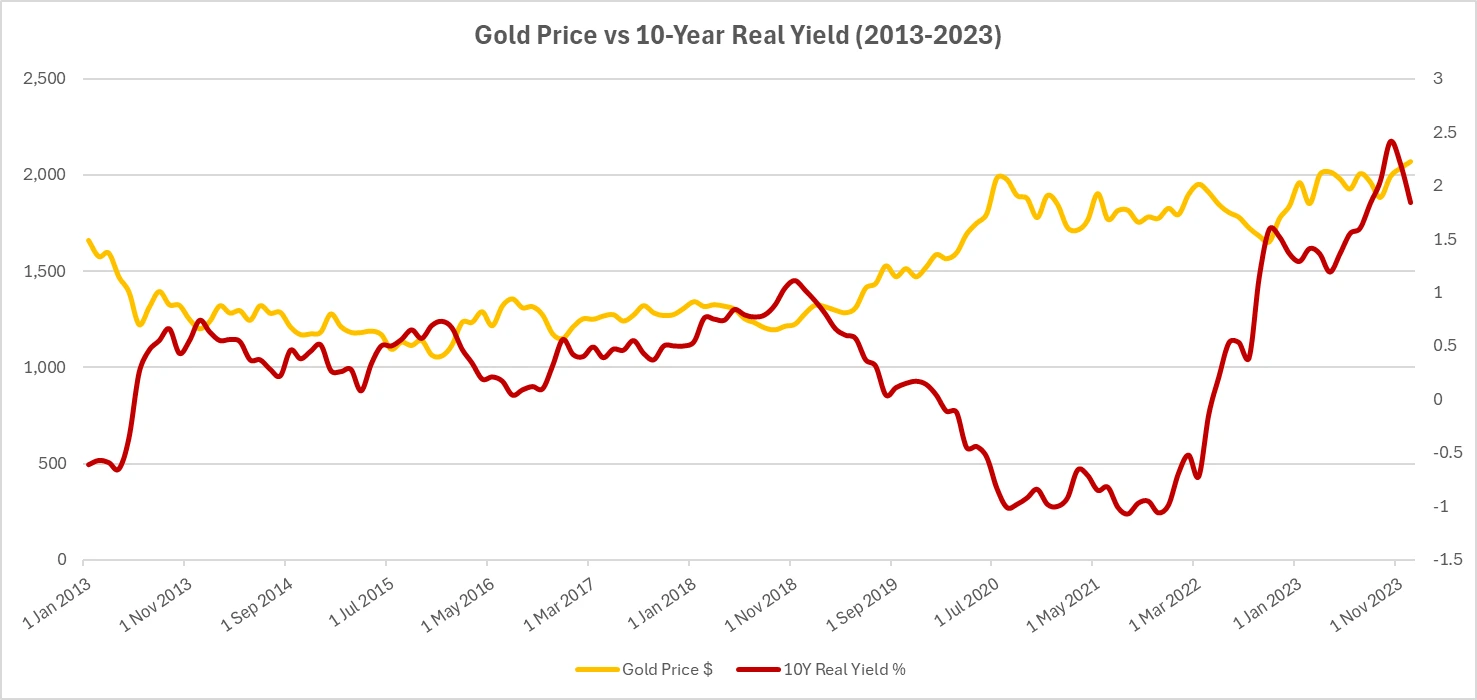

The Relationship Between Real Yields and Gold Prices – A 10-Year Lookback

Gold has long been a go-to for those looking to hedge against inflation or simply sleep better when markets get shaky. But here’s the question: what happens when interest rates, especially real, inflation-adjusted ones start heading north?

The textbook answer is straightforward enough. Higher real yields make yieldless assets like gold less appealing. Lower or negative real yields? Suddenly gold looks a lot more interesting. That’s the theory. The last decade, though, has shown the market doesn’t always stick to the script.

The Classic Inverse Link

Real yields measure what you actually earn from bonds after inflation. When they’re rising, bonds look better, and gold loses some shine. When they’re falling, gold often benefits as investors hunt for stores of value.

Over the long run, the correlation between gold and the US 10-year real yield has been around -0.8, pretty strong for a market relationship. And the history is telling: stretches of ultra-low or negative real yields have matched up with gold’s biggest surges. PIMCO once estimated that for every 1% jump in real yields, gold’s price could drop by 20-25%. No wonder some call it the “anti-bond.”

A Decade in Data

2013’s “taper tantrum” saw the Fed hint at easing off stimulus, real yields climbed 0.5%, and gold fell by about 15%, almost on cue.

By 2017-2018, the Fed was hiking rates more steadily. Real yields pushed into positive territory, and gold drifted under $1,200/oz by year-end.

Then came 2020. Real yields collapsed towards -1% as rates went to zero and stimulus flooded in. Gold rocketed to $2,070/oz.

Fast forward to 2022: inflation spiked, central banks got aggressive, and real yields flipped from -1% to +1.5% in months. Most models screamed “gold should drop hard.” Instead, prices held near $1,800/oz.

And in 2023? Real yields stayed high, yet gold edged back toward record levels. The old pattern was clearly being tested.

Sources: Investing.com (Gold); Board of Governors of the Federal Reserve System (US) via FRED® (10Y Real Yield). Data as of 12 August 2025.

Gold’s price (blue) and US 10-year real yields (orange) have generally moved in opposite directions over the past decade, though recent years show notable exceptions.

Why the Pattern Broke

Three main forces got in the way:

- Geopolitics – War in Europe and wider uncertainty sent safe-haven demand into overdrive.

