Fed Rate Cut Hopes Fuel Global Rally Amid Tariff and Inflation Crosswinds | Weekly Recap: 8 Sep – 12 Sep 2025

Economic Overview

September’s second week was all about balancing softer data with central bank caution and a few geopolitical flare-ups. In the US, the August CPI print came in at +0.4% MoM, pushing the annual rate to 2.9%, its highest level since January. Core CPI held steady at 3.1%, which was enough to reassure investors that underlying pressures aren’t spiralling. Producer prices dipped slightly after July’s spike, adding to the sense that inflation is cooling, albeit slowly. At the same time, the labour market showed more cracks: unemployment ticked up to 4.3%, while job gains turned negative. Taken together, the data reinforced Powell’s Jackson Hole message that the Fed is closer to easing than hiking.

In the UK, the story was a little different. The economy flatlined in July, with factory weakness cancelling out strength elsewhere. This was widely expected, yet still an uncomfortable reminder that growth remains fragile. The BoE’s August cut to 4.0% was finely balanced, and Bailey repeated his preference to move cautiously. Inflation is still stubborn at 3.7%, while wages are holding up. Sterling stayed relatively firm thanks to solid housing data and steady consumer credit, with markets now betting on one more cut later in the year, probably in November.

The eurozone offered its own mixed picture. August CPI eased to 2.1%, showing clear progress on disinflation. The composite PMI held at 51.0, confirming modest expansion, though German factory orders disappointed. Politics also kept investors on edge, with France’s government facing a confidence vote that unsettled bond markets and revived talk of fiscal instability. The ECB, for its part, left rates unchanged and gave little away, underlining its wait-and-see stance.

China stayed the laggard. Trade data showed exports slowing to +4.4% YoY, their weakest in six months, while imports grew just 1.3%, missing forecasts. Consumer prices slipped back into deflation, down 0.4% YoY, while PPI remained negative at –2.9%. Authorities rolled out more liquidity support and eased housing restrictions, but confidence remained weak. The yuan hovered near multi-year lows, equities stayed under pressure, and investors doubted incremental stimulus would be enough.

Equities, Bonds & Commodities

In the US, the S&P 500 rose 1.6%, the Nasdaq jumped 2%, and the Dow added 1% – all flirting with record highs. The CPI release midweek triggered a surge, especially in tech, with Oracle’s upbeat cloud guidance reigniting the AI trade. Europe was steadier: the STOXX 600 added 0.3%, with banks and cyclicals helping offset weaker industrials. London’s FTSE 100 climbed nearly 1% for the week, boosted by gold miners and defence stocks despite soft GDP data. Japan shone brightest: the Nikkei 225 gained over 4%, hitting fresh records above 44,700 as chipmakers tracked US tech strength. China’s long-suffering equities finally caught a bid, with the MSCI China index up 3.2%, making it the top-performing major market.

The US 10-year Treasury yield ended near 4.06%, little changed, but the 2-year fell to 3.56%, flattening bets on rate cuts and slightly steepening the curve. Auctions drew strong demand, underscoring Treasuries’ safe-haven appeal. Futures now price around 75 bps of Fed cuts by year-end. Bunds and gilts saw lighter moves, with European yields broadly steady after the ECB pause and UK data.

Commodities split. Oil retreated, with Brent crude down nearly 3%, settling just under $67. OPEC+ confirmed a modest October production hike, adding to supply concerns. Gold, meanwhile, surged to record highs above $3,600/oz, up 1.5% for the week and more than 40% YoY. Investors piled into the metal on falling real yields, dollar softness, and safe-haven demand.

