Global Markets Rebound as Rate-Cut Optimism Returns | Weekly Recap: 24-28 November 2025

Economic & Macro Overview

Markets ended the final week of November on firmer footing as investors priced in a growing likelihood of a Federal Reserve rate cut at the December 9-10 meeting. Softer US data following the post-shutdown backlog and easing Treasury yields helped shift sentiment toward a more dovish outlook.

In Europe, sentiment improved early in the week as inflation continued to drift lower, while investors awaited December’s ECB communication. Meanwhile, geopolitical tone remained calm, and diplomatic progress around Ukraine supported broader risk appetite.

Asia saw diverging dynamics. Japan gained attention after Bank of Japan Governor Kazuo Ueda signalled the BOJ would consider the “pros and cons” of a rate hike at its December 18-19 meeting, pushing the yen and JGB yields higher. China remained subdued, with investors awaiting fresh PMI data and monitoring continued property-sector softness.

Overall, the macro backdrop skewed cautiously risk-on, with improving expectations for policy easing and steadier global data.

Equities, Bonds & Commodities

US equity markets delivered a strong rebound. The S&P 500 gained 3.7% (its best Thanksgiving-week performance since 2008), the Nasdaq rose 4.9%, and the Dow added 3.2% (~289 points). Small caps outperformed sharply, with the Russell 2000 up 5.5%, supported by falling yields and rate-cut expectations. European equities were more muted; the STOXX 600 ended the week broadly flat after mid-week optimism faded. Asia delivered mixed results, with Japan modestly higher and China subdued.

Bond markets strengthened as yields fell. The US 10-year Treasury eased toward the 4% mark, reflecting cooling data and rising rate-cut expectations. Credit spreads tightened modestly as risk appetite improved.

Gold prices steadied after hitting a six-week high early in the week. Spot gold rose to $4,235.59/oz, while silver touched a record high of $57.86 before settling near $56.99. Oil prices remained stable ahead of the OPEC+ meeting, with traders awaiting clarity on supply guidance.

