Q4 2025 Market Recap, 2025 in Review, and 2026 Outlook

As 2025 drew to a close, markets continued to digest the after-effects of aggressive policy shifts in prior years. Q4 2025 didn’t bring new shocks but instead reinforced themes that had been building throughout the year. The quarter provided a moment of relative stability across asset classes, with monetary policy becoming clearer but fiscal constraints coming into sharper focus. This piece explores how Q4 played out across markets, what 2025 taught investors more broadly, and what 2026 may have in store – through a lens of cautious realism rather than bold forecasting.

Q4 2025 Market Recap

Macroeconomic Landscape

By Q4, the policy conversation had largely moved beyond peak-rate debates. Markets began pricing in modest rate cuts for 2026, particularly in the US and UK, as inflation slowed and economic data softened. Central banks turned more cautious, seeking to balance residual inflation concerns with growing signs of economic fatigue. However, fiscal constraints, notably in Europe and parts of the US, started to limit governments’ room for manoeuvre. This created a split-screen effect: monetary policy looked increasingly accommodative, while fiscal realities stayed tight. Bond markets reflected this shift, with UK gilts up 3.3% and US Treasuries gaining 0.9% in Q4, pricing in a more dovish 2026 outlook.

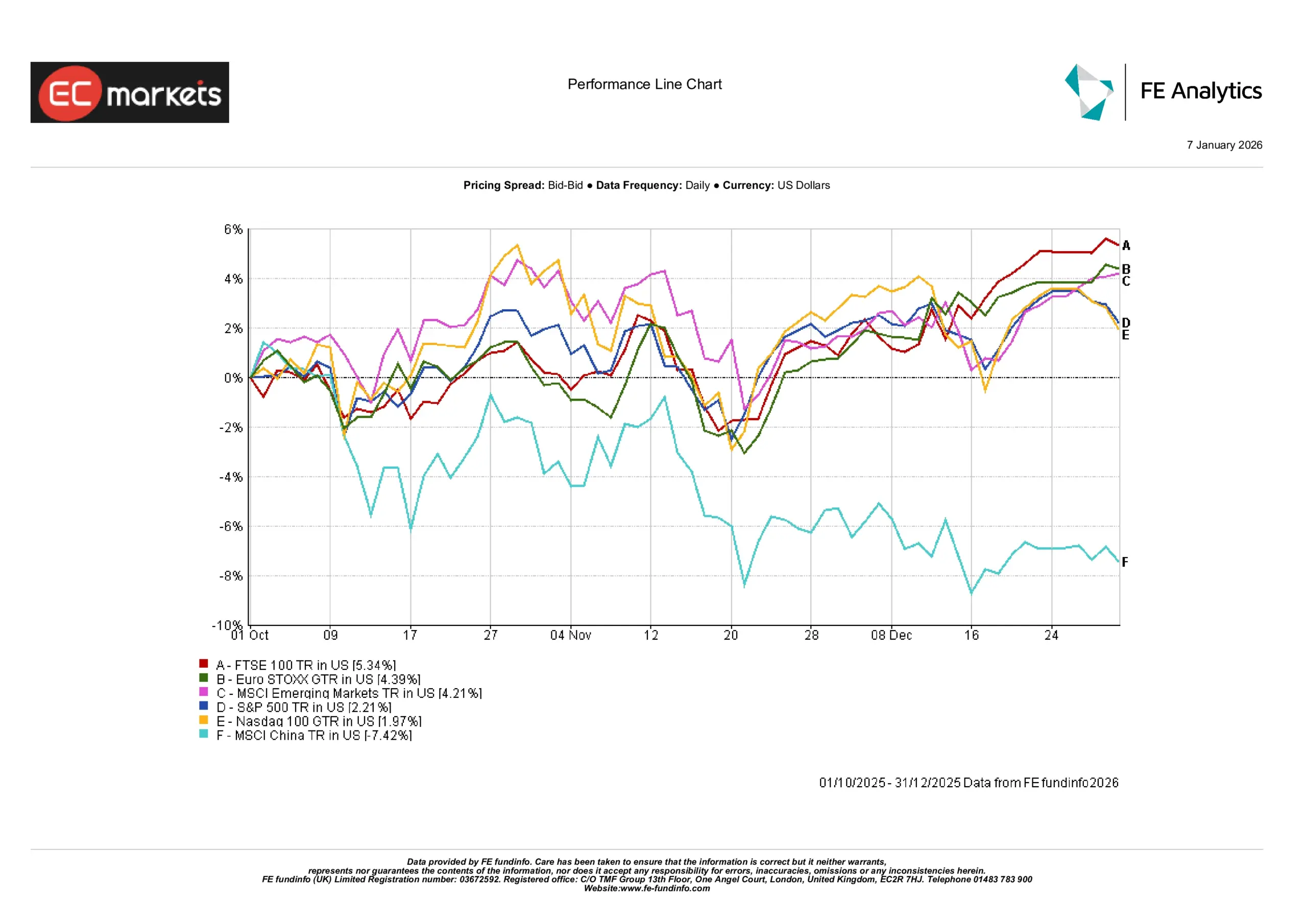

Equity Market Recap

Equity markets ended Q4 on a steadier footing, helped by growing expectations of rate cuts in 2026. The S&P 500 rose 2.2%, while the Nasdaq 100 added 2.0%, with gains more measured after a strong run earlier in the year. Europe fared slightly better, with the FTSE 100 up 5.3% and Euro STOXX rising 4.4%, supported by easing inflation. Emerging markets posted a 4.2% gain, but MSCI China fell 7.4% as recovery hopes faded. Overall, the quarter rewarded resilience but left questions around leadership and the durability of recent trends.

Q4 2025 Index Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 December 2025.

