Stable Data, Selective Rotation Across Global | Weekly Recap: 19-23 January 2026

Economic Overview

Investor sentiment was shaped by steady (not accelerating) macro signals and a market that is increasingly priced for policy inertia. In the US, inflation remained contained (Dec CPI ~+2.7% YoY; core ~+2.6% YoY), reinforcing expectations that the Fed is unlikely to change rates at its January meeting. With growth data only producing modest surprises (rather than persistent upside/downside momentum), markets continued to treat the near‑term outlook as “stable but not strong,” which kept risk appetite contained and encouraged selective positioning rather than broad risk‑on exposure.

In the UK, inflation ticked higher (headline CPI ~3.4% YoY) and came in slightly above forecasts, but the tone of market reaction suggested investors largely saw the move as transitory rather than a re‑acceleration. That kept expectations for eventual easing later in the year largely intact and prevented UK rates from repricing materially.

In Japan, the policy stance remained steady, but the FX channel stayed highly sensitive to intervention risk and policy signalling. Even without a major policy shift, currency markets continued to react to perceived shifts in BoJ tolerance for yen weakness—helping explain why yen‑linked crosses saw large intraperiod swings, even when weekly closes were more subdued.

Overall, the macro narrative this week was “no new inflation shock + no urgent growth scare”, which tends to produce range‑bound rates, mixed equities, and rotation within sectors/regions rather than a directional global move.

Equities, Bonds & Commodities

Equity markets were broadly unchanged, with index‑level performance masking periods of intra week volatility. In the US, the S&P 500 rose +0.06%, the Nasdaq gained +0.10%, and the Russell 2000 added +0.04%, reflecting a modest balance between risk appetite and caution. Globally, moves were similarly contained: the MSCI World proxy (‑0.01%) was essentially flat, while regional markets edged slightly lower (Europe -0.06%, UK –0.04%, Japan -0.05%, EM -0.06%). China finished the period unchanged (0.00%).

Despite the muted weekly closes, markets experienced meaningful intra week swings, driven largely by geopolitical headlines rather than changes in underlying economic fundamentals. As these concerns faded, equities recovered, reinforcing the view that investors remain willing to maintain exposure but are increasingly selective.

Bond markets remained a stabilising influence. With US Treasury yields broadly unchanged across the curve, investors took comfort from the view that monetary policy is firmly in a holding pattern, limiting pressure on equity valuations.

Commodities provided clearer signals. Energy and precious metals continued to attract flows, supported by geopolitical uncertainty and hedging demand, even as broader risk assets remained range‑bound.