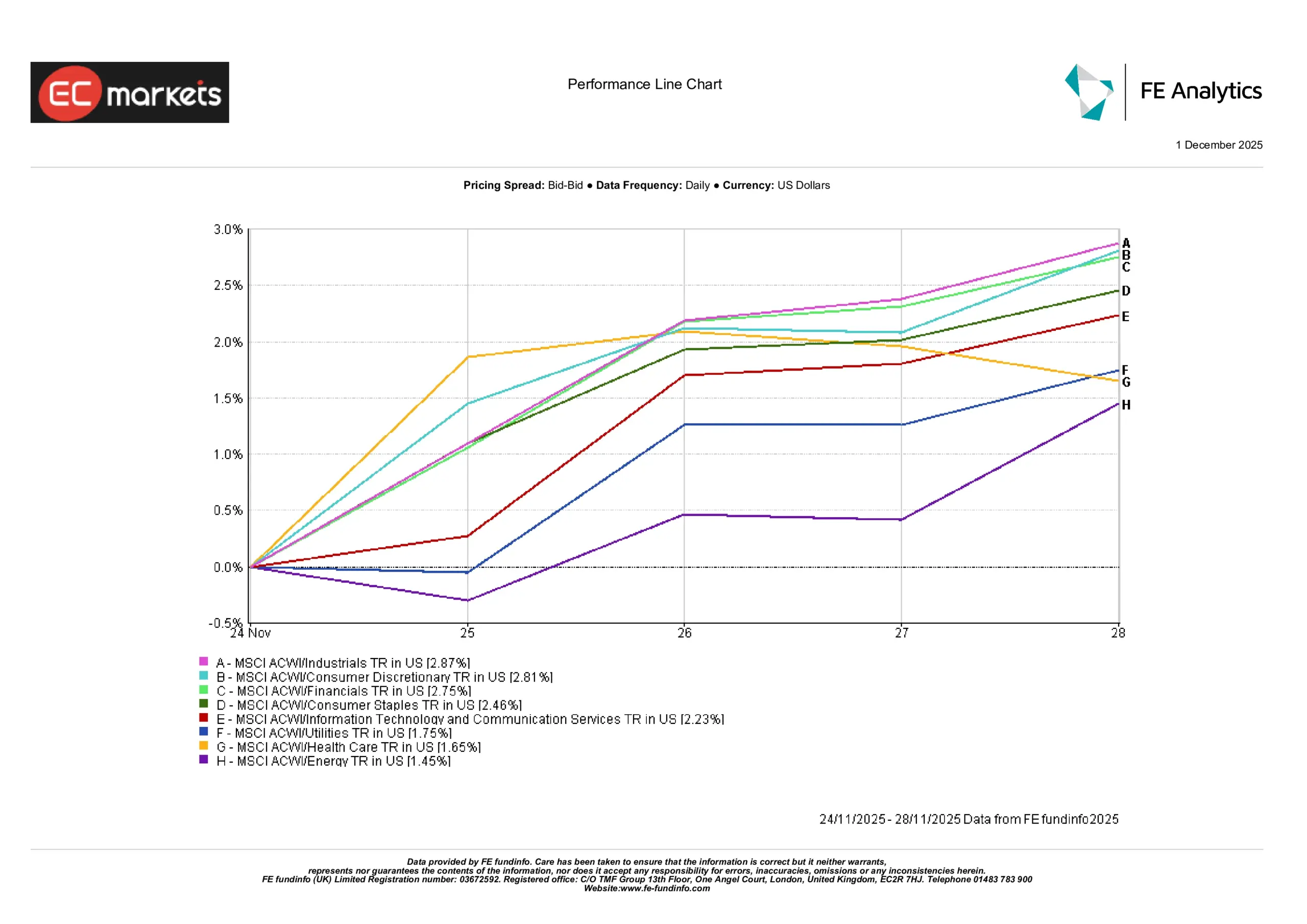

Sector Performance

Sector leadership tilted toward defensive and income-oriented names, though gains were broad across the board. As per the MSCI ACWI sectors, industrials led the week, rising 2.87%, followed closely by consumer discretionary (+2.81%) and financials (+2.75%). Consumer staples also delivered a solid 2.46% gain, while technology and communication services advanced 2.23%.

Utilities rose 1.75%, with healthcare up 1.65%, while energy lagged comparatively but still posted a positive 1.45%. Overall, the data show a clear improvement in risk appetite, with cyclical and growth-sensitive sectors rebounding alongside continued interest in defensives.

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of December 1st, 2025.

