FX Account Opening Guide | Comparing the Pros and Cons of Domestic and Overseas Brokers

As of 2025, FX accounts available to individual investors are broadly divided into “domestic” and “overseas.” The choice between the two significantly affects leverage limits, tax rates, and fund protection mechanisms — making your initial decision a key factor in future performance. This guide explores both options in depth, offering concrete insights to help you find the ideal trading environment.

1. Domestic FX Accounts — Strong Regulation and Low Costs

- Leverage limited to 25x

The Financial Services Agency (FSA) requires a minimum margin ratio of 4%, effectively capping leverage at 25x. This regulation aims to curb excessive speculation and minimize collapse risk during market volatility. - Client funds segregated under trust protection

All brokers are required to segregate client funds with trust banks. Even in the event of bankruptcy, funds are returned in full under this system. - Flat tax rate of 20.315%

Taxed separately from other income, with losses carried forward for up to three years — allowing for efficient tax planning. - Tight spreads and Japanese-language support

Low trading costs (e.g., USD/JPY at around 0.2 pips). Brokers also offer robust educational content and support in Japanese, including phone consultations.

Disadvantages:

- Lower leverage limit

- Fewer deposit/opening bonuses

- No negative balance protection — additional margin may be required during extreme volatility

2. Overseas FX Accounts — High Flexibility and Attractive Bonuses

- High leverage (up to 1000–2000x)

Maximizes capital efficiency, enabling even small investors to aim for significant returns in a short period. - Negative balance protection

Brokers reset negative balances, eliminating debt risk — a major psychological relief for many traders. - Account opening and deposit bonuses

Many brokers offer trading credits worth thousands to tens of thousands of yen just for opening or funding an account, making it easier for beginners with limited capital to get started.

Disadvantages:

- No mandatory trust protection — safety varies greatly depending on the strength of the broker’s license

- Profits are taxed as ordinary income, meaning higher earners may face tax rates of up to 55%

- Quality of Japanese-language support and withdrawal speed vary widely among brokers

3. Understanding Regulations and Licenses

| Main Regulators | Features | Languages Supported |

| FSA (Japan) | 25x leverage cap, mandatory trust protection | Japanese |

| FCA (UK) | 30x leverage cap, segregated client funds | English |

| CySEC (Cyprus) | EU regulation passport, investor compensation fund | English |

| FSA Seychelles, etc. | High leverage allowed, no trust protection | English |

In short: domestic FX offers uniform safety, while overseas FX varies in safety depending on regulatory strength.

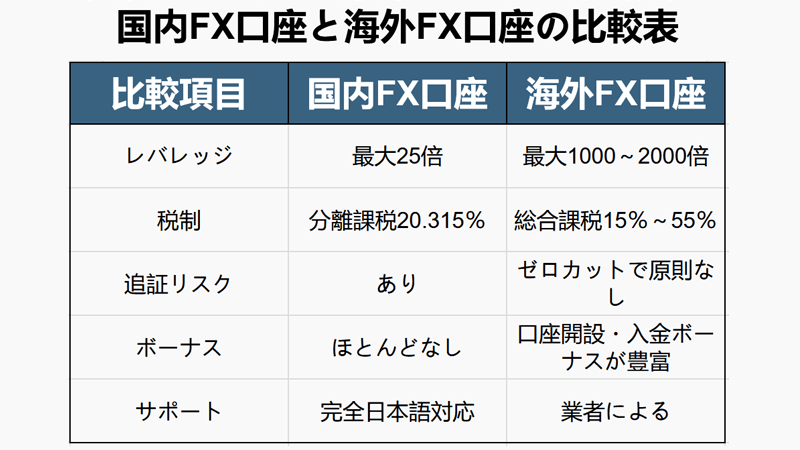

| Comparison Item | Domestic FX | Overseas FX |

| Leverage | Up to 25x | Up to 1000–2000x |

| Tax System | Separate tax 20.315% | Comprehensive tax 15%–55% |

| Margin Call Risk | Exists | Generally none (negative balance protection) |

| Bonuses | Almost none | Abundant opening and deposit bonuses |

| Support | Full Japanese support | Depends on broker |

4. Simulating Tax Differences

- Domestic FX Example

Profit of ¥1,000,000 ⇒ Tax: ¥203,150 (20.315%) - Overseas FX Example

Other income ¥3,000,000 + FX profit ¥1,000,000 = ¥4,000,000 ⇒ Combined tax (income + resident tax) approx. 23% ⇒ around ¥920,000 in tax.

*Note: Higher annual income results in higher tax rates.

The difference becomes more pronounced as profits increase. High earners may consider using corporate accounts or switching from overseas FX to domestic FX.

5. Trading Platforms and Execution Speed

- Domestic FX: Mainly proprietary platforms. Convenient for Japanese users with one-click orders and localized UI, though execution speed is average.

- Overseas FX: Uses global standards like MT4/MT5 or cTrader. Offers extensive indicators and automated trading (EAs). Latency may occur if servers are far from the user’s location.

This related article introduces top recommended overseas FX accounts in ranking format — be sure to check it out!

6. Recommended Account Opening Flow

- Define your goal

- High-risk, high-return focus → Overseas FX

- Stable operation, easy tax management → Domestic FX

- Check broker reliability

- Domestic: registration number, trust bank name

- Overseas: license number, reputation, withdrawal reports

- Try demo trading

- Prepare identification documents (e.g., driver’s license + My Number)

- Submit the account opening form

- Deposit funds and start small test trades

7. Summary

- Domestic FX: Ideal for long-term stability with “robust regulation × low cost × simple taxation.”

- Overseas FX: Enables flexible profit-seeking even with small capital through “high leverage × negative balance protection × generous bonuses.”

The key is to clarify your goals, capital, and risk tolerance — then choose the FX account that matches them. Start with multiple accounts, test spreads and support firsthand, and gradually increase your investment. Enjoy FX trading in the optimal environment and take your asset building to the next level.