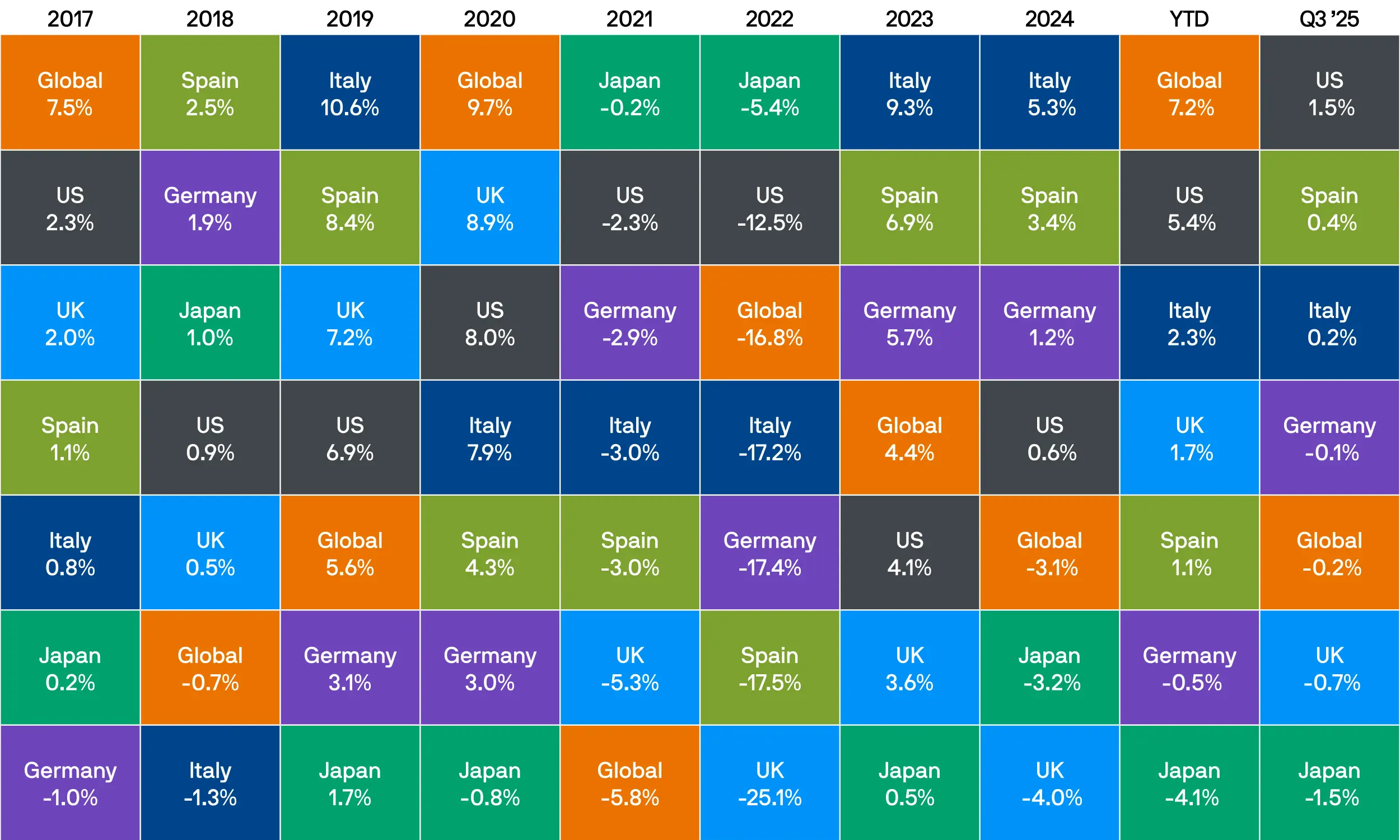

Q3 2025 – Global Market Update & Outlook

In Q3 markets pivoted sharply on policy divergence. The Fed signalled an imminent easing cycle, while many governments moved toward fiscal restraint. Growth and employment weakened enough in the US to prompt a late-September rate cut, even as fiscal policy pulled back. Investors shrugged off earlier trade-war fears and “basked in a steamy summer market melt-up”: equities surged to record highs, technology and cyclicals led the rally, and safe havens like gold jumped. The quarter’s surprise was how markets cheered easier money amid retrenchment in public spending.

