Why Europe’s Equity Rally May Be Just Getting Started

Europe. Not exactly the first name that pops into investors’ minds when they think “market leadership,” is it? For much of the last decade, it’s played the quiet understudy while the US tech scene hogged centre stage. But here in 2025? Something’s shifted. European equities are on a tear, and this time, it might not be a false start.

Europe’s Valuation Edge Over the US

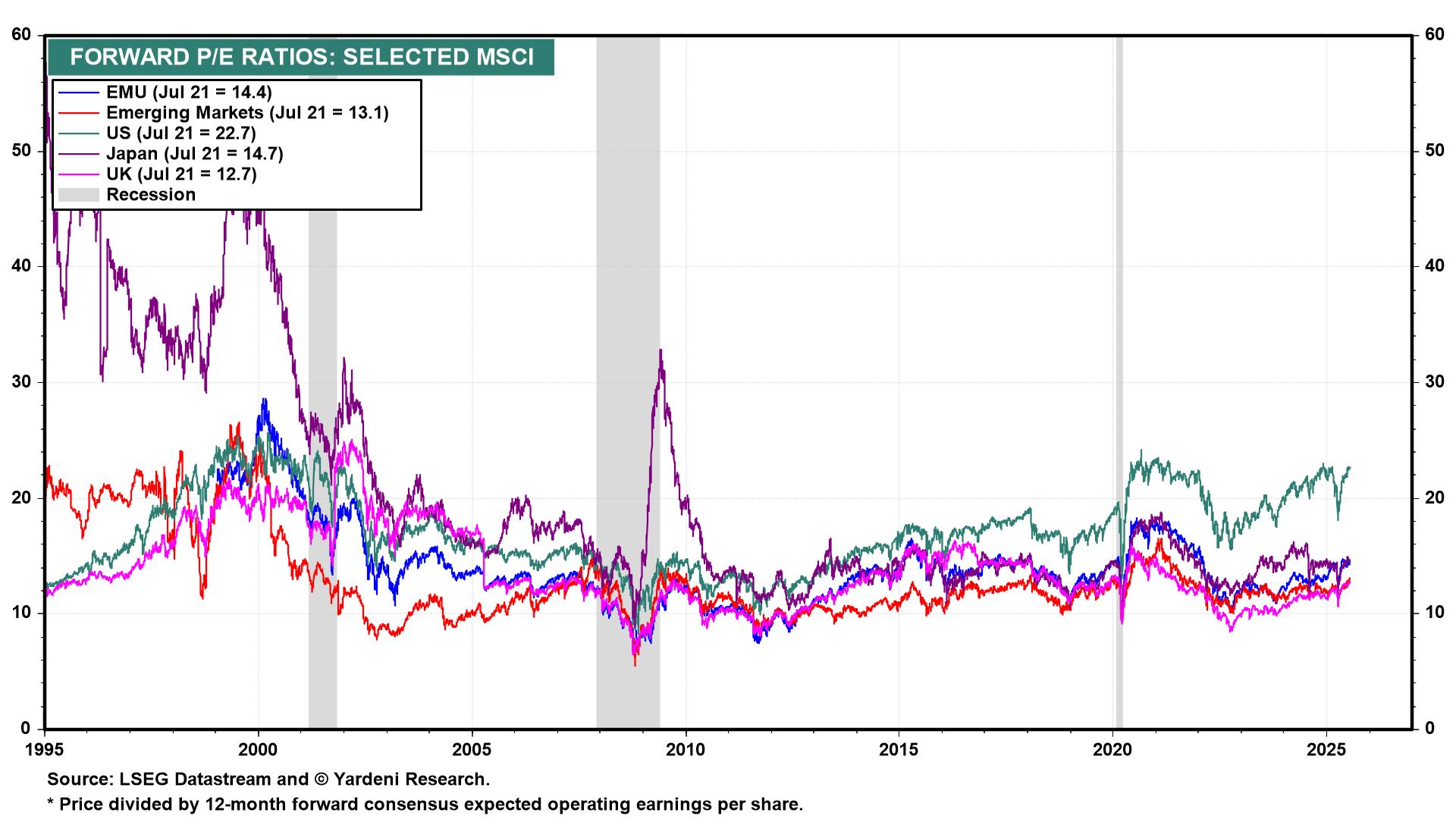

Start with the valuations. European stocks are still trading at a 35-40% discount to US equities on a forward P/E basis. The MSCI Europe index sits around 15× forward earnings, compared to around 22× for the S&P 500. Dividend yields tell a similar story: Europe averages over 3.0%, while the S&P offers around 1.25%. Investors aren’t just paying less, they’re getting paid more to stay patient. It’s not a growth-chaser’s playground, but for income and mean reversion, it’s compelling.

Forward Price-to-Earnings Ratios by Region (Jul 2025)

Source: LSEG Datastream, Yardeni Research. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 22 July 2025.

European equities (EMU: 15×) trade at a 36% discount to US stocks (22×) – a valuation gap near historic extremes.

