Fed’s First Cut and Sticky Prices: Markets Find Relief, but Risks Linger | Weekly Recap: 15-19 Sep 2025

Markets finally got what they had been waiting months for – the Fed’s first rate cut since late 2024. The move arrived in a week where the data told two stories at once: inflation showed fresh signs of stickiness, but broader momentum looked soft enough to justify easing.

In the US, August producer prices surprised on the downside, slipping 0.1% MoM. But consumer prices pulled the other way, rising 0.4% on the month and 2.9% YoY – the fastest pace since January. That mix gave the Fed cover to deliver a 25bp trim midweek, a decision Powell described as “data-dependent and cautious.” Investors had hoped for hints of a quicker cycle, but the message was steady-as-she-goes.

Across the Atlantic, the UK remains in a difficult spot. CPI for August came in at 3.8% – the highest in the G7 and driven largely by food prices. Growth data were weak, with GDP expanding just 0.2% in Q2, while public borrowing overshot forecasts. Against that backdrop, the BoE held at 4% but slowed the pace of its bond sales to avoid straining the gilt market. In the eurozone, inflation dipped just above target to 2.1%. The ECB kept policy steady at 2% on September 11, with Christine Lagarde striking an upbeat tone, noting that trade tensions have eased somewhat after recent tariff agreements.

China’s data underlined the challenge policymakers face. Industrial output grew 5.2% YoY in August, while retail sales slowed to 3.4% – both the weakest in a year.

Equities, Bonds & Commodities

Equities had a broadly positive week, with the Fed’s cut giving Wall Street its latest push higher. All three major US indices ended at record levels on Friday: the Dow gained 0.37% to 46,315, the S&P 500 rose 0.49% to 6,664, and the Nasdaq advanced 0.72% to 22,631. The rally leaned heavily on technology, particularly semiconductors, after chipmakers grabbed headlines late in the week.

Europe didn’t match the US mood. The STOXX 600 ended the week roughly flat, though Thursday brought a sharp bounce when the tech sector surged 4.1% on news of Nvidia’s strategic investment into Intel. UK equities underperformed, with the FTSE 100 slipping slightly. Concerns about sticky inflation and fiscal credibility weighed on sterling and domestic stocks alike. In Asia, performance diverged: Chinese and Hong Kong shares managed small gains, with MSCI China up 0.6%, while Japan’s Nikkei fell 0.6% after the Bank of Japan unexpectedly pared back risky-asset holdings.

Bonds told a more cautious story. US Treasuries sold off after the Fed meeting, with yields grinding higher despite the rate cut. The 10-year finished the week near 4.13%, while the 2-year settled around 3.57%. In Europe, gilts and Bunds stayed under pressure, reflecting fiscal worries as much as central-bank policy. Japanese government bonds were stable, consistent with the BoJ’s ultra-easy stance.

Commodities were mixed. Oil softened, with Brent closing near $66.7 a barrel – down 1.1% on Friday and modestly lower for the week – as supply optimism and weak industrial numbers capped prices. Traders also speculated about OPEC+ boosting output. Gold, by contrast, extended its rally. Spot prices hit $3,707/oz midweek, a fresh record, before ending up around 1% higher on the week.