In this article, we dissect the diverging policy backdrop in the US, Europe and Asia/EM, summarize Q3 cross-asset returns, and outline the positioning going into Q4.

Macroeconomic Landscape

United States: Growth and inflation cooled through Q3, with GDP and job gains slowing after the summer. By mid-September the Fed noted “growth of economic activity moderated…job gains have slowed.” With unemployment edging higher and inflation still above target, the FOMC delivered its first cut since early 2024, lowering rates by 25bp to 4.00-4.25%. Chair Powell stressed downside risks to employment and reaffirmed the 2% inflation goal, leaving room for further easing. Fiscal policy, however, is no longer supportive. The US mix has shifted toward monetary easing against fiscal drag.

Europe: The euro area remains subdued, with ECB forecasts showing 2025 GDP growth at 1.2% and inflation at 2.1%. In September the ECB held its deposit rate at 2.00%, keeping a data-dependent stance. On the fiscal side, governments are consolidating: the IMF warned of the need for quality tightening in 2025 and beyond. Growth in Q3 was flat, with industry and services stable but household demand soft.

Asia & EM: Policy responses varied. China eased with rate and reserve-requirement cuts worth ~1 trillion yuan but stayed cautious given property risks. Japan remains stuck with inflation above target but weak growth, leaving the BOJ on hold after its April hike. India cut rates 100bp by mid-2025 then paused, with tax cuts supporting demand.

Overall, monetary policy is loosening globally, but fiscal stances diverge: advanced economies are consolidating while many emerging markets continue stimulus.