- Central bank buying – Over 1,000 tonnes purchased in 2022 alone created a price floor.

- Currency moves – The strong dollar hurt gold early in 2022, but when the dollar cooled later, that drag disappeared.

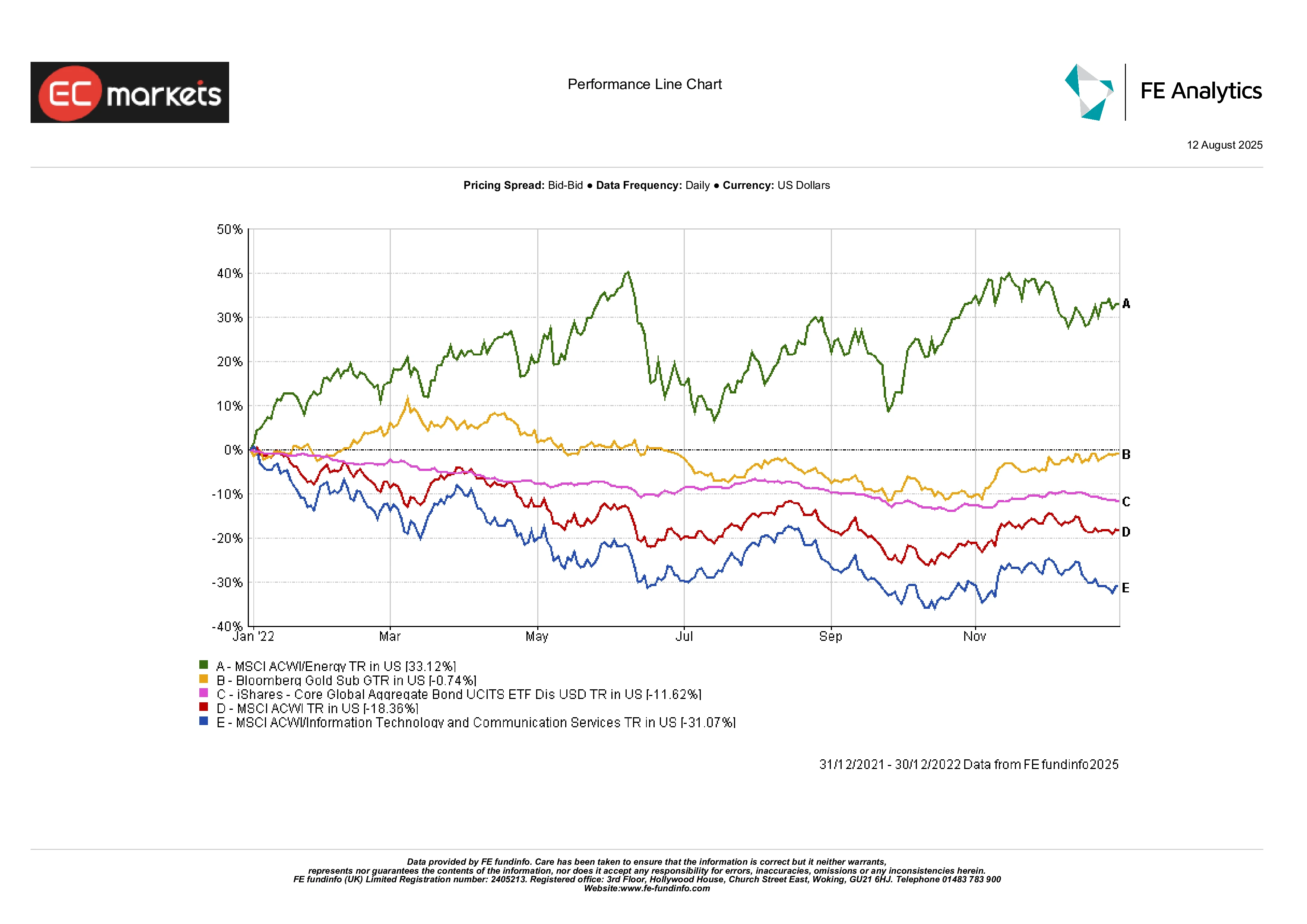

Cross-Asset Comparisons

2022 was a tough year for almost everything: stocks fell, bonds had one of their worst years on record. Gold? Flat. That was enough to beat a classic 60/40 portfolio and even inflation-linked bonds, which lost value as yields reset higher.

Energy stocks started the year strong, but momentum faded. Tech got hit hard by higher rates. Through it all, gold proved why investors still keep a slice of it in their portfolios: not for excitement, but for resilience.

2022 Asset Class Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 12 August 2025.

In 2022, gold outperformed major asset classes like bonds, global equities, and tech stocks, despite flat returns. Energy was the only major winner.

Risks and Exceptions

The “real yields up, gold down” rule works most of the time, but not always. In crises, both can rise together if safety is the main driver. And if central banks keep buying in size, that could permanently soften gold’s sensitivity to yields.

On the other hand, a world with low inflation and sustained high real yields would make life harder for gold, just as it did in the 1980s and late ’90s.

Final Takeaway

The last decade confirmed the link between real yields and gold; but it also reminded us the link can be stretched by bigger forces. Inflation shocks, geopolitical risk, central bank accumulation… all can rewrite the usual rules.

For investors, the point isn’t to ignore real yields, but to treat them as one piece of the puzzle. In calm times, they’re often the best guide to gold’s direction. In stormy ones, the market’s attention shifts.

So yes, history says falling real yields should help gold, and rising ones should hurt it. Just be ready for those moments when the market decides it has bigger things on its mind.