The Global Carry Trade: Opportunities and Hidden Risks

In foreign exchange, the carry trade is a simple idea that can add steady returns when markets are calm. You borrow in a currency with a low interest rate and hold a currency with a higher rate, earning the difference while you own the position. When interest rates are predictable and markets aren’t jumping around, that interest “carry” can be a meaningful source of return. In those periods, money often flows from countries with very cheap borrowing to those that pay more, which is why carry can influence day‑to‑day FX moves.

Where the “Cheap Money” Comes from

A funding currency is the currency you borrow. Good funding currencies usually have very low interest rates, low inflation, strong, stable financial systems, and deep, liquid markets. JPY is a classic example; CHF and, at times, EUR plays that role too. Traders like borrowing in these currencies because the cost of money tends to move slowly and the exchange rate is usually less volatile.

There’s a catch. When something spooks markets, like bad economic news, a political shock, or a financial scare, investors rush to reduce risk. That often means buying back the currency they borrowed, which can push the funding currency up quickly. If you’re short that currency, the move can wipe out months of interest in hours. This is why yen “short squeezes” have a reputation for hurting carry trades.

Where the “Income” is Earned

On the other side are higher‑yielding currencies. These are often commodity‑linked or emerging‑market currencies such as the AUD, NZD, MXN, ZAR and, in some cycles TRY. The headline interest rate is your starting point, but smart carry traders look at a few extra things:

- Inflation‑adjusted return (real yield): does the income still have value after inflation?

- What the central bank is likely to do next: will the rate gap hold, narrow, or widen?

If conditions are steady and the rate gap looks durable, you are, in effect, paid to wait, so long as the exchange rate doesn’t move sharply against you.

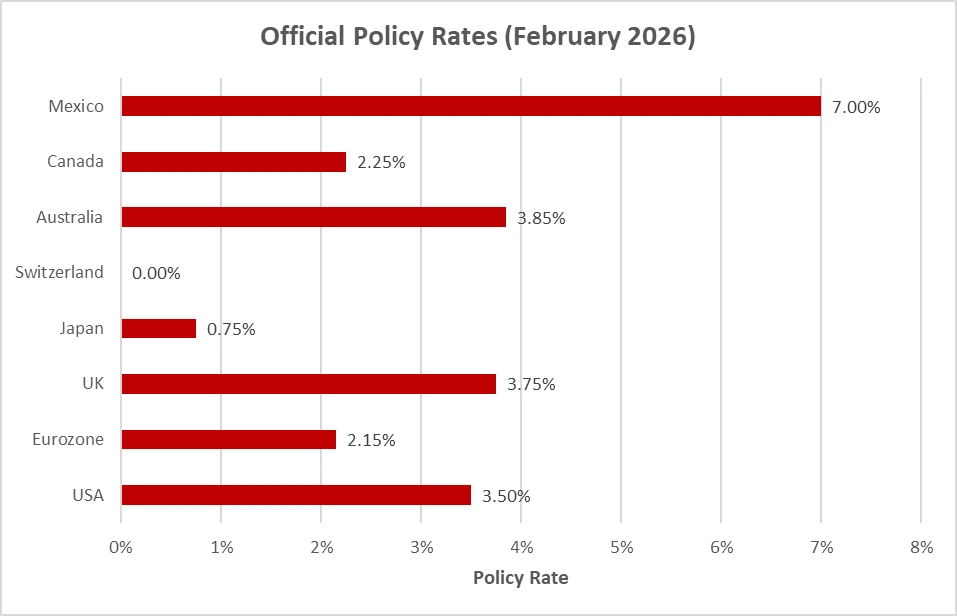

Interest‑Rate Differentials in Key Carry Currencies (2026)

Source: Central bank policy rates compiled from Reserve Bank of Australia, Reserve Bank of New Zealand, Bank of Mexico, South African Reserve Bank, Central Bank of the Republic of Turkey, and Bank of Japan.

What Really Makes or Breaks Carry

Carry works when two ingredients align: the interest you earn from the rate gap and a stable exchange rate while you collect it. The picture flips when markets speed up. A burst of volatility can erase months of carry in days as exchange rates gap, bid‑ask spreads widen, and liquidity thins when you need to adjust

A strong, US‑dollar upswing can overwhelm positive carry, turning income into a scramble to protect capital. The rule is simple: carry loves quiet markets and consistent policy. When conditions aren’t tranquil, moves outrun the yield you hoped to harvest.

Where Opportunities May Lie in 2026

In today’s backdrop, central banks are not moving in lockstep. The Fed is broadly paused and data‑dependent, the ECB is cautious as growth softens, and the BoJ is still very gradual, meaning JPY can remain a funding currency unless domestic inflation forces a change. That mix leaves rate gaps in parts of Latin America and select Asia‑Pacific markets that still look attractive on paper.

The Risks People Underestimate

The main risk is not that the interest stops, it’s that prices can move faster than the interest builds up. A sharp move in the funding currency (the yen is the usual suspect) or a policy surprise (an unexpected cut in the high‑yield currency or a hike in the funding currency) can flip a winner into a loser. In stressed markets, bid‑ask spreads widen and exits get expensive.

Even small exchange‑rate moves matter: a 1-2% adverse move can erase months of carry, especially if the position is leveraged.

Where Carry Fits in a Modern FX Portfolio

The carry trade is intuitive and scalable, but its edge is conditional. It works best when rate spreads are wide and credible, markets are calm, and central banks are not throwing curveballs. It struggles when those supports wobble. In 2026, with policy paths diverging and volatility mostly contained but twitchy, the right approach is selective carry with clear risk controls, not blanket exposure.

Keep an eye on inflation trends, growth momentum, and central‑bank messaging. If those stay supportive, carry can keep adding steady income.