From Inflation to Disinflation: What That Means for Assets in 2026

After the inflation shock of 2022 and 2023, price pressures have finally started to cool. Inflation has not disappeared, but it has slowed, and that phase is known as disinflation. Prices are still rising, just not at the pace that unsettled households, policymakers, and markets a couple of years ago.

This distinction matters. Disinflation is very different from deflation, where prices actually fall. By late 2025, most major economies had inflation back in the low single digits, and central banks were increasingly confident that the worst of the price pressure cycle was behind them.

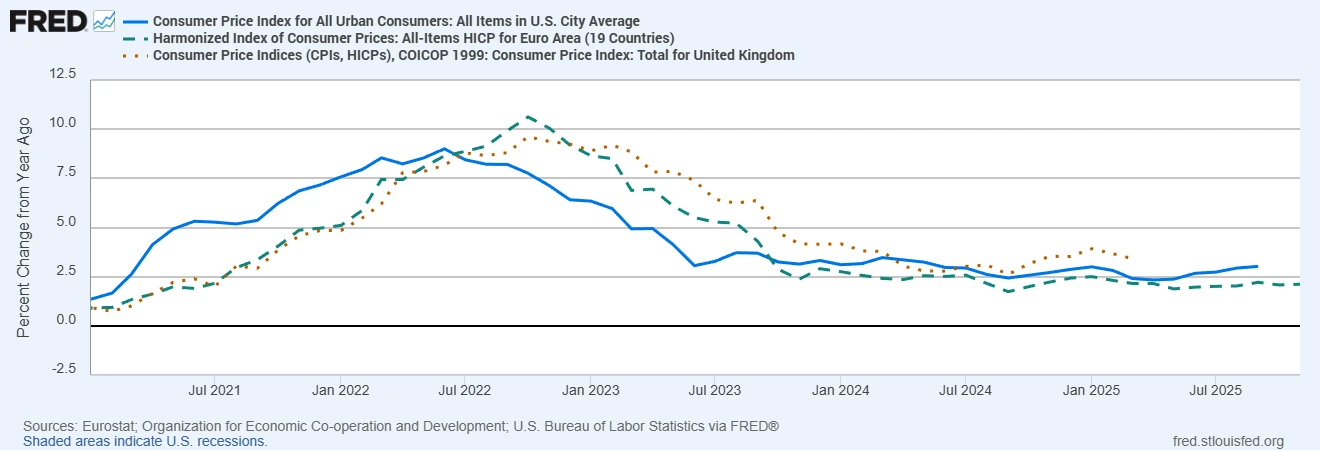

Headline CPI Inflation (Year-on-Year): US, Eurozone, UK

Sources: Eurostat; Organization for Economic Co-operation and Development; U.S. Bureau of Labor Statistics via FRED®

Inflation has eased meaningfully from its 2022 peak, with headline CPI across the US, Eurozone, and UK now back in low single digits.

For markets, this shift changes the entire backdrop. Once inflation stops being the dominant risk, the playbook looks very different. Interest-rate expectations adjust, currency flows respond, and sector leadership starts to rotate. For traders and investors heading into 2026, the challenge is understanding what disinflation supports and what it quietly undermines.

Equities: Growth vs Value

In equities, disinflation usually tilts the balance back toward growth. When inflation cools, markets tend to move away from the value and commodity-heavy sectors that benefited during the inflation spike, and back toward technology, consumer, and other growth-oriented areas.

The logic is straightforward. Lower inflation typically means lower real rates, which increases the present value of future earnings. That is especially supportive for long-duration growth companies, where much of the value sits further out in time.

What was more interesting, though, was the change in market breadth. As disinflation became more established, performance began to broaden beyond a small group of mega-cap leaders. Smaller caps and cyclicals started to participate more meaningfully, suggesting that the equity rally was becoming less concentrated and more sustainable.

