Risk Reward Ratio & Position Sizing

Do you ever feel like trading is 50/50, kind of like a coin toss? Well contrary to some beliefs, it’s not - that’s where the risk reward ratio and position sizing comes into play.

In this course, we are going to cover important topics about risk reward ratio and position sizing, including:

- Why risk reward ratio is so important.

- How to calculate risk reward ratio the right way.

- What position sizing really means and how it can protect your account from losses.

- How to calculate position sizing for any trade.

There’s a lot to cover, so let’s get right into it! Starting from the top, what is the ratio risk reward?

- What is the Ratio Risk Reward?

- Why is Risk Reward more important than Win Rate?

- How to calculate the Risk Reward Ratio

- What is Position Sizing?

- How to calculate Position Sizing

- Why Position Sizing is crucial to the success of your trades

- The Risk Reward Ratio & Position Sizing: Formulas you need to know

- Some Common Mistakes to avoid with the Risk Reward Ratio & Position Sizing

- The Risk Reward Ratio & Position Sizing Conclusion: Trade with Precision, not with Emotion

What is the Ratio Risk Reward?

Before we jump into the maths, let’s first define the concept, the ratio risk reward tells you how much you’re risking on a trade versus how much you could potentially be gaining, let’s look at an example:

- Assuming you risk $100 to potentially make $300

- The ratio risk reward is 1:3

But how does it work exactly? Let's break it all down.

The formula is quite simple:

Risk Reward Ratio = Target - Entry / Entry - Stop Loss

It can help answer the question of ‘is this trade even worth it?’ Or should I be putting my energy on another trade?

Why is Risk Reward more important than Win Rate?

You might be thinking that you need to win most of your trades to make money, but the truth is that even with a 40% win rate, you can be profitable, of course however, only if your ratio risk reward is favourable. It’s crucial to master how to calculate risk reward ratio step by step. Without this foundation, it’s impossible to know whether your system is truly profitable over time. Understanding how to calculate risk reward ratio can help you filter out low-quality trades and concentrate only on setups with high potential returns.Let’s look at an example:

How to calculate the Risk Reward Ratio

Let’s assume: You win 4 out of 10 trades, you ‘risk: $100’ and your reward is $300 (3:1). What’s the result?

- Your wins= 4 x $300 = $1,200

- Your losses= 6 x $100 = $600

- And you net profit= $600

Now it's time for the math, but don’t worry, learning how to calculate risk reward ratio is easier than you think!

Step 1: Define your Trade Setup

Entry: $100

Stop Loss: $90

Target: $130

Step 2: Plug into the Formula

Risk= $100 - $90 = $10

Reward= $130 - $100 = $30

Ratio= $30 / $10 = 3:1

This ratio of 3:1 indicates that you'd be risking $1 to make $3. Now that we've calculated risk reward ratio, what’s the key takeaway? Follow this rule: don’t take trades unless the potential reward justifies the risk! If you can stick to this rule, you can protect your trades and start making consistent profits. That’s the power of understanding how to calculate risk reward ratio and how to use it properly. If you use it the right way, you can start seeing consistent and calculated gains.

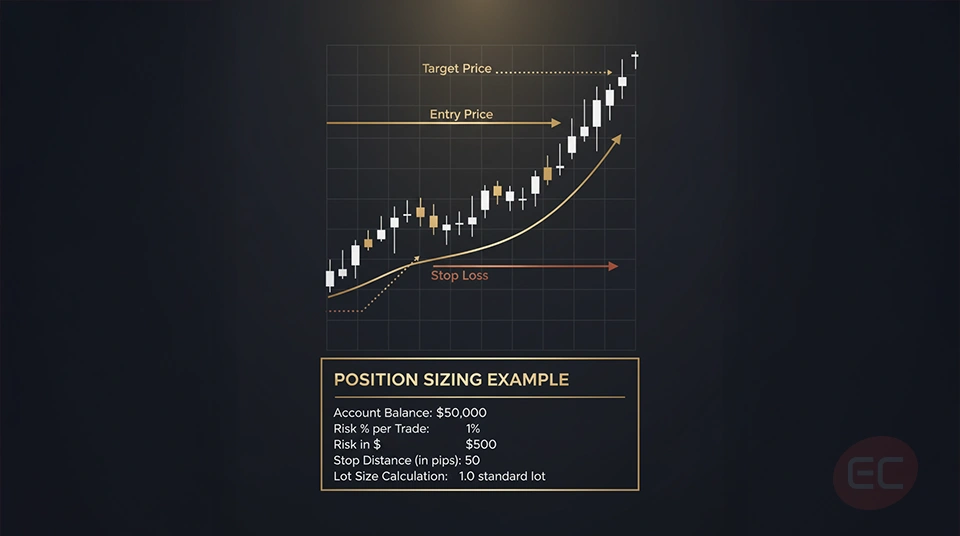

What is Position Sizing?

