Markets Split as Growth Holds but Politics Bite | Weekly Recap: 25 Aug – 29 Aug 2025

Economic Overview

Global markets rode a volatile week shaped by shifting monetary policy expectations and geopolitical surprises. In the US, Powell’s Jackson Hole remarks landed on the dovish side, signalling risks have tilted toward labour softness and nudging the door open for a September rate cut. At the same time, the Commerce Department revised Q2 GDP up to 3.3% annualised, a firmer base than first thought. Core PCE eased to 2.9% YoY, keeping the disinflation trend intact even as consumer confidence slipped and hiring cooled. Put together, traders leaned into nearly 90% odds of a cut next month.

The UK feels at a turning point. The BoE’s early-August trim to 4.0% was a close call, and July CPI at 3.7%, still almost double target, complicates the path ahead. Growth has held up thanks to services and steady consumer demand, so markets now see, at most, one small cut later this year. In the eurozone, the August composite PMI rose to 51.1, the best in over a year, with manufacturing poking back into expansion for the first time since 2021. The catch: services-side price pressure remains sticky. French politics didn’t help sentiment either – a surprise confidence vote from Prime Minister Bayrou rattled bonds and added another layer of uncertainty.

China stayed the global laggard. July industrial profits fell for a third straight month, and new lending contracted YoY for the first time in two decades. Policy tweaks – easier housing rules here, liquidity support there – have yet to shift confidence. Equities slid, the yuan hovered near multi-year lows, and investors kept asking for more decisive stimulus.

Equities, Bonds & Commodities

Equities were subdued. The S&P 500 slipped 0.2% and the Nasdaq lost 0.3%, snapping a three-week run. The Dow dipped 0.3% as defensives lagged, while small caps were flat to slightly positive. Europe’s STOXX 600 fell 1% on politics and softer sentiment, and Japan’s Nikkei eased 0.5%. Emerging markets did worse, with MSCI EM down 1.5% as Chinese stocks dropped 2.7%.

Bonds found a bid. The US 10-year closed near 4.23%, a couple of basis points lower, while the 2-year hovered around 3.6%. Treasury auctions drew solid demand despite the political noise around the Fed. Bunds rose early and faded to ~2.68%; UK gilts held near 4.35%.

Commodities split. Brent spiked toward $69 on supply scares, then finished roughly flat near $68 as talk of OPEC+ adding barrels resurfaced. WTI ended just above $64. Gold caught a tailwind, up 1.3% to ~$3,445/oz, its best month since April, helped by softer real yields and a touch of haven demand.

