What Moves Currency Pairs? An Introduction for New Traders

If you’ve ever travelled abroad, you’ve seen exchange rates at work. One year your pound buys you two cappuccinos in Rome, the next year barely one and a half. For traders, those shifts aren’t just holiday quirks – they’re opportunities. The big question is simple: what moves currency pairs?

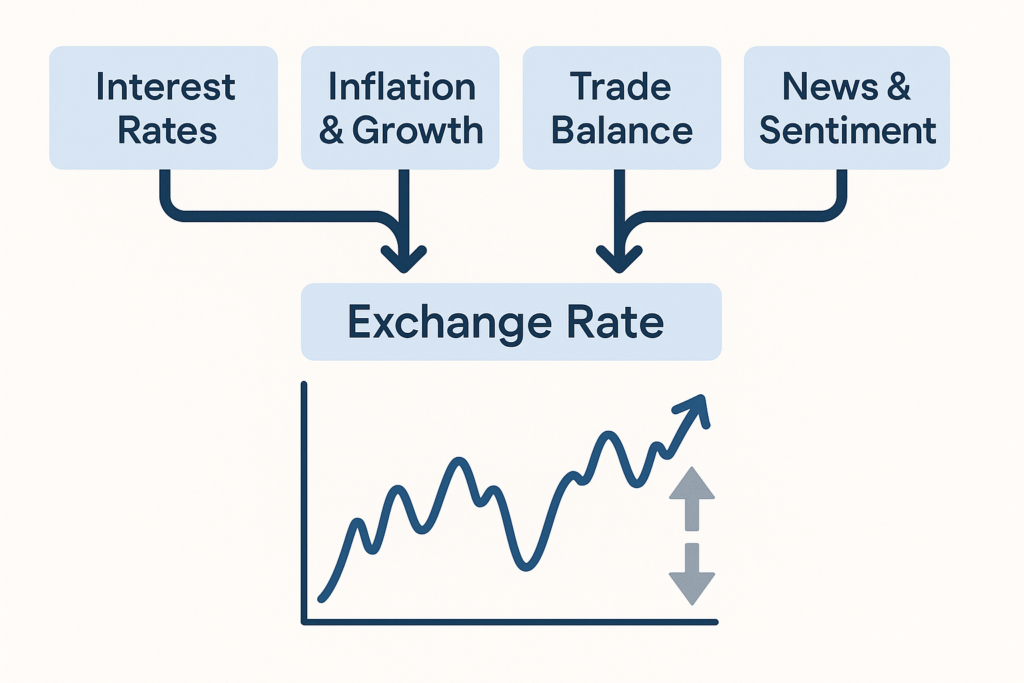

It comes down to supply and demand, but with currencies the drivers are broader. You’re not just dealing with one company’s profits; you’re dealing with entire economies.

Economic Fundamentals

The first and most obvious driver is the health of a country’s economy. Interest rates are at the centre of it. When a central bank raises rates, investors pay attention. Higher rates mean better returns, so money flows in. That extra demand pushes the currency up.

Inflation works in the opposite way. If prices keep climbing, the value of money quietly diminishes. A currency with high inflation is like a balloon that leaks air: it still floats for a while, but everyone knows it won’t hold up forever. Traders react by selling it down.

Growth figures feed into this too. Strong GDP numbers or healthy job data signal an expanding economy. That often lifts a currency. Weak growth or rising unemployment sends the opposite message.

Trade and Global Flows

Currencies don’t just reflect local conditions – they mirror how a country trades with the world. If a nation exports heavily, it gets paid in foreign currencies. Exporters then swap those earnings back into the local currency, creating demand that pushes its value higher.

If the country imports more than it sells, it has to keep sending its own money abroad. That increases supply in global markets and can weaken the currency. It’s a bit like a stall at a market that buys more stock than it sells – always handing out cash rather than taking it in.

Commodities add another twist. Countries rich in oil, gas or metals often see their currencies track those prices. The Canadian dollar is a classic case. When oil prices climb, demand for Canadian exports rises, which boosts the loonie. When oil slumps, the currency often softens with it.

News, Politics and Market Mood

Data isn’t the whole story. Headlines and sentiment can also swing markets even faster. Elections, referendums, central bank surprises or geopolitical shocks – they all feed into currencies.

Even in calmer times, mood matters. When investors feel nervous, they pile into so-called safe-haven currencies like the US dollar or Swiss franc. When they feel optimistic, they reach for higher-yielding currencies and take on more risk. In short, news and psychology can outweigh fundamentals in the short run – which is why traders track economic calendars and breaking headlines so closely.

Putting It Together with EC Markets

For new traders, the challenge is making sense of all these forces at once. One day rates are the main story, the next it’s politics, and often it’s a mix of both.

That’s where EC Markets comes in. The platform gives you access to all major and minor currency pairs, so you can see how different drivers play out. You also get tools like an economic calendar to track the big announcements, plus competitive conditions – spreads on majors from 0.0 pips and leverage up to 1:1000. Whether it’s a central bank decision or a jobs report, you can prepare, watch the move unfold, and trade with the information in front of you.

Bottom Line

So, what moves currency pairs? A blend of fundamentals, trade flows, politics and market mood. Interest rates act like valves, inflation like leaks, and headlines like sudden gusts of wind.

The key is not to chase every flicker but to recognise the bigger forces. Keep an eye on growth and inflation, watch central banks, and don’t ignore sentiment. Use demo trading to practise and see how pairs like EUR/USD or GBP/JPY react.

Over time, those sharp swings stop looking like chaos and start to look like signals. And once you see the signals, you’ll have a better handle on what really drives currency pairs – and how to trade them with confidence.