Banks Slip as Gold and Bonds Rally | Weekly Recap: 13-17 Oct 2025

Economic Overview

US markets opened the week in limbo as the government shutdown entered its third week, freezing major data releases. Fed officials stepped into the void, reinforcing a gradual easing bias. Core inflation remains sticky: US core PCE inflation ran about 2.9% year-on-year in August. With the shutdown delaying US CPI (now shifted to late October) markets clung to Fed signals.

Meanwhile, UK and Eurozone central banks kept to steady policy. UK CPI was ~3.8% in August, and likely ~4% in September. ECB officials likewise held fire: Euro-area inflation hovered near 2.2% in September.

The macro picture was little changed – even as China showed modest strength on exports (September exports +8.3% YoY) and pledges of “moderately loose” policy, trade tensions (rare‐earth export curbs, looming US tariffs) kept a lid on risk appetite.

In short, developed‐market central banks held a cautious tone, with the Fed clearly signalling more cuts ahead, while markets grappled with uncertainty over the US fiscal backdrop and global growth.

Equities, Bonds & Commodities

Equity markets saw heightened volatility mid-week but ultimately ended in positive territory. Major US indexes snapped a midweek slip to finish modestly higher – the S&P 500 and Dow each rose roughly 1.5% on the week and the Nasdaq about 2%. Stocks were buoyed late-week by solid earnings in tech and financials which helped offset earlier swings on bank and trade jitters. Europe also eked out gains: the STOXX 600 closed the week up around +0.4%, thanks in part to a rally in luxury names and relief after a tied French parliamentary confidence vote. In Asia, markets were more mixed – Japan’s Nikkei fell after a Tuesday sell‐off triggered by political uncertainty (Japan’s ruling party leadership race), and Hong Kong/Shanghai dipped as global worries spread.

On the bond side, yields continued to drift lower into Friday. The US 10-year Treasury yield fell back toward ~4.0% (trading around 3.97% on Thursday, its lowest since spring) as investors bought bonds amid risk aversion. The yield curve remained inverted, reflecting confidence in further Fed cuts but caution on growth. German Bund 10-year yields eased toward ~2.4%, and U.K. gilts settled just under 4%.

In commodities, safe-havens surged. Gold hit fresh all-time highs on Thursday (briefly topping ~$4,378/oz) and closed near ~$4,300, buoyed by sovereign debt worries and a weaker dollar. Oil prices were relatively soft: Brent traded in the mid-$60s (a little lower on the week) as demand concerns and OPEC+ signals offset Middle East tensions.

Overall, risk-off flows drove bonds and gold up, even as equities digested mixed news.