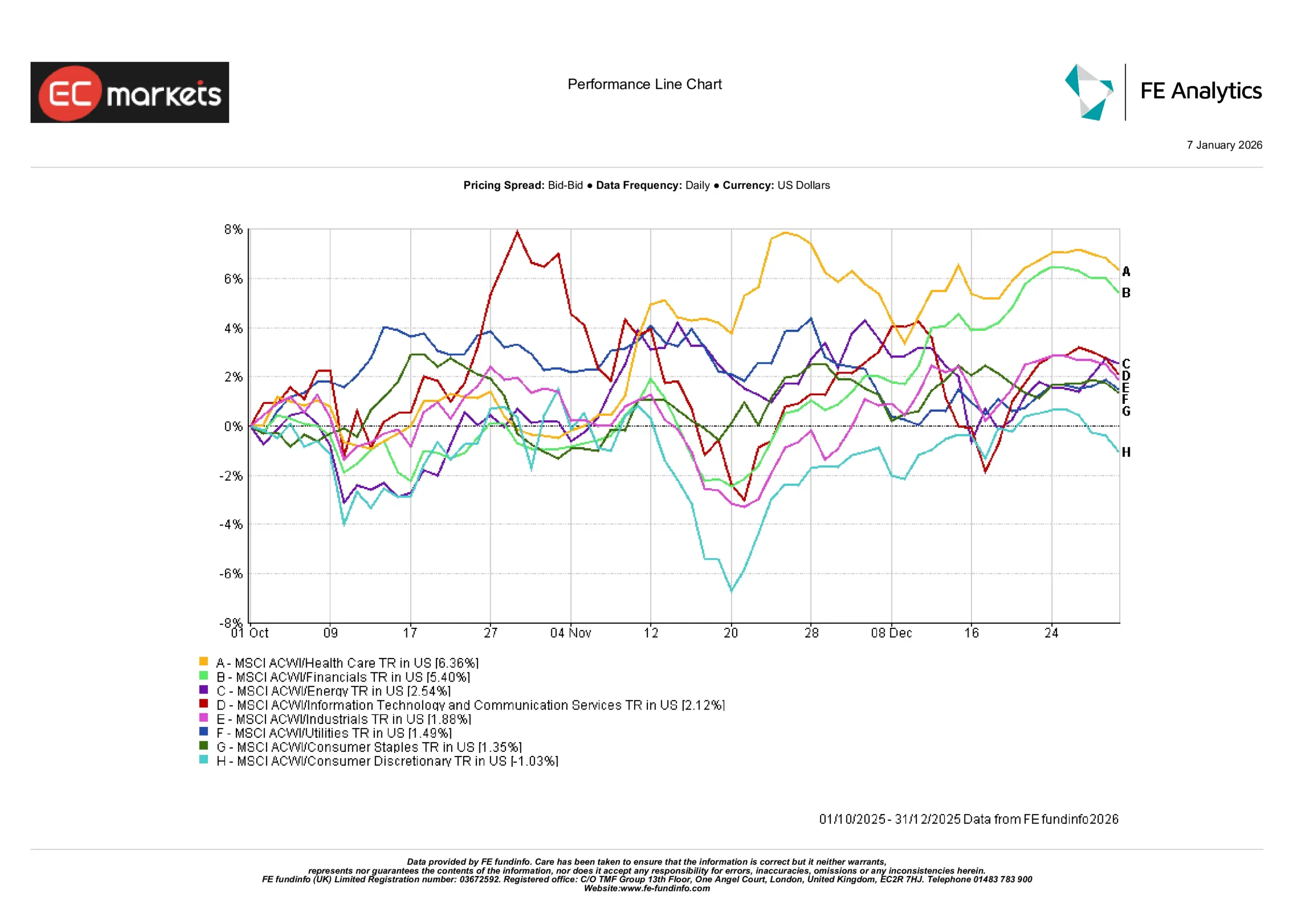

Sector Performance

Sector performance remained uneven in Q4. Health care and financials led with gains of 6.4% and 5.4%, reflecting defensive quality and improving margins. Technology and communication services posted moderate returns, while consumer discretionary was the only sector to decline, down 1.0%. Utilities and staples ended slightly positive, suggesting a cautious rotation rather than a clear leadership shift. Market breadth concerns persisted, with gains still concentrated among large-cap names.

Q4 2025 Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 December 2025.

Fixed Income

Q4 provided a more stable environment for bonds. Government bond returns were mixed: UK gilts outperformed with a 3.3% return, while US Treasuries posted a more modest 0.9% gain. German and Japanese bonds were negative for the quarter, reflecting differing inflation paths and central bank postures.

This divergence confirmed that fixed income had returned as a stabilising asset class, but one that demanded selectivity. Investors were no longer buying duration indiscriminately. Instead, performance hinged on national policy credibility and inflation differentials.

Fixed Income Government Bond Returns

Source: Bloomberg, LSEG Datastream, J.P. Morgan Asset Management. All indices are Bloomberg benchmark government indices. Total returns are shown in local currency, except for global, which is in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 December 2025.

