Selective Rotation Defines a Quiet Week as Yields Hold | Weekly Recap: 12-16 January 2026

Economic Overview

Major central banks mostly held a steady course amid broadly easing inflation. US price data remained benign – headline CPI was about 2.7% year-on-year in December, about the same as November – supporting expectations that the Fed may only cut rates later in 2026 rather than move quickly.

In Europe, the ECB likewise saw inflation around its 2% target and growth holding up, leading it to pause policy. ECB chief economist Philip Lane noted there was “no near-term rate debate” as long as the baseline outlook holds.

By contrast, China’s central bank took an easing turn: the PBoC cut sector-specific lending rates by 25bp and signalled room for more support this year.

In Japan, the BoJ announced it will begin modestly selling some of its ETF and REIT holdings to normalize policy (a move that was welcomed by markets).

Notably, international peers of Fed Chair Powell publicly reaffirmed their support for his independence after news of a Justice Department subpoena, underscoring central bank autonomy.

Overall, the mix of stable inflation and clear policy signals kept investors cautious but reassured that monetary policy is on a firm footing across regions.

Equities, Bonds & Commodities

Equity markets were mixed over the week. In the US, the S&P 500 ended Friday around 6,940 (from 6,977 on Monday), a drop of roughly –0.5%, whereas the Russell 2000 small‑cap index climbed about +1.6%. Globally, the MSCI World index was little changed (off about -0.2%).

Treasury yields held near recent highs but moved only slightly: the US 2‑year yield was about 3.54% on Jan 12 and 3.56% on Jan 15, while the 10‑year yield was ~4.19% on Jan 12 and 4.17% on Jan 15. The 30‑year yield eased a bit, from roughly 4.83% to 4.79%.

In commodities, oil (WTI crude) finished around $59.4/bbl on both Monday and Friday (essentially flat on the week). Gold prices were also stable, roughly unchanged around the $4,595 mark (reflecting the contract quotes in dollars). Silver saw the largest move: it jumped about +5.8% (rising from $84.98 to $89.94 per ounce).

