Why a Strong Dollar Isn’t Always a Win, Even for the US

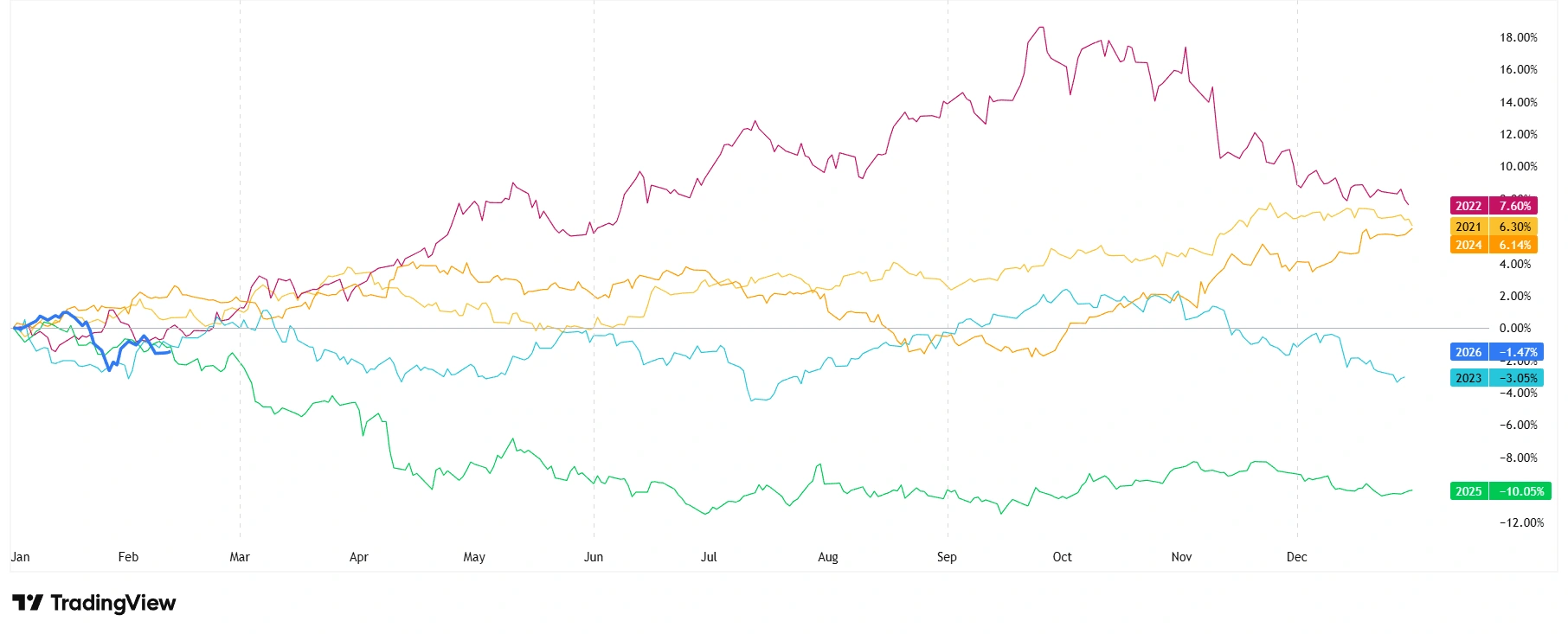

Markets rarely move in straight lines, and the dollar’s impact varies year by year; the chart below shows how seasonality plays out across different years.

US Dollar Index (DXY): 5‑Year Trend

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 12 February 2026.

When people hear that the US dollar is strong, the first reaction is usually positive. After all, a strong currency suggests confidence, stability, and a powerful economy. It also helps Americans buy imported goods more cheaply, and that sounds like a straightforward win.

But as with most things in financial markets, the picture is rarely that simple. Behind the headlines, a stronger dollar creates a series of challenges that can weigh on the US economy itself, and by extension, shape conditions for investors across global and emerging markets.

Here’s a closer look at why “strong” doesn’t always mean “healthy”… and why it matters.

1. A Strong Dollar Makes America’s Massive Debt Even Heavier

The US carries more than $38 trillion in federal debt, a staggering figure that becomes harder to manage when the dollar strengthens.

That’s because:

- A strong dollar usually goes hand‑in‑hand with higher US interest rates.

- Higher rates mean higher borrowing costs for the government.

- More of the national budget ends up servicing interest rather than supporting growth.

The Congressional Budget Office expects US interest payments alone to near $1 trillion by 2026, a sign that debt servicing is becoming a growing drag on public finances.

For investors in global and EC markets, this matters because:

- Higher US rates often pull capital away from developing economies.

- Strong-dollar cycles typically result in tighter global liquidity.

- Countries with dollar‑denominated debt feel the strain first.

This is a reminder that US currency strength often carries global consequences.

2. Strong Dollar = Weak US Exports

To understand how performance patterns shift from one year to another during strong‑dollar cycles, here’s a seasonal comparison of annual returns:

Year‑Over‑Year Seasonal Market Performance

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 12 February 2026.

When the dollar strengthens, American products become more expensive for the rest of the world. That’s challenging for US exporters, and the numbers show it:

- In 2024, the US exported roughly $3.2 trillion in goods and services.

- It imported around $4.1 trillion, creating a trade deficit close to $1 trillion.

A strong dollar widens this gap because:

- Foreign buyers may turn to cheaper alternatives from Europe or Asia.

- US manufacturers lose price competitiveness.

- Export‑driven industries face slower demand and potential job cuts.

For EC markets, this dynamic can create unexpected opportunities:

- Countries offering competitive pricing often capture global demand displaced from the US

- Manufacturing and commodity exporters can benefit from shifts in trade flows.

