Data Softens; Policy Holds: A Market Leaning Toward Quality | Weekly Recap: 9-13 February 2026

Economic Overview

It was a week that rewarded patience. In the US, January CPI rose 0.2% MoM and 2.4% YoY, a softer print signalling disinflation remains on track. The jobs report, released mid‑week instead of Friday, pointed to cooling without collapse, keeping focus on how far prices can ease before growth slows. Those signals nudged bond yields lower and steadied overall risk sentiment.

In the UK, the BoE left Bank Rate at 3.75% in a close 5-4 vote, reminding that policy is edging toward cuts if disinflation persists into spring. Across the euro area, the ECB also held steady and repeated its data‑dependent, meeting‑by‑meeting approach, leaving the deposit rate at 2.00% and avoiding pre‑commitments.

In short, a cooler CPI and patient central banks framed the week and shaped what followed across assets. Lower yields favoured defensives and other rate‑sensitive exposures; currencies stayed largely range‑bound under the wait‑for‑the‑data stance; and commodities traded the balance between softer inflation and evolving supply headlines. The net effect: a market moving selectively rather than directionally, rewarding quality, visibility and sensible positioning over bold macro calls.

Equities, Bonds & Commodities

Equities drifted rather than charged, with US indices fading into the close as investors weighed softer inflation against lingering questions about earnings durability.

Rates did what they usually do when inflation cools: the 10‑year Treasury yield eased toward ~4.04% by Friday, consistent with the CPI surprise and a modest pickup in rate‑cut pricing later this year. The curve also bull‑steepened modestly as two‑year yields fell more than the 10‑year, reflecting a gentle shift in expectations toward mid‑year Fed easing even as policymakers keep optionality; that helped cushion duration‑sensitive equity cohorts.

Commodities told a two‑part story. Oil was steady to softer, Brent around $67–68 and WTI near $63, as traders weighed an OPEC+ output‑increase narrative against easing inflation and ample supply signals; both benchmarks were on track for small weekly declines. On the supply side, EIA spot data through mid‑week showed benchmark prices slipping after early gains, consistent with ample inventories, while Friday’s closes left Brent down roughly 0.6% and WTI off about 1.2% for the week. Gold, by contrast, firmed toward the $5,000 handle as yields dipped and dollar strength faded.

