Why Most Traders Lose Money – And How Not To

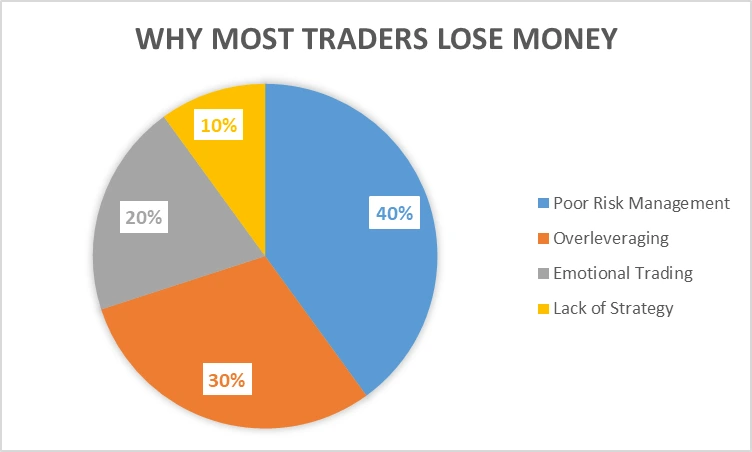

It’s no secret why most traders lose money: the stats are bleak. But these losses usually aren’t random. Common traps like ignoring risk limits, over-leveraging and trading on emotion trip up beginners (and even seasoned players).

In this article we look at why most traders lose money and how you can avoid the same mistake. We’ll use everyday language – think “revenge trading after a loss” or “doubling down on a bad trade” – and share practical tips using tools like EC Markets’ demo accounts, adjustable leverage and risk-management features.

*For illustrative purposes only

Poor Risk Management

One big reason traders lose money is bad risk habits. Imagine a gambler who keeps doubling the bet after each loss, hoping to win it back – that’s “doubling down on a bad trade.” Many traders shoot first and ask questions later. For example, they may not set a stop‑loss or may risk too large a slice of their account on one bet. Another classic is “revenge trading after a loss”: letting frustration drive you to place bigger trades in a panic.

To avoid these traps, make risk controls automatic. Always set a stop‑loss or take‑profit on each trade, and never risk more than a small percentage of your money per trade. EC Markets’ platforms have built‑in risk tools. For instance, you benefit from negative balance protection and can customise position sizes easily. Use these features! Demo trading is another great safeguard. In short, treat risk management like the boss of your trading: if it’s ignored, it will enforce itself the hard way!

Overleveraging Your Positions

Leverage can feel like free money, until it backfires. Overleveraging is when you borrow too much to trade big positions, and even small market moves trigger huge losses. While EC Markets offers up to 1:1000 leverage, remember you can always dial it down. Beginners often think “more leverage = more profit,” but also “more risk.” For example, one extra point move at 1:1000 can wipe you out if you don’t manage it.

Start with lower leverage and only increase it as you gain experience. EC Markets’ adjustable leverage lets you choose the ratio that fits your comfort zone. In practice, a prudent trader might only use 10-50:1 at first. Also, stick to planned position sizes. Keeping leverage in check means avoiding the situation where one bad tick means goodbye to your account.

Want to know more about leveraging? Continue to read here.

Emotional Trading and Impulse

Another pitfall is letting emotions run the show. We know trading is exciting, but reacting to every gut feeling is dangerous. For instance, after a string of losses some people do “revenge trading” – they try to win back money immediately, often making more impulsive, bigger bets. Others “panic sell” winners out of fear or hold losers for too long hoping they’ll rebound.

You may be right once, twice, thrice.. but remember the probabilities of you losing also exist!

To avoid emotional snares, build disciplined habits. A simple routine can help: before entering a trade, tick through a checklist (e.g. “Does this meet my plan’s criteria? Is my stop-loss set?”). After a trade, review it calmly. Also, consider keeping a trade journal: writing down your reasoning and emotions for each trade can expose patterns and nudge you to stick to your strategy. In short, trade your plan, not your feelings!

No Plan or Strategy

Finally, trading without a clear plan is like driving blindfolded. Some traders wing it. They look at charts and make snap decisions without a strategy.

Instead, write down a simple trading plan before you start. It doesn’t need to be fancy, just a few points like: which markets you’ll trade, what signals you’ll use to buy or sell, and how much you’ll risk per trade. Stick to that plan unless new analysis shows it’s time to change it.

Over time, you’ll notice what works and what doesn’t. By following a defined strategy, you transform trading from gambling into a skill-based profession.

Bottom Line

Trading is tough, but losses aren’t inevitable. The difference comes down to habits. Losing traders often chase losses, use too much leverage, and trade impulsively. In contrast, winning traders use tight stop‑losses, risk only small amounts, and follow a plan. EC Markets provides tools to support smart habits: demo accounts for practice, adjustable leverage, and risk features like negative balance protection.

The bottom line is this: trading is no walk in the park, but with good habits and the right tools, you can flip the odds. Be honest with yourself, learn from mistakes, and stick to sensible rules. Do that, and you’ll understand why most traders lose money – and even better, you’ll be the one who doesn’t.