The BoE’s August cut to 4.0% was a narrow call, and Governor Bailey urged caution against moving too quickly. Inflation stayed elevated at 3.7%, with wage growth still strong. Services PMI slipped to 50.5, hinting at slower momentum, but housing and consumer credit data were resilient, keeping sterling steady. Markets now see one more cut later this year.

In the eurozone, the picture was mixed. August CPI eased to 2.1%, showing progress on disinflation, while the composite PMI held at 51.0. Yet German factory orders disappointed, and French politics rattled sentiment as Prime Minister Bayrou faced a confidence vote, unsettling bonds and sparking fiscal worries.

China lagged again. PMIs stayed weak, services cooled, and stimulus measures failed to lift confidence. The yuan hovered near multi-year lows, equities slid, and India also came under pressure after new US tariffs hit markets.

Equities, Bonds & Commodities

Equities had a bumpy week. In the US, the S&P 500 slipped 0.3% and the Nasdaq 0.4%, ending a three-week winning streak. The Dow was flat, with strength in cyclicals offsetting defensive weakness. Softer payrolls data boosted rate-cut hopes but also stoked worries the economy may be slowing faster than expected.

Europe underperformed. The STOXX 600 fell 1.1%, led lower by banks and industrials, while the FTSE 100 lost 0.9% as a stronger pound weighed on exporters and retailers. Japan’s Nikkei dropped 0.7% as the yen firmed. China slumped despite new policy changes, leaving broader emerging markets in the red zone.

Bonds drew steady demand. The US 10-year yield fell nine basis points to 4.14%, while the 2-year eased to 3.53%. Strong auction demand underscored Treasuries’ haven appeal despite political noise. UK gilts edged down to 4.28% as investors pared back BoE easing bets.

Commodities diverged. Brent crude touched $69 before ending 1.2% higher near $68.5; WTI closed at $64.7. And gold extended its rally, up 1.5% to $3,495/oz.