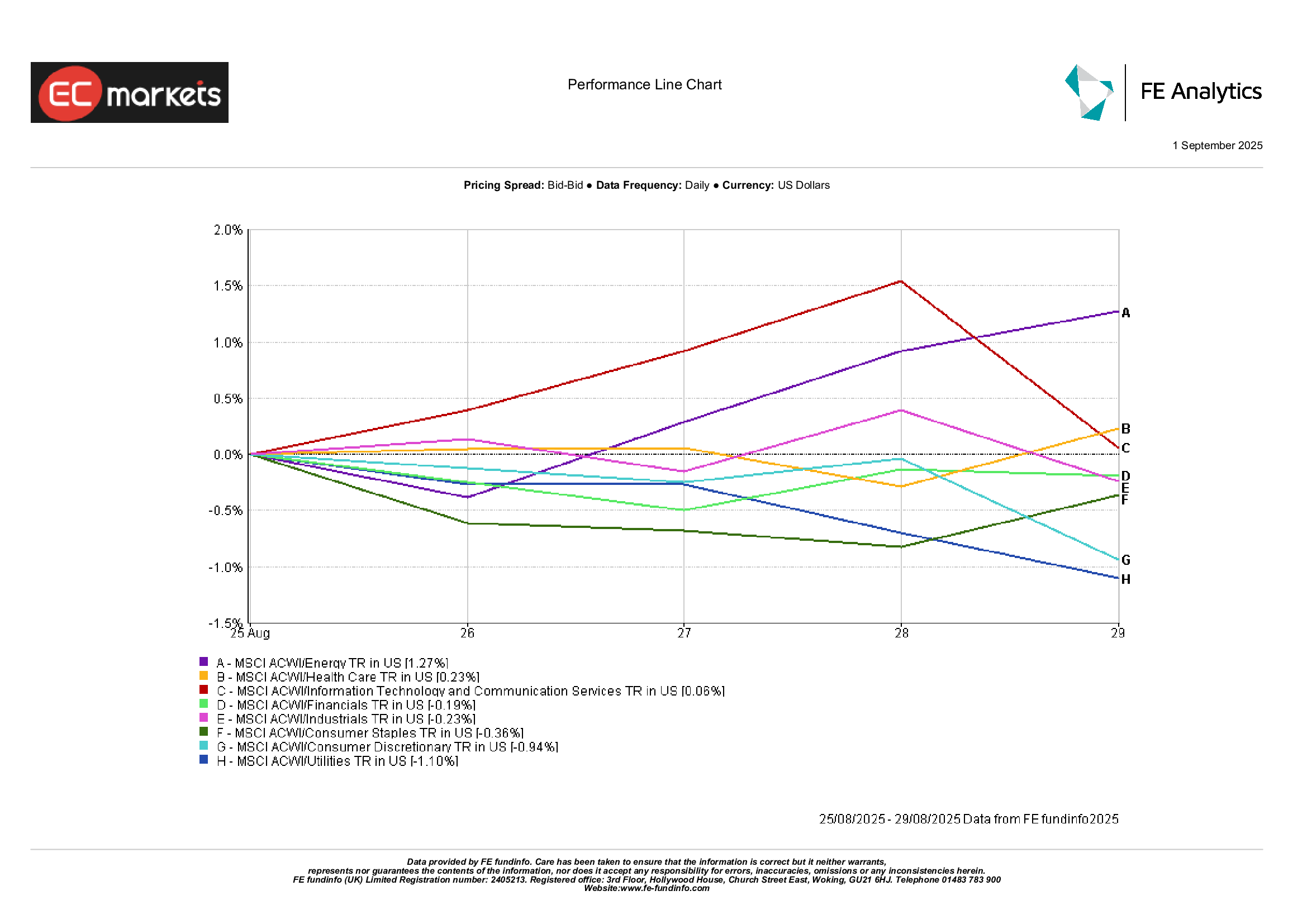

Sector Performance

Leadership rotated again. Energy led (+1.3%) on the mid-week oil bounce and hopes China demand eventually stabilises. Healthcare edged up (+0.2%) on steady earnings and a few positive trial updates. Tech and Communication Services were fractionally positive – Nvidia’s strong print lifted semis, but profit-taking capped the move.

Laggards were mostly defensives and consumer-linked names. Utilities fell 1.1% as elevated yields dulled the appeal of dividends. Consumer Discretionary lost 0.9% on China exposure and cautious retailer outlooks. Staples slipped 0.4% as easing food inflation trimmed pricing power. Financials and Industrials hovered near flat, balancing higher NII and solid aerospace against softer freight/logistics.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 29 August 2025.