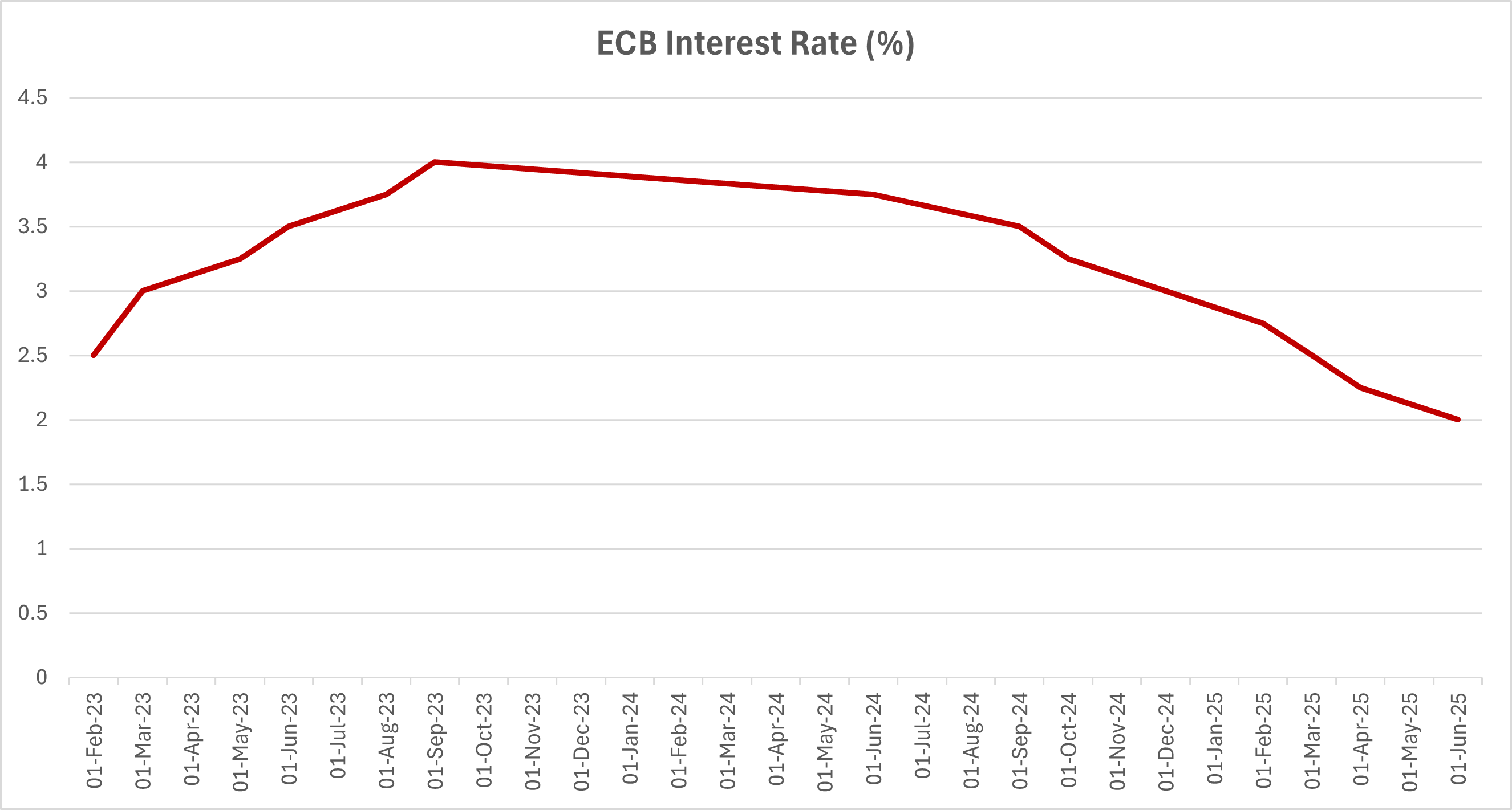

Macro Tailwinds: Inflation Easing and ECB Rate Cuts

Now add macro momentum. Eurozone inflation has cooled to 2.3% as of June, down from over 10% in late 2022, giving the ECB some room to cut. And they’ve already cut four times since mid-2024, trimming the deposit rate from 4% to 2.0%, with markets pricing in another two cuts by year-end. Meanwhile, Germany, long seen as the fiscal hawk of the bloc, is turning dovish. Berlin’s 2025 budget includes €60 billion in stimulus, with a heavy focus on energy, digitalisation, and defence. That’s definitely not a small shift!

ECB Deposit Rate Trend (Feb 2023 – Jun 2025)

Source: European Central Bank. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of June 2025.

After peaking at 4.0% in late 2023, the ECB has delivered a full 200 basis points of cuts, bringing the deposit facility rate down to 2.00% – with more expected in H2 2025.

Economic Activity Shows Signs of Life

The Eurozone’s composite PMI rose to over 50 in June, the first expansionary reading in nearly a year. Germany and Italy, often treated as economic dead weight, posted positive quarterly surprises. The European Commission expects 1.1% growth for the bloc in 2025, modest, sure, but an improvement from the near-zero slog of 2023-24.

And then there’s sentiment. After years of being shunned, Europe is finally attracting fresh capital. Net inflows into European equity ETFs topped $16 billion in Q1 2025, the strongest start to a year since 2006. US fund managers, notoriously