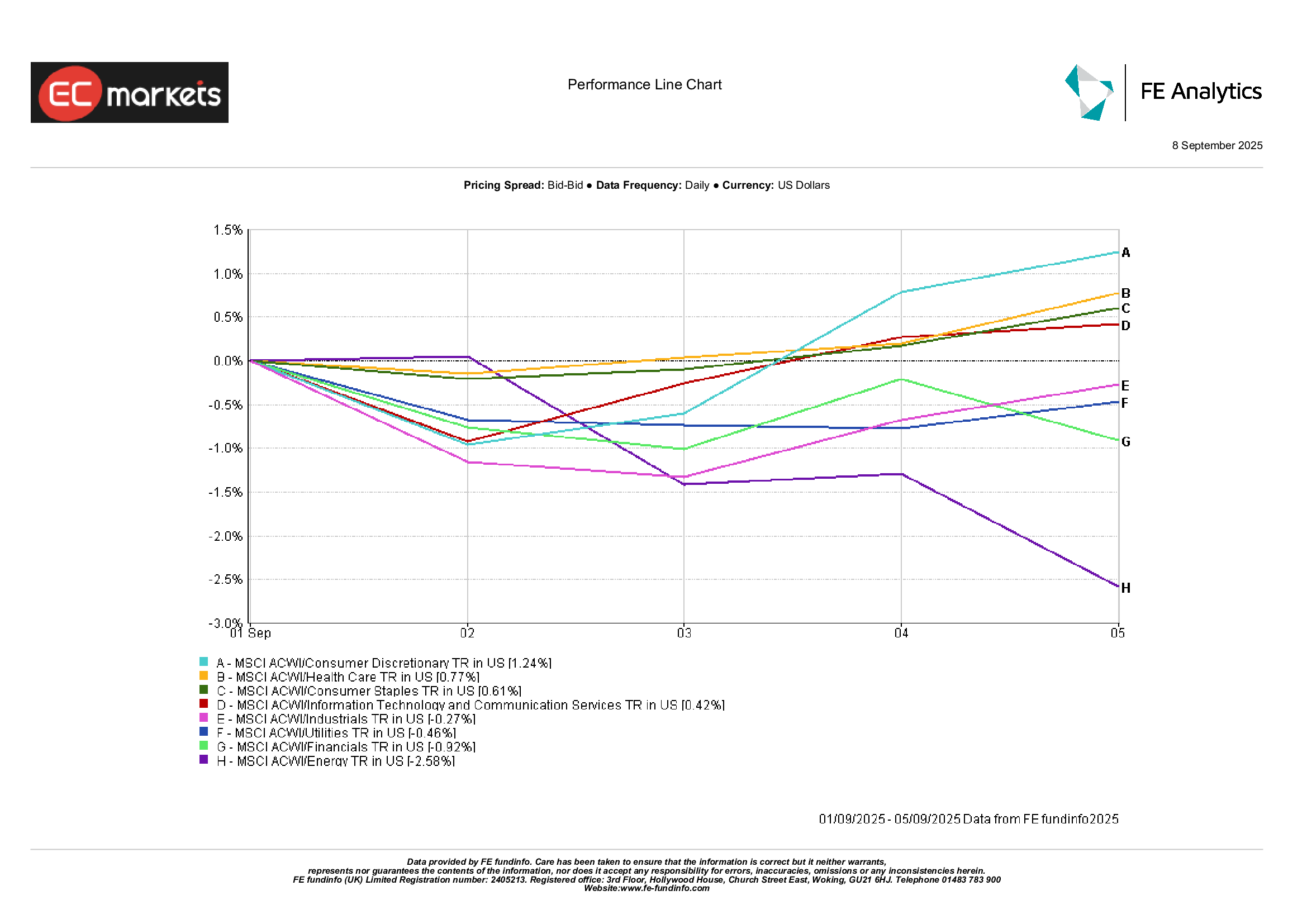

Sector Performance

Sector leadership rotated again.

Consumer Discretionary came out on top, up 1.2% on solid US retail earnings and hopes that households can withstand higher borrowing costs. Health Care followed with a 0.8% rise, boosted by positive trial updates and its reputation as a safe but growth-friendly play. Consumer Staples gained 0.6% as food producers delivered steady results.

On the flip side, Energy sank 2.6% despite oil’s late rally, as doubts lingered over the durability of demand. Utilities lost 0.5% with higher yields continuing to sap the appeal of dividends. Industrials slipped 0.3%, dragged down by logistics and transport, though aerospace stayed resilient.

The week’s pattern showed a split: consumer-facing names outperformed, while energy and traditional defensives fell behind.

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 5 September 2025.