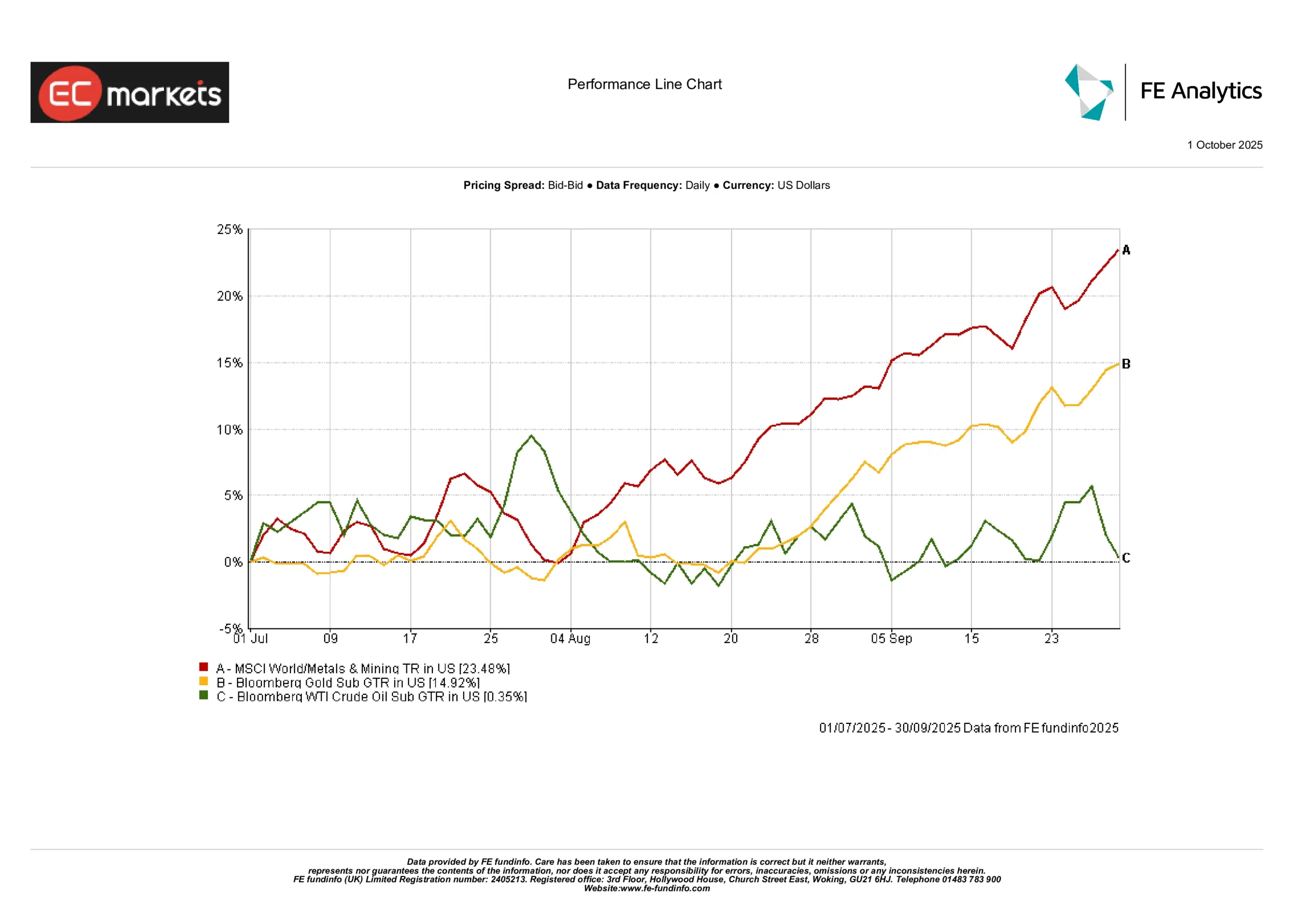

Commodities and Currencies

Commodities were more active than headlines suggested. Gold climbed 4.9% in Q4, offering stability as rate expectations softened. Industrial metals surged, with the MSCI World Metals & Mining index up 23.5%, driven by hopes of a global manufacturing pickup and strategic stockpiling. In contrast, oil remained rangebound, WTI crude rose just 0.4%, as geopolitical tensions offset tepid demand. The mixed performance highlighted diverging drivers: precious metals responded to policy signals, while energy and base metals tracked sentiment and supply dynamics.

Q4 2025 Commodity Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 December 2025.