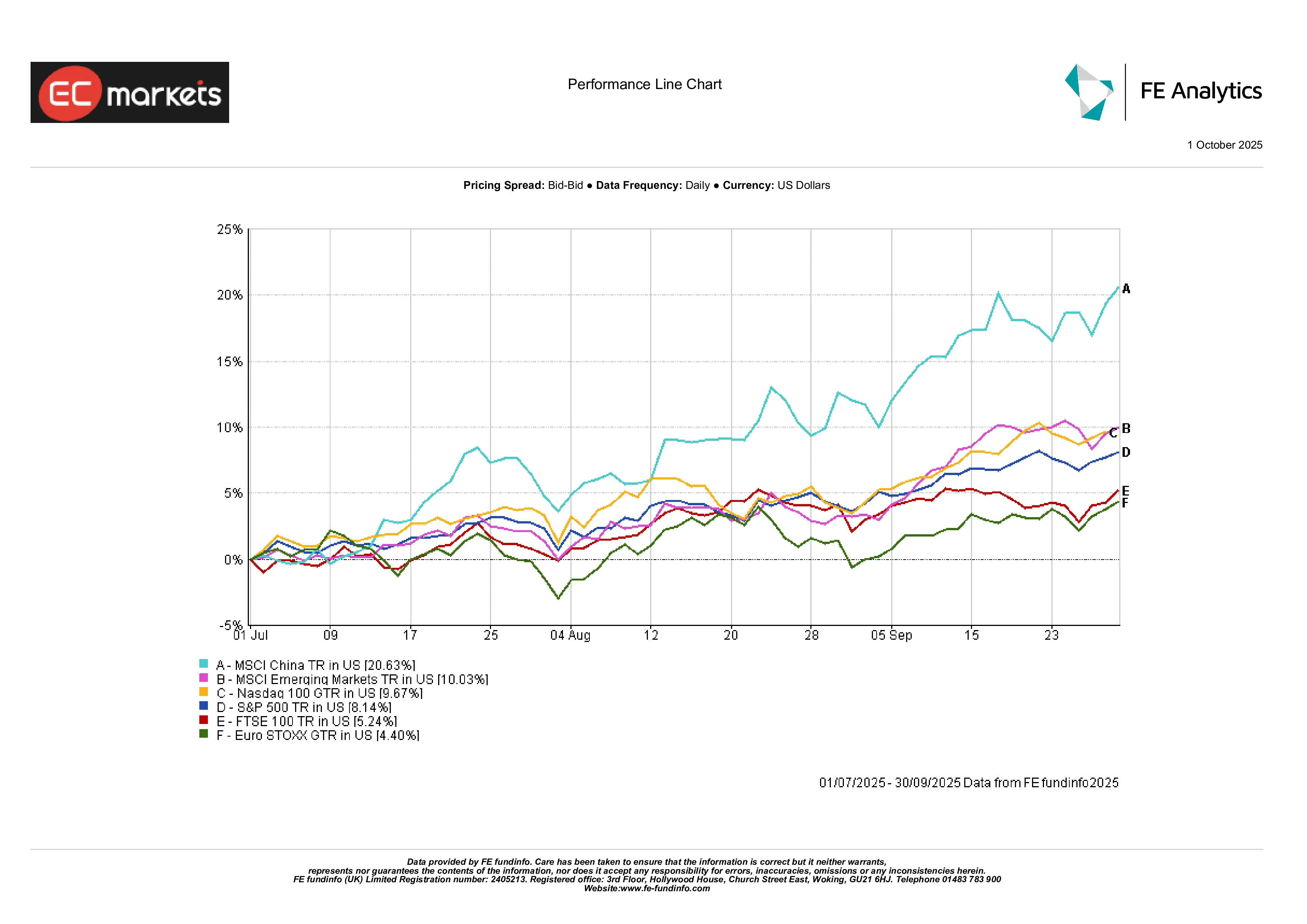

Equity Market Recap: Risk Back On, but Selectively

United States: US equities powered higher in Q3, with the S&P 500 gaining 8.14% and the Nasdaq-100 up 9.67%. Unlike the blanket rallies of past years, this move was selective. Megacap tech again led the charge, but the key was earnings delivery. Companies that paired AI exposure with solid balance sheets were rewarded, while speculative growth lagged. The Fed’s late-September rate cut added fuel, helping indices close the quarter near record highs.

Europe: European equities posted steady but more modest gains. The Euro Stoxx returned 4.40% in USD terms, while the FTSE 100 rose 5.24%. Supportive ECB messaging and disinflation underpinned sentiment, but leadership here was about rotation rather than tech. Financials and industrials outperformed as yield curves steepened and fiscal support lingered in Germany and France.

Asia & EM: Asia stole the spotlight. MSCI China surged 20.63% as Beijing rolled out measured easing and sentiment improved. The broader MSCI EM Index rose 10.03%, buoyed by strong performance across Asia and Latin America. Korea and Taiwan benefited from the semiconductor cycle, while India paused after its earlier run-up as valuations caught up with fundamentals. The message was clear: policy support and relative growth momentum drew capital back into emerging markets, with China’s rebound the standout.

Q3 2025 Index Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 June 2025.