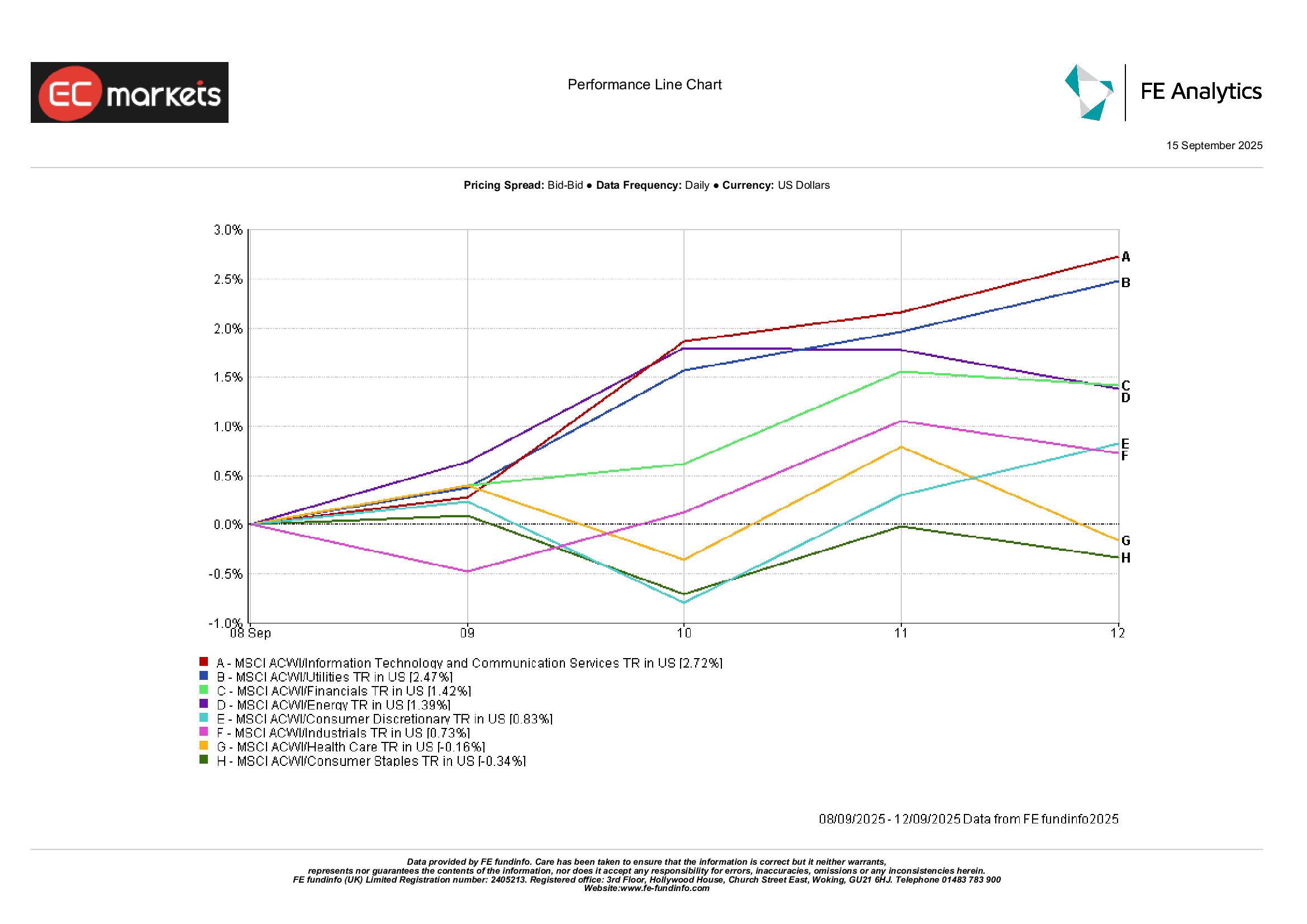

Sector Performance

Global sectors told a risk-on story. Tech and Communication Services led with +2.7%, lifted by AI enthusiasm and lower yields. Utilities gained 2.5%, benefiting from their bond-proxy appeal as rates slipped. Financials added 1.4%, helped by a slightly steeper curve and upbeat commentary from bank CEOs on consumer resilience.

At the other end, Consumer Staples fell 0.3%, reversing earlier defensive gains as investors rotated toward growth. Health Care dropped 0.2%, with vaccine makers under pressure and politics around drug pricing resurfacing. Industrials managed only +0.7%, masking strength in defence and aerospace but weakness in transport and machinery. In short, growth names and yield-sensitive plays led, while classic defensives lagged.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 12 September 2025.

