Gold Extends Rally to Record Highs Near $5,100 on Safe-Haven Flows

Gold has pushed to fresh intraday and closing highs near $5,100 an ounce, extending a rally that has gathered serious momentum in recent weeks. Spot prices briefly touched $5,110.50, showing that buyers are still willing to step in despite prices sitting at record levels, as uncertainty across markets keeps demand for gold firm.

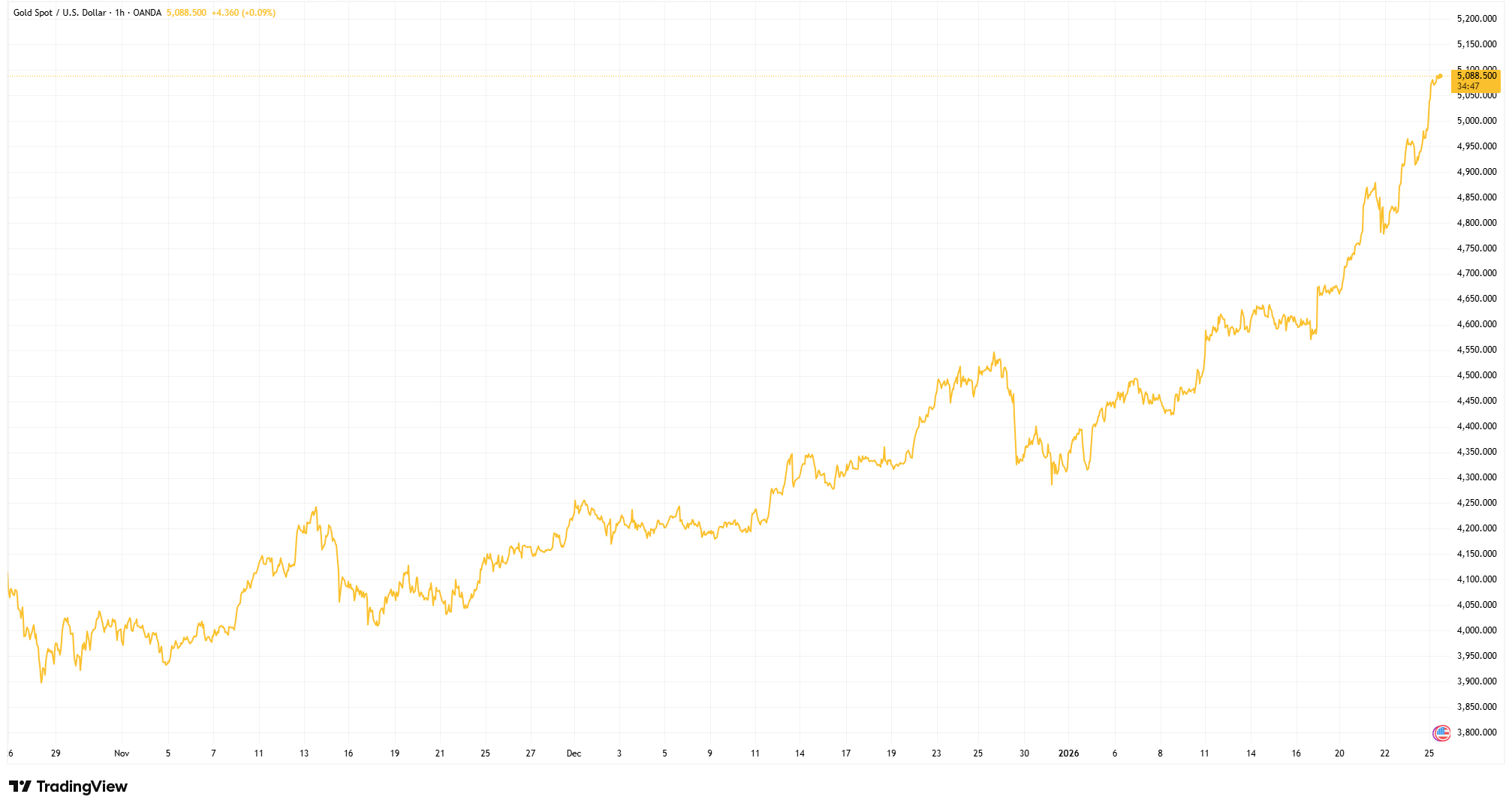

Spot Gold Hits Fresh Highs Above $5,000

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 26 January 2026.

Gold prices have surged sharply in recent weeks, breaking above $5,000 as investors seek safety amid macro uncertainty, geopolitical tensions and a softer US dollar.

The move takes gold well beyond the earlier $4,600 breakout highlighted in previous EC Markets coverage. At the time, bullion found support as Venezuela’s struggles kept safety in focus, before climbing further as investors looked for protection. Since then, the rally has only strengthened, pushing gold into territory the market has never seen before.

Much of the strength comes down to the broader interest rate outlook. Markets are increasingly comfortable with the idea that global rates have peaked, with expectations building that cuts could follow later in the year. That has kept real yields under pressure, making gold more attractive as the return on holding government bonds remains limited after inflation.

Geopolitics are also playing a role. Tensions across several regions have kept investors cautious, and gold continues to benefit as a go‑to asset when confidence wobbles. Traders say the recent price action feels driven by genuine risk concerns rather than short‑term speculation.

Central banks have added another layer of support. Sovereign buyers have continued to add gold to their reserves, even at elevated prices. In many emerging markets, gold remains a key tool for diversifying reserves away from traditional currencies, providing steady demand in the background.

Volatility in equity markets has helped as well. Uneven performance across major stock indices has pushed some investors to reduce risk, while the US dollar has struggled to find direction. A softer dollar has made gold more appealing for non‑US buyers, adding to the upside pressure.

Elsewhere, markets are reflecting the same cautious mood. Gold futures have followed spot prices higher and are holding near record levels. Government bond yields have edged lower as demand for safety increases. Other precious metals such as silver and platinum have also moved higher, though their gains have been more measured, with gold clearly leading the pack.

The latest surge fits neatly with the themes EC Markets has been tracking. What started as a defensive move during periods of regional stress and economic uncertainty has grown into a broader rally, with some investors now viewing gold as a longer‑term hedge rather than a short‑term trade.

That said, the pace of the move means the market is vulnerable to pauses or pullbacks. Sharp rallies often attract profit‑taking, and upcoming inflation data or central bank signals could trigger short‑term swings.

Even so, the bigger picture hasn’t changed much. With real yields still low, geopolitical risks unresolved and central bank demand steady, dips may continue to find buyers. For now, attention now turns to whether gold can hold above the $5,000 mark as the week unfolds.