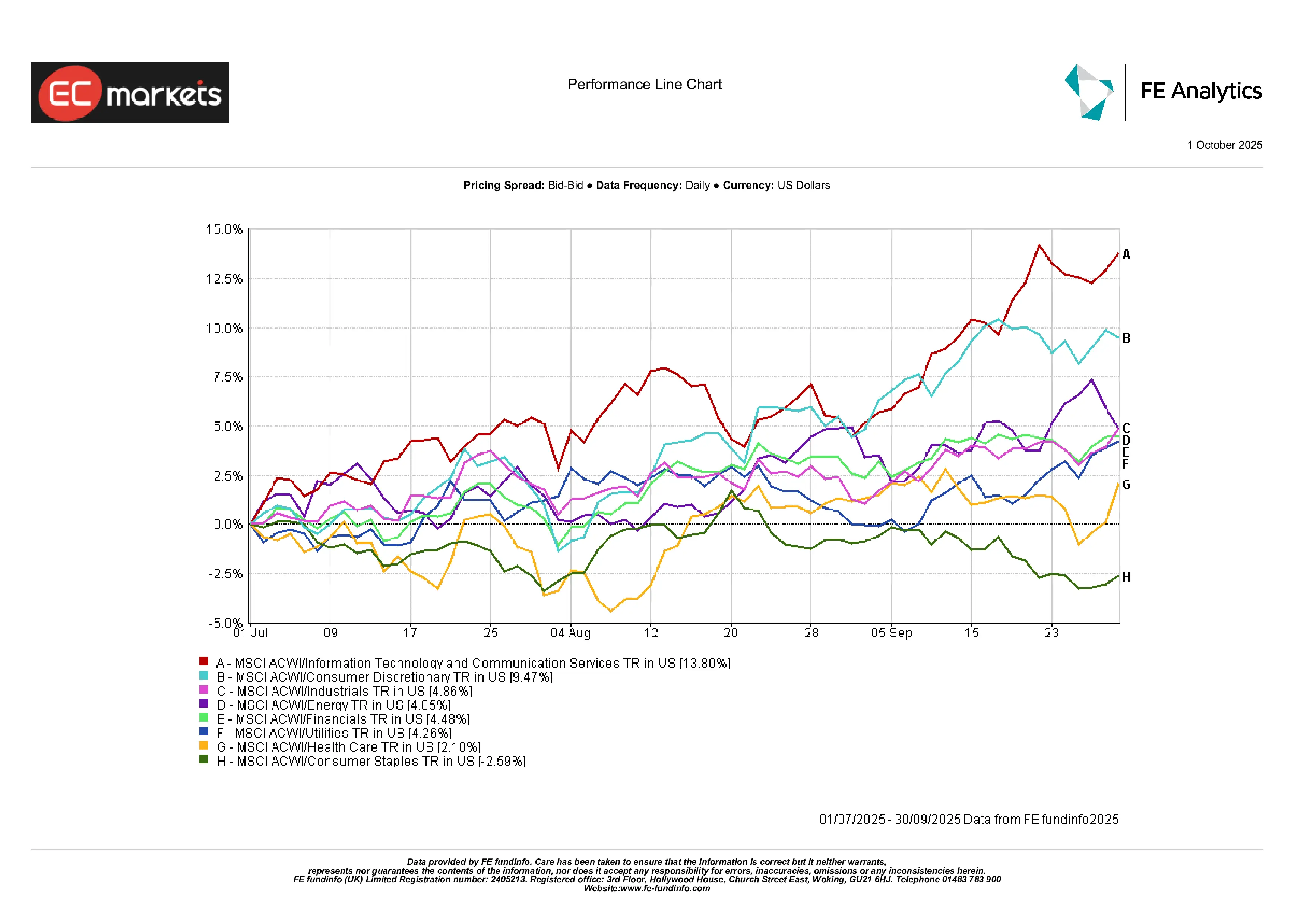

Sector Rotation and Market Themes

Growth Leads Again: Q3 saw growth sectors firmly back in charge. Technology and communications services surged, with global ACWI benchmarks showing gains of +13.8% across the space. Companies with strong earnings delivery drew the bulk of investor attention. By contrast, speculative growth names without clear cash flow support trailed behind.

Consumer & Cyclicals Benefit: Consumer discretionary rose 9.5% as resilient spending and solid retail earnings underpinned confidence. Industrials and energy each added around 5%, supported by infrastructure momentum, higher commodity demand, and steadier oil prices. Financials also advanced ~4-5%, with banks benefiting from healthier loan demand and stabilising yields, particularly in Europe.

Defensives Lag: Utilities and healthcare posted only modest gains (~4%), while consumer staples slipped into negative territory (-2.6%). With central banks turning dovish and real yields easing, the appeal of “bond proxy” defensives waned. Investors rotated decisively toward higher-beta exposures, leaving traditionally safe sectors behind.

Q3 2025 Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 June 2025.