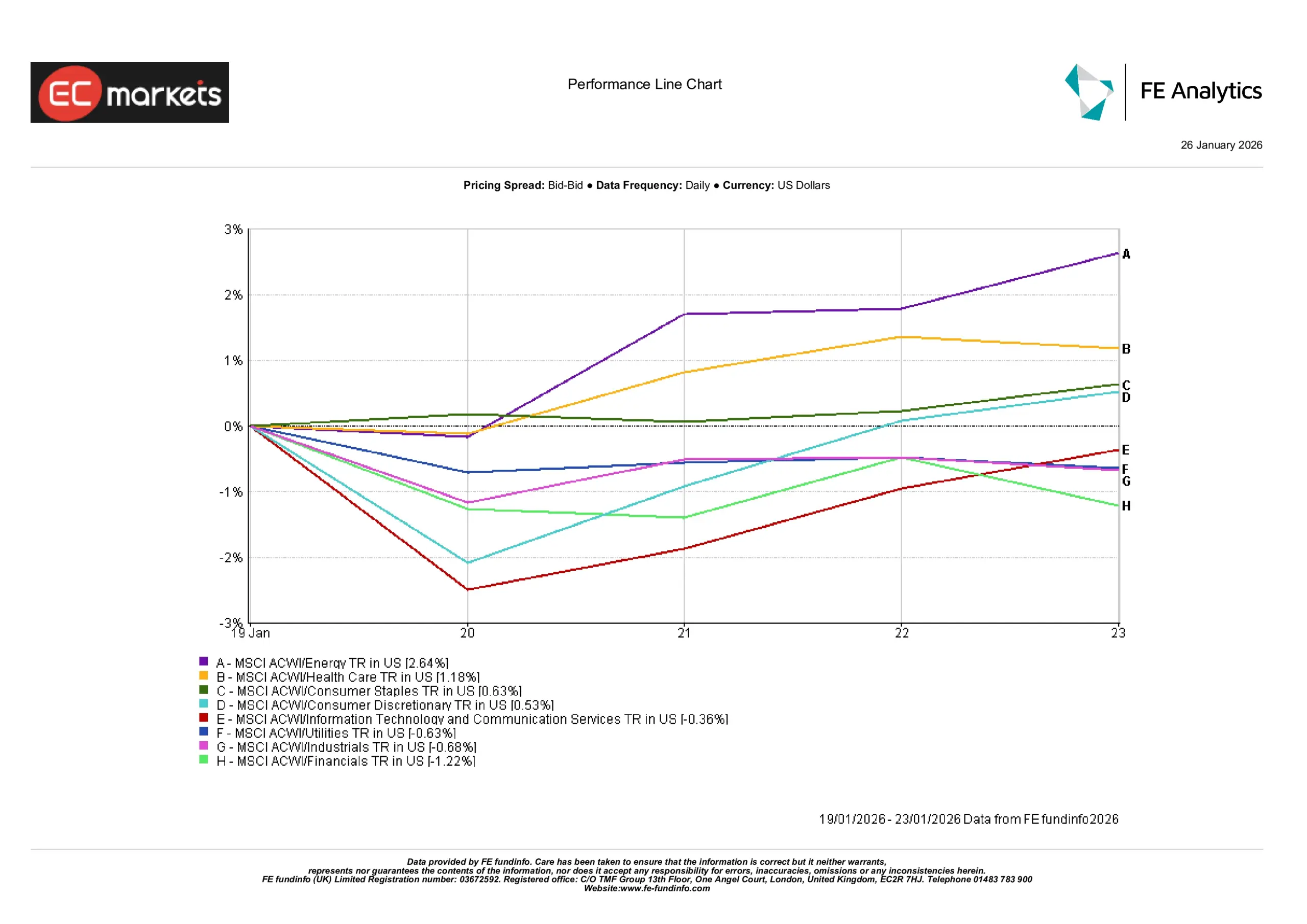

Sector Performance

Sector returns largely reflected the combination of stable yields and stronger commodity prices. Energy stocks led the market, gaining roughly +2.6%, directly mirroring the rise in oil prices and improving cash‑flow expectations. Defensive sectors also outperformed: healthcare rose about +1.2% and consumer staples around +0.6%, as investors favoured earnings resilience in a low‑momentum macro environment.

More growth‑oriented sectors delivered smaller gains. Consumer discretionary advanced roughly +0.5%, while technology and communication services rose about +0.4%, benefiting modestly from the stabilisation in bond yields later in the week. However, upside remained limited, reflecting ongoing valuation sensitivity.

By contrast, interest‑rate‑sensitive and cyclical sectors lagged. Utilities fell around –0.6%, industrials declined about –0.7%, and financials underperformed at roughly –1.2%. Financials in particular were weighed down by the lack of yield‑curve steepening, which continues to cap net interest margin expectations. Overall, sector performance pointed to selective defensiveness rather than a broad rotation into risk.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 23 January 2026.

