Safe-Haven Assets Explained: When Investors Flock to Gold, Yen, and USD

When markets start acting up or the headlines go full “crisis mode,” you’ll often hear investors shifting into so-called safe-haven assets. Gold, yen, and the dollar. But what exactly makes them “safe,” and why do people run to them when everything else feels like it’s falling apart?

What Are Safe-Haven Assets, Really?

Safe-haven assets are investments known to retain (or even increase) their value during market downturns. In other words, when most stocks or riskier assets are falling, these havens tend to hold steady or rise, providing a safe space for investors.

Now, there are plenty of options out there: gold, certain currencies, even government bonds. But for now, we’re focusing on the big three – gold, the Japanese yen, and the US dollar. They’ve earned their reputation over time. Some would even say they’ve been here before.

Gold: The Classic Safe Haven

Gold doesn’t pay interest. It doesn’t grow like a stock. And yet… people love it. Especially when things feel unstable. Why? Well, it’s real. You can hold it. It’s limited in supply, can’t be printed like paper money, and has been around long before the Nasdaq ever existed.

Investors often buy gold during economic turmoil, driving its price up when other markets are tanking. For example, in March 2023 gold surged past $2,000 an ounce for the first time in a year as banking sector turmoil sparked a rush to safety. This shiny metal tends to shine brightest when confidence in the broader market is shaky.

Japanese Yen: A Currency Refuge

The Japanese yen is a well-known safe-haven currency. The yen often rises when the world is in panic mode. Part of the reason is due to Japan’s political stability, large economy and its extremely low interest rates. Traders borrow yen cheaply, invest it elsewhere, and – when trouble hits – they pull their money back home. Fast.

That wave of money returning to Japan strengthens the yen. We saw this in late 2024, when geopolitical tensions flared. Investors moved into the yen, which jumped to its highest level in weeks as a typical risk-off reaction, not for profits, but for protection.

US Dollar: The Global Safe-Haven

The US dollar isn’t just any currency – it’s the world’s primary reserve currency and a default safe haven for many. Investors around the globe trust the dollar because it’s backed by the largest economy and deep financial markets. In times of crisis, there’s often a “cash is king” mentality where demand for the dollar surges. People flock to US dollars (and US Treasury bonds) seeking stability and liquidity, even if the turmoil started in the US itself.

In late 2024, even as global risks climbed, the US Dollar Index jumped to its highest point in a year. Was it because everything in America was perfect? No. But compared to the alternatives? It looked pretty solid.

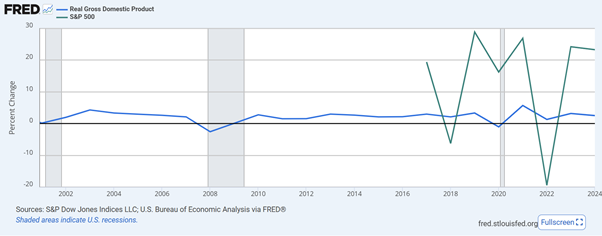

Safe-Haven Assets vs S&P 500: Feb-Apr 2023

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 17 July 2025.

Here’s how gold, the yen, and the dollar behaved during a recent bout of market stress. Notice how they moved in the opposite direction of riskier assets like the S&P 500.

Takeaway

Safe-haven assets aren’t about big returns. They’re about comfort, protection, and a bit of breathing room when markets get messy.

Gold. Yen. USD. Each plays its own role – and each one has proven its worth in different crises.

The bottom line: Understanding why money moves into gold, yen, and USD during trouble can help you appreciate how seasoned traders think about risk. They’re not foolproof or guaranteed to always go up, but these safe havens often act as a financial security blanket when the investing seas get stormy. Staying informed about how they behave gives you one more tool to navigate uncertain times.