Fixed Income: Back in the Game

After a brutal 2024, bonds are quietly making a comeback. Treasury yields fell from their April highs, credit spreads tightened, and returns turned positive across the board. Investment-grade credit returned over 4% for the quarter, high yield added 3.6%, and global bonds regained their traditional role: diversification and income.

The biggest change was sentiment. After Q1’s wobble, investors began to believe again in the defensive properties of fixed income. Emerging market debt also posted solid gains – local rates declined, and FX appreciation added to returns.

Fixed Income Government Bond Returns

Source: Bloomberg, LSEG Datastream, J.P. Morgan Asset Management. All indices are Bloomberg benchmark government indices. Total returns are shown in local currency, except for global, which is in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 September 2025.

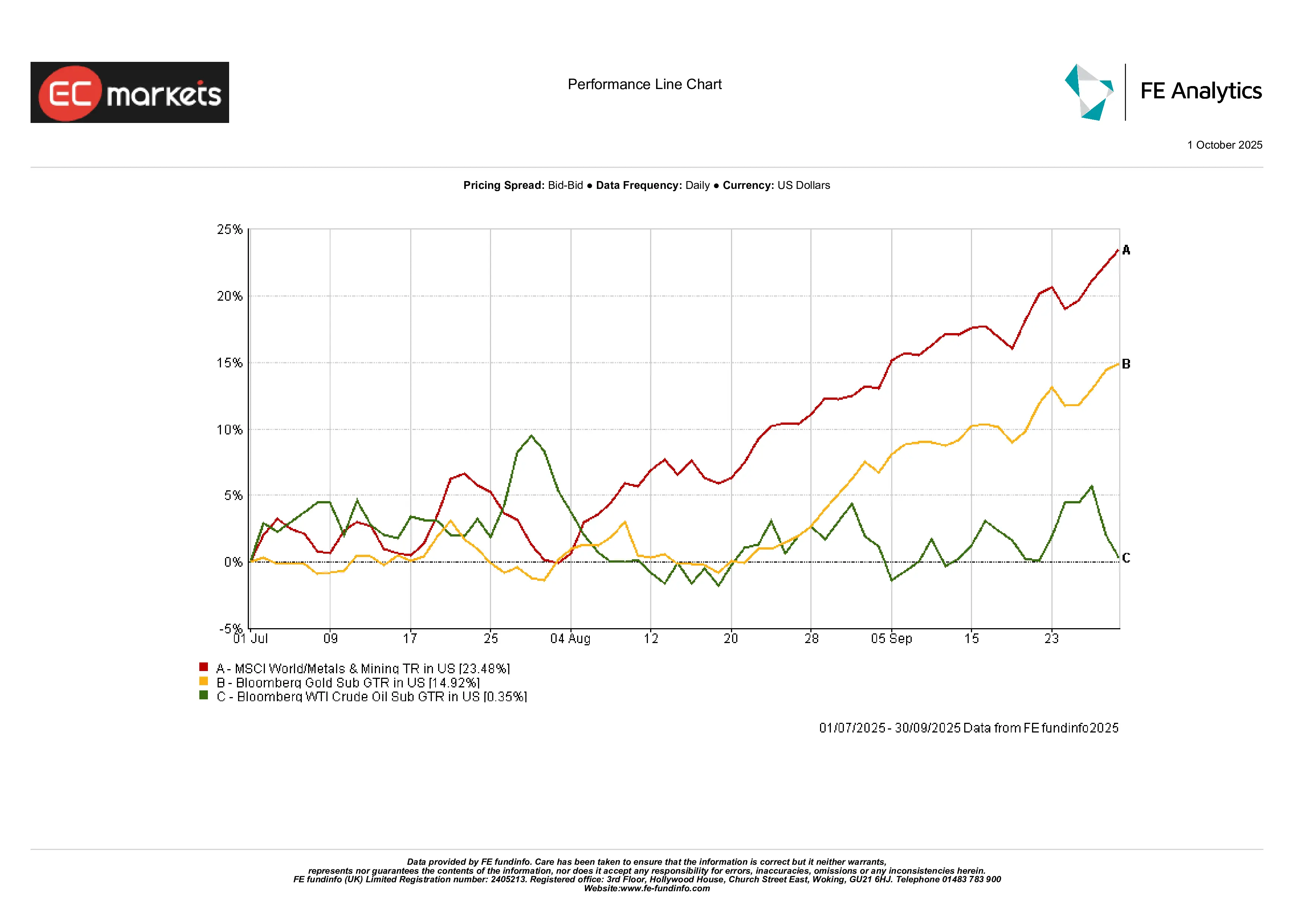

Commodities and Currencies: Gold Shines Oil Slips

Precious Metals Shine: Gold was the clear standout in Q3, rising nearly 15% to fresh all-time highs as falling real yields, a dovish Fed pivot, and continued central bank demand boosted safe-haven flows. Silver outperformed even further, with prices nearly tripling over the quarter. The combination of monetary easing and geopolitical unease made precious metals one of the few assets to rally alongside both equities and bonds.

Energy Flatlines, Industrials Surge: Oil finished the quarter broadly unchanged after earlier volatility. A balanced mix of OPEC+ rhetoric, stable supply, and softer demand expectations left WTI range-bound. By contrast, industrial metals delivered explosive gains, with the MSCI World Metals & Mining Index jumping over 23%. Infrastructure stimulus, re-shoring, and Chinese policy support drove the rally, underscoring strong cyclical demand.

Q3 2025 Commodity Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 June 2025.