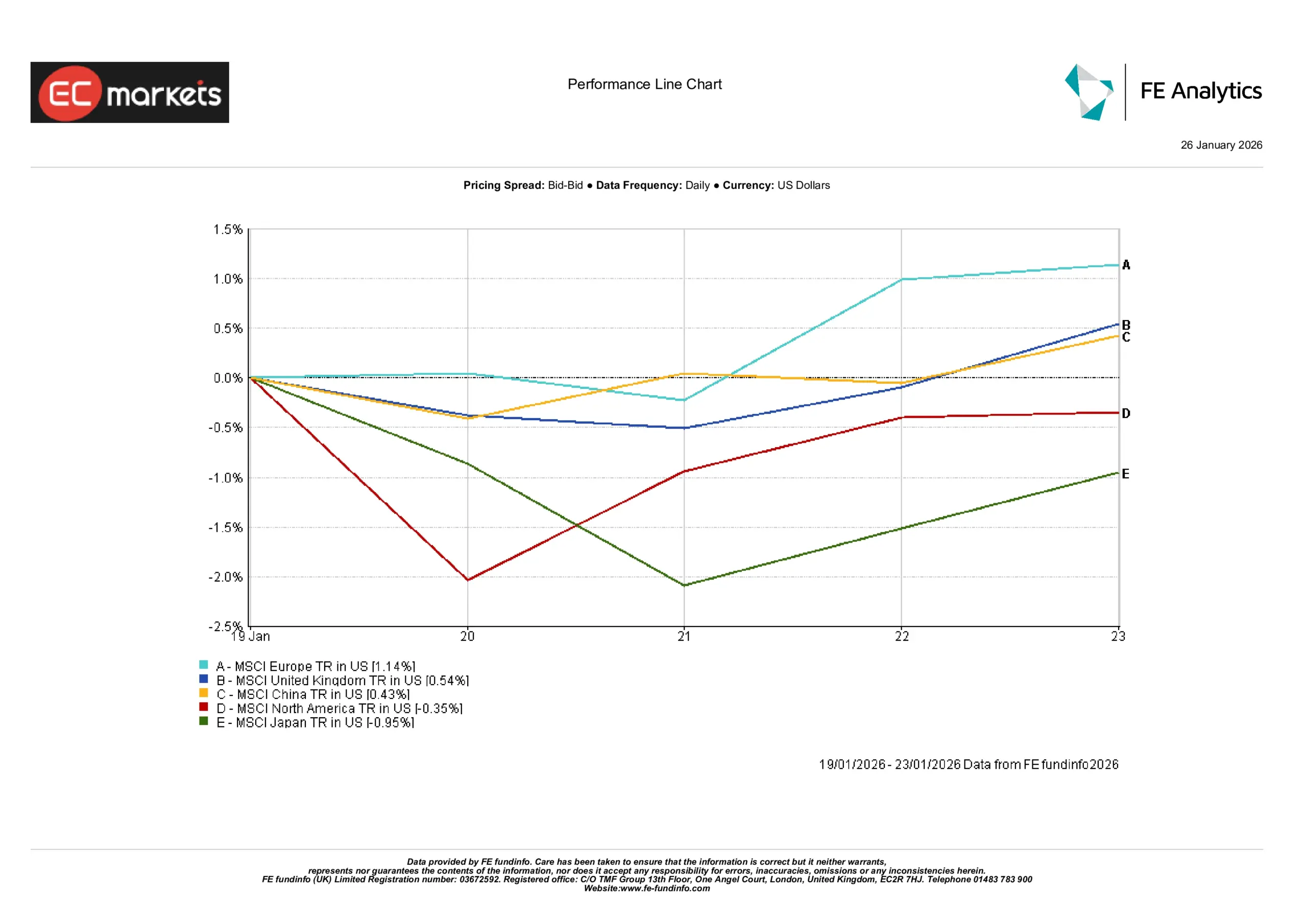

Regional Markets

Regional equity performance was mixed. European markets excluding the UK led, rising roughly +1.1% in USD terms, supported by improved sentiment around trade relations and strength in sectors aligned with the week’s themes. The UK market also finished higher, up around +0.5%, as sterling weakness and the index’s defensive, multinational composition provided support.

In Asia, China’s Shanghai market edged up around +0.4%, reflecting continued optimism around incremental policy support. In contrast, Japanese equities fell roughly –1.0%, as yen volatility and sensitivity to Bank of Japan messaging weighed on exporter sentiment.

North American equities lagged overall, with regional indices down about –0.3%, consistent with the softer performance of US benchmarks. Emerging markets finished modestly higher, with the MSCI EM index up around +0.4% on Friday (roughly +1% on the week), supported by firmer commodity prices and stabilising currencies across parts of Asia.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 23 January 2026.

Currency Markets

Currency moves were contained but directionally mixed. EUR/USD declined around –0.7% over the period, trading between approximately 1.18 and 1.16, as the dollar remained relatively firm on stable US rate expectations. GBP/USD rose modestly by about +0.4%, oscillating within the 1.33–1.36 range, supported by UK data that was not as weak as feared.

Against the yen, moves were more pronounced. USD/JPY rose about +1.4%, trading from roughly 155.9 to above 158, as yield differentials continued to favour the dollar despite intermittent intervention speculation. GBP/JPY advanced around +1.8%, moving within a ~207-212 range, as sterling strength outweighed episodic yen support. Overall, FX markets reflected prevailing yield differentials rather than a decisive shift in global risk sentiment.

Outlook & The Week Ahead

Looking ahead, attention will turn to upcoming central bank meetings and key data releases. The Fed’s January FOMC meeting is widely expected to result in no change to policy, while markets will closely watch guidance for any shift in tone. In the US, Q4 GDP and durable goods data will provide further insight into growth momentum, alongside the start of the Q4 earnings season led by major banks and large‑cap technology names. In Europe, Q4 GDP releases will help gauge the region’s recovery, while developments in Japan and Asia‑Pacific – including inflation data and PMI releases – may influence regional sentiment. Overall, with policy expectations well‑anchored, markets are likely to remain cautious and data‑driven absent meaningful surprises.