Two Weeks That Reset Expectations: What the Jan-Feb Data Really Told Us

Some market moments feel louder than others; not because of headlines alone, but because several signals arrive at once and prompt investors to rethink the bigger picture. The last week of January and the first week of February was one of those moments.

A cluster of delayed US releases, paired with fresh inflation and labour data, created a compressed window where growth expectations, rate assumptions, and sector leadership were quietly re‑priced. Nothing dramatic on the surface, yet underneath, sentiment shifted. Here’s what changed, and why it matters for the next phase of 2026.

The Setup: Services Steady, Manufacturing Soft

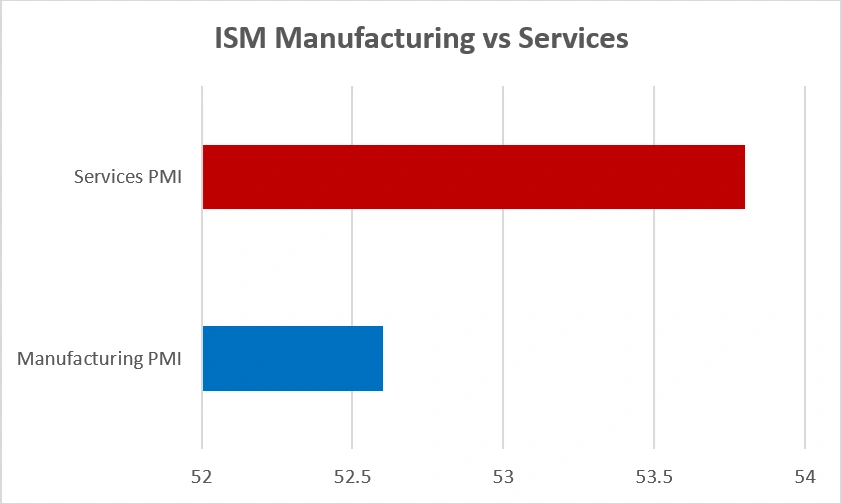

Early‑February data underscored the economy’s two‑track setup. Manufacturing only recently moved back into expansion, with the ISM Manufacturing PMI rising to 52.6 after months in contraction. Services stayed solid, holding at 53.8 for January, marking the sector’s 19th straight month of growth.

ISM Manufacturing vs Services PMI (January 2026)

Source: Institute for Supply Management (ISM).

Services activity remained stronger than manufacturing in early 2026, with both sectors holding above the 50‑point expansion threshold.

Labour trends pointed to similar moderation. Private employers added just 22,000 jobs in January, a soft print driven by losses in areas like professional services (‑57,000) and manufacturing (‑8,000), while education and health services added 74,000 jobs, preventing an outright decline in hiring. Consumer sentiment showed cautious improvement, ticking up to 57.3, though still about 20% below last year’s levels, highlighting lingering concerns about finances and job stability.

Why it matters: A slowing but not stalling economy gives central banks space to stay patient. For markets, that usually means narrower leadership and greater sensitivity to each data point.

Inflation & Rates: The Quiet Hand on the Wheel

Growth still formed the backdrop, but inflation and rate expectations did most of the steering. Headline inflation eased to 2.7%, with core holding at 2.6% – cooling, but not yet consistent enough to feel settled. That “almost there” mix shaped much of early‑February sentiment, shifting the debate from whether inflation will fall to how smoothly it can glide lower – and how long the Fed may keep policy tight to make sure it does.

Those questions showed up most clearly in the bond market. The 10‑year Treasury yield hovered around 4.20-4.29%, and even small daily moves were enough to tug on valuations, especially in rate‑sensitive corners of the equity market.

10‑Year Treasury Yield (Jan-Feb 2026)

Source: Board of Governors of the Federal Reserve System (US) via FRED®

That’s why stocks behaved the way they did. Not with panic, but with a quiet, orderly recalibration. When yields drifted higher, rate‑sensitive names stepped back; when yields steadied, markets regained their footing. It’s the kind of late‑cycle behaviour you’d expect when inflation is improving but uneven – and when the bond market, more than the headlines, is quietly setting the tone.

Equities: Rotation Without Panic

Despite the dense calendar, equities didn’t break, they adapted. Volatility picked up as investors hedged around the major releases, but the broader tone stayed orderly. Under the surface, leadership continued to shift:

Growth‑oriented tech and cyclical industrials softened when yields moved higher, reflecting sensitivity to discount rates and cycle‑linked earnings.

Defensives like health care and consumer staples found steady support. This wasn’t a rush to safety; it was a pragmatic response to uncertainty around the timing of policy easing.

Think of it as a move from rate‑driven optimism to data‑driven realism; a late‑cycle temperament that favours discipline, balance, and careful sizing.

Housing & Consumption: Real‑Time Rate Signals

Two areas offered clear insight into how restrictive policy is filtering through the economy.

H Housing showed tentative stabilisation as mortgage rates finally eased off, suggesting the worst of the rate shock may be behind us. That doesn’t imply a rebound, but it suggests the worst of the rate shock may be past, important given housing’s tendency to lead turning points.

Retail spending was more nuanced. Consumers continue to spend, but with greater selectivity. Essentials remain firm; discretionary purchases look more rate‑sensitive. For corporate earnings, this tilt toward durability over aspiration is meaningful.

Why These Two Weeks Mattered

Individually, none of February’s releases were dramatic. Collectively, they reset expectations. Markets began the year anticipating a smooth shift toward lower inflation, stable growth, and gradual rate cuts. The latest data didn’t invalidate that outlook, but they made it appear slower, bumpier, and more dependent on what comes next.

Practically, that means:

- Valuations are harder to stretch without clear progress on disinflation.

- Sector leadership rotates rather than trending cleanly.

- Volatility rises even as long‑term narratives remain intact.

Crucially, this sequence sharpened attention on the March policy meeting, now the next checkpoint for confidence in the soft‑landing path.

What This Means for Investors

These two weeks didn’t deliver drama—it delivered clarity. The US economy looks resilient but slowing, inflation is easing but uneven, and rate expectations are adjusting rather than collapsing. That mix rarely produces straight lines.

For portfolios, it argues for:

- Balance over boldness: pair quality growth with resilient defensives.

- Selective cyclicals: favour firms with pricing power and strong balance sheets.

- Respect for duration risk: let data shape positioning rather than relying on early pivot hopes.

The easy narrative phase is over. What comes next will be driven less by headlines and more by the steady cadence of fundamentals, and that quieter shift is often the one that matters most.