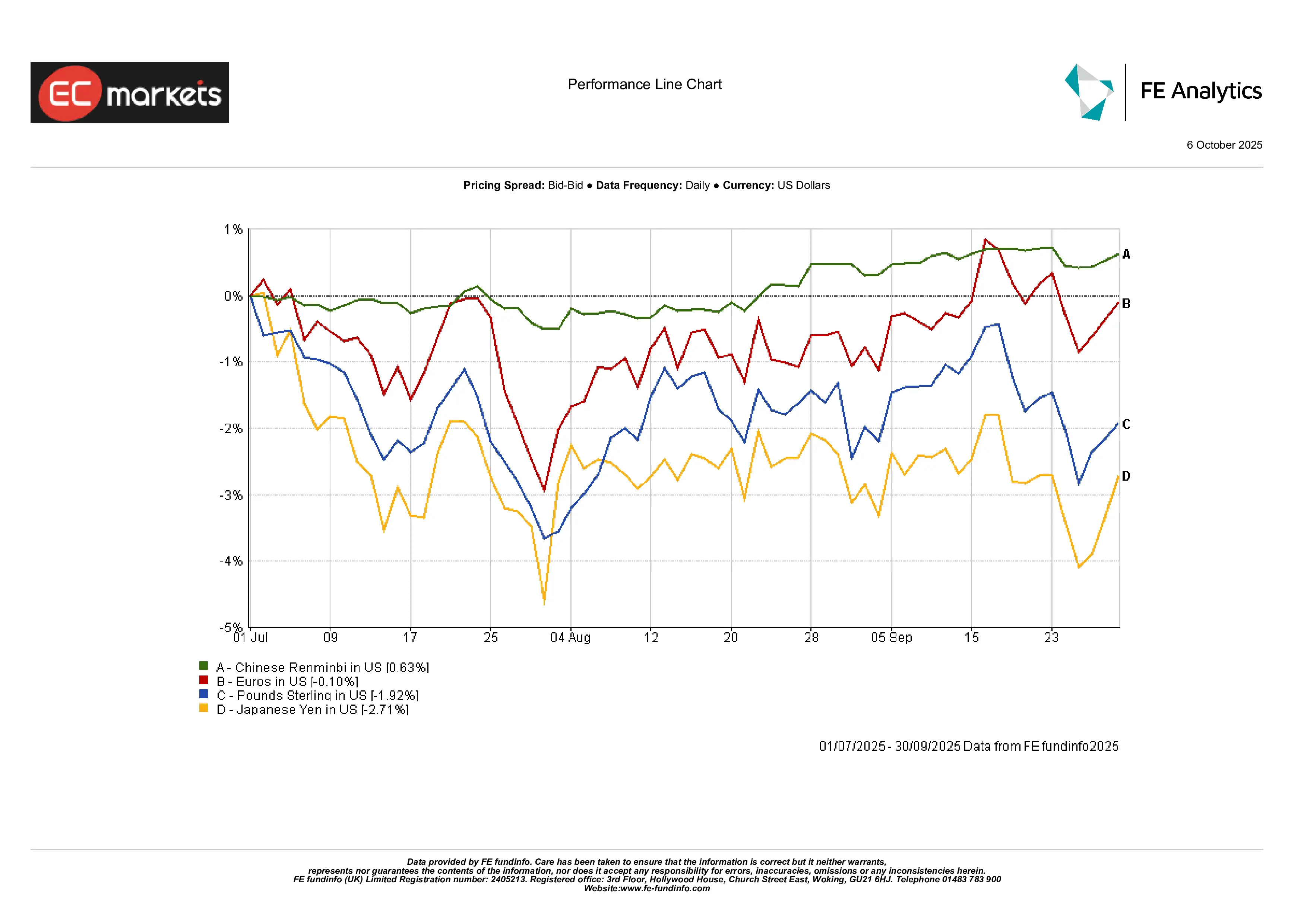

FX Moves Modest but Divergent: Currency shifts were more measured. The US dollar firmed slightly, though gains were concentrated against the yen, which fell 2.7% as carry trades stayed dominant. The euro was flat, while sterling lost nearly 2% on dovish BOE signals. The Chinese yuan stabilised with a modest 0.6% gain, reflecting policy credibility. Emerging-market currencies were broadly stronger, helped by capital inflows and the appeal of higher real yields.

Q3 2025 Currency Dynamics

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 June 2025.

Outlook and Positioning

Heading into Q4, markets will balance expectations of Fed easing against fiscal and political headwinds. In the US, investors are now pricing in several more Fed cuts this year (the futures market and analysts had pushed total cuts to ~75bp by year-end). However, fiscal risks are rising: Congress faces funding deadlines and the Treasury will issue significant new debt. In Europe, ECB policymakers will watch core inflation and German fiscal plans before acting. Geopolitical and event risks loom: potential US government shutdowns, new tariffs, China’s upcoming five-year plan, and elections could all roil markets. Given the rally to date, positioning may be cautious. Investors might favor high-quality growth sectors in the near term, but they remain alert to a potential rotation toward value or more defensive assets if earnings forecasts come down. With interest rates near multi-decade highs in some markets, credit investors will watch spreads closely. In short, the late-2025 environment is likely to be one of careful navigation: a Fed easing cycle still lies ahead, but fiscal “brakes” are being applied and any policy surprise could prompt renewed volatility.

Conclusion

Q3 2025 ended on a markedly different note from the stormy first half. The Fed’s late-quarter rate cut was the headline pivot, sharply changing market sentiment. This dovish turn – in stark contrast to the more cautious fiscal outlook globally – helped power a broad rally. Equity markets reached new highs, led by tech and cyclicals, while gold and other safe havens also jumped. Yet the calm mask of this “melt-up” hides important caveats. Valuations are elevated (note that only ten firms now represent ~40% of the S&P 500 value) and policy divergences are large. The central lesson is that monetary and fiscal policies are pulling in opposite directions: loose money is supporting risk assets for now, but fiscal tightening and geopolitical friction could strain that backdrop.

Looking ahead, it’s important to stay mindful. The market welcomed the Fed’s rate cut, but the bigger picture is still mixed. Government spending is tightening, global risks are still around, and prices remain high in many places.

The main message from this quarter is balance. Confidence is back, but so are the challenges. As we move into the next few months, it’s about staying steady – being open to new opportunities while keeping an eye on the limits of how much support the economy can get.