In other words, what’s a headwind for the US can be a tailwind elsewhere.

3. Cheaper Imports Hurt Local Industries

It’s true, a strong dollar makes imported goods cheaper for US consumers. But this also means:

- Imported products undercut American-made alternatives.

- Domestic industries face intense competitive pressure.

- Sectors like manufacturing feel the squeeze, especially during economic slowdowns.

Wall Street tends to thrive during strong-dollar periods as global capital flows toward US markets.

But Main Street? Much less so.

4. Financial Markets React, Sometimes Too Enthusiastically

A strong dollar often serves as a magnet for global investors seeking stability. That means:

- Higher demand for US stocks and bonds

- Rising asset prices

- Increased volatility for emerging markets as funds flow outward

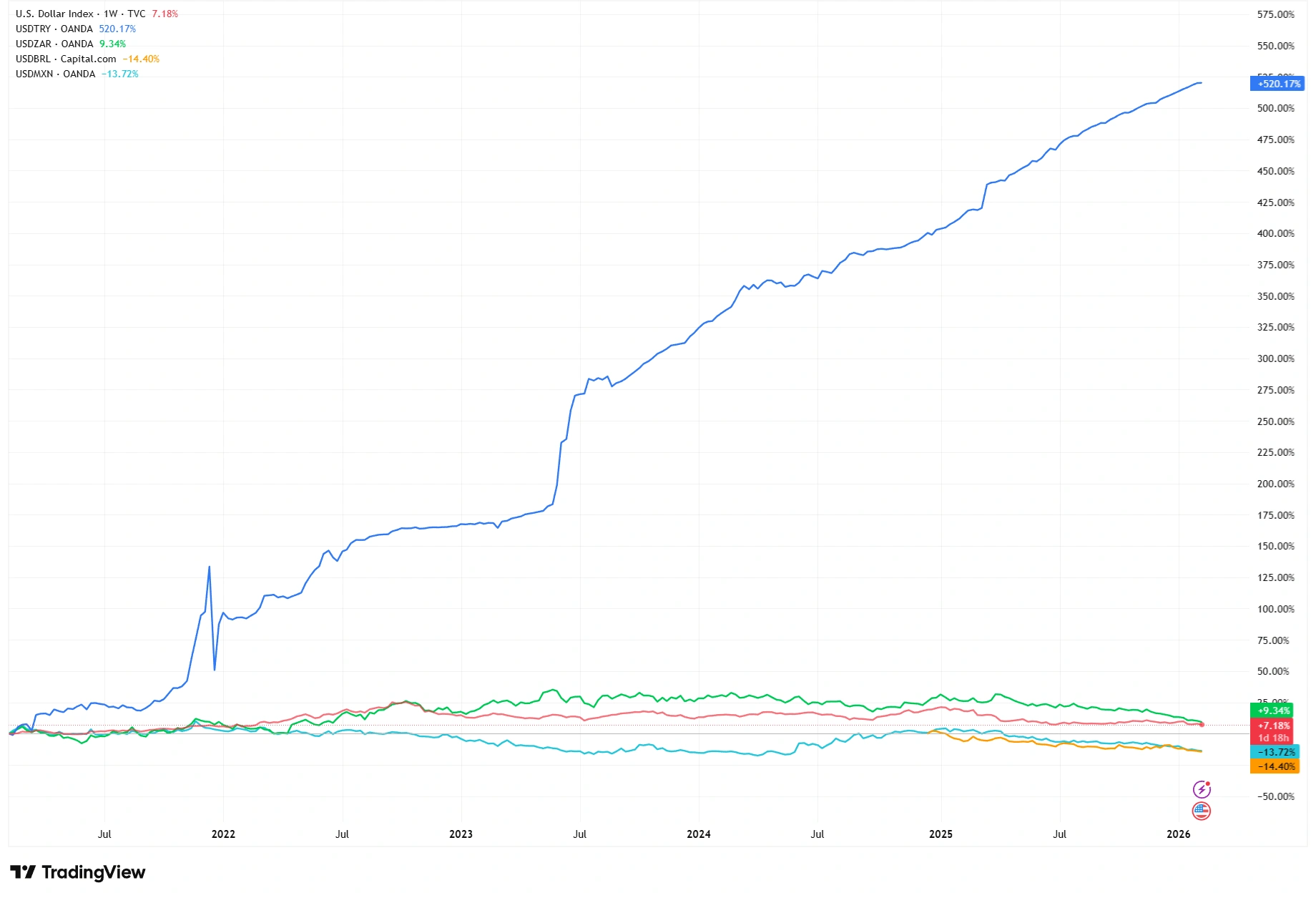

EM Currencies vs USD Performance

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 12 February 2026.

While this may boost US market performance in the short term, it also:

- Distorts valuations

- Makes US markets more sensitive to future rate cuts or reversals

- Creates capital‑flight risks for EC economies

This is why strong-dollar phases are often accompanied by currency pressure in developing regions, forcing central banks to raise interest rates even when domestic conditions don’t justify it.

Strength… With Side Effects

So while a strong dollar may signal confidence, it can just as easily:

- Inflate US borrowing costs

- Weaken export competitiveness

- Pressure domestic industries

- Tighten global liquidity

- Strain EC economies with USD-denominated debt

The key takeaway?

A strong dollar isn’t inherently positive or negative, but it is powerful. It reshapes economic conditions both inside and outside the US, and investors ignore it at their own risk.

Final Thought

For investors, currency strength is more than a headline, it’s a barometer of global capital flows, risk appetite, and economic momentum. Understanding how the US dollar behaves (and why) can help you position portfolios more effectively, especially during periods of market stress.