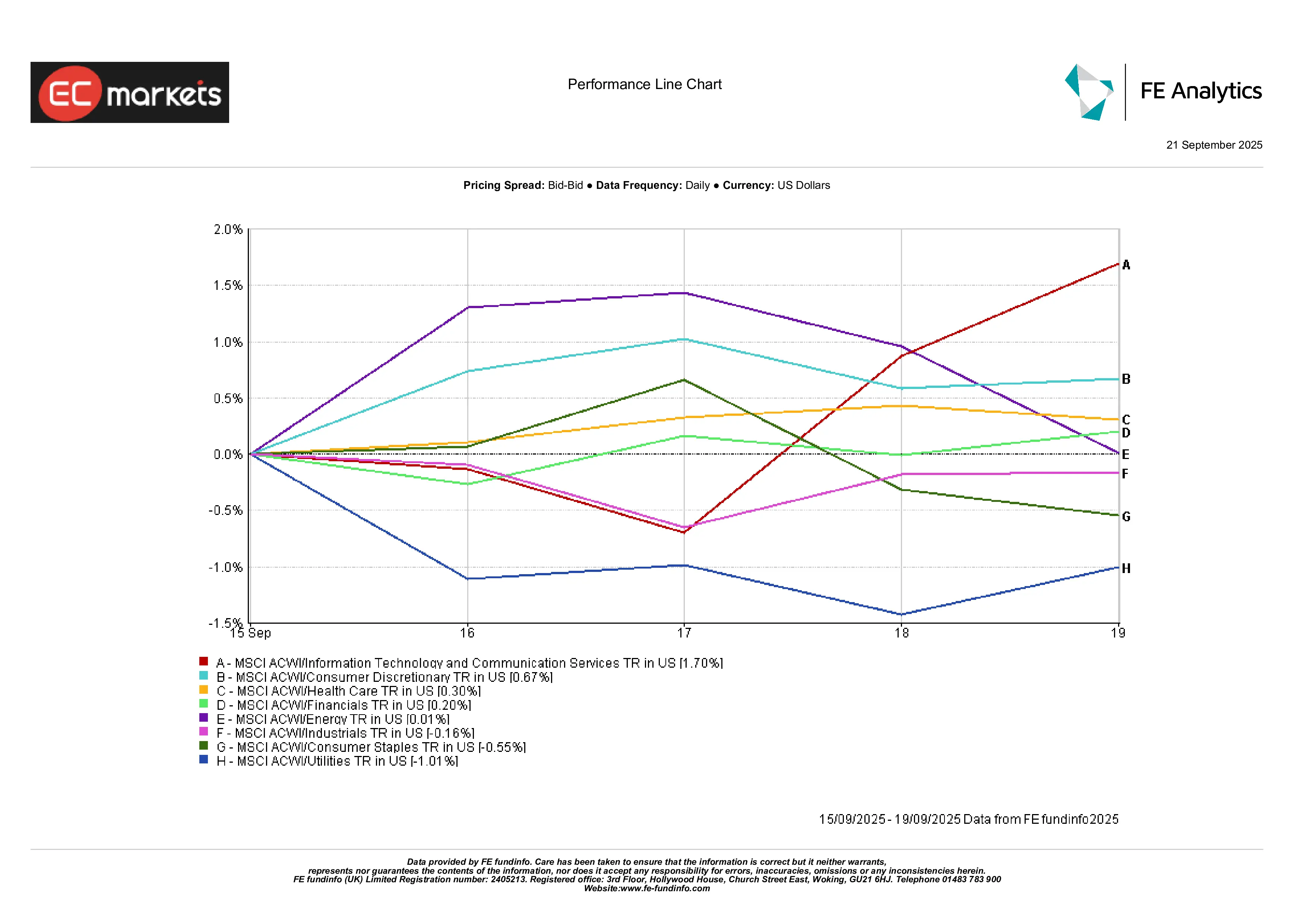

Sector Performance

Sector trends highlighted the market’s pro-growth tilt. Information Technology and Communication Services led the way, both rising about 1.7% for the week. Consumer Discretionary also outperformed, up around 0.7% as retail, leisure, and travel stocks benefited from looser financial conditions. Health Care eked out a 0.3% gain, offering a modest defensive ballast.

At the other end, Utilities lagged sharply, down 1% as higher yields reduced the relative appeal of dividends. Consumer Staples lost 0.6% amid signs of softer spending, while Industrials dipped 0.2% on weak trade and logistics data. Energy was flat, its usual leverage to oil prices neutralised by Brent’s midweek slide. Financials added just 0.2%.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 15 September 2025.

