What Are Defensive Stocks, and When Do They Outperform?

Let’s face it. The market can be a bit of a rollercoaster. One moment you’re riding high, the next you’re watching red lines stack up on your screen. During those volatile moments, wouldn’t it be helpful to have a few steady performers in your portfolio — something a bit less… wobbly?

That’s where defensive stocks come in. They might not be the loudest names on the board, but when things go south, they tend to hold their ground. In this piece, we’ll break down what they are, when they shine, and why they’ve got a reputation for keeping cool under pressure.

So, What Are Defensive Stocks?

In plain terms, defensive stocks are shares in companies that sell the things people buy no matter what. Think groceries, electricity, medication. It doesn’t really matter if the economy is booming or going sideways, these businesses keep ticking.

Names like Procter & Gamble, Nestlé, and Johnson & Johnson are often brought up here. Why? Because they make the essentials. People don’t suddenly stop brushing their teeth or buying food just because inflation’s running hot or GDP turns negative. The same goes for healthcare, if you need a prescription or a doctor, you’ll find a way.

That’s the core idea. These companies don’t rely heavily on consumer confidence or big spending cycles. They offer consistency. And when in panic, it’s crucial.

Why They Hold Up When Markets Slide

Here’s where things get interesting. During a downturn, investors often dump growth stocks and start searching for safety. And safety, in this case, looks like reliable earnings and cash flows. Maybe even a dependable dividend.

That’s why defensive stocks tend to fall less when the broader market is sinking. It’s not that they rise dramatically, most don’t. But they act like a cushion. They lose less, and sometimes they even stay flat, which can feel like a win when everything else is sliding fast.

Plus, there’s a psychology factor. When fear sets in, people want something familiar. Defensive names offer that sense of calm. They’ve been there through past crises, and that track record gives them credibility.

Staples, Utilities, and Healthcare: The Big Three

Let’s quickly look at the three sectors most people think of when we talk about defensives:

1. Consumer Staples: This covers food, drinks, toiletries, the everyday stuff. People don’t skip breakfast just because the Nasdaq is down, right?

2. Utilities: Think electricity, gas, water. These are basic services, and even in a deep recession, households still pay their utility bills.

3. Healthcare: No matter what’s going on with the economy, people still get sick. Demand here stays pretty steady, and in some cases, it even rises during uncertain periods.

Each of these sectors has its quirks, but they share one key trait: resilience.

Do They Actually Work?

During the COVID crash (Feb-Apr 2020), defensive sectors like healthcare and consumer staples outperformed the broader market.

While the S&P 500 fell about 9.4%, healthcare stocks ended slightly positive (+0.34%), and consumer staples dropped just 8.4%.

Meanwhile, utilities lagged, falling nearly 15.9%, showing that not all defensive sectors react the same way.

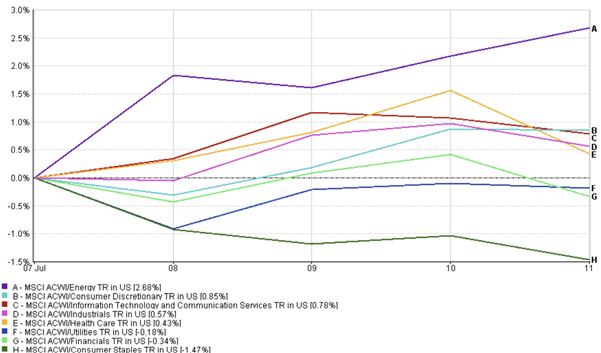

How Defensive Sectors Performed During the COVID-19 Crash (Feb-Apr 2020)

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 July 2025.

In the 2022 sell-off (Apr-Jun), it was the same pattern. The S&P 500 tanked over -16%. Defensive sectors? They were down too, but only by half as much.

Defensive Stocks vs the Market During the 2022 Sell-Off (Apr-Jun 2022)

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 July 2025.

Bottom Line

Defensive stocks won’t make headlines, and that’s kind of the point. They’re built for calm, not chaos. But when markets turn rough, they can be the quiet workhorses that keep your portfolio grounded.

You won’t brag about them at a dinner party. But you might sleep a little better knowing they’re in your corner.