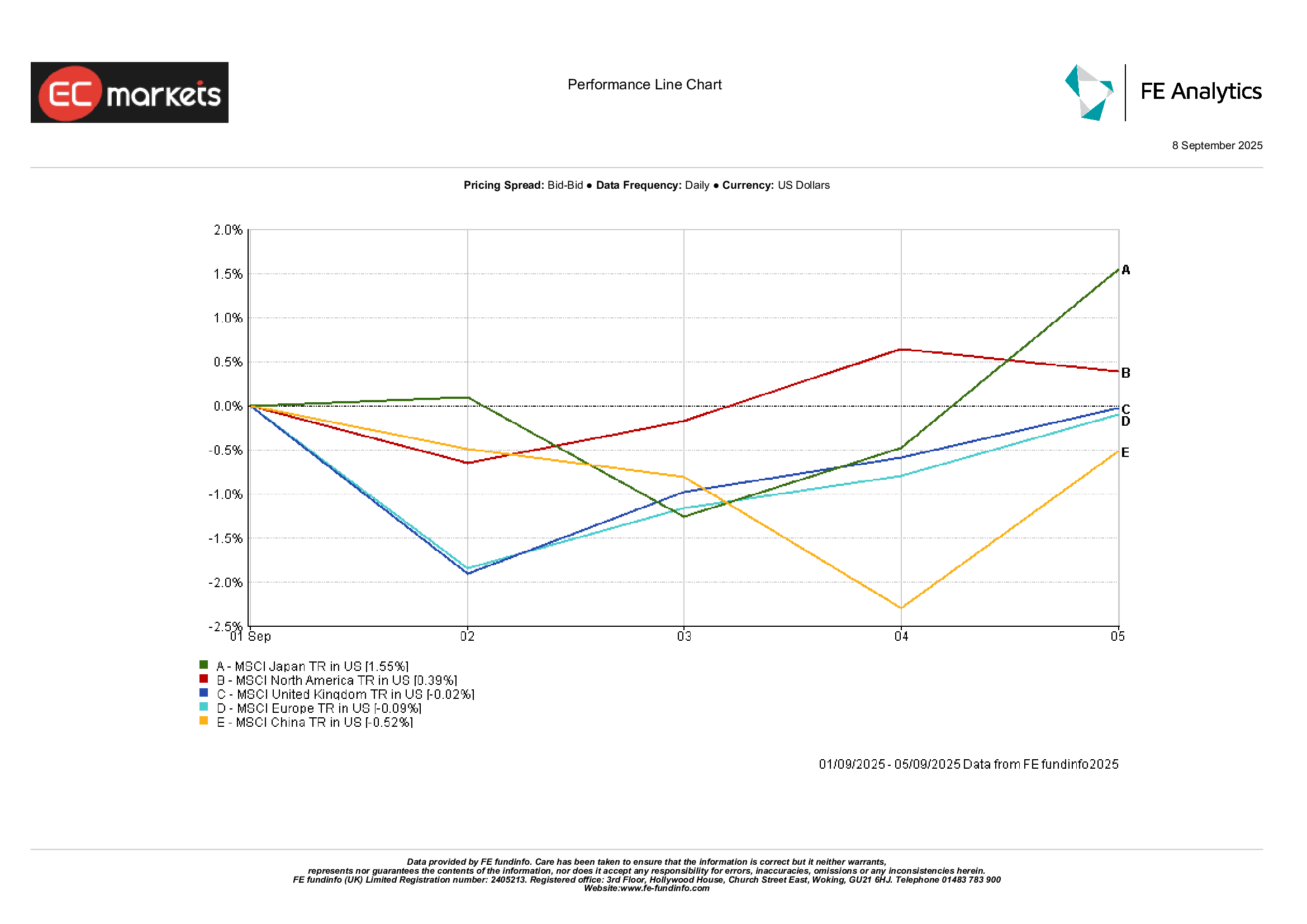

Regional Markets

Regional moves painted a varied picture.

Japan outperformed, with MSCI Japan up 1.6% on yen strength and improving corporate sentiment. North America also managed gains, with MSCI up 0.4% thanks to resilient US data. Europe lagged: MSCI Europe dipped 0.1%, while the UK slipped 0.02%, both dragged by politics and a stronger currency. China remained the weakest major market, with MSCI China down 0.5% as investors stayed sceptical of incremental policy measures.

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 5 September 2025.

Currency Markets

The dollar lost a bit of ground, with the DXY index down 0.3% to 97.8 after the softer payrolls report reinforced bets on a Fed cut. EUR/USD finished flat at 1.171, whipsawing between 1.164 and 1.172 as inflation progress offset earlier weak money supply data. GBP/USD ended near 1.354, down just 0.2%, as steady UK data balanced dollar swings.

The yen found support, with USD/JPY slipping from 148.5 to 148.2 as lower US yields helped haven demand. GBP/JPY moved higher, finishing just above 200 for the first time since 2016, up about 0.7% on sterling’s relative strength. Commodity currencies did better: AUD/USD added 0.4% alongside firmer oil and metals, the yuan steadied after PBoC steps, while the rupee stayed weak near three-week lows.

Outlook & The Week Ahead

Looking to next week, the calendar is heavy. In the US, Wednesday’s CPI and Thursday’s PPI will be the big ones, showing whether disinflation is still on track. Retail sales and Michigan sentiment will round out the picture on consumers. With the Fed meeting just around the corner, every data point will be watched closely.

In Europe, GDP and inflation updates are due, while politics stay in the spotlight with France’s confidence vote looming. The UK will release housing and spending data, and investors will watch for signs of cracks in household resilience.

In Asia, China will publish trade and credit numbers, which could either confirm the slowdown or show hints of stabilisation. Japan releases machinery orders, and the BoJ’s summary of opinions will give traders another chance to gauge any shift in tone.

On the commodity front, the OPEC+ meeting will be key as markets look for clarity on fourth-quarter supply. Geopolitical risks remain live – from Ukraine to US-India trade disputes.

With September seasonality and higher trading volumes back, volatility could pick up. Investors are cautiously optimistic heading into mid-month, but with valuations already stretched, any surprises could spark sharper moves.