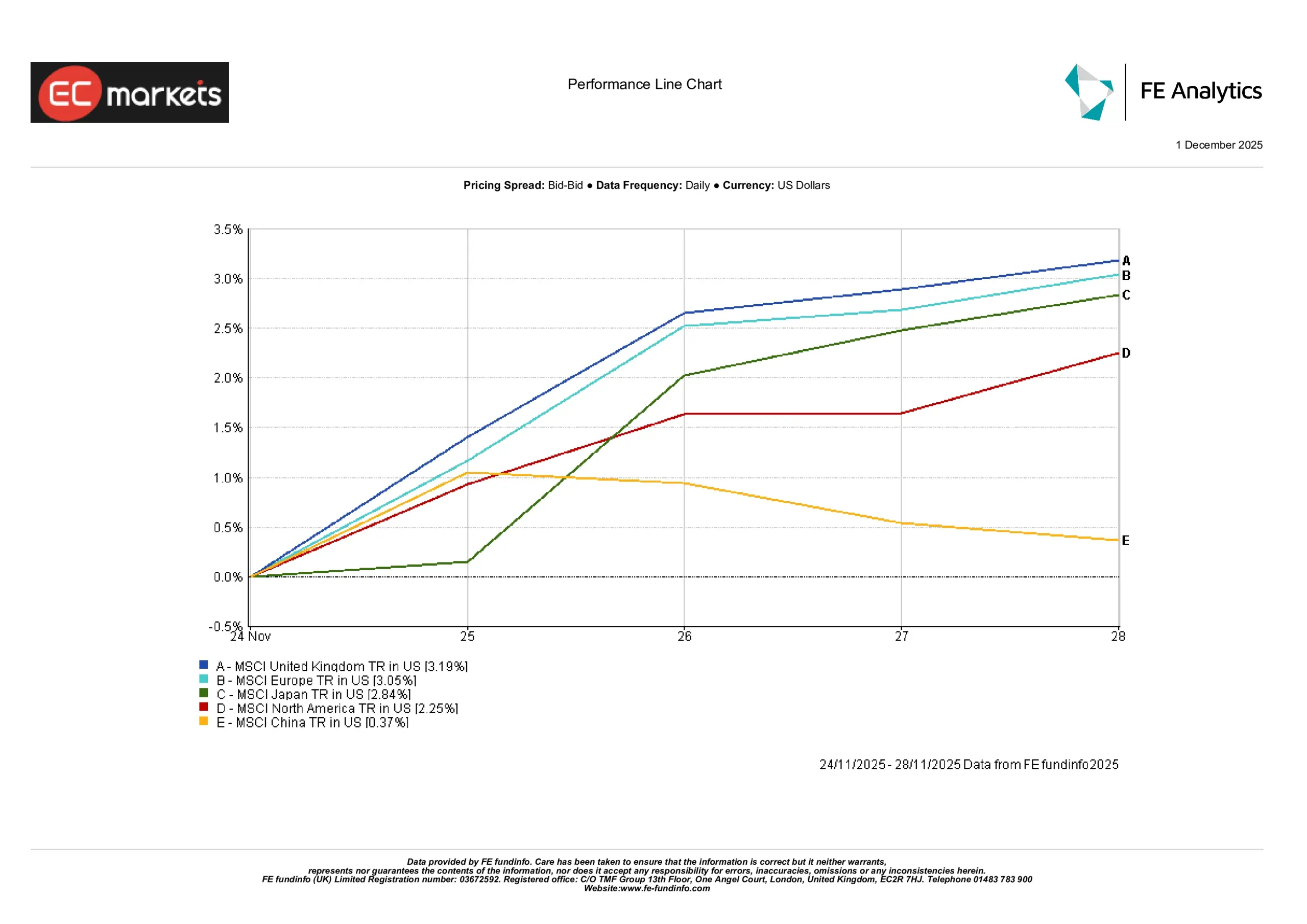

Regional Markets

Regional performance was broadly positive last week. The MSCI UK led gains, rising 3.19%, supported by stronger risk appetite and easing gilt yields. MSCI Europe followed with a 3.05% increase, despite softer industrial data across the region. Japan also advanced, with the MSCI Japan up 2.84%, helped by yen movements and firmer BOJ policy expectations. In North America, the MSCI North America added 2.25%, driven by improving macro sentiment and falling Treasury yields. Meanwhile, the MSCI China rose only 0.37%, reflecting ongoing weakness in domestic demand and cautious investor positioning.

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of December 1st, 2025.

Currency Markets

The US dollar headed for its worst weekly performance since late July, as traders increased bets on a December Fed rate cut. The dollar index slipped roughly 0.6% over the week despite a late-Friday recovery. The greenback briefly weakened to two-week lows as labour-market softness fed into dovish expectations.

A notable disruption occurred mid-week, when a cooling issue at CME Group’s CyrusOne data centres halted currency and futures trading for over 11 hours, though markets remained largely unfazed once trading resumed in thin post-Thanksgiving conditions.

The euro traded near $1.1585, the yen firmed slightly to around ¥156.25 per dollar, and sterling hovered around $1.3211, heading for its best weekly performance since early August. The Canadian dollar strengthened, buoyed by stronger-than-expected Q3 GDP data.

Cryptocurrencies also firmed, with bitcoin rising around 1.4% to $92,680.

Outlook & The Week Ahead

Attention now shifts to November PMIs, delayed US data (including manufacturing, services and employment indicators), and Eurozone inflation prints. The release of the Fed’s preferred inflation gauge, Core PCE, will likely be the key determinant of market direction ahead of the mid-December FOMC meeting.

With rate expectations increasingly dovish and global economic data remaining mixed, markets may experience elevated volatility as investors reassess macro trends heading into year-end.