allergic to anything outside Silicon Valley, are dipping back in. Morgan Stanley and JPMorgan both issued “overweight Europe” notes this spring. Even Goldman Sachs bumped its MSCI Europe target up by 8%, citing “valuation-driven upside and a favourable policy mix.”

Europe’s Sector Mix Works in Its Favor

The sector tilt helps too. While the S&P 500 is over 30% tech, MSCI Europe is only around 7%, instead overweight banks, energy, industrials, and healthcare. That mix, long seen as a drag, now works in its favour. Financials have been leading the pack in 2025, buoyed by improving margins and robust balance sheets. Utilities and industrials are also gaining, thanks to infrastructure spending and energy policy tailwinds.

Of course, this isn’t risk-free. The war in Ukraine drags on. Europe remains politically fragmented. And if US tech reignites, the flows could reverse just as quickly. Plus, long-term structural issues like an ageing population and underinvestment in innovation haven’t gone away.

Why Europe Might Still Surprise

But here’s the crux: Europe doesn’t need to be perfect. It just needs to be better than what’s been priced in. And right now, it is.

After a decade of playing defence, Europe is finally catching a favourable breeze, lower rates, higher earnings, and improving global attention. For investors looking to diversify away from the crowded US growth trade, this might be the moment to revisit the old continent. It’s not the flashiest trade on the board. But sometimes, that’s exactly where the best stories begin.