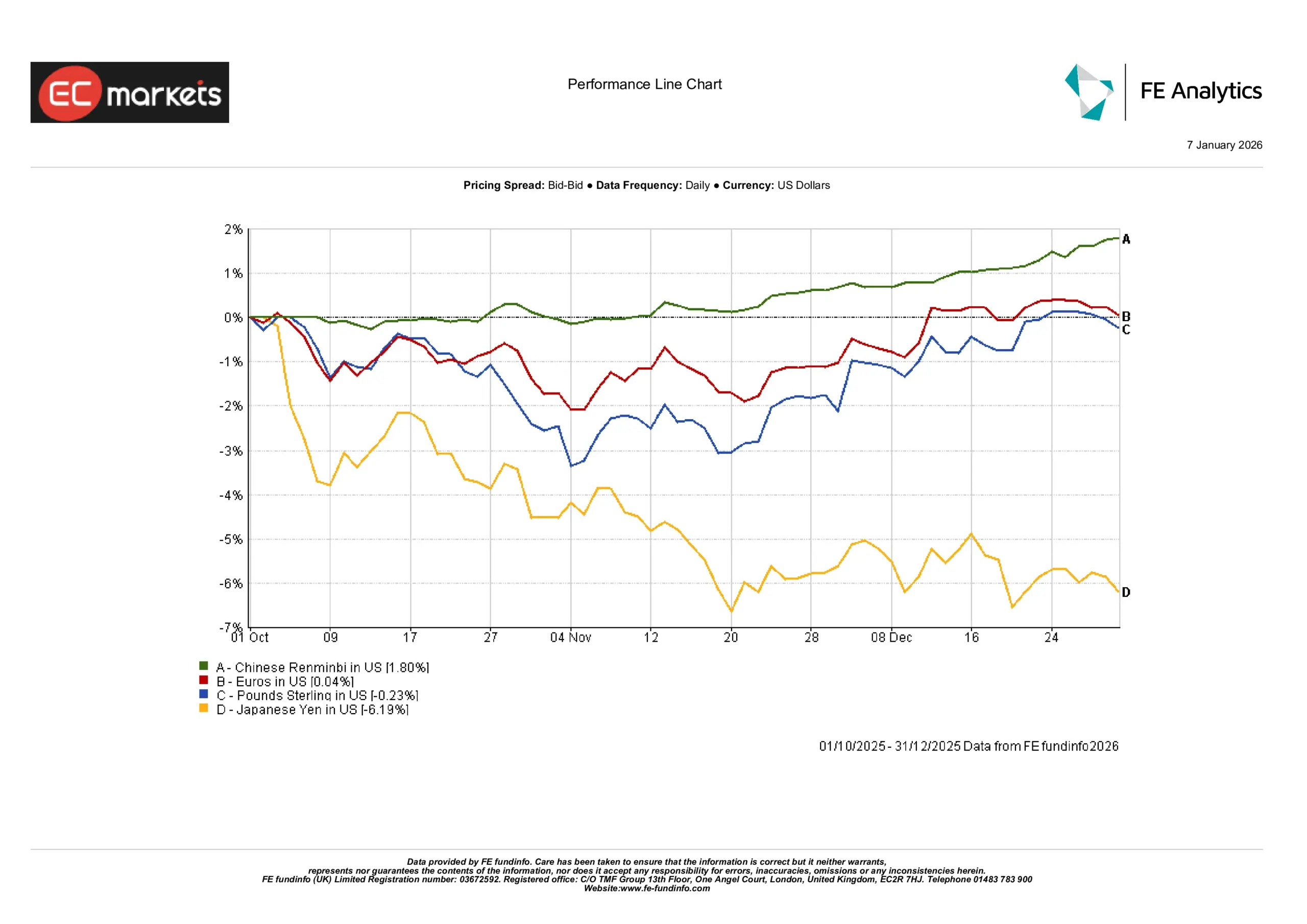

Currency moves diverged in Q4. The US dollar was largely stable against the euro and pound, with EUR/USD flat and GBP/USD down 0.2%. The Chinese renminbi strengthened 1.8%, supported by capital inflows and policy stabilization. In contrast, the Japanese yen weakened significantly, falling over 6% as yield differentials widened. Overall, emerging market currencies showed resilience, while developed market FX reflected differing rate expectations and macro dynamics.