Regional Markets

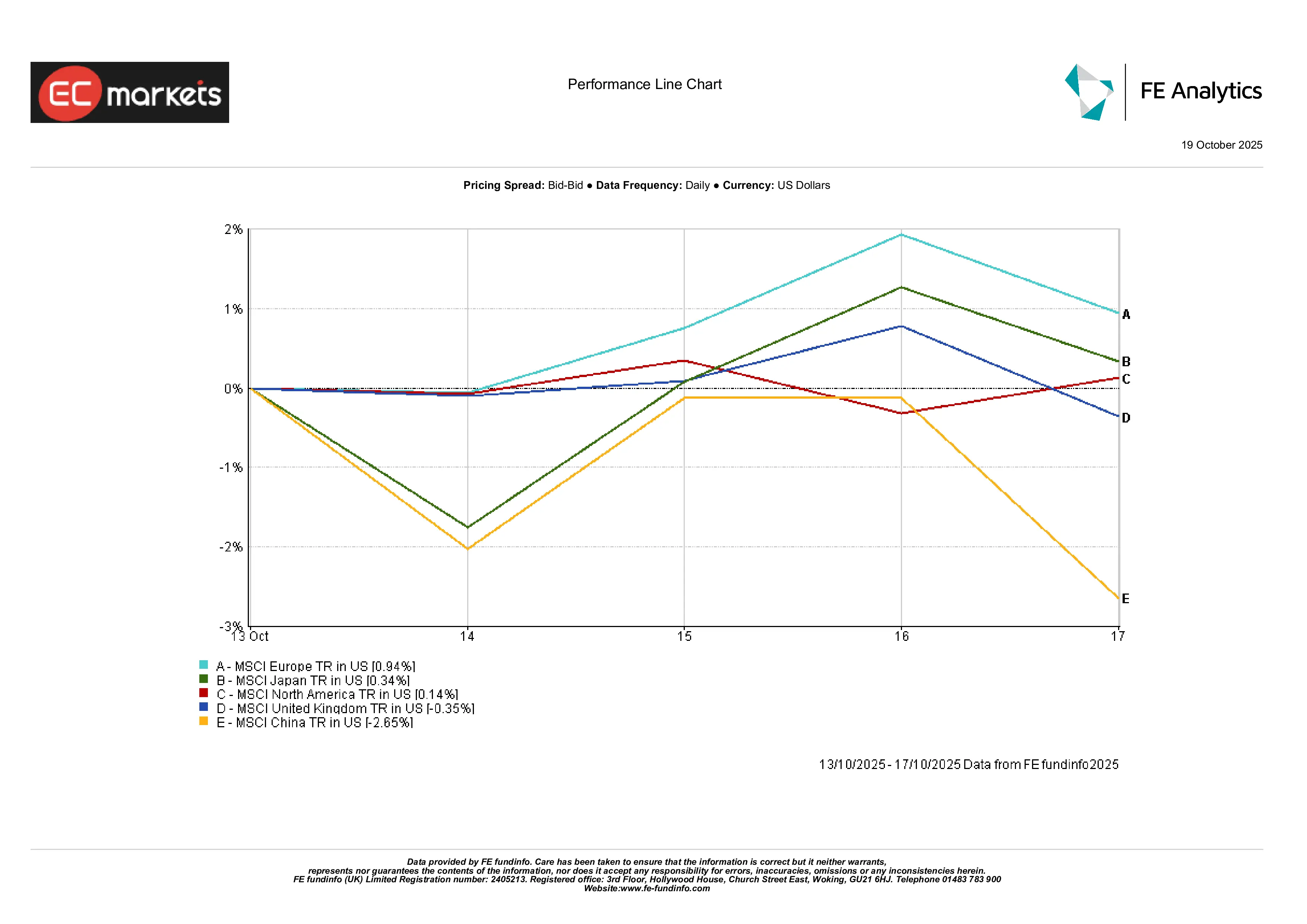

Returns varied by region. Europe outperformed, with MSCI Europe rising approximately 0.94%, while Japan and North America followed with modest gains of 0.34% and 0.14% respectively.

The UK market slipped slightly, with MSCI United Kingdom down about 0.35%, despite some support from defensives and resources. China notably underperformed – MSCI China fell by around 2.65%, weighed by renewed trade concerns and policy uncertainty.

The divergence highlighted the cautious risk tone, with developed markets broadly flat to slightly higher, while Asia saw more pronounced weakness led by China.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 17 October 2025.