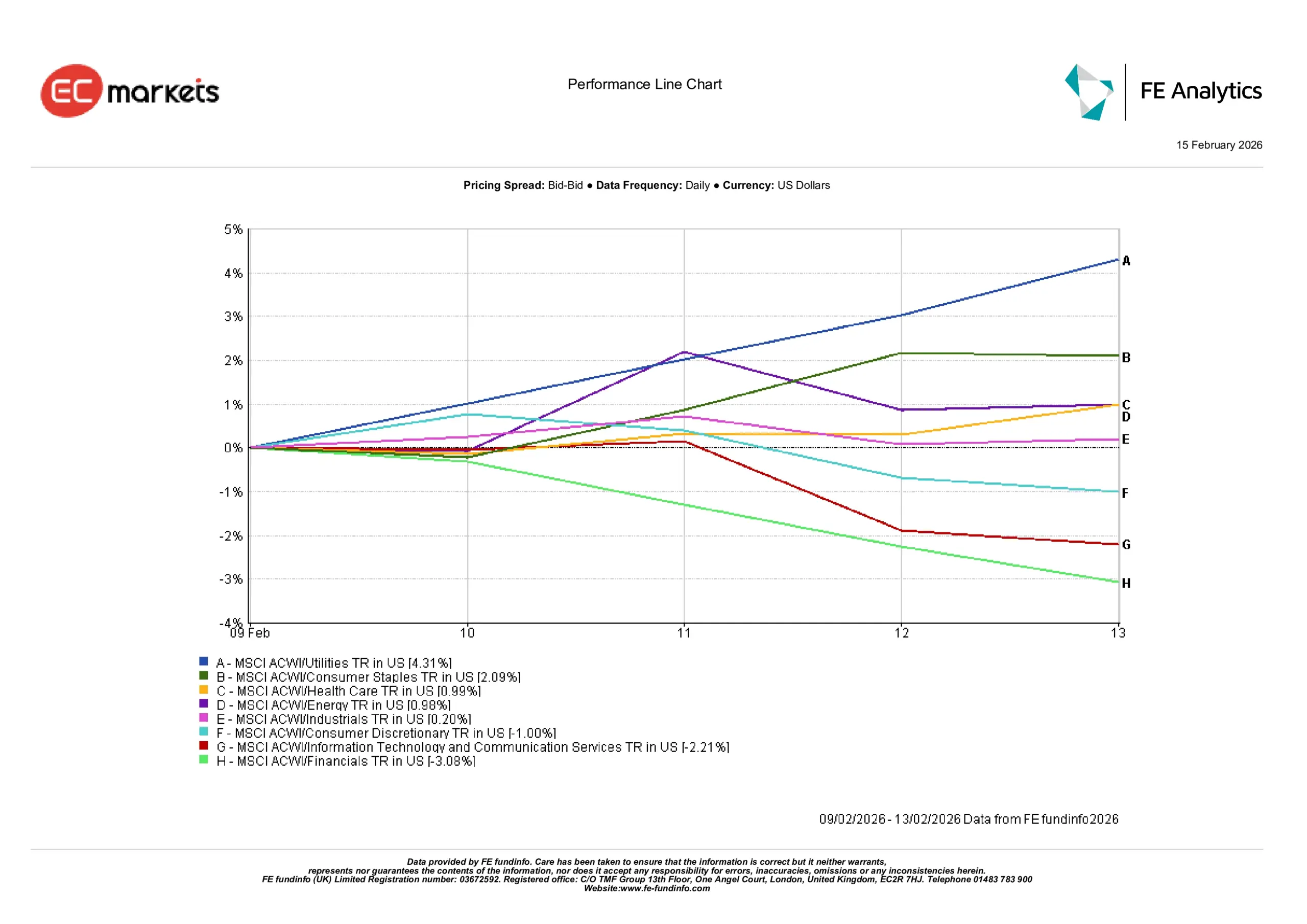

Sector Performance

Cause and effect were clear: the drop in yields and the calmer policy tone channelled flows toward resilience and away from cyclicality.

Utilities (+4.31%) were the clear standouts this week, helped by falling yields and the simple appeal of steady, reliable earnings. Consumer Staples (+2.09%) and Health Care (+0.99%) also enjoyed that calmer backdrop, as investors leaned toward sectors that tend to hold up when the macro picture feels a bit uncertain.

On the other side, Financials (‑3.08%) struggled as lower yields chipped away at profit expectations, while Information Technology & Communication Services (‑2.21%) cooled after a strong run, with investors pausing to reassess valuations post‑CPI. Energy (+0.98%) and Industrials (+0.20%) sat somewhere in the middle, caught between softer oil prices and a still‑selective growth outlook. Consumer Discretionary (‑1.00%) lagged too, reflecting the more uneven tone in household‑spending signals.

Taken together, the week rewarded steadiness: sectors tied to stability and cashflow held firm, while more growth‑sensitive areas felt the pressure of shifting expectations.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 13 February 2026.