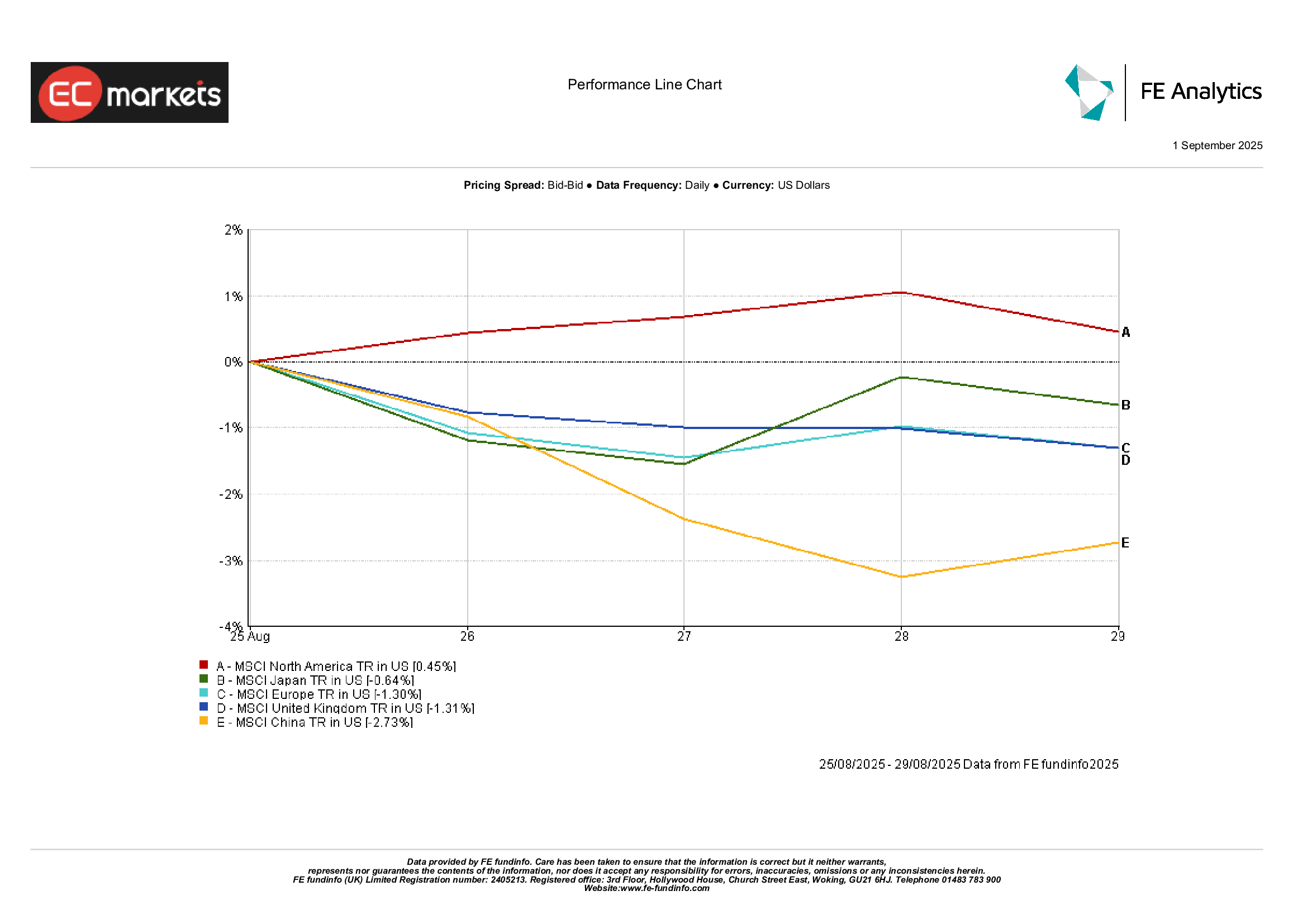

Regional Markets

Mixed picture by region. North America outperformed, with the MSCI North America Index up 0.5% on firmer US data and resilient tech. Europe fell 1.3% and the UK also lost 1.3%, pressured by French politics and a stronger pound. Japan’s Nikkei eased 0.6% in USD terms as the yen firmed. China lagged with the MSCI China Index down 2.7% despite stamp-duty cuts meant to steady equities.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 29 August 2025.

Currency Markets

The dollar paused after August’s slide. DXY was broadly flat around 98. The euro whipsawed – a dip on soft money supply data, then a rebound to finish near $1.171, little changed on the week. Sterling was steady too, ending near $1.351 (-0.2%) as firmer mid-week USD offset decent UK prints.

The yen stayed range-bound: USD/JPY tested 148, then settled near 147.1 as late-week risk caution nudged the pair lower. GBP/JPY hovered around 198.6, barely moved as pound and yen swings offset. Commodity FX found a bit of lift. AUD firmed with oil and metals; the yuan steadied after weeks of pressure; the rupee clawed back some tariff-driven losses.

Outlook & The Week Ahead

Plenty on deck. In the US, ISM Manufacturing lands Tuesday, the Beige Book mid-week, and August payrolls on Friday. A “cool but not cold” jobs print with tame wages would all but seal a September cut; a hot report could muddle it.

Europe’s flash CPI on 1 September will test whether services inflation is finally easing; unemployment and final PMIs follow. France’s confidence vote looms the week after. The UK posts housing and consumer credit data, and Governor Bailey speaks Thursday. In Asia, China’s official and Caixin PMIs will be key for any sign the slowdown is bottoming.

OPEC+ meets 4 September. Any tweak to supply guidance could swing crude. Geopolitics remains a live wire, from Ukraine to US–India trade. With September seasonality and fuller liquidity back, volatility can pick up. The tone into month-end is cautiously optimistic, but rich valuations leave little room for disappointment.