Inflation Lingers, Tariffs Loom, Equities Hold Ground | Weekly Recap : 14 July – 18 July 2025

Economic Overview

This week felt like a tug of war between optimism and caution.

In the US, retail sales surprised to the upside and consumer sentiment held up, giving bulls something to cheer about. But June’s inflation numbers told a different story. Core CPI ticked up to 2.9% YoY, keeping the Fed firmly in wait-and-see mode. No July rate cut seems to be on the cards, and traders are now looking further down the calendar.

Across the Atlantic, the UK’s economic pulse stayed faint. After a 0.1% contraction in May, not much has improved, and markets are still pricing a strong chance of a BoE cut in August. In Europe, inflation is still too hot for comfort, even as growth stays moderate.

Over in Asia, China rolled out some fresh policies aimed at luring back foreign investors, just as concerns grow over slowing private sector investment. That was enough to give equities a strong lift. Japan, on the other hand, remained subdued ahead of this weekend’s upper house elections, and a stronger yen didn’t help.

The backdrop? Sticky inflation, uneven growth, and the steady hum of trade risk – especially with the next US tariff deadline fast approaching.

Equities, Fixed Income, and Commodities

Equities took a cautious step forward.

In the US, the S&P 500 gained about 0.6% and the Nasdaq pushed 1.5% higher (both hitting fresh highs again). The Dow was mostly flat for the week.

European markets were a mixed bag. The STOXX 600 ended the week broadly unchanged, while the FTSE 100 rose 0.6%, helped along by energy and utility names. Data out of the UK didn’t offer much support, but strong performances from index heavyweights helped steady the ship.

In Asia, it was a tale of two markets. Japan’s Nikkei slipped about 0.8% as the yen firmed and investors braced for the weekend’s election outcome. China, meanwhile, came roaring back on hopes that policy easing might be just getting started.

US Treasury yields barely budged. The 10-year hovered near 4.45%, while the 2-year settled around 3.9%. The curve remains flat as markets adjusted to the idea that rate cuts are further out than previously hoped. In Europe and the UK, yields were equally steady, as central bankers stayed noncommittal in the face of lingering inflation.

Brent crude eased back to around $69.30/bbl, down about 2% on the week, while WTI tracked similarly. Traders are weighing ample global supply against soft demand signals, including sluggish housing data and a still‑uncertain sanctions landscape.

Gold hovered near $3,350 per ounce, inching up as the dollar weakened slightly. Industrial metals like copper held steady on hopes that Chinese stimulus might lift demand in the coming months.

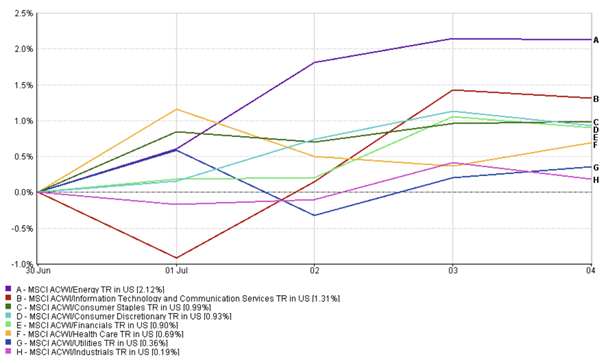

Sector Performance Updates

Last week’s market mood tilted toward growth – again.

Tech and Communication Services stole the spotlight, each rising just over 2%, fuelled by upbeat earnings and the persistent AI buzz. Utilities and Industrials also moved higher – both up around 0.5-0.6% – as markets looked for steady income and infrastructure exposure amid macro jitters. Consumer Discretionary posted a modest gain (~+0.45%), supported by solid brand earnings.

Energy, however, gave back some ground – dropping about 1.7% as oil prices softened. Healthcare slid roughly 1.8%, with biotech taking a breather after a strong run. Consumer Staples drifted slightly lower (around -0.1%), caught in the rotation away from defensives and into higher‑beta names.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 18 July 2025.

The takeaway? Investors continue to favour growth and risk-sensitive sectors, though they haven’t entirely abandoned the safe plays – yet.

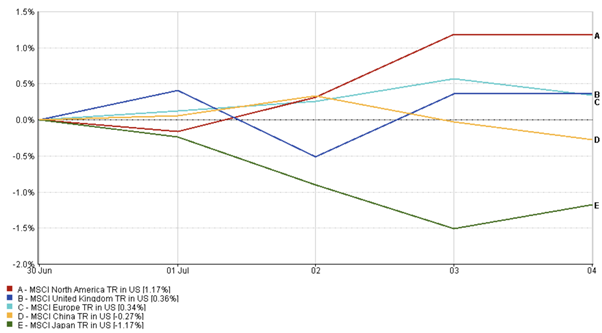

Regional Market Updates

Regional equity performance was a mixed bag, with North America and China leading the way.

North America was the clear front-runner, with the MSCI North America Index up just over 0.5%, driven by tech and consumer strength.

Europe slipped by about 0.4%, with gains in materials offset by weakness in healthcare and autos. The mood remained cautious amid lingering economic concerns.

UK equities were a touch weaker on a total return basis, despite the FTSE 100’s gains. Financials and small caps underperformed, while rate cut bets propped up interest-rate-sensitive names.

Japan fell roughly 0.2%, weighed down by a rising yen and investor uncertainty ahead of national elections.

China was the standout. The MSCI China Index surged about 3.2% on the week –the top-performing region – thanks to renewed hopes of government support and policy easing.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 18 July 2025.

Currency Market Movements

Currencies traded mostly sideways, with a mild risk-off tone lingering under the surface.

The US dollar index (DXY) ended the week near 98.5, little changed after bouncing around on inflation data and central bank commentary.

EUR/USD edged up toward 1.162, recovering some ground as trade concerns softened later in the week.

GBP/USD held near 1.34, as the market stayed focused on upcoming UK data and the BoE’s next move.

The yen continued to drift lower, with USD/JPY nearing 149. With Japanese elections looming and the BoJ firmly on hold, there wasn’t much standing in the dollar’s way.

Overall, FX traders remained cautious – no clear conviction, just a lot of watching and waiting.

Market Outlook and the Week Ahead

In the US, the focus now turns to the Fed’s July 29-30 meeting. No policy changes are expected, but markets will dissect every word of the statement for signs of when rate cuts might finally arrive. Inflation is still running hot – 2.7% headline, 2.9% core – so the Fed has reasons to be patient. Upcoming data on PPI, consumer sentiment, and durable goods orders could also sway expectations.

In the UK, July’s PMI numbers will be critical. Any renewed softness could lock in a rate cut at the BoE’s August meeting, which is currently about 78% priced in.

Europe’s flash inflation figures are due soon and will shape expectations ahead of the ECB’s September decision. Central bankers are watching closely to see whether price pressures ease enough to justify loosening later this year.

In Asia, eyes are on Japan’s upper house elections this weekend, which could shift the policy tone heading into H2. Meanwhile, China’s upcoming releases – Q2 GDP, retail sales, and industrial production – will be watched for signs of recovery (or the lack of it).

And then there’s the tariff clock. The August 1 deadline for fresh US-EU tariffs is creeping up, and any new moves from Washington could shake up risk assets again.