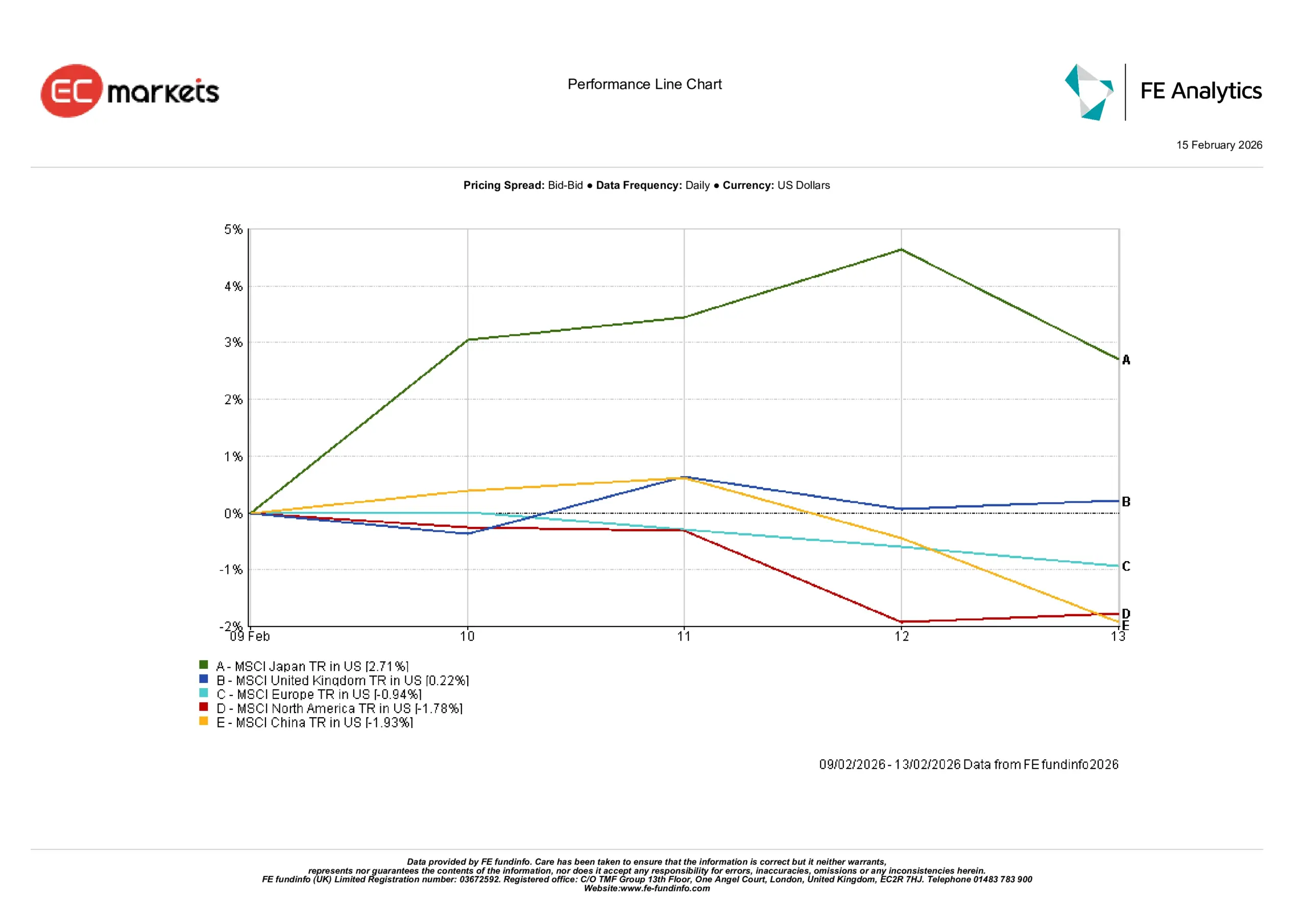

Regional Markets

Regional markets told a similar story of selectivity.

Japan (+2.71%) led the pack as investors looked for opportunities beyond the crowded US mega‑cap space, with a still‑soft yen giving exporters an extra lift. The UK (+0.22%) inched higher too, helped by the BoE’s measured tone and the FTSE’s tilt toward global earners. Europe (+0.04%) was broadly flat after steady messaging from the ECB, while North America (‑1.78%) reflected the softer US equity tone. China (‑1.93%) remained a drag, reinforcing the idea that investors are favouring selective exposure across emerging markets rather than broad‑based risk-taking.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 13 February 2026.

Currency Markets

FX echoed the macro script. EUR/USD hovered near 1.187 into Friday after the ECB’s hold and data‑dependent guidance; the pair’s stability matched a week with more confirmation than surprise. GBP/USD consolidated around 1.365 following the BoE’s close vote, with sterling waiting on the next inflation and wages prints.

Rate differentials did the talking in yen pairs: USD/JPY eased toward ~152.7 alongside lower US yields, and GBP/JPY settled near ~208.4, still elevated by historical standards but off recent peaks. The cross‑currents connect directly to the Treasury move and to the BoE’s patient stance.

Outlook & The Week Ahead

The coming week is likely to be shaped less by headline surprises and more by how markets interpret the quality of the data now that inflation has shown signs of cooling. With the US economy still absorbing a softer CPI print and a steadier labour signal, the focus shifts to whether this early‑year disinflation can broaden out without undermining activity. That balance, cooling but not cracking, will largely dictate how much room policymakers feel they truly have to lean toward easing as we move closer to spring.

For the UK and euro area, the upcoming inflation and wage figures take on added importance after both the BoE and ECB delivered cautious holds. Investors will be looking for evidence that services inflation is easing in a way that justifies the more dovish tilt implied in recent communication. If the data cooperate, markets may begin to price a clearer path toward rate cuts, even if central banks continue to insist decisions remain strictly data‑driven.

Across markets, the tone is likely to stay selective rather than directional. Softer yields have already given rate‑sensitive pockets some breathing room, but earnings resilience and balance‑sheet strength will continue to guide allocations more than macro narratives alone. In commodities, the push‑and‑pull between stabilising inflation and shifting supply expectations should keep volatility elevated but contained, offering opportunity rather than outright trend.