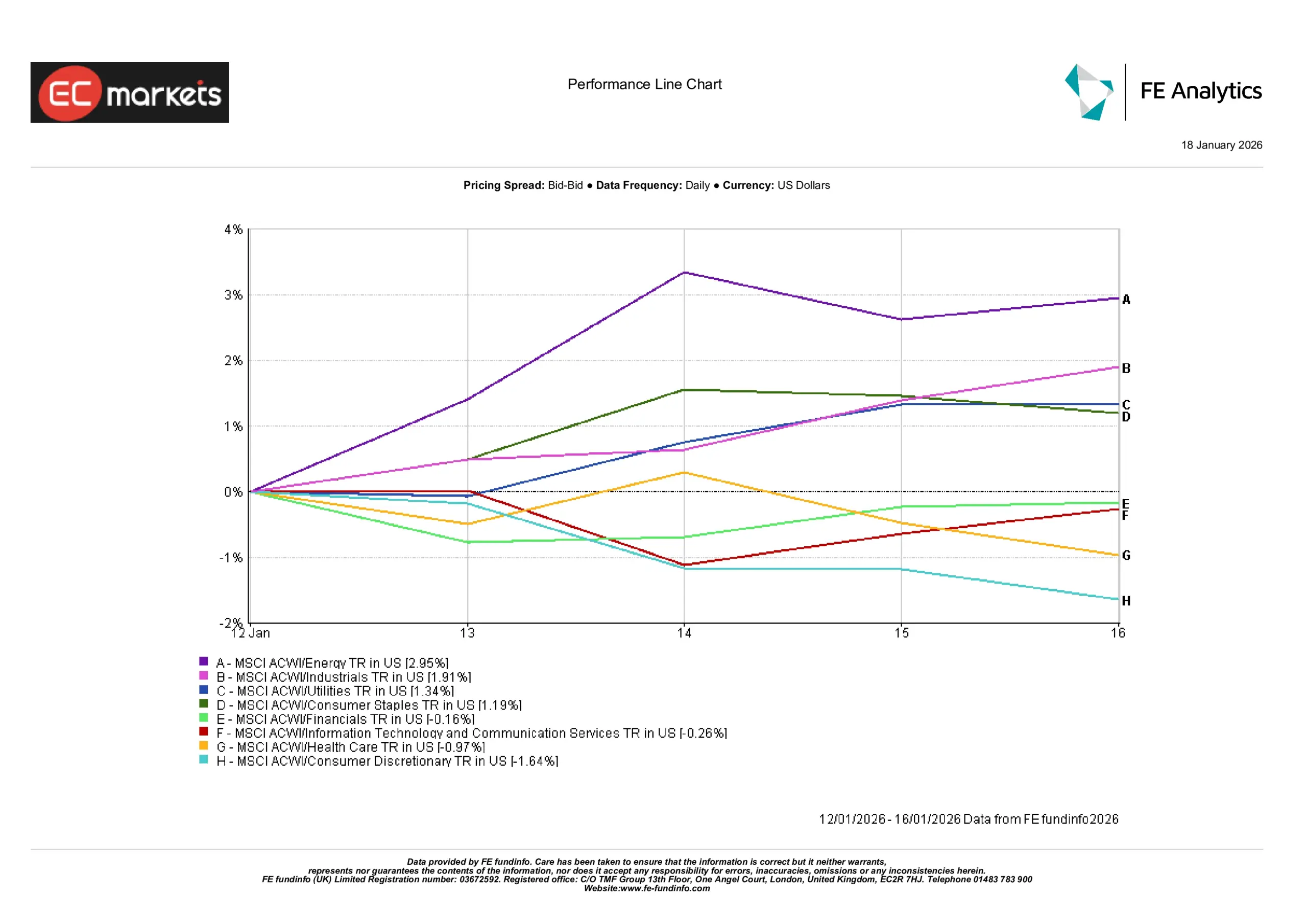

Sector Performance

Energy stocks led the week’s sector gains, with MSCI ACWI Energy up about +2.95% (helped by the firmer oil price). Industrials (+1.91%), utilities (+1.34%) and consumer staples (+1.19%) also rose as investors leaned into traditionally defensive or inflation-hedged areas. At the other end of the spectrum, consumer discretionary plunged around -1.64%, and health care fell roughly -0.97%. Technology and communications stocks were slightly negative (around -0.3%), while financials were essentially flat (about -0.2%).

The net picture was selective: strength was concentrated in energy and other stable sectors, whereas high-growth and consumer-oriented groups lagged. This pattern suggests investors were rotating modestly away from growth and cyclicals into defensive themes, rather than embracing a broad risk-on rally.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 16 January 2026.