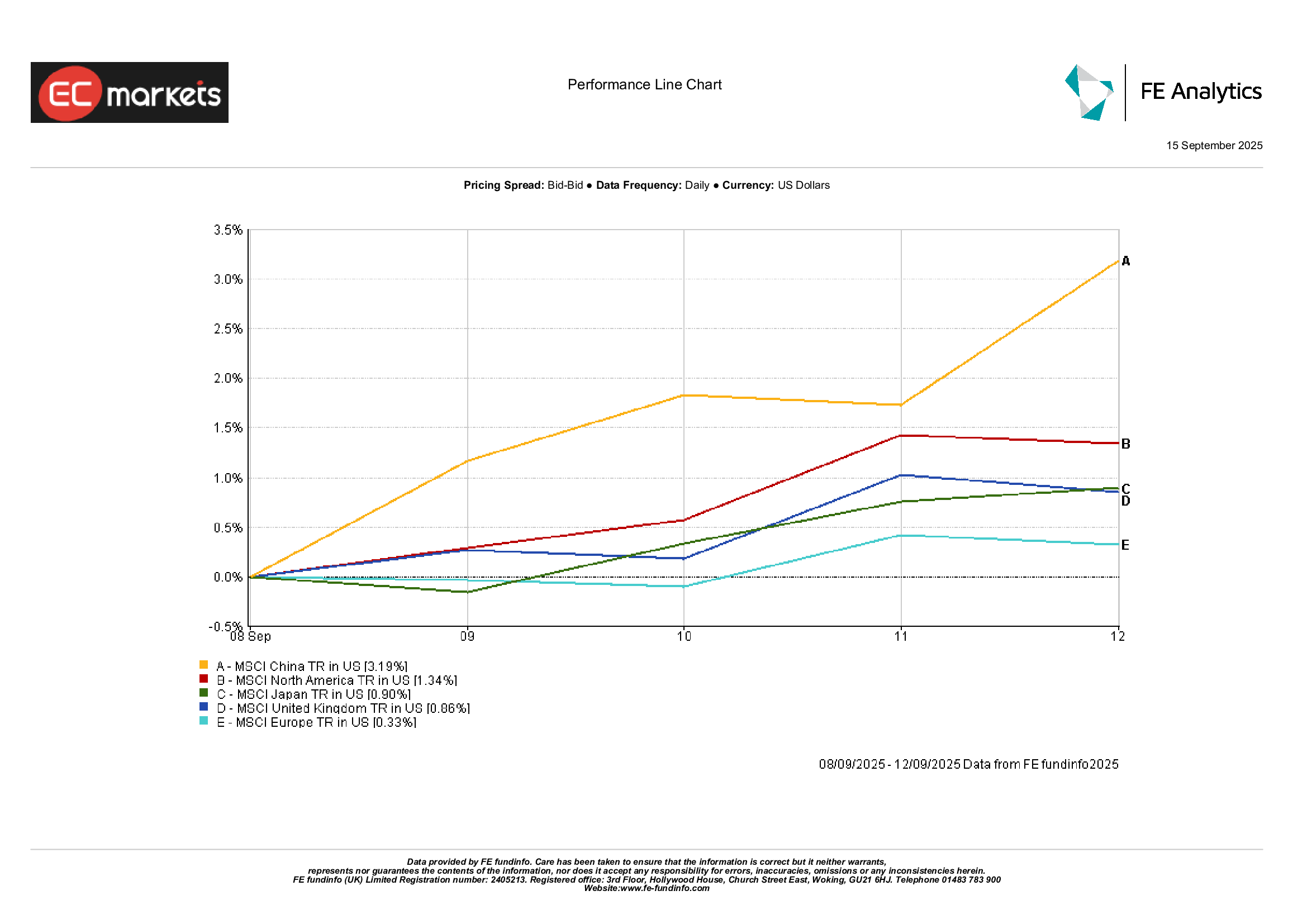

Regional Markets

Regionally, China was the standout, with MSCI China up 3.2% after weeks of declines, helped by policy hopes and a softer dollar. Japan also posted strong gains, with MSCI Japan up 0.9%. North America added 1.3%, riding the US equity rally. Europe trailed, with MSCI Europe up just 0.3%, weighed by political uncertainty and heavier defensive weights. The UK’s MSCI United Kingdom gained 0.9%, lifted by miners and defence names. In short, Asia and North America led, while Europe lagged.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 12 September 2025.

Currency Markets

The dollar eased, with the DXY index slipping 0.2% on Fed cut bets. EUR/USD rose slightly to 1.173, buoyed by ECB caution and softer US data. GBP/USD climbed 0.4% to 1.356, supported by firm UK wage data and resilient housing. The yen weakened overall, with USD/JPY up 0.3% to 147.7 after an early dip midweek. GBP/JPY broke through 200, finishing around 200.2, its highest since 2016.

Outlook & The Week Ahead

The coming week brings potential inflection points. The Fed’s Sep 16-17 meeting is the headline, with a 25 bps cut widely expected. Powell’s tone will be just as important as the move itself: too cautious and markets may wobble, too dovish and the dollar could weaken further. US retail sales and industrial production will add colour on momentum heading into Q4.

In Asia, China releases August industrial output, fixed-asset investment, and retail sales – numbers that will test whether recent support measures are working.

In Europe, flash PMIs and UK CPI could move local bonds and currencies.

Energy markets will also digest OPEC+’s October plans and any supply disruptions tied to geopolitics.

With September seasonality back in play, volatility may pick up. For now, sentiment leans cautiously optimistic, but stretched valuations leave little margin for disappointment.