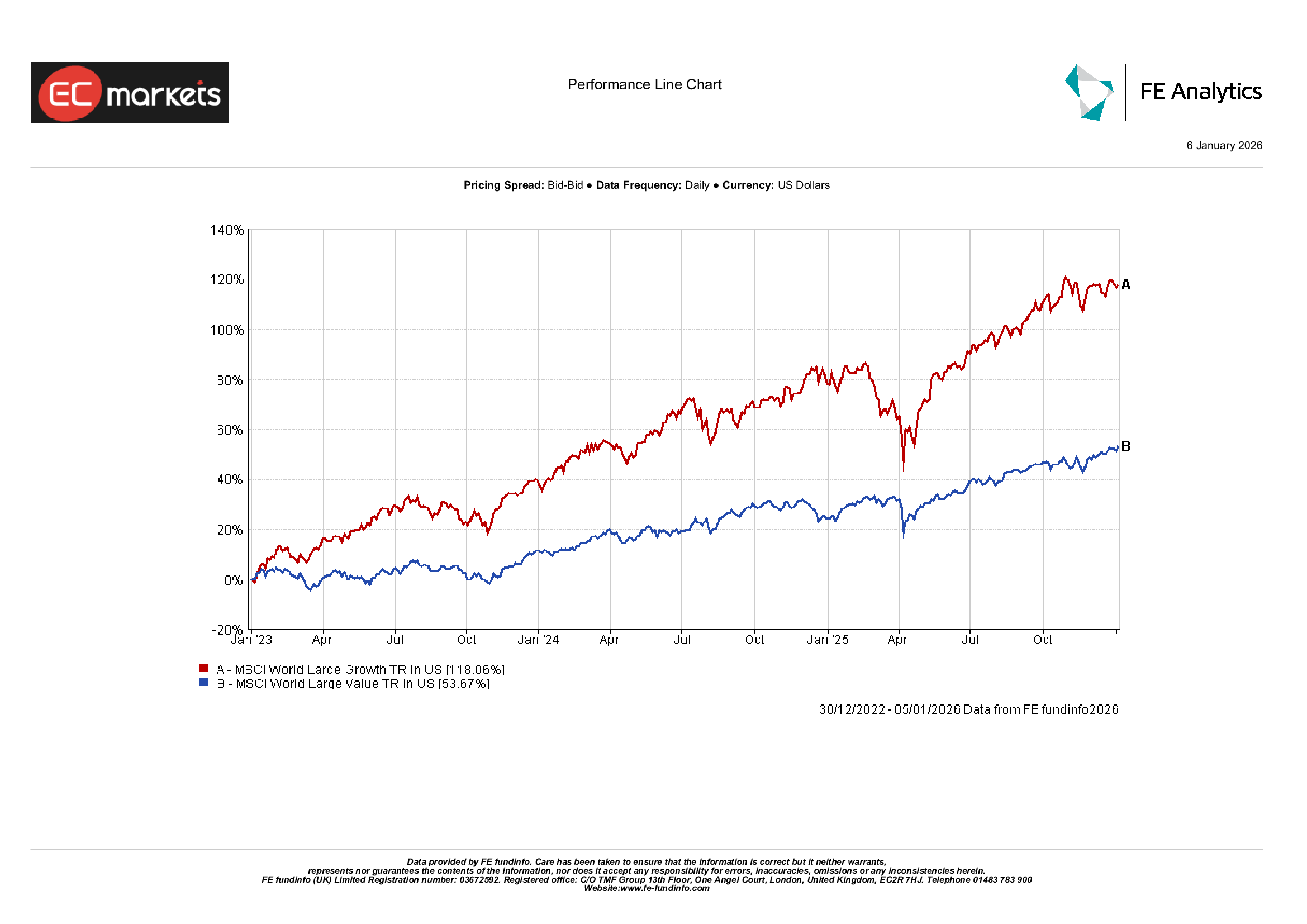

Growth vs Value Equity Rotation

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 06 January 2026.

That said, valuations remain the obvious risk. If disinflation reflects a genuine slowdown rather than a clean soft landing, growth rallies can lose momentum quickly. Lower inflation helps, but it does not override weaker demand or softer earnings.

The key for 2026 is earnings. If profits hold up as inflation cools, growth stocks can continue to lead.