Q4 2025 Currency Dynamics

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 December 2025.

2025 in Review: A Year of Selective Recovery

2025 was a year of gradual stabilisation, not a full recovery. Several major themes defined the market environment.

Policy Normalisation Without Stimulus

Unlike prior easing cycles, 2025 did not come with fresh stimulus. Rate cuts were limited or merely anticipated, and fiscal space remained constrained. This created an environment where investors had to rely more on organic earnings and cash flow than on external boosts.

Equity Leadership Remained Narrow

While global equity indices ended higher on the year, gains were concentrated. The US market outperformed, driven largely by the technology sector. European and emerging markets lagged. According to the index chart, the Nasdaq 100 outpaced other major benchmarks, while MSCI China ended the year flat to negative.

Fixed Income Made a Comeback

After two years of losses, 2025 marked a turning point for bonds. Global government bonds delivered a 7.0% annual return, with US Treasuries close behind. UK gilts also posted strong full-year numbers. However, core European and Japanese bonds remained weak. This showed that while income returned, capital appreciation was far from uniform.

Real Assets Stayed Relevant

Commodities and infrastructure continued to attract long-term interest. Despite a lack of strong price momentum, assets linked to energy security, defence, and supply chains maintained a structural bid. This reflected broader themes around strategic resilience.

Volatility Driven by Policy, Not Data

Policy announcements, not economic prints, moved markets. Investors became more attuned to regulatory, fiscal, and electoral developments than to quarterly GDP or inflation surprises. This shift in focus underlined the role of politics in market volatility.

Looking Ahead to 2026: Aftershocks and Adjustments

Heading into 2026, many prior assumptions no longer hold. Markets are not bracing for major stimulus, and investors are less focused on peak inflation or rate hikes. Instead, attention is turning to how higher rates filter through balance sheets and financial systems.

Higher Rates Take Time to Bite

Borrowing costs have stayed elevated long enough to affect household spending, corporate margins, and government budgets. But these effects are uneven and delayed. 2026 may reveal more of this slow-burn stress, particularly in areas like commercial property, small-cap credit, and leveraged sectors.

Balance Sheets Over Growth

Markets are likely to reward companies that show cash flow discipline and debt control. With less support from monetary policy, fundamentals matter more. This shift could favour quality over momentum and resilience over speed.

Debt Now Limits Policy Options

Years of accumulated debt are becoming harder to ignore. As refinancing costs rise, fiscal flexibility shrinks. This matters for both public investment plans and the ability to cushion economic shocks.

Will Market Breadth Improve?

One open question is whether equity market strength broadens or remains reliant on a few leaders. A more diversified rally would support long-term portfolio resilience. A concentrated one increases fragility.

Structural Themes Stay in Focus

Energy transition, defence, and infrastructure remain multi-year investment themes. Their appeal is less about quarterly data and more about long-range commitments.

Geopolitics and Elections Bring Volatility

With major elections looming in 2026, policy signals may dominate headlines and market reaction. Political volatility, rather than economic surprise, may become the key short-term risk driver.

Conclusion: A Year for Selectivity and Patience

2026 doesn’t look like the start of a new bull cycle. Nor does it resemble the crisis periods of recent memory. Instead, it sits in the middle: a year shaped by the echo of past policy moves, the limits of debt tolerance, and the need for careful positioning.

Investors who focus on balance, diversification, and cash flow are more likely to navigate this environment successfully. 2025 reminded markets that progress can be uneven, and that discipline often matters more than boldness. As we head into 2026, that lesson remains timely.

Sometimes the most important shifts are the quiet ones.