Are We at the Start of a Structural Dollar Downcycle?

The US dollar has been the dominant force in global markets for the better part of the last few years. Back in 2022-23, the Fed’s aggressive rate hikes and waves of global risk-off sentiment pushed the dollar higher and higher. The DXY hovered in the low 100s, with every Fed speech and CPI print moving the needle. It was the trade that just kept working.

Dollar Index (DXY): From Dominance to Retreat

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 18 November 2025.

The US Dollar Index rose sharply through 2022, peaking above 20% gains, but has since given up ground, fuelling debate over whether we’re seeing a cyclical retracement or the start of something structural.

But fast forward to 2025, and the tone has changed. Inflation is finally under control, the Fed is shifting toward rate cuts, and the global economy is stabilizing. The dollar? It’s starting to soften.

Traders are now asking: is this just a normal pullback, or the early signs of a much bigger, longer shift?

Historical Perspective on Dollar Cycles

Dollar cycles don’t turn often, but when they do, the impact tends to last. Historically, big turning points (like in the mid-80s or early 2000s) came when several macro forces lined up at once: narrowing rate differentials, rising external deficits, and a growing appetite for alternatives abroad. In each case, the dollar stayed weak for years.

Now, some of those ingredients are bubbling up again. The US is running large twin deficits. Global growth is stabilizing. Other central banks are catching up with the Fed. Some strategists are starting to whisper: could this be the start of the first genuine dollar downcycle in over two decades?

Macro Conditions in 2025

Several big-picture trends are shifting. Interest rate differences between the US and other major economies are narrowing. By late 2024, both the Fed and the ECB had cut rates by around 1%, and more cuts are expected. As of late 2025, the ECB’s deposit rate is about 2%, with eurozone inflation also near that level. US inflation is coming down too, which means the dollar’s yield advantage isn’t what it used to be. In the UK and Japan, rate hikes have paused, further closing the gap. That shrinking difference could weaken one of the key drivers behind recent dollar strength.

At the same time, America’s debt picture is drawing more attention. The “America First” fiscal package passed earlier this year is expected to add $3-4 trillion to the national debt over the next decade. Even without that, the US is running large twin deficits, both budget and current account. Deficits may hit 6-7% of GDP, and interest payments already take up a big chunk of federal spending. This means the US needs steady inflows of foreign capital just to cover its borrowing needs.

Meanwhile, global central banks are slowly starting to rethink their reserves. The dollar still makes up over half of all disclosed currency reserves, but that number has slipped slightly, and not just because of market moves. While no big shift has happened yet, the conversation around alternatives is getting louder. That alone suggests change could be brewing over time.

Liquidity vs. Secular Shift

Let’s not forget: the dollar still has a lot going for it. Deep liquidity. Trust. The world’s benchmark assets. Even in 2025, markets still clear in dollars, Treasuries remain the top safe haven, and during a crisis, flows still snap back to the greenback.

But cracks are forming. EM central banks are quietly buying more non-dollar assets. And with fiscal, monetary, and geopolitical trends all pressing in the same direction, the idea of a structural downtrend doesn’t feel so far-fetched.

Conclusion

If the dollar is in the early stages of a long decline, the ripple effects could be wide. Commodities, right from oil to gold, tend to rise as the dollar weakens. EM assets usually catch a bid. Even US equities can benefit, especially multinationals with foreign revenue. But it’s not all sunshine: if the move reflects deep structural issues, risk appetite could suffer.

