Gold Climbs Above $4,600 as Investors Seek Safety

Gold prices surged to fresh record highs on Monday, January 12, 2026, with spot gold climbing above $4,600 per ounce during early Asian and European trading. The move capped a strong start to the week for precious metals and reflected a clear shift in investor mood, as uncertainty around the global economy and rising geopolitical tensions pushed more money into traditionally safer assets.

Gold Climbs to Record Highs as Investors Seek Safety

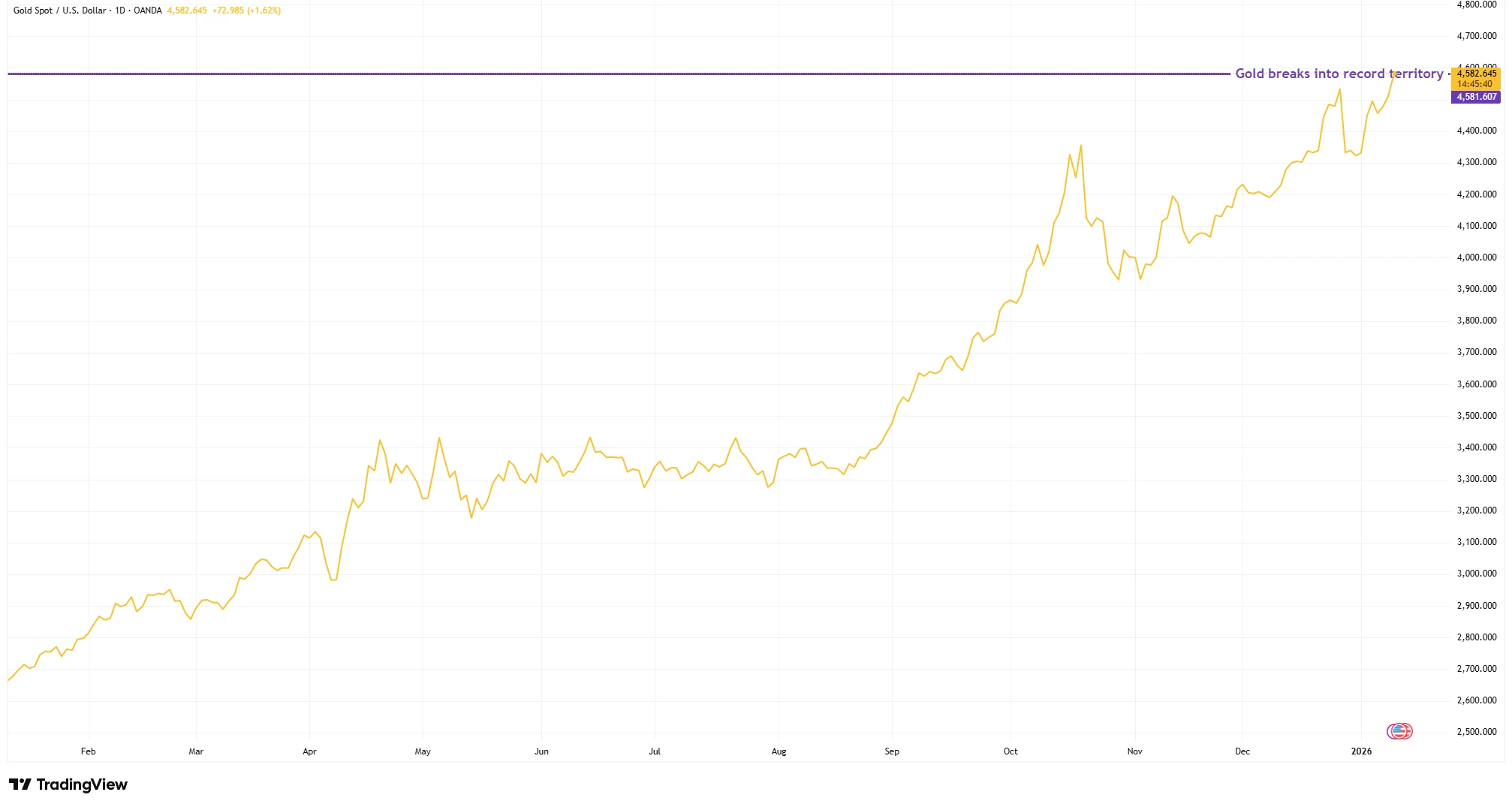

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 12 January 2026.

Gold prices surge to record highs as investors move towards safer assets amid economic and geopolitical uncertainty.

One of the key triggers for the rally was weaker-than-expected US jobs data released late last week. The report showed that job growth in December slowed more than markets had anticipated, raising concerns about the strength of the world’s largest economy. For investors, this has strengthened the view that the US Federal Reserve may need to start cutting interest rates sooner than previously expected in order to support growth.

Why does this matter for gold? When interest rates are high, investors tend to favour assets that pay interest or dividends. But when rates are expected to fall, gold becomes more attractive because the opportunity cost of holding it declines. Rate cut expectations also tend to weigh on the US dollar, which further supports gold prices, as a weaker dollar makes gold cheaper for buyers using other currencies.

Geopolitical uncertainty has added another layer of support. Tensions in the Middle East, particularly around Iran, have kept markets on edge, while broader global conflicts and political uncertainty continue to cloud the outlook. In periods like this, investors often look for assets that are seen as stores of value, and gold has historically played that role. The combination of economic worries and geopolitical risk has helped fuel demand for the metal at a time when confidence remains fragile.

The rally in gold has also been mirrored across other precious metals, with silver reaching new highs and platinum and palladium also advancing. This broader strength suggests the move is not just about gold itself, but part of a wider shift towards more defensive positioning across markets.

In the background, the US dollar has softened slightly, reinforcing gold’s upward move. Currency movements may seem technical, but the effect is simple: when the dollar weakens, gold becomes more affordable for international buyers, helping to sustain demand even at higher price levels.

Looking ahead, investors will be watching upcoming US inflation data and comments from the Federal Reserve for clues on how soon interest rates could start to fall. If economic data continues to soften or geopolitical risks escalate further, gold may remain well supported. For now, the latest surge reflects a market increasingly focused on caution, stability, and protection in an uncertain global environment.