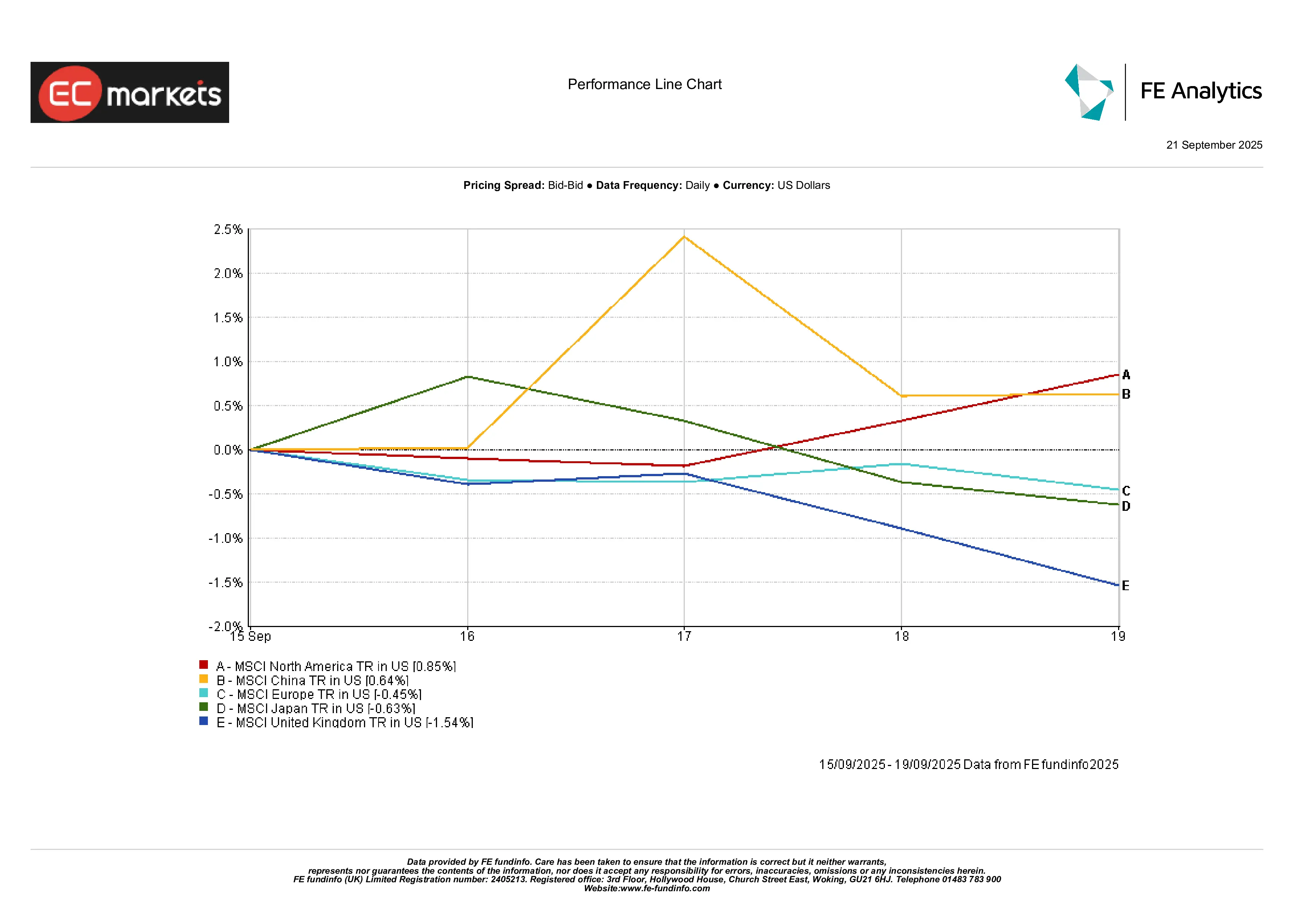

Regional Markets

North America was once again the outperformer. The MSCI North America index rose 0.85% as the Fed’s pivot and tech strength lifted sentiment. Asia was mixed: MSCI China added 0.64% on stimulus hopes, but Japan dragged the region lower, falling 0.6% on BoJ moves and weak industry data. Europe slipped, with the MSCI Europe index down 0.45%. The UK was the laggard, losing around 1.5% on fiscal worries and currency weakness.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 15 September 2025.

Currency Markets

The dollar was steady overall. The DXY edged up 0.3% on Friday to 97.7 but ended slightly lower on the week. EUR/USD fell 0.3% to 1.1745 as rate differentials weighed, while GBP/USD dropped 0.6% to 1.347 after softer UK data and a cautious BoE stance. USD/JPY stayed flat around 148, while GBP/JPY slipped 0.6% to 199.3. The pound was the weakest of the majors, while the euro held steady against the yen.

Outlook & The Week Ahead

Looking forward, attention shifts to a busy data and policy slate. In the US, Fed minutes from the September 18 meeting and upcoming speeches will be parsed for clues on the path of easing. Inflation and labour data remain central, but markets are already eyeing the October earnings season, with big tech and banks due to report. Global PMI flash surveys will test whether Fed action has sparked any new momentum.

Europe faces its own watch points: flash CPI, ongoing ECB debates about the balance of QE, and political noise around France’s budget. In Asia, China’s trade and industrial production figures are due midweek, and investors will be watching for signs of stabilisation or fresh weakness.

Meanwhile, geopolitics continues to hover. The conflict in Gaza, the war in Ukraine, and the uncertain state of US-China relations all keep risk premia elevated. Oil traders, in particular, will be glued to OPEC+ updates and Middle East headlines.

The broader mood is one of cautious optimism. Investors believe more rate cuts are coming, even if inflation remains above target. That backdrop has helped equities and gold, but uneven growth leaves markets highly sensitive to surprises. The Fed’s pivot has locked in a risk-on tone for now – yet it wouldn’t take much, whether a hot inflation print or geopolitical shock, to tilt sentiment back toward defensives.