Sector Performance

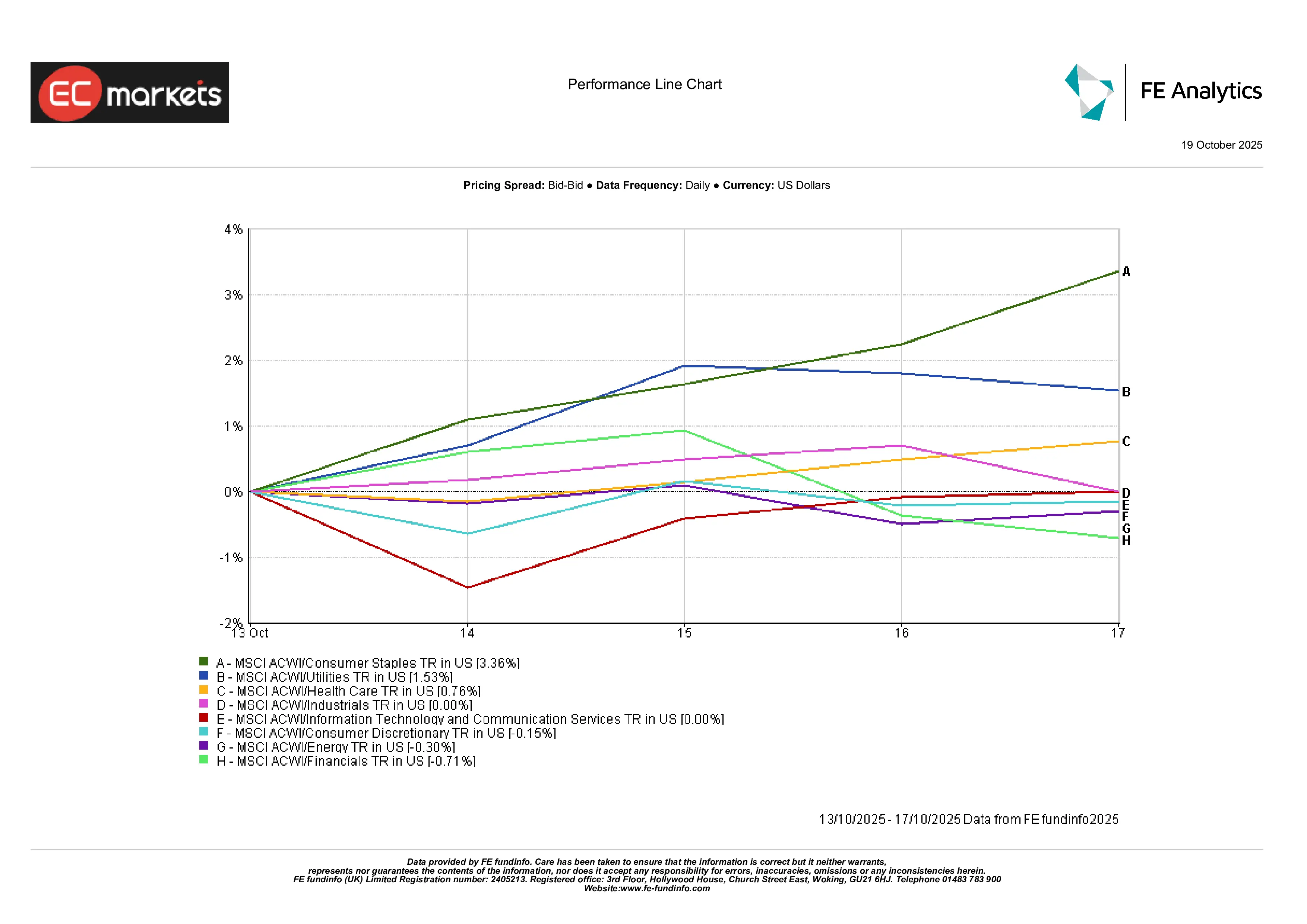

Defensive sectors led, reflecting the risk‐off mood. Utilities and Consumer Staples outperformed, benefiting from falling yields and haven demand. For example, staples saw strong buy-on‐weakness.

In contrast, growth and cyclicals underperformed: Financials languished as bank equities came under pressure (European banks fell ~2-3% on Friday alone) and Technology stocks were mixed – tech-heavy Nasdaq still gained on the week, but marquee names saw profit-taking late-week. Energy stocks lagged as oil prices eased.

Across MSCI ACWI sectors, the chart below shows Utilities and Staples among the few winners (some up modestly), while Financials, Tech and Discretionary gave back ground.

Overall the market rotated back toward stability.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 17 October 2025.

Currency Markets

The dollar broadly softened on risk aversion and Fed dovish signals. The USD Index (DXY) hovered around 98–99 (roughly flat to down marginally on the week).

GBP/USD traded near 1.33-1.34 – slightly lower on Friday after UK GDP missed forecasts and an uptick in jobless claims – ending around $1.34.

EUR/USD was about 1.165-1.17, buoyed by safe-haven flows into the euro and lower US yields.

USD/JPY was at roughly ¥151-152 (yen weak, touching 7-month lows), as the market priced in BOJ policy divergence with a more dovish Fed.

Crosses like GBP/JPY climbed near ¥203-204 on pound strength. In summary, sterling and the euro held firm against the dollar, while the yen remained pressured (DXY ~98.5).

Outlook & The Week Ahead

With the US government now edging toward reopening, attention shifts to delayed economic data – particularly September’s CPI and retail sales figures, both rescheduled for release this week. These prints will be key in gauging whether inflation is easing in line with Fed expectations, and could shape the probability of a second rate cut before year-end.

Central bank communication will also continue to drive sentiment. Several FOMC members are due to speak in the coming days, offering clues on how firmly policymakers remain committed to the easing path outlined earlier this month. In the UK and eurozone, final September inflation data and flash October PMIs will test the “steady for longer” stance of both the BoE and ECB.

In China, markets will digest last week’s Q3 GDP and lending figures, which offered mixed signals on the strength of policy transmission. Investors will be watching for signs of follow-through in trade and industrial activity.

Oil remains in focus as geopolitical tensions in the Middle East evolve. Any new OPEC+ commentary or regional disruptions could influence energy markets heading into month-end. In short, markets are entering late October cautiously optimistic that policy support will hold – but with data and geopolitics still capable of reshaping the narrative.