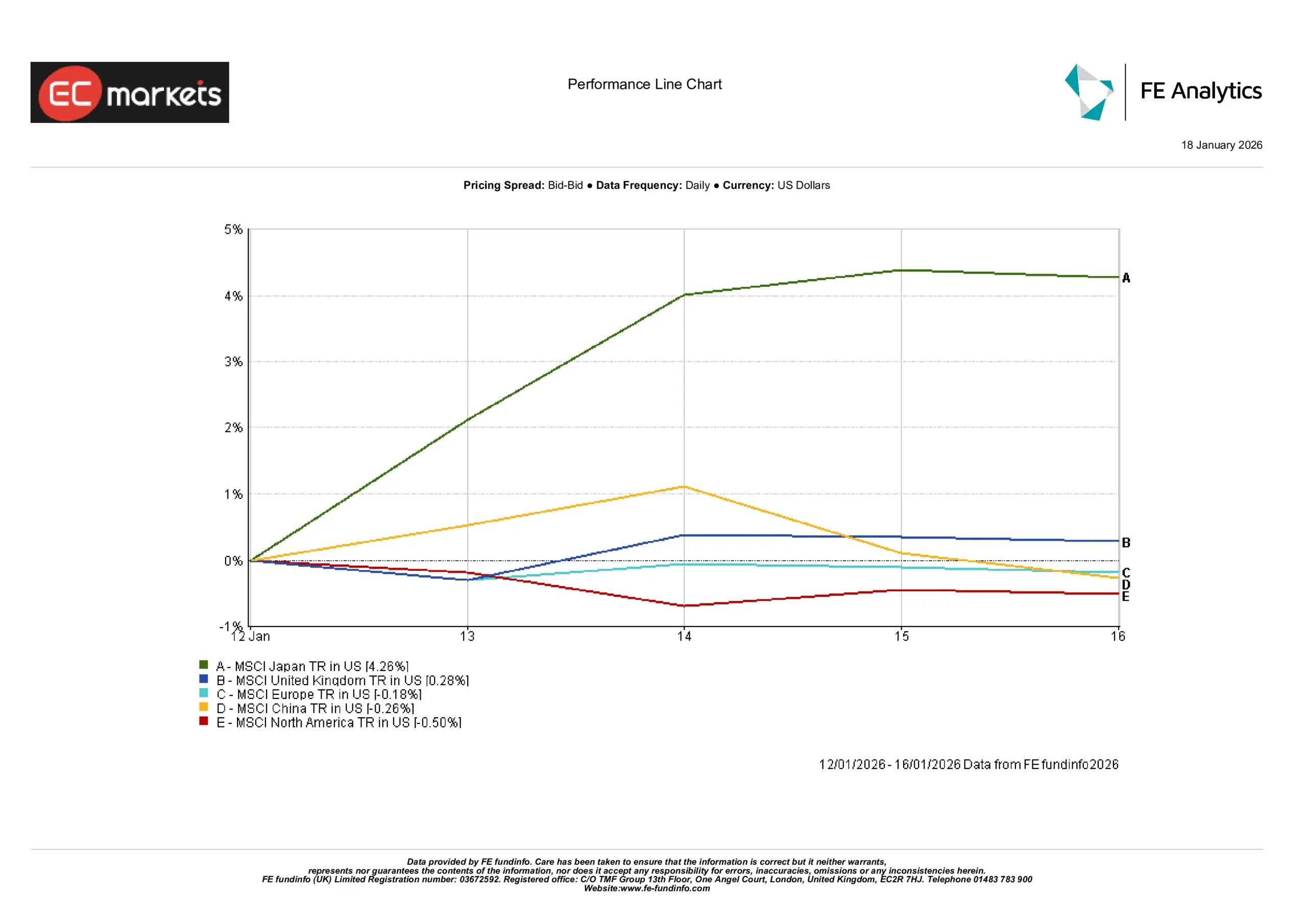

Regional Markets

Regional equity performance varied. In Asia-Pacific, Japan led gains (MSCI Japan was up over +4% for the week) while China was modestly lower; in Europe the UK and continental markets were roughly flat, and North American indices were slightly down. Sectors now paint a clear picture: energy stocks led the advance, with the MSCI ACWI/Energy sector up about +2.9% for the week (driven by continued strength in oil and gas names), followed by industrials (+1.9%) and other defensives (utilities +1.3%, staples +1.2%). At the bottom of the pack were growth-linked sectors: consumer discretionary fell roughly –1.6% and healthcare about –1.0%, reflecting a rotation away from more interest-rate-sensitive “growth” areas. Overall, broad cyclicals outperformed defensives, supporting the modest up‑tick in global value indices.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 16 January 2026.

Currency Markets

EUR/USD was range-bound and roughly flat, finishing the week fractionally weaker (around -0.1%). The euro traded between about 1.159 and 1.166 dollars, effectively near the prior week’s levels.

GBP/USD likewise ended the week almost unchanged (+0.01%), roughly in the mid-1.34 range. Sterling oscillated between roughly 1.338 and 1.346 dollars, reflecting modest U.K. data and a broadly firm U.S. dollar. USD/JPY declined about -0.3% (yen up), trading in the ~158.1–159.1 range. The yen’s strength came amid higher Japanese yields and softer U.S. economic news, despite earlier BoJ policy moves. GBP/JPY also fell ~-0.3%, with the pound moving in roughly the 211.6–213.6 yen band.

In short, the dollar and pound ended the week fractionally weaker on the yen, while EUR and GBP were little changed against the dollar. The moves largely mirrored regional shifts and yield differentials, with the USD broadly firm versus Europe but softer against Japan’s currency.

Outlook & Week Ahead

In the coming week, markets will be looking for fresh data for clues on the economic and policy outlook. Key US indicators (for example, retail sales, inflation or jobless claims) will be watched for any tilt in the trajectory of growth and prices. China’s activity reports (trade figures and PMIs) will be closely followed for signs of momentum after recent policy easing.

On the policy front, speeches by Fed, ECB and BoE officials may shape market expectations, though no central bank meetings are scheduled. At this stage, with policies clearly signalled, we expect markets to remain relatively calm absent a surprising data upset. Investors will likely remain cautious but constructive, looking to positioning rather than new catalysts to drive short-term moves.