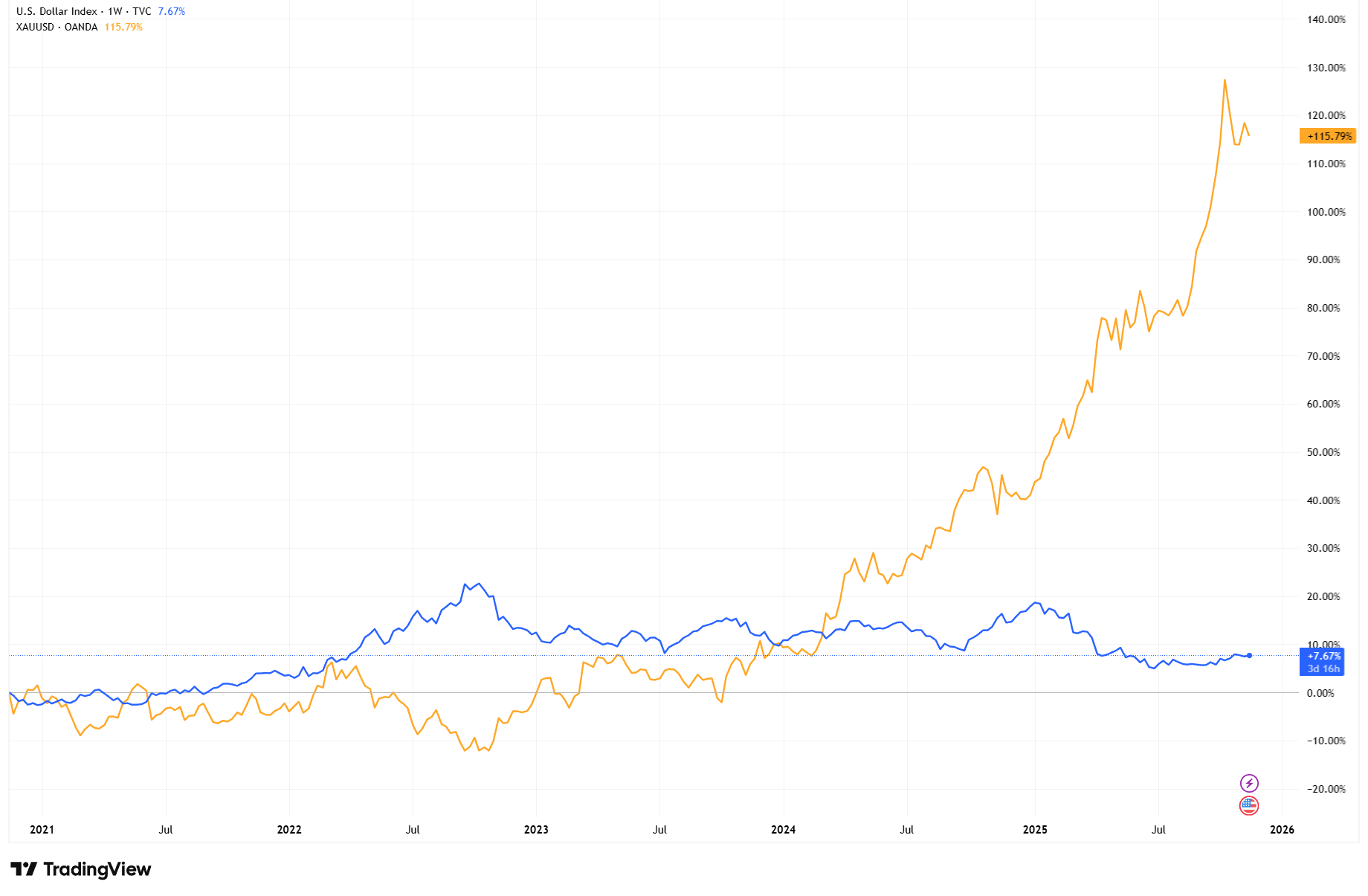

Gold vs USD Index – Inverse Relationship Builds

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 18 November 2025.

As the dollar cooled, gold soared, a 115% rise since early 2021, highlighting how macro hedges and hard assets thrive when confidence in the greenback wavers.

The big takeaway? This isn’t just about what the Fed does next. It’s about whether the dollar’s role in the global system is beginning to evolve, slowly, subtly, but significantly!