Bonds: Duration and Credit

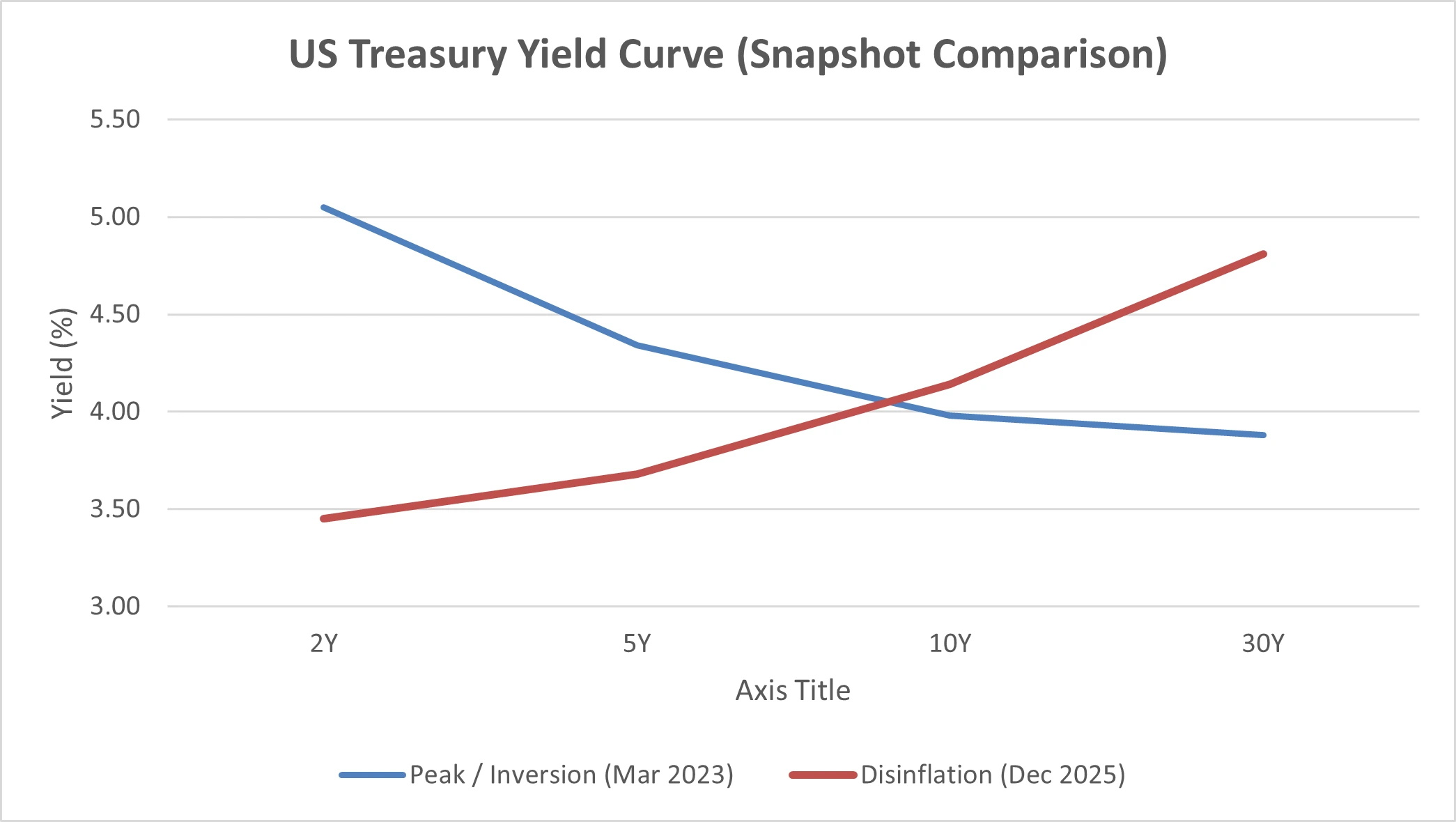

On paper, disinflation should be good news for bonds. Slower inflation brings the conversation back to rate cuts, and historically bonds tend to perform well when central banks begin easing.

In reality, that trade has been more complicated. Even as inflation eased, strong economic data delayed expectations of aggressive rate cuts. Long-term yields did not fall as much as many investors expected, limiting returns for longer-duration bonds.

Instead, shorter-duration bonds and credit performed better. Higher yields provided a cushion, and lower interest-rate sensitivity helped protect returns while policy remained restrictive.

Source: Board of Governors of the Federal Reserve System (US) via FRED®

Looking ahead to 2026, bond performance will depend heavily on how decisively central banks move. If disinflation continues and rate cuts become clearer, longer-duration government bonds could finally see more meaningful upside.

Commodities: Gold and Oil

Commodities do not all react the same way to disinflation. Gold, in particular, has held up well. Even as inflation eased, demand for protection did not disappear. Lower real yields, currency moves, and ongoing geopolitical uncertainty kept gold attractive as a hedge rather than a pure inflation trade.

Oil tells a different story. Disinflation often signals softer demand expectations, and that tends to weigh on energy prices. Lower oil prices help reduce cost pressures across the economy, but they also weigh on energy producers and commodity-linked equities.

FX and the US Dollar

In foreign exchange, disinflation is really about policy divergence. It is less about inflation in isolation, and more about who cuts rates first, and by how much.

As inflation cooled in the US, expectations for further rate hikes faded and attention shifted toward potential easing. That reduced some of the dollar’s yield advantage and led to periods of weakness.

For 2026, currency moves are likely to be driven by differences in the pace of disinflation and the timing of rate cuts across regions.

Takeaways: Positioning for 2026

For equities, growth can continue to benefit if earnings remain resilient and rate cuts move closer, but valuations matter. Broader market participation may offer opportunities as leadership continues to widen.

For bonds, short-duration and credit have worked well in a higher-yield environment. Be ready to extend duration if clearer signals of sustained easing emerge.

For commodities, gold continues to play a role as a hedge in a low real-yield, uncertain world.

Overall, disinflation makes the environment easier to navigate, but it does not remove risk. The opportunity in 2026 is real, but it is not a one-way trade.