Understanding Inflation Data: CPI, Core CPI and Why They Matter

Inflation is a driver of markets. When new inflation numbers come out each month, traders of currencies, stocks, bonds and commodities all pay attention. A sudden rise or fall in inflation can quickly change expectations for interest rates and move markets.

What is CPI?

The Consumer Price Index (CPI) is the most widely watched measure of inflation. It tracks the prices consumers pay for a broad “basket” of everyday goods and services. In plain terms, CPI measures how much more (or less) you’re paying compared to a year ago. In practice this means CPI includes things like groceries, petrol, housing costs, energy bills, medical care and transport. So when we say CPI is up 2%, it means the average price of that basket is 2% higher than a year ago. Because it reflects broad living costs, CPI is seen globally as the key inflation gauge. It is used by policymakers to track price trends and by businesses and consumers to adjust wages, rents and contracts for inflation.

What is Core CPI?

Policymakers often talk about Core CPI, which is just CPI excluding food and energy prices. That’s excluded because food and fuel prices can jump around a lot due to weather, geopolitics or supply shocks. Core CPI strips out this volatility to show underlying trends. Central banks prefer to watch core inflation because it gives a steadier picture of price pressures. In short, core CPI helps officials see whether price gains are broad-based or just coming from, say, a temporary surge in oil prices. Markets often react strongly to the core figure because it is seen as a guide to future inflation under normal conditions.

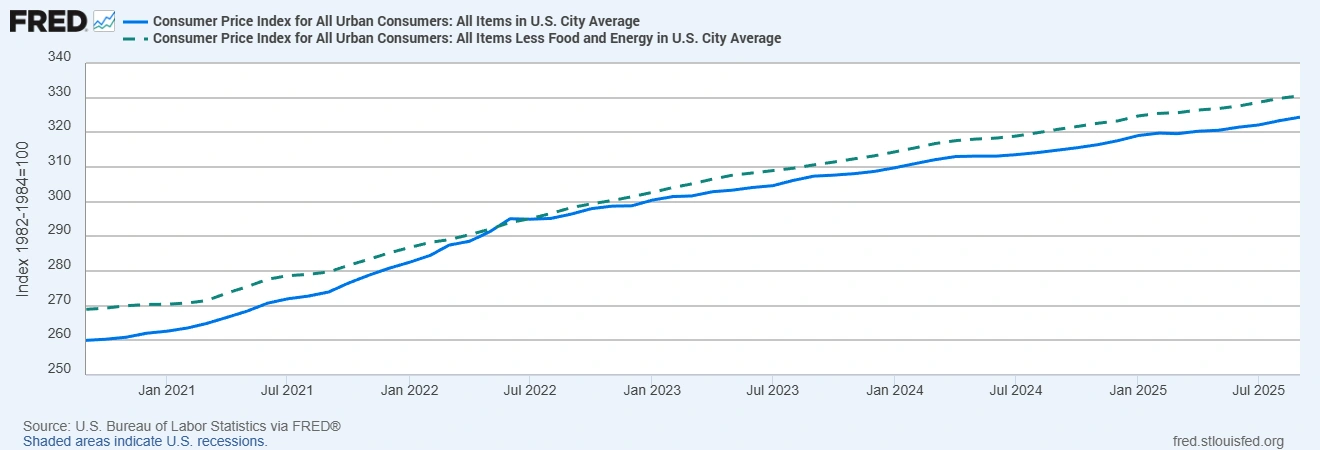

CPI vs Core CPI: Headline Inflation vs Underlying Trends

A comparison of headline inflation and core inflation, highlighting why markets pay close attention to the core reading.

Why Inflation Data Matters to Traders

For traders, inflation reports are a big deal because they shape monetary policy expectations. In simple terms, high inflation often forces central banks to tighten policy (raise interest rates or slow purchases). Higher rates tend to push bond yields up and put pressure on price-sensitive assets. For example, higher borrowing costs can hurt fast-growing companies or smaller companies. Rising interest rates make borrowing costly, and stock prices may decline with higher interest rates. Likewise, bond prices have the opposite move when rates rise (bond yields rise as prices fall).

If CPI is higher than expected, traders assume policy will be tighter. This usually means bond yields will climb and many stocks (especially tech and growth stocks that rely on cheap credit) may dip.

If CPI is cooler, it often eases rate worries. Lower or falling inflation tends to lift equities and credit markets, since it suggests rates may stay low or even be cut.

In short, CPI and core CPI reports anchor interest-rate expectations. Every move in those figures reshapes the outlook for borrowing costs, which in turn ripples through all asset prices.

Inflation and the everyday trader

Inflation also matters in practical ways. Traders mark their calendars for CPI release days because the numbers often spark sharp intraday moves. Any difference between the actual CPI figure and the consensus forecast can trigger immediate volatility as the market re-prices positions.

- FX markets: Currency pairs can jump or drop on a CPI surprise. For example, a stronger-than-expected CPI can strengthen the currency (as traders bet on higher rates) or weaken it if it undermines confidence.

- Commodities: Some commodities are sensitive to inflation. Gold, for instance, is often seen as an inflation hedge. Oil and other raw materials may also react if high inflation signals strong demand.

- Consumers and economy: High inflation erodes purchasing power, meaning each pound buys less. When people’s expenses rise quickly, consumer sentiment can fall and spending may slow (a drag on economic growth).

Overall, traders treat inflation releases as events to prepare for volatility and potential opportunity. A big surprise in the CPI report can set off market swings in stocks, bonds, FX and commodities. That is why you’ll see economic calendars highlight CPI days prominently and traders adjust orders as soon as the data hits.

Bottom Line

CPI and Core CPI are far more than dry monthly statistics; they are key drivers of market sentiment and risk appetite. By anchoring interest-rate expectations, inflation figures guide central bank policy and thus the direction of bond yields and equity values. They also feed into everyday economic dynamics like consumer spending and business pricing decisions. As such, savvy traders treat inflation reports not as isolated numbers, but as crucial signals of economic momentum. Keeping an eye on CPI (and its core reading) means staying ahead of shifts in monetary policy, market trends and potential trading opportunities.

At EC Markets, we breakdown these concepts in our Weekly Market Recaps. To know more, continue to read here.