Now that we’ve covered the risk reward ratio, let’s shift gears a little bit. Position sizing answers the question of ‘how much of your capital should you risk on this trade?’ Is it too big? Well you might blow your account. Is it too small? Your wins might end up not moving the needle. Smart traders use position sizing to control risk per trade, the typical rule is risking 1–2% of their total account, not too much, not too little.

How to calculate Position Sizing

Here’s a simple 3-step formula to help you calculate your position sizing:

Step 1: decide on your risk per trade, let’s say you have a $10,000 account and want to risk 2%, your maximum risk= $200

Step 2: define and understand your stop loss distance, suppose your entry is $100 and your stop loss is $95, your risk per unit= $5

Step 3: use the formula:

Position size= Max risk / risk per unit

Position size= $200 / $5= 40 units

So in this case, you’d buy 40 shares to stay within your risk limit, that’s how to calculate position sizing, and it's one of the most important skills in trading, so make sure you write it down and memorize it.

Why Position Sizing is crucial to the success of your trades

Trading should not be looked at like hitting home runs, instead, it’s about surviving the losing streaks. Here’s what proper position sizing does and why it's so important:

- Protects your account during losses.

- Avoids emotional overreaction.

- Keeps your risk consistent.

Understanding how to calculate position sizing gives you a structured way to translate your risk tolerance into actionable trade quantities. When you know how to calculate position sizing, you’re essentially removing one of the biggest dangers in trading: overexposure. If you can remember this, you can protect your account from going into loss.

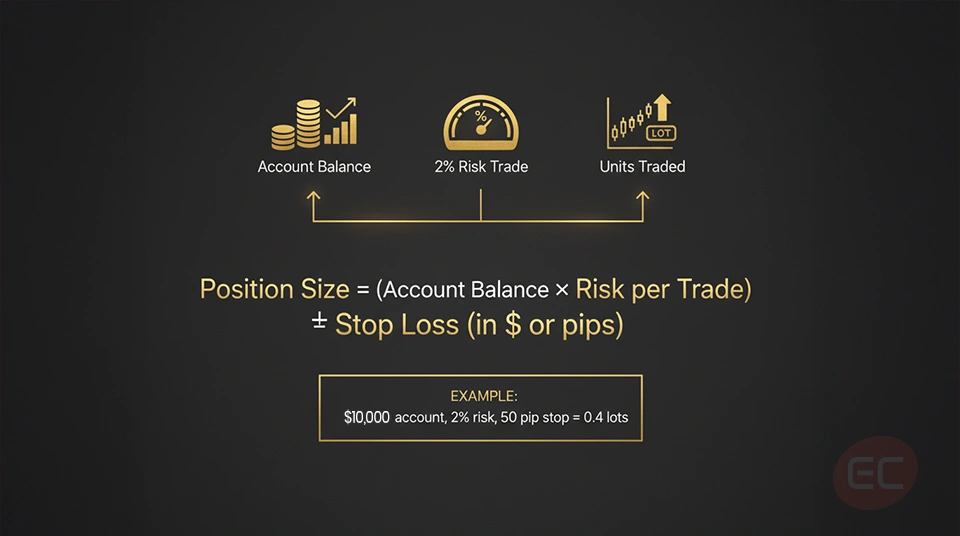

The Risk Reward Ratio & Position Sizing: Formulas you need to know

1) Ratio Risk Reward: Target Price - Entry price ÷ Entry Price - Stop Loss

2) Position Sizing: Account Risk $ ÷ Risk per Share

Here’s an example:

- Risking $200

- Stop loss is $5 away

- Position size = 40 shares

If you master these two formulas, it is more important than any indicator on your chart.

Some Common Mistakes to avoid with the Risk Reward Ratio & Position Sizing

New traders often get this wrong, so let’s make sure you don’t make the same mistakes!

1) Do not guess your position size: you should always calculate based on risk.

2) Do not ignore the risk reward ratio: a trade with 1:1 reward is rarely worth it.

3) Do not risk the same lot size on every trade: every setup is different, your position sizing should be adjusted accordingly.

4) Do not move your stop loss: make sure you don’t sabotage your risk reward ratio by letting losses grow.

By avoiding these, you'll start trading like a professional and not like a gambler.

The Risk Reward Ratio & Position Sizing Conclusion: Trade with Precision, not with Emotion

By now, you should have a good understanding of:

- How to calculate risk reward ratio

- Why the ratio risk reward matters more than being right

- What is position sizing and how to use it

- How to calculate position sizing based on your account and risk

So when you’re combining smart risk reward ratios with disciplined position sizing, you don’t need to win every single trade, instead, you just need to be consistent. Write this rule down and stick to it: risk small, win big, stay in the game! That’s the winning formula. If you can stick to this rule, you can eventually start seeing consistent profits.

To learn more high level risk management techniques, check out our article on Advanced Risk Management. Keep reading the EC Markets Academy as we explore more trading knowledge that will amplify your trading knowledge and get you from a beginner to a confident trader. See you at the next course!